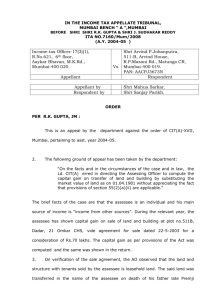

VIMAL PUNMIYA & CO.

advertisement