F S C 5: B

advertisement

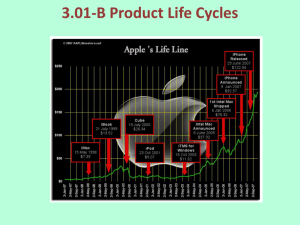

FOUNDATIONS OF STRATEGY CHAPTER 5: BUSINESS STRATEGIES IN DIFFERENT INDUSTRY AND SECTORAL CONTEXTS By: Anthony Gauthier, Austin Hughes, Michael Wilson, John Bell, and Travis Messerschmitt INTRODUCTION One of the greatest challenges to management is to ensure the enterprise adapts to the environment and changes in the environment. Changes in the environment are spurred on by competition among companies to maintain or obtain competitive advantage. Change is also primarily driven by changing technology, consumer needs, politics, and economic growth. THE HISTORY OF COCA COLA IN CONTEXT In 1886 Coca Cola invented, Pepsi follows in 1898, a new race begins… 1906 Fed passes new regulations on food contents, Coke has to change formula, Pepsi does not. 1916 Coca Cola designs unique cola bottle, recognizable in dark, sets apart from 1000’s of competitors. Pepsi attempts to follow to standardize bottle, fails due to financial difficulties, rationing of sugar leads to company bankruptcy in 1923. INDUSTRY LIFE CYCLE The industry life cycle is the supply side equivalent of the product life cycle. Four stages: introduction, growth, maturity, and decline. DEMAND GROWTH Introduction: Sales are small and market penetration is low, often high cost and low quality products, primary customers are innovation oriented and risk tolerant. Growth: Accelerated market penetration as technical improvements and increased efficiency open up market. Maturity: There is increasing market saturation, once pinnacle reach demand solely is for replacement. Decline: A new industry with superior technology arrives, begins decline. PRODUCTION AND DIFFUSION OF KNOWLEDGE New knowledge in the form of product innovation is responsible for the birth of new industries. Knowledge creation and diffusion drive industries to evolve. DOMINANT DESIGNS INTRO Dominant Design – a product architecture that defines the look, functionality, and production method for the product and is accepted by the industry as a whole. DOMINANT DESIGN MODEL Firms hone in on product innovation. Battle ensues to find superior way. Best way becomes industry standard. Everyone shifts to mimic dominant design. Firms focus in on process innovation. FROM PRODUCT TO PROCESS INNOVATION Dominant Design emerges in an industry Companies shift from big to small product innovations Industry Starts growing Companies invest in process innovations LIFE CYCLE PATTERN Alternative product/offering come about Dominant design arrives Product innovation declines Companies grow around dominant design Economies of scale are achieved Focus turns to cash flow & market share Industry revenue starts declining LIFE CYCLE GENERALITIES Vary greatly across industries Isn’t the same around the globe Sources of competitive advantage change Affluent countries are first to start new life cycle INTRO PHASE OF THE LIFE CYCLE Introduction DEMAND TECHNOLOGY PRODUCTS Early adopters w/ high income Rapid product innovation w/ competing technologies Poor quality. Tons of variety in features offered MANUFACTURING/DISTRIBU Requires highly skilled labor & TION short production runs TRADE COMPETITION KEYS TO SUCCESS Advanced countries Few companies Product innovation. Credible branding THE INTRODUCTION PHASE The number of firms in an industry increases rapidly in the industry’s early stages. Some start-ups, some established companies that are attempting to diversify their product line. Production innovation is the basis of entry. New industries typically begin in advanced industrial countries because of the presence of wealthy customers and the high availability of technological and scientific resources. THE GROWTH PHASE • • • • When the market grows, scaling up becomes the key challenge. Financial resources become more important. Production in newly industrialized countries becomes attractive to reduce production related costs. Example: The PC market in the 1980s and 1990s. THE MATURITY PHASE Competitive advantage is increasingly a quest for efficiency. As product standardization increases, the number of firms begins to fall. Industries go through “shakeout” phases With maturity comes de-skilling of production processes and production shifts to developing countries with low labor costs. Example: Cell phones; the move to touchscreens/smartphones could be considered a shakeout phase. The carbonated beverage industry (Coca Cola). THE DECLINE PHASE Technological substitution, changes in consumer preferences, or foreign competition may lead to the decline phase. Decline phase does not guarantee loss of profits – some firms capitalize on other firms’ exits. Two factors determine if firms can plan for the decline: (1) balance between capacity and output and (2) the nature of the demand for the product. If firms can plan for the decline, it is easier to achieve a balance between capacity and output. Example: Print newspaper KEY SUCCESS FACTORS AND STRATEGY 1. 2. 3. 4. Introductory Stage: product innovation, acquiring capital, and capabilities in manufacturing, marketing and distribution. Growth Stage: scaling up and adapting design and manufacturing for large-scale production. Maturity Stage: Cost efficiency through economies of scale and low wages and overheads. Decline Stage: Cost cutting and maintaining stability. PUBLIC VS NOT-FOR-PROFIT SECTORS Public organizations are defined by ownership, funding, and interests they serve (i.e., government). Revenue comes from taxes Examples of public goods: road services, national defense, law enforcement Without these necessary goods, market failure would result. PUBLIC VS NOT-FOR-PROFIT SECTORS Non-for-profit organizations do not distribute surplus funds. After covering costs, profits are invested back into the organization. Examples: education, healthcare, arts, culture, religion (Red Cross, Federal Credit Unions, churches) Social enterprises are different from not-for-profit and public organization. They are similar to notfor-profits in that they use business to achieve social goals, but they act in interest of their shareholders and their goals. KEY DIFFERENCES BETWEEN PUBLIC AND PRIVATE ORGANIZATIONS THAT IMPACT STRATEGY 1. MULTIPLE POTENTIALLY CONFLICTING GOALS Public sector must worry about political interests and resource scarcity above the interests of shareholders Private sector is able to give primacy to shareholders’ interests to reconcile competing claims 2. DISTINCTIVE CONSTRAINTS AND DIFFERENT LEVERS Public sector must take into account public opinion, political factors, tax-raising capacity… Private sector does not have the same tools as public, such as regulatory framework or legislation. 3. AN ABSENCE OF MARKET FORCES Water treatment facilities correct failures from the private sector in the public sector. 4. MONOPOLY POWER Private sector can become classified as utilities and come under heavy regulation Public sector provides services that can become ignorant of customer complaints 5. LESS AUTONOMY AND FLEXIBILITY Public sector is directly influenced by politics, but managers have the opportunity to shape the environment 6. INCREASED ACCOUNTABILITY Public sector has much more public scrutiny and are intended to act in the interest of the public Private sector is accountable but original intent is to care for stakeholders and its own longevity rather than public interests. 7. LESS PREDICTABILITY Media pressure can change the outcome of policies made by managers in the public sector APPLICATION TO NON-PROFIT Employment of volunteers: the U.S. government conducts a census every 10 years Fundraising OSTER’S SIX FORCES Some strategic methods are not universally applicable, especially in non-profit STAKEHOLDER ANALYSIS Identification of the list of potential stakeholders Ranking stakeholders according to their importance and influence on the organization Identifying the criteria that each stakeholder is likely to use to judge the organization’s performance Deciding how well the org. is doing from their perspective Identifying what can be done to satisfy each stakeholder Identifying and recording longer term issues with individual stakeholders and stakeholders as a group POWER/INTEREST GRID SCENARIO PLANNING - A systematic way of thinking about how the future might unfold - Short term vs. Long term - Make events and run simulations to identify outcomes Steps: 1. Define the purpose of the analysis Ex: Asses risk of expansion/downsizing 2. Deciding on time horizon Short term vs. Long term 3. Identify Key Uncertainties Public’s view of your product 4. Identify Key Trends What is happening in your industry Steps Continued… 5. Create Scenarios and Check Consistency Make sure scenarios are both plausible and consistent with current trends in your industry 6. Identify Indicators that Signal Which Scenario is Unfolding Which events lead to certain outcomes 7. Assess Strategic Implications Ask “What if?” - Scenario Analysis brings different insights and ideas to the table and puts your company on the same page before moving forward.