GENERAL FUND REPORT

advertisement

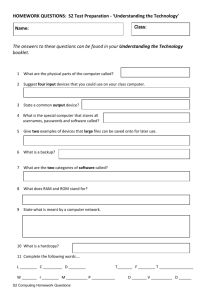

North Penn School District GENERAL FUND REPORT Financials - June 2014 STATEMENT OF REVENUE AND EXPENDITURES June 1, 2014 ‐ June 30, 2014 Beginning Balance, May 31, 2014 REVENUE Current Real Estate Interim Real Estate Public Utility R.E. Tax Payments in Lieu of Tax Earned Income Tax Real Estate Transfer Tax Delinquent Real Estate Tax Interest Earnings Athletic Events Student Fees Tuition from Patrons Rentals Service Local Gov LEAS Other Local Revenue Basic Instructional Subsidy $ 197,870.58 $ 17,217.27 $ ‐ $ ‐ $ 2,222,220.33 $ 520,190.81 $ 133,920.15 $ 9,162.51 $ 19,780.00 $ 5,379.00 $ 1,510.00 $ 8,793.75 $ (26,038.00) $ 28,180.99 $ ‐ Special Education Subsidy Special Ed Aged Pupil Transportation Subsidy Property Tax Reduction Alloc PA Accountability Grant State Social Security Other State Revenue Federal Revenue Sources Other Financing Sources $ ‐ $ ‐ $ 1,130,546.96 $ ‐ $ ‐ $ 337,470.59 $ 3,185,276.81 $ 196,055.91 $ ‐ Revenue & Beginning Fund Balance EXPENDITURES Regular Instruction Special Education $ 20,164,106.44 $ 6,976,743.84 Vocational Education Other Instructional Programs Nonpublic School Programs Preschool Programs Pupil Personnel Services Instructional Support Services Administrative Services Pupil Health Services Business Services Operations, Maint, Grounds Pupil Transportation Other Support Services Noninstructional Services Capital Project Other Finance Fringe Benefits Suspense $ ‐ $ 61,074.99 $ ‐ $ 9,512.20 $ 1,406,495.05 $ 814,294.89 $ 1,265,009.16 $ 431,643.46 $ 316,321.25 $ 1,184,266.99 $ 1,608,275.12 $ 124,376.80 $ 171,696.93 $ 57,878.25 $ 42,598.00 $ ‐ Ending Fund Balance, June 30, 2014 $ 69,966,084.33 $ 7,987,537.66 $ 77,953,621.99 ASSETS Cash & Cash Equivalents Investments Payroll Tax Escrow Account Taxes Receivable Interfund Receivable State Subsidies Receivable Federal Subsidies Receivable Other Accounts Receivable $ 56,317,423.52 $ 697,997.29 $ 25,661.95 $ 3,387,386.59 $ 2,523,941.85 $ 368,768.75 $ 3,176,908.33 $ 432,907.24 $ 145,199.46 Blue Cross Deposit & SEPaST Prescription Trust Inventory $ ‐ $ ‐ $ 199,665.13 Total Assets $ 67,275,860.11 LIABILITIES Judgements Payables Accounts Payable Prior Year Payables Accrued Salaries, Benefits, Taxes Deferred Revenues $ 3,387,525.73 $ 5,250,949.35 $ 6,940.00 $ 12,707,507.07 $ 2,603,609.34 Less:Total Liabilities $ 23,956,531.49 Fund Balance‐Inventory Fund Balance‐Blue Cross Fund Balance ‐ Medical Fund Balance‐PSERS Fund Balance‐Unrestricted $ 192,286.29 $ ‐ $ 2,700,000.00 $ 13,406,187.00 $ 17,650,443.91 Equals: Fund Equity $ 43,319,328.62 $ 34,634,293.37 $ 43,319,328.62 G:\Business Office\_DirBusiness\FinanceCommittee\2014-2015\GenFundFinRprts2014-15Financial June 2014 North Penn School District TREASURER'S REPORT GENERAL FUND REVENUE AND EXPENDITURES June 30, 2014 Period 12 2013-2014 Budget Period 12 June 30, 2014-YTD % of Budget 24,427,674.00 33,948,917.20 149,022,685.00 149,545,976.93 600,000.00 2,205,726.03 215,000.00 203,424.46 13,000,000.00 15,280,374.64 2,000,000.00 2,800,000.00 2,694,159.11 3,117,074.08 139.0% Description Beginning Fund Balance 100.4% Real Estate Tax 367.6% Interim Real Estate Tax 94.6% Public Utility Reality Tax 117.5% Earned Income Tax 134.7% Real Estate Transfer Tax 111.3% Deliquent Taxes 78.7% Interest on Investments 2012-2013 Budget June 30, 2013-YTD % of Budget 23,483,279.00 28,647,950.70 122.0% 144,805,430.00 144,855,402.67 100.0% 600,000.00 615,646.67 102.6% 200,000.00 219,282.11 109.6% 13,104,708.00 14,337,468.22 109.4% 1,950,000.00 2,300,000.00 1,805,045.95 3,777,330.50 92.6% 164.2% 225,000.00 177,082.15 80,000.00 96,214.50 20,000.00 177,598.30 16,000.00 90,441.30 565.3% Rentals 40,000.00 64,256.51 160.6% Tuition 40,000.00 66,692.50 166.7% 50,210.00 479,600.71 955.2% Other Local Revenue 86,210.00 400,700.19 464.8% 37,899,740.00 37,707,424.17 99.5% 7000 State Subsidies 34,677,163.00 34,172,683.78 98.5% 5,720,609.00 4,717,110.79 6,054,420.00 4,820,304.97 79.6% 124,100.00 131,156.84 625,000.00 628,013.47 100.5% 211,813,344.00 216,687,620.52 102.3% TOTAL RECEIPTS 204,841,931.00 206,266,104.07 100.7% 236,241,018.00 250,636,537.72 106.1% TOTAL FUNDS AVAILABLE 228,325,210.00 234,914,054.77 102.9% 120.3% Athletic Events 888.0% Student Fees 82.5% 8000 Federal Subsidies 105.7% 9000 Other Financing Sources 300,000.00 211,179.30 70.4% 87,000.00 109,506.15 125.9% 0.00 187,534.55 12,000.00 59,313.04 #DIV/0! 494.3% ***EXPENDITURES*** INSTRUCTION 92,718,840.00 91,825,290.69 99.0% 1100 Regular Program 87,648,684.00 86,350,633.17 98.5% 34,571,425.00 34,270,251.55 99.1% 1200 Special Ed Program 32,524,598.00 33,156,042.52 101.9% 3,679,879.00 3,680,379.00 100.0% 1300 Vocational‐Technical 1,523,172.00 311,303.89 11,700.00 0.00 0.0% 1500 Nonpublic School Programs 0.00 0.00 0.0% 1700 Dual Enrollment 113,404.00 94,642.87 132,618,420.00 130,181,868.00 20.4% 1400 Other Instructional Prog. 83.5% 1800 Pre School 98.2% Instruction Sub Total 3,713,487.00 3,741,215.92 100.7% 1,301,299.00 1,310,585.39 100.7% 10,933.00 11,775.89 107.7% 0.00 0.00 0.0% 0.00 68,117.06 0.0% 125,199,001.00 124,638,369.95 99.6% SUPPORT SERVICES 7,687,598.00 7,723,107.77 100.5% 2100 Pupil Personnel Services 7,574,511.00 6,964,390.35 91.9% 5,198,345.00 5,679,712.09 109.3% 2200 Instructional Support 4,611,518.00 4,785,933.95 103.8% 12,670,966.00 11,674,675.71 12,253,110.00 10,675,278.40 87.1% 2,634,486.00 2,558,230.12 97.1% 2400 Pupil Health Services 2,483,929.00 2,471,098.05 99.5% 3,973,640.00 2,331,389.61 58.7% 2500 Business Services 3,258,537.00 2,271,645.23 69.7% 14,757,831.00 14,336,995.41 97.1% 2600 Operation & Maintence 15,070,918.00 13,236,393.51 87.8% 14,452,932.00 13,346,808.24 92.3% 2700 Pupil Transportation Svcs 14,293,909.00 13,123,837.26 91.8% 1,572,286.00 1,487,304.53 94.6% 2800 Data Processing Services 1,654,819.00 1,405,730.65 84.9% 344,079.00 360,328.56 201,650.00 199,340.86 98.9% 63,292,163.00 59,498,552.04 61,402,901.00 55,133,648.26 89.8% 2,342,098.00 2,308,759.59 98.6% 63,971.00 29,083.65 45.5% 167,300.00 274,191.00 163.9% 2,573,369.00 2,612,034.24 101.5% 92.1% 2300 Administrative Services 104.7% 2900 Other Support Services 94.0% Support Services Sub Totals NONISTRUCTIONAL SVCS 2,438,022.00 2,518,237.63 59,539.00 21,470.78 0.00 405,361.73 2,497,561.00 2,945,070.14 103.3% 3200 Student Activities 36.1% 3300 Community Services 0.0% 4600 Improvement Exist Building 117.9% Noninstructional Svc Sub‐Totals OTHER FINANCING USES 13,943,289.00 13,811,303.92 0.00 0.00 0.00 99.1% 5100 Debt Service 15,962,669.00 13,533,244.18 84.8% 0.0% 5200 Fund Transfers 0.00 500,000.00 0.0% 880,415.00 0.0% 5800 Suspense Account 0.00 520,793.00 0.0% 2,500,000.00 0.00 0.0% 5900 Budgetary Reserve 2,500,000.00 16,443,289.00 14,691,718.92 89.3% 214,851,433.00 207,317,209.10 96.5% 21,389,585.00 43,319,328.62 0.0% Other Uses Sub‐Totals 18,462,669.00 14,554,037.18 78.8% TOTAL EXPENDITURES 207,637,940.00 196,938,089.63 94.8% Current Ending Fund Balance 20,687,270.00 37,975,965.14 G:\Business Office\_DirBusiness\FinanceCommittee\2014-2015\GenFundFinRprts2014-15Rev-Exp June 14