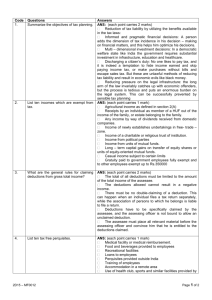

SEARCH

advertisement