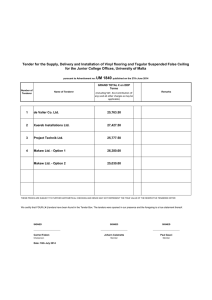

Pinnacle Academ y Chapter Tests [CT] Series

advertisement

![Pinnacle Academ y Chapter Tests [CT] Series](http://s2.studylib.net/store/data/014002175_1-8bebc7237e8a0f33c9dd2d4ff0e2dea6-768x994.png)

Downloaded from www.ashishlalaji.net Pinnacle Academy Chapter Tests [CT] Series August 2015 Batch 201-202, Florence Classic, Besides Unnati Vidhyalay, Jain Derasar Road, Ashapuri Society, Akota, Vadodara-20. ph: 98258 561 55 Solution of Test of CFS – 1 [FR – CA Final] Conducted on 12th March 2016 (Solution is at the end with markings for self assessment) Time Allowed-1 hour Q1 Maximum Marks- 20 Following are the Balance Sheets of X Ltd. and Y Ltd. as on 31st December, 2015: Liabilities Equity Shares of Rs. 10 each 12% Pref. Shares of Rs. 10 each General Reserve Profit & Loss A/c 10% Debentures of Rs. 100 each Capital Reserve Proposed Dividend: Equity Preference Bills Payable X Ltd. 8,00,000 ----3,60,000 2,40,000 ----2,00,000 1,20,000 ----2,10,000 19,30,000 Y Ltd. Assets Fixed Assets 5,00,000 Investments: Equity Shares in 2,00,000 Y Ltd. 1,20,000 Preference 1,20,000 Shares in Y Ltd. Debentures in Y 50,000 Ltd. 1,00,000 Bills Receivables Preliminary 60,000 expenses 24,000 1,15,000 12,89,000 X Ltd. 12,11,000 Y Ltd. 12,10,000 4,50,000 ----- 1,80,000 ----- 25,000 51,600 ----69,000 12,400 10,000 19,30,000 12,89,000 Other information is as under: i. The general reserve of Y Ltd as on 01.01.2015 was Rs.1,80,000. ii. The capital reserve of Y Ltd. as on 01.01.2015 was Rs.60,000. iii. X Ltd. acquired 30,000 equity shares and 15,000 preference shares in Y Ltd. on 01.01.2015. 240 Debentures of Y Ltd. were purchased by X Ltd. many years ago when those debentures were first issued by Y Ltd. 1 Downloaded from www.ashishlalaji.net iv. The balance of Profit and Loss Account of Y Ltd. as on 01.01.2015 of Rs.1,39,000 is after providing for preference dividend and proposed equity dividend @ 10%; both of which were subsequently paid and credited to Profit and loss A/c of X Ltd. v. Y Ltd. has issued fully paid bonus shares in the ratio of 1 share for every 4 shares held in October 2015 by drawing upon the general reserve. The transaction has been given effect to in the books of Y Ltd. vi. Fixed assets of Y Ltd. were revalued at Rs.14,12,500 as on 01.01.2015 effect of which is pending in books of Y Ltd. Depreciation has been provided on fixed assets at 20% p.a. vii. Bills receivables of X Ltd. includes bills of Rs.30,000 accepted by Y Ltd. Prepare consolidated balance sheets of X Ltd. as on 31.12.2015. (20 Marks) th (Assessed answer papers shall be returned latest by 26 March 2016) 2 Downloaded from www.ashishlalaji.net Solution of Test of Consolidated Financial Statements – 1 Conducted on 12th March 2016 Q1 Working Notes: (1) Extent of Holding: (a) Equity Shares: Pre bonus shares: Bonus shares: Post bonus shares: 4 1 5 Pre-bonus shares = 50,000 X 4 / 5 i.e. 40,000 % of holding = (30,000 + Bonus 30,000 X 1 / 4) i.e. 37,500 / 50,000 = 75% (b) Preference Shares: % of holding = 15,000 / 20,000 i.e. 75% (2) Profits earned by Y Ltd. during 2015: P & L A/c as on 31.12.15 Add: Transfer to general reserve Proposed Dividend for 2015 Less: P & L A/c as on 01.01.15 Amount (Rs.) 1,20,000 40,000 84,000 2,44,000 1,39,000 1,05,000 (2 Marks) (3) Revaluation of Fixed Assets of Y Ltd.: Amount (Rs.) 15,12,500 14,12,500 1,00,000 Book value on 01.01.15 (12,10,000 / 80%) Revalued on 01.01.15 at Revaluation Loss on 01.01.15 Depreciation for 01.01.15 to 31.12.15 on Revalued Amount (14,12,500 X 20%) Book Value (already provided) (15,12,500 X 20%) Excess depreciation to be reversed 2,82,500 3,02,500 20,000 (2 Marks) (4) Analysis of Profits of Y Ltd.: General Reserve on 01.01.15 P & L A/c on 01.01.15 Capital Reserve on 01.01.15 Profits in 2015 Transfer to general reserve Revaluation loss on 01.01.15 Depreciation reversed Increase in capital reserve Bonus issue Capital Profits 1,80,000 1,39,000 60,000 ---------3,79,000 (1,00,000) ------------------(1,00,000) Revenue Profits ---------------------------1,05,000 1,05,000 (40,000) ---------20,000 ------------------- Revenue Reserve ---------------------------------------------40,000 ------------------------------------- Capital Reserve ------------------------------------------------------------------------40,000 ---------- 3 Downloaded from www.ashishlalaji.net Provision for Declared Preference Dividend (2015) Preliminary expenses Minority (25%) X Ltd. (75%) ---------(10,000) 1,69,000 42,250 1,26,750 (24,000) ---------61,000 15,250 45,750 ------------------40,000 10,000 30,000 ------------------40,000 10,000 30,000 (4 Marks) (5) Cost of Control: Cost of Shares Less: Pre-acquisition dividend: Correct Cost Less: Paid up value including bonus Share in capital profits Capital Reserve Equity Preference 4,50,000 1,80,000 30,000 18,000 (40,000 X 75%) (24,000 X 75%) 4,20,000 1,62,000 3,75,000 1,50,000 1,26,750 --(81,750) 12,000 69,750 (2 Marks) (6) Cancellation of Investment in Debentures of Y Ltd. Cost of Debentures Less: Paid up value Loss on cancellation 25,000 24,000 1,000 (1 Mark) (7) Minority Interest: Paid up value of shares Share in profits and reserves Share in declared preference dividend (24,000 X 25%) Equity Preference 1,25,000 50,000 77,500 ---6,000 2,02,500 56,000 2,58,500 (1 Mark) (8) Consolidated P & L A/c: P & L A/c as on 31.12.15 of X Ltd. Add: Share in revenue profits Pre-acquisition dividend wrongly credited (30 + 18) Loss on cancellation of debentures Share in declared preference dividend (24,000 X 75%) Amount (Rs.) 2,40,000 45,750 (48,000) (1,000) 18,000 2,54,750 (1 Mark) (9) Consolidated General Reserve and (10) Capital Reserve: Balance on 31.12.15 of X Ltd. Add: Share from Y Ltd. Capital reserve on consolidation Loss on cancellation of debentures General Capital Reserve Reserve 3,60,000 2,00,000 30,000 30,000 ---------69,750 3,90,000 2,99,750 (1 Mark) 4 Downloaded from www.ashishlalaji.net Consolidated Balance Sheet of X Ltd. as on 31st December 2015 I. 1. (a) (b) Equity and Liabilities: Shareholders’ Funds Share Capital Reserves and Surplus 2. Minority Interest 3. Non Current Liabilities Long Term Borrowings 4. II. 1. 2. Note No. Amount 1 8,00,000 9,32,100 Amount 17,32,100 2,58,500 2 Current Liabilities Trade Payables Short Term Provisions (Proposed Dividend) Total Assets: Non Current Assets Fixed Assets - Tangible Current Assets Trade Receivables 26,000 4,15,000 3 2,95,000 1,20,000 24,31,600 23,41,000 4 23,41,000 90,600 5 90,600 24,31,600 Total See accompanying notes. Note No. 1 Amount (Rs.) Reserves and Surplus Consolidated Capital Reserve Consolidated General Reserve Consolidated Profit and Loss Account Less: Preliminary Expenses 2 3 4 Long Term Borrowings 10 % Debentures Less: Mutual Obligation Trade Payables Bills Payables Less: Mutual Obligation Tangible Fixed Assets Less: Revaluation Loss Add: Depreciation reversed 5 Trade Receivables Bills Receivables Less: Mutual Obligation Amount (Rs.) 2,99,750 3,90,000 2,54,750 9,44,500 12,400 9,32,100 50,000 24,000 26,000 3,25,000 30,000 2,95,000 24,21,000 1,00,000 23,21,000 20,000 23,41,000 1,20,600 30,000 90,600 (6 Marks) Solution prepared by CA. Ashish Lalaji 5 Downloaded from www.ashishlalaji.net 6