Pinnacle Academ y Chapter Tests [CT] Series

advertisement

![Pinnacle Academ y Chapter Tests [CT] Series](http://s2.studylib.net/store/data/014002176_1-a4e7c483dfd398f14d6ebc19359ef474-768x994.png)

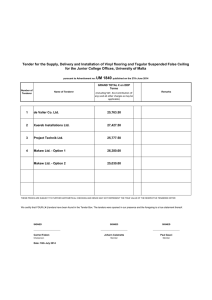

Downloaded from www.ashishlalaji.net Pinnacle Academy Chapter Tests [CT] Series August 2015 Batch 201-202, Florence Classic, Besides Unnati Vidhyalay, Jain Derasar Road, Ashapuri Society, Akota, Vadodara-20. ph: 98258 561 55 Solution of Test of CFS – 2 [FR – CA Final] Conducted on 26th March 2016 (Solution is at the end with markings for self assessment) Time Allowed-1 hour Q1 Maximum Marks- 20 The balance sheets of A Ltd. and B Ltd. as on 31.12.2015 are as follows: Sources of Funds: A Ltd. B Ltd. Share Capital in equity shares of Rs.10 each Capital Reserve General Reserve Profit and Loss Account Creditors Total 2,00,000 20,000 30,000 8,000 34,000 2,92,000 50,000 5,000 5,000 8,000 20,000 88,000 Application of Funds: Fixed Assets Shares in B Ltd. Shares in C Ltd. Stock A Ltd. 1,74,800 66,000 25,200 26,000 2,92,000 B Ltd. 80,000 --------8,000 88,000 Total A Ltd. had acquired 4,000 shares in B Ltd. on 1st January, 2015 and sold 1,000 of them at the Rs.30 on 1st October, 2015. A Ltd. credited the sale proceeds of shares sold to investment account. An interim dividend of 10% for the full year was paid by B Ltd. on 1st July, 2015. Balance in capital reserve, general reserve and Profit and Loss account of B Ltd. on 1st January 2015 were Rs.3,000, Rs.2,000 and Rs.6,000 respectively. A Ltd. had also acquired 1,200 shares of C Ltd. as on 1st January 2015 for Rs.15 per share. On that date the profit and loss account of C Ltd. had a balance of Rs.4,400. A Ltd. acquired another 400 shares for Rs.18 per share on 1st April 2015 when the profit and loss account of C Ltd. showed a balance of Rs.5,300. 1 Downloaded from www.ashishlalaji.net Balance sheet of C Ltd. as on 31st December 2015 is as under: Liabilities Share Capital: Eq. Shares of Rs. 10 each Profit & Loss A/c Creditors Amount Assets Fixed Assets 20,000 Stock 7,200 4,800 32,000 Amount 30,000 2,000 32,000 Prepare consolidated balance sheet of A Ltd. and its subsidiaries B Ltd. and C Ltd. as on 31st December 2015. (20 Marks) (Assessed answer papers shall be returned latest by 14th April 2016) 2 Downloaded from www.ashishlalaji.net Solution of Test of CFS – 2 Conducted on 26th March 2016 Q1 A Ltd. 3,000 / 5,000 1,600 / 2,000 1,200 / 2,000 i.e. 60 % (01.01.15) 60% (01.01.15) 80% 400 / 2.000 i.e. 20 % (01.04.15) B Ltd. C Ltd. Working Notes: (1) Profits earned by subsidiaries during 2015: B Ltd. C Ltd. (Rs.) (Rs.) 8,000 7,200 3,000 ------5,000 ------16,000 7,200 6,000 4,400 10,000 2,800 P & L A/c as on 31.12.15 Add: Transfer to general reserve Interim Dividend for 2015 Less: P & L A/c as on 01.01.15 (2 Marks) (2) Analysis of Profits of Subsidiaries: (a) B Ltd. General Reserve on 01.01.15 Capital Reserve on 01.01.15 P & L A/c on 01.01.15 Profits in 2015 Transfer to general reserve Interim dividend for 2015 Increase in capital reserve Minority (40%) A Ltd. (60%) (b) C Ltd. P & L A/c on 01.01.15 Profits in 2015 Minority (20%) A Ltd. (80%) Adjustment for additional 20% shares for profits earned from 01.01.15 to 01.04.15 (5,300 – 4,400 i.e. 900 X 20%) A Ltd. (Revised) Capital Revenue Revenue Capital Profits Profits Reserve Reserve 2,000 ------------------------3,000 ------------------------6,000 --------------------------------10,000 ----------------11,000 10,000 ------------------------(3,000) 3,000 ----------------(5,000) ----------------------------------------2,000 11,000 2,000 3,000 2,000 4,400 800 1,200 800 6,600 1,200 1,800 1,200 4,400 ------4,400 880 3,520 ------------------------180 3,700 -------2,800 2,800 560 2,240 ------------------------(180) 2,060 --------------------------------------------------------------------------------- --------------------------------------------------------------------------------(5 Marks) 3 Downloaded from www.ashishlalaji.net (3) Rectified cost of investment in shares of B Ltd.: As per balance sheet Add: Sale proceeds wrongly credited Less: Cost of shares sold (96,000 / 4,000 i.e. 24 X 1,000) Rectified Cost No. of Amount shares 3,000 66,000 1,000 30,000 4,000 96,000 1,000 3,000 24,000 72,000 (2 Marks) (4) Cost of Control: Cost of Shares Less: Paid up value Share in capital profits Goodwill B Ltd. C Ltd. 72,000 25,200 30,000 16,000 6,600 3,700 35,400 5,500 40,900 (2 Marks) (5) Minority Interest: Paid up value of shares Share in profits and reserves B Ltd. C Ltd. 20,000 4,000 7,200 1,440 27,200 5,440 32,640 (1 Mark) (6) Consolidated P & L A/c: P & L A/c as on 31.12.15 of A Ltd. Add: Share in revenue profits (2,060 + 1,200) Profit on sale of shares of B (30,000 – 24,000) Amount (Rs.) 8,000 3,260 6,000 17,260 (1 Mark) (7) Consolidated General Reserve and Capital Reserve: Reserve as on 31.12.15 of A Ltd. Add: Share from B General Capital Reserve Reserve 30,000 20,000 1,800 1,200 31,800 21,200 (1 Mark) 4 Downloaded from www.ashishlalaji.net Consolidated Balance Sheet of A Ltd. as on 31st December 2015 Note No. Amount Amount I. 1. (a) (b) Equity and Liabilities: Shareholders’ Funds Share Capital Reserves and Surplus 2. Minority Interest 32,640 3. Current Liabilities Trade Payables 58,800 2,70,260 1 2,00,000 70,260 58,800 3,61,700 Total II. 1. 2. Assets: Non Current Assets (a) Tangible Fixed Assets (b) Intangible Fixed Assets (Goodwill) 3,25,700 2,84,800 40,900 Current Assets Inventories 36,000 36,000 3,61,700 Total See accompanying notes to Consolidated Balance Sheet. Notes forming part of Consolidated Balance Sheet Note No. 1 Amount Amount (Rs.) (Rs.) Reserves and Surplus Consolidated Capital Reserve Consolidated General Reserve Consolidated Profit and Loss Account 21,200 31,800 17,260 70,260 (6 Marks) Solution prepared by CA. Ashish Lalaji 5