ISSUES IN ASSESSEMENT, REASSESEMENT AND REOPENING

advertisement

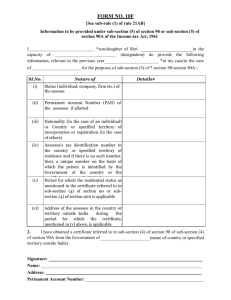

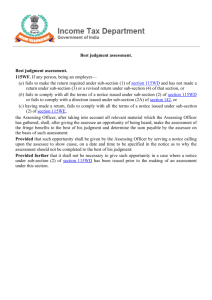

ISSUES IN ASSESSEMENT, REASSESEMENT AND REOPENING Faculty: CA. HARIDAS BHAT On Saturday 14th July, 2012 JB NAGAR CPE STUDY CIRCLE ASSESSMENT & REASSESSMENT Assessement includes Re assessement 2(8) Initiation Whom can be served 142(1) on any person 1. who has made a return under section 139 or 2. in whose case the time allowed under sub-section (1) of section 139 for furnishing the return has expired, to furnish a return of his income or the income of any other person in respect of which he is assessable under this Act, When the notice can be issued:- 143(3) if he considers it necessary or expedient to ensure that the assessee has not under-stated the income or has not computed excessive loss or has not under-paid the tax in any manner, Contents of Notice 142(1) the purpose – i.e. making an assessment under this Act, the details of Assessing Officer service of a notice with requirement date to be specified, Requirements 142(1) to produce, or cause to be produced, such accounts or documents as the Assessing Officer may require, to furnish in writing and verified in the prescribed manner information in such form and on such points or matters (including a statement of all assets and liabilities of the assessee, whether included in the accounts or not) as the Assessing Officer may require: Pre conditions for requirements the previous approval of the Joint Commissioner shall be obtained before requiring the assessee to furnish a statement of all assets and liabilities not included in the accounts; the Assessing Officer shall not require the production of any accounts relating to a period more than three years prior to the previous year. 143(3) on a date to be specified therein, either to attend his office or Page 2 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT to produce, or cause to be produced there, any evidence on which the assessee may rely in support of the return: Time Limitation 143 no notice shall be served on the assessee after the expiry of six months from the end of the financial year in which the return is furnished. PROCEDURE 142 For the purpose of obtaining full information in respect of the income or loss of any person, the Assessing Officer may make such inquiry as he considers necessary. If, at any stage of the proceedings before him, the Assessing Officer, having regard to the nature and complexity of the accounts of the assessee and the interests of the revenue, is of the opinion that it is necessary so to do, he may, with the previous approval of the Chief Commissioner or Commissioner, direct the assessee to get the accounts audited The assessee shall, except where the assessment is made under section 144, be given an opportunity of being heard in respect of any material gathered on the basis of any inquiry under sub-section (2) or any audit under sub-section (2A) and proposed to be utilised for the purpose of the assessment. Power regarding discovery, production of evidence, etc. 131 General Powers. The Assessing Officer, shall, for the purposes of this Act, have the same powers as are vested in a court under the Code of Civil Procedure, 1908 (5 of 1908), when trying a suit in respect of the following matters, namely:— (a) (b) (c) (d) discovery and inspection; enforcing the attendance of any person, including any officer of a banking company and examining him on oath; compelling the production of books of account and other documents; and issuing commissions. Impounding of books. 131 impound and retain in its custody for such period as it thinks fit any books of account or other documents produced before it in any proceeding under this Act: an AssessingOfficer shall not— (a) impound any books of account or other documents without recording his reasons for so doing, or Page 3 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT (b) retain in his custody any such books or documents for a period exceeding fifteen days (exclusive of holidays) without obtaining the approval of the Chief Commissioner or Director General or Commissioner or Director therefor, as the case may be Power to call for information 133 The Assessing Officer, may, for the purposes of this Act,— (1) (2) (3) (4) (5) (6) require any firm to furnish him with a return of the names and addresses of the partners of the firm and their respective shares; require any Hindu undivided family to furnish him with a return of the names and addresses of the manager and the members of the family; require any person whom he has reason to believe to be a trustee, guardian or agent, to furnish him with a return of the names of the persons for or of whom he is trustee, guardian or agent, and of their addresses; require any assessee to furnish a statement of the names and addresses of all persons to whom he has paid in any previous year rent, interest, commission, royalty or brokerage, or any annuity, not being any annuity taxable under the head "Salaries" amounting to more than [one thousand rupees, or such higher amount as may be prescribed], together with particulars of all such payments made; require any dealer, broker or agent or any person concerned in the management of a stock or commodity exchange to furnish a statement of the names and addresses of all persons to whom he or the exchange has paid any sum in connection with the transfer, whether by way of sale, exchange or otherwise, of assets, or on whose behalf or from whom he or the exchange has received any such sum, together with particulars of all such payments and receipts; require any person, including a banking company or any officer thereof, to furnish information in relation to such points or matters, or to furnish statements of accounts and affairs verified in the manner specified by the Assessing Officer, giving information in relation to such points or matters as, in the opinion of the Assessing Officer, will be useful for, or relevant to, any inquiry or proceeding under this Act: Provided further that the power in respect of an inquiry, in a case where no proceeding is pending, shall not be exercised by any income-tax authority below the rank of Director or Commissioner without the prior approval of the Director or, as the case may be, the Commissioner. Power of Joint Commissioner to issue directions in certain cases 144A. A Joint Commissioner may, on his own motion or on a reference being made to him by the Assessing Officer or on the application of an assessee, call for and examine the record of any proceeding in which an assessment is pending and, if he considers that, having regard to the nature of the case or the amount involved or for any other reason, it is necessary or expedient so to do, he may issue such directions as he thinks fit for the guidance of the Assessing Officer to enable him to complete the assessment and such directions shall be binding on the Assessing Officer: Page 4 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT Provided that no directions which are prejudicial to the assessee shall be issued before an opportunity is given to the assessee to be heard. Explanation.—For the purposes of this section no direction as to the lines on which an investigation connected with the assessment should be made, shall be deemed to be a direction prejudicial to the assessee. Best judgment assessment 144 Conditions to invoke When assessee fails to make the return required has not made a return or a revised return When assessee fails to comply with all the terms of a notice issued under sub-section (1) of section 142 or fails to comply with a direction issued under sub-section (2A) of that section, or When assessee having made a return, fails to comply with all the terms of a notice issued under sub-section (2) of section 143, Conditions to pass after taking into account all relevant material which the Assessing Officer has gathered, shall, after giving the assessee an opportunity of being heard, make the assessment of the total income or loss to the best of his judgment and determine the sum payable by the assessee on the basis of such assessment: Other conditions opportunity shall be given by the Assessing Officer by serving a notice calling upon the assessee to show cause, on a date and time to be specified in the notice, why the assessment should not be completed to the best of his judgment: that it shall not be necessary to give such opportunity in a case where a notice under sub-section (1) of section 142 has been issued prior to the making of an assessment under this section. When the order can be passed. 143 On the day specified in the notice, or as soon afterwards as may be, after hearing such evidence as the assessee may produce and such other evidence as the Assessing Officer may require on specified points, and after taking into account all relevant material which he has gathered, Page 5 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT The Assessing Officer shall, by an order in writing, make an assessment of the total income or loss of the assessee, and determine the sum payable by him or refund of any amount due to him on the basis of such assessment: Some relavant points 1. The Income-tax Officers should give each assessee a different timing for hearing. [Circular No. 230, dated 27th October, 1977] 2. The Assessing Officers should make all efforts to see that the assessment orders are passed immediately after the hearing is over. In complicated cases or those involving the handling of voluminous materials, it may not be possible to pass an order immediately after the hearing. Even in such cases the order should be passed within fourteen working days after the date of last hearing. [Letter No. 241/23/70, dated 23rd October, 1970] 3. In cases chosen for sample scrutiny, if the assessment has already been completed under section 143(1) by the computer, the proceedings should be reopened under section 143(2)(b) in scrutiny. [Instruction No. 1753, dated 1st April, 1987] 4. It is not open to the Revenue to issue intimation under section 143(1)(a) after notice for regular assessment is issued under section 143(2). [CIT v Gujarat Electricity Board (2003) 260 ITR 84 (SC)] Time limit for completion of assessments and reassessments 153. (1) No order of assessment shall be made under section 143 or section 144 at any time after the expiry of— (a) (b) two years (21 months for A. Y. 2004-05 till A. Y. 2009-10) from the end of the assessment year in which the income was first assessable; one year from the end of Financial year in which return or a revised return is filed Whichever is later In computing the period of limitation the following shall be excluded: (i) the time taken in reopening the whole or any part of the proceeding or in giving an opportunity to the assessee to be re-heard under the proviso to section 129, or (ii) the period during which the assessment proceeding is stayed by an order or injunction of any court, or (iia) the period commencing from the date on which the Assessing Officer intimates the Central Government or the prescribed authority, the contravention of the provisions of clause (21) or clause (22B) or clause (23A) or clause (23B) or subclause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of clause (23C) of section 10, under clause (i) of the proviso to sub-section (3) of section 143 and ending with the date on which the copy of the order withdrawing the approval or Page 6 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT rescinding the notification, as the case may be, under those clauses is received by the Assessing Officer; (iii) the period commencing from the date on which the Assessing Officer directs the assessee to get his accounts audited under sub-section (2A) of section 142 and ending with the last date on which the assessee is required to furnish a report of such audit under that sub-section, or (iva) the period (not exceeding sixty days) commencing from the date on which the Assessing Officer received the declaration under sub-section (1) of section 158A and ending with the date on which the order under sub-section (3) of that section is made by him, or (v) in a case where an application made before the Income-tax Settlement Commission under section 245C is rejected by it or is not allowed to be proceeded with by it, the period commencing from the date on which such application is made and ending with the date on which the order under sub-section (1) of section 245D is received by the Commissioner under sub-section (2) of that section, Provided that where immediately after the exclusion of the aforesaid time or period, the period of limitation referred to in sub-sections (1), (2) and (2A) available to the Assessing Officer for making an order of assessment, reassessment or recomputation, as the case may be, is less than sixty days, such remaining period shall be extended to sixty days and the aforesaid period of limitation shall be deemed to be extended accordingly. PENALTIES Failure to furnish returns, comply with notices, concealment of income, etc 271. has failed to comply with a notice a sum of ten thousand rupees for each under sub-section (1) of section 142 such failure; or sub-section (2) of section 143 or fails to comply with a direction issued under sub-section (2A) of section 142, or has concealed the particulars of his in addition to tax, if any, payable by income or furnished inaccurate him, a sum which shall not be less particulars of such income, than, but which shall not exceed three times the amount of tax sought to be evaded Failure to keep, maintain or retain books of account, documents, etc. 271A. fails to keep and maintain any such a sum of twenty-five thousand rupees books of account and other documents as required by section 44AA or the Page 7 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT rules made thereunder, in respect of any previous year or to retain such books of account and other documents for the period specified in the said rules, Failure to get accounts audited If any person fails to get his accounts audited in respect of any previous year or years relevant to an assessment year or furnish a report of such audit as required under section 44AB 271B a sum equal to one-half per cent of the total sales, turnover or gross receipts, as the case may be, in business, or of the gross receipts in profession, in such previous year or years or a sum of one hundred thousand rupees, whichever is less. Penalty for failure to comply with the provisions of section 269SS 271D takes or accepts any loan or deposit in a sum equal to the amount of the loan contravention of the provisions of or deposit so taken or accepted section 269SS, Penalty for failure to comply with the provisions of section 269T 271E. repays any loan or deposit referred to a sum equal to the amount of the loan in section 269T otherwise than in or deposit so repaid. accordance with the provisions of that section Penalty for failure to answer questions, sign statements, furnish information, returns or statements, allow inspections, etc. 272A being legally bound to state the truth of sum of ten thousand rupees for each any matter touching the subject of his such default or failure assessment, refuses to answer any question put to him by an income-tax authority in the exercise of its powers under this Act; or refuses to sign any statement made by him in the course of any proceedings under this Act, which an income-tax authority may legally require him to sign; or Page 8 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT to whom a summons is issued under sub-section (1) of section 131 either to attend to give evidence or produce books of account or other documents at a certain place and time omits to attend or produce books of account or documents at the place or time Penalty for failure to comply with the provisions of section 139A (PAN) 272B fails to comply with the provisions of ten thousand rupees section 139A quotes or intimates a number which is false, and which he either knows or believes to be false or does not believe to be true Who can impose the penalty in a case where the contravention, failure or default in respect of which such penalty is imposable occurs in the course of any proceeding before an income-tax authority not lower in rank than a Joint Director or a Joint Commissioner, by such income-tax authority; No order shall be passed unless the person on whom the penalty is proposed to be imposed is given an opportunity of being heard in the matter. Power to reduce or waive penalty, etc., in certain cases 273A. Commissioner may, in his discretion, whether on his own motion or otherwise,(ii) reduce or waive the amount of penalty imposed or imposable on a person under clause (iii) of sub-section (1) of section 271; if he is satisfied that such personhas, prior to the detection by the Assessing Officer, of the concealment of particulars of income or of the inaccuracy of particulars furnished in respect of such income, voluntarily and in good faith, made full and true disclosure of such particulars; and also has, co-operated in any enquiry relating to the assessment of his income and has either paid or made satisfactory arrangements for the payment of any tax or interest payable in consequence of an order passed under this Act in respect of the relevant assessment year. OFFENCES AND PROSECUTIONS Page 9 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT Removal, concealment, transfer or delivery of property to thwart tax recovery 276. fraudulently removes, conceals, rigorous imprisonment for a term which transfers or delivers to any person, any may extend to two years and shall also property or any interest therein, be liable to fine intending thereby to prevent that property or interest therein from being taken Wilful attempt to evade tax, etc. 276C. wilfully attempts in any manner whatsoever to evade any tax, penalty or interest chargeable or imposable the amount sought to be evaded rigorous imprisonment for a term which exceeds one hundred thousand shall not be less than six months but rupees, which may extend to seven years and with fine; any other case with rigorous imprisonment for a term which shall not be less than three months but which may extend to three years and with fine. Conditions (i) has in his possession or control any books of account or other documents containing a false entry or statement; or (ii) makes or causes to be made any false entry or statement in such books of account or other documents; or (iii) wilfully omits or causes to be omitted any relevant entry or statement in such books of account or other documents; or (iv) causes any other circumstance to exist which will have the effect of enabling such person to evade any tax, penalty or interest chargeable or imposable under this Act or the payment thereof. Failure to furnish returns of income 276CC. wilfully fails to furnish in due time the return of income where the amount of tax, which would with rigorous imprisonment for a term have been evaded if the failure had not which shall not be less than six months been discovered, exceeds one hundred but which may extend to seven years thousand rupees and with fine; in any other case: with imprisonment for a term which shall not be less than three months but which may extend to three years and with fine: Provided that a person shall not be proceeded against under this section for failure to furnish in due time the return of income under sub-section (1) of section 139- Page 10 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT (a) (b) the return is furnished by him before the expiry of the assessment year; or the tax payable by him on the total income determined on regular assessment, as reduced by the advance tax, if any, paid, and any tax deducted at source, does not exceed three thousand rupees. Failure to produce accounts and documents wilfully fails to produce, or cause to be produced, on or before the date specified in any notice served on him under sub-section (1) of section 142, such accounts and documents as are referred to in the notice or wilfully fails to comply with a direction issued to him under sub-section (2A) of that section, 276D punishable with rigorous imprisonment for a term which may extend to one year or with fine equal to a sum calculated at a rate which shall not be less than four rupees or more than ten rupees for every day during which the default continues, or with both. 277. False statement in verification, etc. makes a statement in any verification under this Act or under any rule made thereunder, or delivers an account or statement which is false, and which he either knows or believes to be false, or does not believe to be true, where the amount of tax, which would with rigorous imprisonment for a term have been evaded if the statement or which shall not be less than six months account had been accepted as true, but which may extend to seven years exceeds one hundred thousand and with fine; rupees, in any other case: (i) with rigorous imprisonment for a term which shall not be less than three months but which may extend to three years and with fine. Abetment of false return, etc. 278 abets or induces in any manner another person to make and deliver an account or a statement or declaration relating to any income chargeable to tax which is false and which he either knows to be false or does not believe to be true where the amount of tax, penalty or with rigorous imprisonment for a term interest which would have been which shall not be less than six months evaded, if the declaration, account or but which may extend to seven years statement had been accepted as true, and with fine; or which is wilfully attempted to be evaded, exceeds one hundred thousand rupees, in any other case: with rigorous imprisonment for a term which shall not be less than three months but which may extend to three years and with fine Page 11 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT Punishment not to be imposed in certain cases 278AA Notwithstanding anything contained in the provisions of section 276A, section 276AB, or section 276B no person shall be punishable for any failure referred to in the said provisions if he proves that there was reasonable cause for such failure. Offences by companies 278B. (1) Where an offence under this Act has been committed by a company, every person who, at the time the offence was committed, was in charge of, and was responsible to, the company for the conduct of the business of the company as well as the company shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly: Provided that nothing contained in this sub-section shall render any such person liable to any punishment if he proves that the offence was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such offence. (2) Notwithstanding anything contained in sub-section (1), where an offence under this Act has been committed by a company and it is proved that the offence has been committed with the consent or connivance of, or is attributable to any neglect on the part of, any director, manager, secretary or other officer of the company, such director, manager, secretary or other officer shall also be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly. Explanation.-For the purposes of this section,(a) "company" means a body corporate, and includes(i) (ii) (b) a firm; and an association of persons or a body of individuals whether incorporated or not; and "director", in relation to- (i) (ii) a firm, means a partner in the firm; any association of persons or a body of individuals, means any member controlling the affairs thereof.] Offences by Hindu undivided families 278C. (1) Where an offence under this Act has been committed by a Hindu undivided family, the karta thereof shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly: Provided that nothing contained in this sub-section shall render the karta liable to any punishment if he proves that the offence was committed without his knowledge or that he had exercised all due diligence to prevent the commission of such offence. Page 12 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT (2) Notwithstanding anything contained in sub-section (1), where an offence under this Act has been committed by a Hindu undivided family and it is proved that the offence has been committed with the consent or connivance of, or is attributable to any neglect on the part of, any member of the Hindu undivided family, such member shall also be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly.] Presumption as to culpable mental state 278E. (1) In any prosecution for any offence under this Act which requires a culpable mental state on the part of the accused, the court shall presume the existence of such mental state but it shall be a defence for the accused to prove the fact that he had no such mental state with respect to the act charged as an offence in that prosecution. Explanation.-In this sub-section, "culpable mental state" includes intention, motive or knowledge of a fact or belief in, or reason to believe, a fact. (2) For the purposes of this section, a fact is said to be proved only when the court believes it to exist beyond reasonable doubt and not merely when its existence is established by a preponderance of probability.] Prosecution to be at the instance of Chief Commissioner or Commissioner 279. Page 13 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT RELEVANT PRINCIPLES / DOCTRINES : Rule of Evidence : Speaking on the rule of evidence, as per the provision of Income Tax Act dealing with assessment, sub-section (3) of section 143 of the Income Tax Act contains the phrase “ after hearing such evidence and after taking into account such particulars as the assessee may produce “. Accordingly, the assessing officer can invoke the principles laid down in Evidence Act in proceedings before him. He is entitled to gather material which may not be accepted in a court of law as evidence. An assessing officer need not worry about technical rules of evidence as contained in the Evidence Act. When he collects the material that is adverse to the assessee , an opportunity has to be given to the assessee to make submissions on such information and material. Inference could be drawn on the appreciation of evidence and material. Burden of proof : (i)A burden of proof as a doctrine when understood it lies on the person who has to prove a fact. It never shifts and remains on the said person. The doctrine means that one of the two contending parties to an issue had to lead evidence and if alleged, the party who alleges so has to prove in the matter. (ii)The situations that have relevance in the application of the doctrine of burden of proof in the Income-tax Act are (a) when an assessee makes claim of expenditure as per the Act, (b) when the assessing officer has to decide whether a receipt is income liable tax and (c) when the assessee claims that the income and/or receipt is exempt from taxation. (iii) The question that arises in respect of the above three situations when examined situation wise, how the doctrine has to be understood? As to situation (a), the burden of proving the facts in respect of the claim as to the deduction and/ or allowance is on the assessee. As to situation (b), the burden of proof is on the assessing officer to substantiate that the particular receipt constitutes income and therefore liable to tax. As to situation (c), the burden of proof is on the assessee to substantiate that the income and / or receipt is exempt from tax. The evaluation of evidence is a process in which the burden of proof remains with the person and never shifts. Once the fact is proved, there is something known as onus of proof. The onus of proof shifts based on the evaluation of evidence produced by the parties to the assessment; i.e., assessee and the assessing officer. Rule of Consistency : The rule of consistency is normally considered in the income tax proceedings in so far as a finding reached in the assessment proceedings, after due consideration of the facts and proper enquiry. There is however a rider to this to the effect that it is open to the revenue and to the assessee to deviate from the finding if fresh evidence is brought on record and/or based on a mistaken impression, a finding Page 14 of 15 By CA Haridas Bhat GMJ & CO. ASSESSMENT & REASSESSMENT has been arrived in the assessment proceedings. As per the considered principles, judicial propriety requires consistency. The same shall not be applicable to the proceedings under Income-tax Act, when there are substantial reasons to differ from the earlier finding in the latter assessment proceedings. Promissory Estoppel : The general rule the principles of promissory estoppel are not applicable to a statute has an exception in so far as the proceedings under Income-tax Act are concerned. However, while considering question of fact, The Income Tax authorities are free to ignore this rule in the matter of subsequent assessment when the conduct of an assessee suggests otherwise. Principle of Natural Justice: The basic principles of Natural justice are:- (i) that the parties should be heard before deciding an issue; (ii) the hearing must be before an impartial judge, as no man can be judge of his own cause. Therefore, the hearing must be before an unbiased judge; (iii) the judge should decide in good faith. He should have no bias, personal or pecuniary; and (iv) the decision given must be reasoned one and therefore, the decision must be evidenced by a speaking order which enumerates the reasons for coming to a particular conclusion. Effect of violation of principles of natural justice: Normally any decision taken in violation of principles of natural justice would be void and not merely voidable. However, a minor deviation from the principles may be cured by remanding the case for fresh decision, after giving proper opportunity of being heard. It may also be added that order passed in violation of principles of natural justice makes the order and not the entire proceedings invalid. As such, the officer can restart the proceedings and complete them after giving an opportunity of being heard. Page 15 of 15 By CA Haridas Bhat GMJ & CO.