Efficacy of China‘s capital controls RIETI/BIS/BOC conference

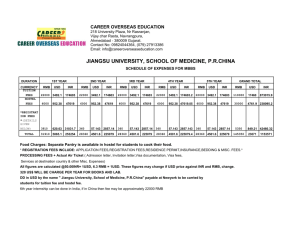

advertisement

Efficacy of China‘s capital controls RIETI/BIS/BOC conference Globalisation of financial servceis in China: implications for capital flows, supervision and monetary policy Beijing, 19 March 2005 Guonan Ma and Robert McCauley Bank for Intenational Settlements 1 Agenda I. China‘s capital account is leaky: 1. Expanding gross cross-border flows 2. Non-FDI capital inflows: main sources of reserve accumulation 3. Bank flows responsive to yields and currency expectations 4. Leaks through leads/lags in trade payments II. But China‘s capital controls bind: a. Big onshore/offshore yield spreads b. Signs of the spreads suggest underlying pressure on curerncy when capital controls bind c. China retains independent monetary policy in the short run 2 I. 1. China’s rising gross cross-border flows China’s gross cross-border flows1 Graph 1 As a percentage of GDP 100 100 Gross current account flows Gross capital account flows 80 80 60 60 40 40 20 20 0 1 1982 1990 0 2003 Defined as the sum of debit and credit flows on China’s balance of payments, excluding errors and omissions. Source: CEIC. 3 China’s rising gross cross-border flows z The sum of all the BoP debit and credit flows as a proxy for the size of gross cross-border flows z Gross cross-border flows via both current and capital accounts have increased significantly: ¾ 100% of GDP in 2003 vs. less than 20% in 1982 z Gross cross-border capital flows have expanded faster than gross current account flows: ¾ Possible underestimation of cross-border bank flows z Larger cross-border flows set the stage for a leaky capital account and limited efficacy of controls 4 I. 2. Major sources of China’s rapid reserves accumulation z Official foreign reserves accumulation accelerated to record $207 billion during 2004 – Equivalent to 13% of GDP!! z Big reserves build-up was fuelled mainly not by basic balance surpluses but by net non-FDI capital inflows: Basic balance = current account + net FDI balance z Basic balance surplus funded all FX accumulation in 2001 and 2002 but only half of the buildup since 2003 5 Non-FDI inflows versus basic balance surplus Graph 2 China’s basic balance, non-FDI capital flows and reserve accumulation In billions of US dollars 100 100 80 Reserve accumulation1 Basic balance2 Non-FDI capital flows 80 60 60 40 40 20 20 0 0 –20 2001 2002 2003 2004 –20 1 Adjusted for valuation effect and the $45bn bank recapitalisation in 2003H3. 2 Sum of current account balance (adjusted for net current transfers) and net FDI balance. 3 Includes net current transfers and errors & omissions. Sources: CEIC; BIS estimates. 6 Leaky capital controls: unusually large inflows in remittance and error flows Graph 6 China’s balance of payments: net current transfers and errors and omissions In billions of US dollars 20 20 Net current transfers Errors and omissions 10 10 0 0 – 10 – 10 – 20 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 – 20 2003 Source: CEIC. 7 Adjusting China’s basic balance z Unusually big swings in net remittances and net error/omission flows – suggest a leaky capital account and – distort the relative role of non-FDI capital flows z The need for adjusting the basic balance and non-FDI capital flows: 1) Adjusted basic balance = current account + FDI – exceptional net remittance 2) Adjusted net Non-FDI capital flows = non-FDI capital flows + exceptional net remittance + net error/omission flow 8 I. 3. Bank flows sensitive to relative yields and expected exchange rate z Dollar bank deposits and loans respond systematically to relative yields and currency expectations: – After the Asian crisis, Chinese residents added $ deposits and trimmed $ loans, because of lower RMB yields and depreciation expectations – Since 2002, they stopped adding $ deposits and took more $ loans, owing to higher RMB rates and appreciation expectations z These responsive dollar bank flows – reflect active underlying cross-border capital flows – affect the pace of reserves accumulation 9 Dollar deposits sensitive to relative yields Graph 4 China’s foreign currency deposits and relative dollar deposit yields 10 400 1-year USD/RMB deposit rate less 1-year RMB deposit rate (lhs, in basis points) Ratio of foreign currency to RMB deposits (rhs, in per cent) 300 9 200 8 100 7 0 6 –100 5 –200 1999 2000 2001 2002 2003 4 2004 Note: The onshore dollar deposit rate is for small deposits (USD 3 millions of less). Sources: The People’s Bank of China; authors’ own estimates. 10 Since 2002, strong demand for dollar loans while weak dollar deposit holdings Graph 8 Foreign currency loans and deposits at banks in China In US$ billions; end-of-period figures 160 150 160 Loans Deposits 150 140 140 130 130 120 120 110 110 100 100 90 1998 1999 2000 2001 2002 2003 90 2004 Note: Data for 2004 refer to June. Sources: The People’s Bank of China; authors’ own estimates. 11 BIS area banks report active crossborder bank flows in China z These shifts in dollar deposits and loans have been partially accommodated or financed by banks in China drawing down their net overseas claims on BIS banks – Both Chinese and foreign-owed banks in China z In 2002 and 2003, China’s net claims on BIS banks shrank by almost half (territorial data) => – Overseas claims fell by 10% – Overseas borrowings rose by one third 12 Rising claims and falling liabilities of BIS banks vis-à-vis China (US$ bn) 120 30 20 100 10 80 0 -1 0 60 -2 0 40 -3 0 N e t c la im s o n C h in a (R H S ) -4 0 C la im s o n C h in a (L H S ) 20 -5 0 L ia b ilitie s v s C h in a (L H S ) Q3 2003 Q4 2002 Q1 2002 Q2 2001 Q3 2000 Q4 1999 Q1 1999 Q2 1998 Q3 1997 Q4 1996 Q1 1996 Q2 1995 Q3 1994 Q4 1993 Q1 1993 Q2 1992 Q3 1991 Q4 1990 -6 0 Q1 1990 0 13 I. 4. Capital flows leak through China’s large, more liberalised trade sector z “Leads and lags” in trade payments may produce cross- border capital flows of $193 billion, given – Accelerated export receipts & delayed import payments => capital inflows – China’s exports and imports total $1,155bn last year – A two-month shift in export receipts or import payments z These potential trade-related capital flows are equivalent to – 32% of China’s official foreign reserves ($610bn at end of 2004) – Nearly 100% of China’s reserve accumulation in 2004 14 II. Despite leaks, China’s capital control still effective and binding z A better measure: cross-border arbitrage conditions z Capital control reduces capital mobility z Said to be effective when interest rates on same currency differ onshore and offshore z Covered interest parity rests on free capital mobility and market- based interest rates: RMB forward premium (annualised) = RMB interest rate - USD interest rate 15 Implied offshore RMB interest rate z In presence of effective capital control, onshore and offshore markets segment and yields differ z Implied RMB interest rate abroad = USD interest rate abroad – offshore RMB forward premium F = S (1+r)/(1+r$), where F = Offshore RMB forward rate (measured by NDF) S = Spot RMB/USD rate r$ = USD LIBOR r = NDF implied RMB interest rate offshore 16 Capital controls: effectiveness and direction of market pressure z When onshore yields on RMB ≠ offshore NDF- implied yields on RMB, markets in the same currency are segmented z The size and sign of the gap between onshore RMB yield and NDF-implied offshore RMB yield suggest – Effectiveness of capital control – Direction of market pressure 17 Large onshore/offshore spread for the RMB z The cross-border yield spread on RMB averages 250-300 bps z The RMB spread is the second largest in Asia for the 2002-2004 episode z By comparison, the Korean won counterpart is only 50 bps for the same period 18 Feb.04 Dec.03 Oct.03 Aug.03 Jun.03 Apr.03 Feb.03 Dec.02 Oct.02 Aug.02 Jun.02 Apr.02 Feb.02 10% Dec.01 14% Oct.01 Aug.01 Jun.01 Apr.01 Feb.01 Dec.00 Oct.00 Aug.00 Jun.00 Apr.00 Feb.00 Dec.99 Oct.99 Aug.99 Jun.99 Apr.99 Feb.99 Dec.98 Evolving onshore and offshore RMB rates 18% 16% O f f s h o r e 3 m N D F - im p lie d 12% O n s h o r e 3 m C h ib o r 8% 6% 4% 2% 0% -2 % -4 % -6 % -8 % 19 Onshore less offshore spread has been positive since 2002 1 ,0 0 0 800 600 S p r e a d b e t w e e n 3 m o n s h o r e y ie ld a n d o f f s h o r e N D F - im p lie d y ie ld 400 200 0 -2 0 0 -4 0 0 -6 0 0 -8 0 0 Feb.04 Dec.03 Oct.03 Aug.03 Jun.03 Apr.03 Feb.03 Dec.02 Oct.02 Aug.02 Jun.02 Apr.02 Feb.02 Dec.01 Oct.01 Aug.01 Jun.01 Apr.01 Feb.01 Dec.00 Oct.00 Aug.00 Jun.00 Apr.00 Feb.00 Dec.99 Oct.99 Aug.99 Jun.99 Apr.99 Feb.99 - 1 ,2 0 0 Dec.98 - 1 ,0 0 0 20 Signs of spread indicative of directions of market pressure z Before mid 2001, implied RMB interest rate offshore was higher than onshore rate, suggesting capital controls effective in limiting capital outflows z Now offshore RMB interest rate is lower, suggesting capital controls effective in limiting capital inflows into RMB assets – restrictions on the accumulation of RMB assets funded by dollar liabilities – even more net dollar sales against RMB to the PBOC in the absence of effective capital control 21 Domestic CNY yields less USD yields bps 800 700 3m Chinese repo less 3m US Treasury 600 PBC base lending rate less effective Fed fund rate 500 3m CHIBOR less 3m LIBOR 400 300 200 100 0 -100 -200 -300 -400 Ju n. 9 S 7 ep .9 D 7 ec .9 7 M ar .9 8 Ju n. 9 S 8 ep .9 D 8 ec .9 8 M ar .9 9 Ju n. 9 S 9 ep .9 D 9 ec .9 9 M ar .0 0 Ju n. 0 S 0 ep .0 D 0 ec .0 0 M ar .0 1 Ju n. 0 S 1 ep .0 D 1 ec .0 1 M ar .0 2 Ju n. 0 S 2 ep .0 D 2 ec .0 M 2 ar .0 3 Ju n. 0 S 3 ep .0 D 3 ec .0 M 3 ar .0 4 Ju n. 0 S 4 ep .0 D 4 ec .0 4 -500 Source: CEIC. 22 Table 2 Relations among interbank market rate pairs 7 days 3 months CNY/USD EUR/USD CNY/USD EUR/USD Ave of absolute difference (bps) 152.7 142.1 271.2 276.9 Max of the differential (bps) 173.4 190.0 783.5 166.4 Min of the differential (bps) -429.6 -281.5 -435.2 -283.8 Correlation coefficient 0.405 0.657 0.591 0.744 Note: The interbank market offer rates are CHIBOR for the renminbi, LIBOR for the US dollar and EURIBOR for the euro; monthly data from January 1999 to February 2005. Source: CEIC. 23 Summary z China’s gross cross-border flows rose significantly; non-DFI capital inflows fuelled half of the latest reserves accumulation z Recent big swings in capital flows via the current account (such as remittance and leads/lags in trade payments) by Chinese residents to put on short-dollar, long-RMB positions z Large cross-border bank flows responsive to relative yields and indicative of a leaky capital account z Arbitrage fails to equalise yields, suggesting effective capital controls that have limited cross-border capital flows and segmented onshore and offshore markets z China enjoys no less monetary independence than the euro area z China’s capital account is leaky, but its capital controls still bind 24