North Montco Technical Career Center Refinancing Discussion November 17, 2014

advertisement

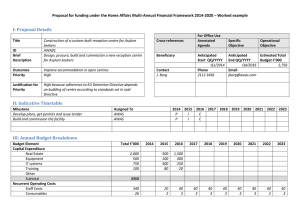

North Montco Technical Career Center Refinancing Discussion November 17, 2014 Presented by: Jamie Doyle Managing Director Public Financial Management, Inc One Keystone Plaza, Suite 300 North Front & Market Streets Harrisburg, PA 17101 717.232.2723 (P) 717.232.8610 (F) www.pfm.com MUNICIPAL MARKET UPDATE November 10, 2014 MMD YIELD CURVE The MMD Yield Curve is a high grade municipal yield curve published daily by Municipal Market Data. It is one of the most commonly used benchmarks in municipal finance. The yields within the curve reflect the current yields for each maturity year at which bondholders would be likely to sell high quality (AAA rated) general obligation backed bonds. The yield curve is typically influenced by new issuances in the primary market as well as post‐issuance trading in the secondary market. Municipal bonds typically trade at a "spread to MMD", meaning the difference between the yield in a specific year of a bond issue and the respective yield in the MMD Yield Curve. While these spreads vary over time, they can be a meaningful and powerful tool in trying to compare relative yield levels in a volatile interest rate environment. HISTORICAL MMD CURVE ILLUSTRATION ‐ SINCE JANUARY 1, 2004 7.00 6.00 Yield (%) 5.00 4.00 3.00 2.00 1.00 Range Average Current Maturity Year SPOT ANALYSIS ‐ 10 YEAR MMD ‐ SINCE JANUARY 1, 2004 4.80 Yield (%) 4.30 3.80 3.30 2.80 Since 1/1/2004 Amount Date 2.30 Min Max 1.470 4.860 11/28/2012 10/15/2008 1.80 Average 3.071 n/a Current 2.170 11/10/2014 1.30 1/1/04 1/1/05 1/1/06 1/1/07 1/1/08 1/1/09 1/1/10 1/1/11 1/1/12 1/1/13 1/1/14 1 Public Financial Management, Inc. 30 Year 29 Year 28 Year 27 Year 26 Year 25 Year 24 Year 23 Year 22 Year 21 Year 20 Year 19 Year 18 Year 17 Year 16 Year 15 Year 14 Year 13 Year 12 Year 11 Year 10 Year 9 Year 8 Year 7 Year 6 Year 5 Year 4 Year 3 Year 2 Year 1 Year 0.00 North Montco Technical Career Center Topics of Discussion I) Market Update Interest rates still remain below historical averages, despite equity markets reaching new highs and signs of an improving domestic economy. Tapering of the Federal Reserve’s Quantitative Easing bond buying program began in late 2013 and concluded in October 2014. Rates have since fallen slightly because supply of bonds is limited. II) Project Overview Series of 2010 Bonds (Maturities dated 5/15/15 – 5/15/31) ♦ $8,480,000 principal outstanding ♦ May 15, 2015 call date ♦ 2010 Technical Career Center underlying rating of Aa2 Pro‐rata share of bond issue to be split between member districts based on the original 2010 STEB percentage per Articles of Agreement Pro‐rata share to be guaranteed by member districts and count against member district’s borrowing capacity Pro‐rata share will not count against member districts Bank Qualified limit in the opinion of the Technical School Bond Counsel III) Financing Team Overview Issuer State Public School Building Authority Borrower North Montco Technical Career Center Bond Counsel Fox Rothschild LLP Financial Advisor Public Financial Management, Inc. Underwriter TBD Trustee TBD Public Financial Management, Inc. 11/10/2014 2 IV) Estimated Financing Timeline November 5, 2014 Initial presentation to NMTCC Business Managers November 11, 2014 Initial presentation to NMTCC Superintendents November 17, 2014 Initial Presentation to the JOC Authorization to proceed from JOC December 15, 2014 JOC to Approve SPSBA Preliminary Application Resolution January 12, 2015 Wissahickon School District to approve not to exceed resolution January 15, 2015 North Penn School District to approve not to exceed resolution January 22, 2015 Souderton Area School District to approve not to exceed resolution January 27, 2015 Methacton School District to approve not to exceed resolution January 2015 SPSBA meeting to approve borrowing & DCTSA approve borrowing February 18, 2015 Bond Sale – JOC meeting to approve competitive sale results March 25, 2015 Settlement May 15, 2015 2010 Bonds Call Date Public Financial Management, Inc. 11/10/2014 3 NORTH MONTCO TECHNICAL CAREER CENTER SERIES OF 2010 1 Date 41,958.00 5/15/2015 11/15/2015 5/15/2016 11/15/2016 5/15/2017 11/15/2017 5/15/2018 11/15/2018 5/15/2019 11/15/2019 5/15/2020 11/15/2020 5/15/2021 11/15/2021 5/15/2022 11/15/2022 5/15/2023 11/15/2023 5/15/2024 11/15/2024 5/15/2025 11/15/2025 5/15/2026 11/15/2026 5/15/2027 11/15/2027 5/15/2028 11/15/2028 5/15/2029 11/15/2029 5/15/2030 11/15/2030 5/15/2031 TOTALS 2 3 4 5 6 10 11 Fiscal Year Debt Service Wissahickon SD Local Effort Total Local Effort 529,487.50 48,558.27 142,672.79 55,707.38 62,547.01 309,485.44 689,175.00 63,202.90 185,701.31 72,508.10 81,410.49 402,822.79 692,625.00 63,519.29 186,630.93 72,871.08 81,818.02 404,839.31 690,625.00 63,335.87 186,092.02 72,660.66 81,581.77 403,670.31 693,325.00 63,583.48 186,819.54 72,944.72 81,900.71 405,248.46 689,512.50 63,233.85 185,792.24 72,543.61 81,450.36 403,020.06 689,287.50 63,213.21 185,731.62 72,519.94 81,423.77 402,888.54 688,537.50 63,144.43 185,529.53 72,441.03 81,335.18 402,450.17 692,262.50 63,486.05 186,533.24 72,832.94 81,775.20 404,627.43 692,862.50 63,541.07 186,694.92 72,896.06 81,846.08 404,978.13 692,662.50 63,522.73 186,641.03 72,875.02 81,822.45 404,861.23 691,662.50 63,431.02 186,371.57 72,769.81 81,704.33 404,276.73 694,862.50 63,724.49 187,233.83 73,106.48 82,082.33 406,147.13 692,062.50 63,467.70 186,479.35 72,811.90 81,751.58 404,510.53 693,462.50 63,596.10 186,856.59 72,959.19 81,916.96 405,328.83 693,862.50 63,632.78 186,964.37 73,001.27 81,964.21 405,562.63 693,262.50 63,577.75 186,802.70 72,938.15 81,893.33 405,211.93 3,119,537.50 11,599,537.50 11,599,537.50 1,063,770.98 3,125,547.58 1,220,387.34 1,370,223.78 6,779,929.67 Pro-Rata Share* AR% (2014-15) or 50% PE% 15.69% 50.00% 83.10% 46.10% 50.00% 83.10% 18.00% 50.00% 83.10% 20.21% 50.00% 83.10% Principal Rate Interest Semi-Annual Debt Service 370,000 4.000 385,000 3.000 400,000 3.000 410,000 3.000 425,000 3.250 435,000 3.500 450,000 3.500 465,000 3.500 485,000 4.000 505,000 4.000 525,000 4.000 545,000 4.000 570,000 4.000 590,000 4.000 615,000 4.000 640,000 4.000 665,000 4.250 159,487.50 152,087.50 152,087.50 146,312.50 146,312.50 140,312.50 140,312.50 134,162.50 134,162.50 127,256.25 127,256.25 119,643.75 119,643.75 111,768.75 111,768.75 103,631.25 103,631.25 93,931.25 93,931.25 83,831.25 83,831.25 73,331.25 73,331.25 62,431.25 62,431.25 51,031.25 51,031.25 39,231.25 39,231.25 26,931.25 26,931.25 14,131.25 14,131.25 529,487.50 152,087.50 537,087.50 146,312.50 546,312.50 140,312.50 550,312.50 134,162.50 559,162.50 127,256.25 562,256.25 119,643.75 569,643.75 111,768.75 576,768.75 103,631.25 588,631.25 93,931.25 598,931.25 83,831.25 608,831.25 73,331.25 618,331.25 62,431.25 632,431.25 51,031.25 641,031.25 39,231.25 654,231.25 26,931.25 666,931.25 14,131.25 679,131.25 8,480,000 7 8 9 PRO-RATA LOCAL EFFORT Methacton North Penn Souderton SD SD ASD Local Effort Local Effort Local Effort *Based on original 2010 STEB percentages Public Financial Management, Inc. 11/14/2014 4 NORTH MONTCO TECHNICAL CAREER CENTER AMOUNT TO CALL BONDS 1 2 3 4 5 SERIES OF 2010 AMOUNT TO CALL BONDS Date Principal Interest 5/15/2015 8,480,000.00 159,487.50 TOTALS 8,480,000.00 159,487.50 Public Financial Management, Inc. Escrow Agent Required 8,639,487.50 0.00 8,639,487.50 11/14/2014 5 NORTH MONTCO TECHNICAL CAREER CENTER SERIES OF 2015 REFUNDS THE SERIES OF 2010 1 2 3 4 ASSUMES 11/15 PRINCIPAL PAYMENT DATES 5 6 TOTALS Principal Coupon 390,000 0.940 480,000 1.160 485,000 1.380 495,000 1.630 500,000 1.880 510,000 2.120 520,000 2.360 535,000 2.550 550,000 2.680 565,000 2.800 580,000 2.900 600,000 3.000 615,000 3.070 640,000 3.130 660,000 3.180 680,000 3.230 8,805,000 Interest Semi-Annual Debt Service Fiscal Year Debt Service 30,189.79 108,683.25 106,850.25 106,850.25 104,066.25 104,066.25 100,719.75 100,719.75 96,685.50 96,685.50 91,985.50 91,985.50 86,579.50 86,579.50 80,443.50 80,443.50 73,622.25 73,622.25 66,252.25 66,252.25 58,342.25 58,342.25 49,932.25 49,932.25 40,932.25 40,932.25 31,492.00 31,492.00 21,476.00 21,476.00 10,982.00 10,982.00 30,189.79 498,683.25 106,850.25 586,850.25 104,066.25 589,066.25 100,719.75 595,719.75 96,685.50 596,685.50 91,985.50 601,985.50 86,579.50 606,579.50 80,443.50 615,443.50 73,622.25 623,622.25 66,252.25 631,252.25 58,342.25 638,342.25 49,932.25 649,932.25 40,932.25 655,932.25 31,492.00 671,492.00 21,476.00 681,476.00 10,982.00 690,982.00 30,189.79 2,768.65 8,134.77 605,533.50 55,532.30 690,916.50 2,179,596.04 11 12 13 Wissahickon SD Local Effort Proposed Total Local Effort Existing Local Effort Savings 3,176.27 3,566.24 17,645.93 309,485.44 291,839.51 163,163.72 63,708.18 71,530.13 353,934.33 402,822.79 48,888.46 63,362.61 186,170.56 72,691.32 81,616.20 403,840.69 404,839.31 998.62 689,786.00 63,258.93 185,865.94 72,572.39 81,482.66 403,179.92 403,670.31 490.40 692,405.25 63,499.13 186,571.71 72,847.96 81,792.07 404,710.87 405,248.46 537.59 688,671.00 63,156.67 185,565.50 72,455.08 81,350.95 402,528.20 403,020.06 491.86 688,565.00 63,146.95 185,536.94 72,443.92 81,338.43 402,466.25 402,888.54 422.30 687,023.00 63,005.54 185,121.44 72,281.69 81,156.28 401,564.94 402,450.17 885.23 689,065.75 63,192.88 185,671.87 72,496.61 81,397.58 402,758.94 404,627.43 1,868.49 689,874.50 63,267.05 185,889.79 72,581.70 81,493.12 403,231.65 404,978.13 1,746.49 689,594.50 63,241.37 185,814.34 72,552.24 81,460.04 403,067.99 404,861.23 1,793.25 688,274.50 63,120.31 185,458.66 72,413.36 81,304.11 402,296.45 404,276.73 1,980.29 690,864.50 63,357.84 186,156.55 72,685.85 81,610.06 403,810.30 406,147.13 2,336.83 687,424.25 63,042.33 185,229.56 72,323.91 81,203.67 401,799.47 404,510.53 2,711.06 692,968.00 63,550.74 186,723.35 72,907.16 81,858.54 405,039.80 405,328.83 289.04 692,458.00 63,503.97 186,585.93 72,853.51 81,798.30 404,741.70 405,562.63 820.93 690,982.00 63,368.61 186,188.21 72,698.22 81,623.94 403,878.98 405,211.93 1,332.95 10,984,596.04 1,007,375.89 2,959,848.83 1,155,689.36 1,297,582.33 6,420,496.40 6,779,929.67 359,433.28 Pro-Rata Share* AR% (2014-15) or 50% PE% 15.69% 50.00% 83.10% 46.10% 50.00% 83.10% 18.00% 50.00% 83.10% Amount 359,433.28 255,508.18 614,941.46 Percentage 4.24% 3.01% 7.25% Estimated Pro-Rata Net Savings 56,395.09 165,698.75 64,697.98 20.21% Savings Allocation 50.00% School District's Share 83.10% State's Share Total Savings 72,641.45 *Based on original 2010 STEB percentages 10,984,596.04 7 8 9 PRO-RATA LOCAL EFFORT Methacton North Penn Souderton SD SD ASD Local Effort Local Effort Local Effort 3/25/2015 3/25/2015 10 0.28 Date 41,958.00 5/15/2015 11/15/2015 5/15/2016 11/15/2016 5/15/2017 11/15/2017 5/15/2018 11/15/2018 5/15/2019 11/15/2019 5/15/2020 11/15/2020 5/15/2021 11/15/2021 5/15/2022 11/15/2022 5/15/2023 11/15/2023 5/15/2024 11/15/2024 5/15/2025 11/15/2025 5/15/2026 11/15/2026 5/15/2027 11/15/2027 5/15/2028 11/15/2028 5/15/2029 11/15/2029 5/15/2030 11/15/2030 5/15/2031 SETTLE DATED Public Financial Management, Inc. 11/14/2014 6 NORTH MONTCO TECHNICAL CAREER CENTER SERIES OF 2015 Estimated Composition of the Issue SOURCES: Bonds Accrued Interest Total USES: Amount to Call Bonds Underwriter's Discount $7.50 Bond Insurance $0.00 Original Issue Discount/(Premium) Total Legal Fees Financial Advisor Financial Printing/OS Formatting Credit Rating Trustee Miscellaneous Expenses/Rounding Total 8,805,000.00 0.00 8,805,000.00 8,639,488.00 66,037.50 0.00 0.00 24,000.00 40,000.00 15,000.00 16,000.00 1,500.00 2,974.50 8,805,000.00 Estimated Estimated TBD Estimated Estimated Estimated Estimated Estimated Dated Date 3/25/2015 0.28 Settlement Date 3/25/2015 0.28 Yield of the Issue 2.807932 Public Financial Management, Inc. 11/14/2014 7 Not To Exceed Parameters Public Financial Management, Inc. 8 PARAMETERS RESOLUTION In order to be able to enter the market when it is most advantageous, the member districts will consider a “Parameters Resolution”, which authorizes the financing team to issue the bonds as long as certain parameters are met. The Parameters Resolution establishes a set of threshold under which the ultimate financing must fit within, including: o Maximum principal amount o Maximum interest rate o Maximum final maturity Member districts will not need to hold special meetings to approve the final pricing of the bonds. The JOC will approve the not to exceed resolution at its meeting on February 18, 2015 or later 9 NORTH MONTCO TECHNICAL CAREER CENTER SERIES OF 2015 Methacton School District Pro-Rata Share 15.69% Settled Dated 3/25/2015 3/25/2015 4 5 6 Proposed Fiscal Year Debt Service MAX PARAMETERS 1 2 3 Date 41958 5/15/2015 11/15/2015 5/15/2016 11/15/2016 5/15/2017 11/15/2017 5/15/2018 11/15/2018 5/15/2019 11/15/2019 5/15/2020 11/15/2020 5/15/2021 11/15/2021 5/15/2022 11/15/2022 5/15/2023 11/15/2023 5/15/2024 11/15/2024 5/15/2025 11/15/2025 5/15/2026 11/15/2026 5/15/2027 11/15/2027 5/15/2028 11/15/2028 5/15/2029 11/15/2029 5/15/2030 11/15/2030 5/15/2031 Principal Rate Interest Semi-Annual Debt Service 57,269 94,140 6.000 6.000 99,632 6.000 105,908 6.000 98,063 6.000 97,278 6.000 97,278 6.000 98,847 6.000 101,201 6.000 101,985 6.000 105,123 6.000 106,692 6.000 110,615 6.000 112,184 6.000 115,322 6.000 118,460 6.000 121,598 6.000 14,513.25 50,529.65 47,705.45 47,705.45 44,716.50 44,716.50 41,539.28 41,539.28 38,597.40 38,597.40 35,679.06 35,679.06 32,760.72 32,760.72 29,795.31 29,795.31 26,759.30 26,759.30 23,699.75 23,699.75 20,546.06 20,546.06 17,345.30 17,345.30 14,026.86 14,026.86 10,661.36 10,661.36 7,201.71 7,201.71 3,647.93 3,647.93 71,781.75 144,669.65 47,705.45 147,336.95 44,716.50 150,624.00 41,539.28 139,601.78 38,597.40 135,875.40 35,679.06 132,957.06 32,760.72 131,607.72 29,795.31 130,995.81 26,759.30 128,744.30 23,699.75 128,822.75 20,546.06 127,238.06 17,345.30 127,959.80 14,026.86 126,210.36 10,661.36 125,982.86 7,201.71 125,661.21 3,647.93 125,245.43 TOTALS 1,741,590 71,781.75 192,375.09 192,053.45 192,163.28 178,199.18 171,554.46 165,717.78 161,403.03 157,755.11 152,444.04 149,368.80 144,583.35 141,986.66 136,871.72 133,184.57 129,309.14 125,245.43 854,406.80 2,595,996.80 2,595,996.80 10 NORTH MONTCO TECHNICAL CAREER CENTER SERIES OF 2015 North Penn School District Pro-Rata Share 46.10% Settled Dated 3/25/2015 3/25/2015 4 5 6 Proposed Fiscal Year Debt Service MAX PARAMETERS 1 2 3 Date 41958 5/15/2015 11/15/2015 5/15/2016 11/15/2016 5/15/2017 11/15/2017 5/15/2018 11/15/2018 5/15/2019 11/15/2019 5/15/2020 11/15/2020 5/15/2021 11/15/2021 5/15/2022 11/15/2022 5/15/2023 11/15/2023 5/15/2024 11/15/2024 5/15/2025 11/15/2025 5/15/2026 11/15/2026 5/15/2027 11/15/2027 5/15/2028 11/15/2028 5/15/2029 11/15/2029 5/15/2030 11/15/2030 5/15/2031 Principal Rate Interest Semi-Annual Debt Service 168,265 276,600 6.000 6.000 292,735 6.000 311,175 6.000 288,125 6.000 285,820 6.000 285,820 6.000 290,430 6.000 297,345 6.000 299,650 6.000 308,870 6.000 313,480 6.000 325,005 6.000 329,615 6.000 338,835 6.000 348,055 6.000 357,275 6.000 42,642.50 148,465.05 140,167.05 140,167.05 131,385.00 131,385.00 122,049.75 122,049.75 113,406.00 113,406.00 104,831.40 104,831.40 96,256.80 96,256.80 87,543.90 87,543.90 78,623.55 78,623.55 69,634.05 69,634.05 60,367.95 60,367.95 50,963.55 50,963.55 41,213.40 41,213.40 31,324.95 31,324.95 21,159.90 21,159.90 10,718.25 10,718.25 210,907.50 425,065.05 140,167.05 432,902.05 131,385.00 442,560.00 122,049.75 410,174.75 113,406.00 399,226.00 104,831.40 390,651.40 96,256.80 386,686.80 87,543.90 384,888.90 78,623.55 378,273.55 69,634.05 378,504.05 60,367.95 373,847.95 50,963.55 375,968.55 41,213.40 370,828.40 31,324.95 370,159.95 21,159.90 369,214.90 10,718.25 367,993.25 TOTALS 5,117,100 210,907.50 565,232.10 564,287.05 564,609.75 523,580.75 504,057.40 486,908.20 474,230.70 463,512.45 447,907.60 438,872.00 424,811.50 417,181.95 402,153.35 391,319.85 379,933.15 367,993.25 2,510,398.55 7,627,498.55 7,627,498.55 11 NORTH MONTCO TECHNICAL CAREER CENTER SERIES OF 2015 Souderton Area School District Pro-Rata Share 18.00% Settled Dated 3/25/2015 3/25/2015 4 5 6 Proposed Fiscal Year Debt Service MAX PARAMETERS 1 2 3 Date 41958 5/15/2015 11/15/2015 5/15/2016 11/15/2016 5/15/2017 11/15/2017 5/15/2018 11/15/2018 5/15/2019 11/15/2019 5/15/2020 11/15/2020 5/15/2021 11/15/2021 5/15/2022 11/15/2022 5/15/2023 11/15/2023 5/15/2024 11/15/2024 5/15/2025 11/15/2025 5/15/2026 11/15/2026 5/15/2027 11/15/2027 5/15/2028 11/15/2028 5/15/2029 11/15/2029 5/15/2030 11/15/2030 5/15/2031 Principal Rate Interest Semi-Annual Debt Service 65,700 108,000 6.000 6.000 114,300 6.000 121,500 6.000 112,500 6.000 111,600 6.000 111,600 6.000 113,400 6.000 116,100 6.000 117,000 6.000 120,600 6.000 122,400 6.000 126,900 6.000 128,700 6.000 132,300 6.000 135,900 6.000 139,500 6.000 16,650.00 57,969.00 54,729.00 54,729.00 51,300.00 51,300.00 47,655.00 47,655.00 44,280.00 44,280.00 40,932.00 40,932.00 37,584.00 37,584.00 34,182.00 34,182.00 30,699.00 30,699.00 27,189.00 27,189.00 23,571.00 23,571.00 19,899.00 19,899.00 16,092.00 16,092.00 12,231.00 12,231.00 8,262.00 8,262.00 4,185.00 4,185.00 82,350.00 165,969.00 54,729.00 169,029.00 51,300.00 172,800.00 47,655.00 160,155.00 44,280.00 155,880.00 40,932.00 152,532.00 37,584.00 150,984.00 34,182.00 150,282.00 30,699.00 147,699.00 27,189.00 147,789.00 23,571.00 145,971.00 19,899.00 146,799.00 16,092.00 144,792.00 12,231.00 144,531.00 8,262.00 144,162.00 4,185.00 143,685.00 TOTALS 1,998,000 82,350.00 220,698.00 220,329.00 220,455.00 204,435.00 196,812.00 190,116.00 185,166.00 180,981.00 174,888.00 171,360.00 165,870.00 162,891.00 157,023.00 152,793.00 148,347.00 143,685.00 980,199.00 2,978,199.00 2,978,199.00 12 NORTH MONTCO TECHNICAL CAREER CENTER SERIES OF 2015 Wissahickon School District Pro-Rata Share 20.21% Settled Dated 3/25/2015 3/25/2015 4 5 6 Proposed Fiscal Year Debt Service MAX PARAMETERS 1 2 3 Date 41958 5/15/2015 11/15/2015 5/15/2016 11/15/2016 5/15/2017 11/15/2017 5/15/2018 11/15/2018 5/15/2019 11/15/2019 5/15/2020 11/15/2020 5/15/2021 11/15/2021 5/15/2022 11/15/2022 5/15/2023 11/15/2023 5/15/2024 11/15/2024 5/15/2025 11/15/2025 5/15/2026 11/15/2026 5/15/2027 11/15/2027 5/15/2028 11/15/2028 5/15/2029 11/15/2029 5/15/2030 11/15/2030 5/15/2031 Principal Rate Interest Semi-Annual Debt Service 73,767 121,260 6.000 6.000 128,334 6.000 136,418 6.000 126,313 6.000 125,302 6.000 125,302 6.000 127,323 6.000 130,355 6.000 131,365 6.000 135,407 6.000 137,428 6.000 142,481 6.000 144,502 6.000 148,544 6.000 152,586 6.000 156,628 6.000 18,694.25 65,086.31 61,448.51 61,448.51 57,598.50 57,598.50 53,505.98 53,505.98 49,716.60 49,716.60 45,957.54 45,957.54 42,198.48 42,198.48 38,378.79 38,378.79 34,468.16 34,468.16 30,527.21 30,527.21 26,465.00 26,465.00 22,342.16 22,342.16 18,067.74 18,067.74 13,732.70 13,732.70 9,276.39 9,276.39 4,698.83 4,698.83 92,460.75 186,346.31 61,448.51 189,782.01 57,598.50 194,016.00 53,505.98 179,818.48 49,716.60 175,018.60 45,957.54 171,259.54 42,198.48 169,521.48 38,378.79 168,733.29 34,468.16 165,833.16 30,527.21 165,934.21 26,465.00 163,893.00 22,342.16 164,822.66 18,067.74 162,569.24 13,732.70 162,276.20 9,276.39 161,861.89 4,698.83 161,326.33 TOTALS 2,243,310 92,460.75 247,794.81 247,380.51 247,521.98 229,535.08 220,976.14 213,458.02 207,900.27 203,201.45 196,360.36 192,399.20 186,235.15 182,890.40 176,301.94 171,552.59 166,560.72 161,326.33 1,100,545.66 3,343,855.66 3,343,855.66 13 SAMPLE MOTION Resolved: The Joint Operating Committee of the North Montco Technical Career Center (the “TCC”) does hereby authorize the Administration to work with Public Financial Management, as Financial Advisor, Fox Rothschild LLP as Bond Counsel, and the local Solicitor in conjunction with the issuance of the School Lease Revenue Bonds, Series of 2015, for the purpose of current refunding the School Lease Revenue Bonds, Series of 2010 via a competitive RFP process with a minimum net savings target of ________% (Historic benchmark is 2.0% ≈ $169,600). Public Financial Management, Inc. 14