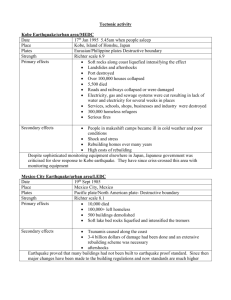

DP Natural Disasters and Plant Survival: The impact of the Kobe earthquake

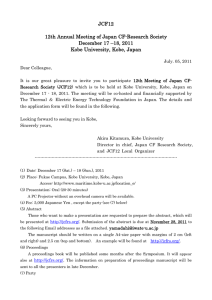

advertisement