Pinnacle Academ y Chapter Tests [CT] Series

advertisement

![Pinnacle Academ y Chapter Tests [CT] Series](http://s2.studylib.net/store/data/014002156_1-981c591522bbd86fa591f849a5990d00-768x994.png)

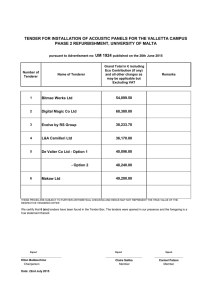

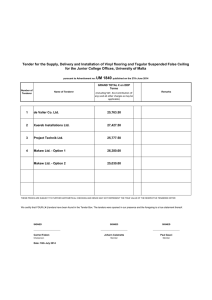

Downloaded from www.ashishlalaji.net Pinnacle Academy Chapter Tests [CT] Series August 2015 Batch 201-202, Florence Classic, Besides Unnati Vidhyalay, Jain Derasar Road, Ashapuri Society, Akota, Vadodara-20. ph: 98258 561 55 Solution of Test of Disclosure Accounting Standards [FR – CA Final] Conducted on 10th October 2015 (Solution is at the end with markings for self assessment) Time Allowed-1 hour Q1 (a) Maximum Marks- 30 Decide whether disclosures are required for following transactions as per AS 18 citing appropriate reason for inclusion / exclusion: i. N Ltd. made sales to G Ltd. The sales were made at normal selling prices followed by N Ltd. The Managing Director of N Ltd. owns 30% in G Ltd. ii. A Ltd. made sales to B Ltd. The sales were at cost plus 20%. B Ltd. is subsidiary of D Ltd. and D Ltd. is associate of A Ltd. iii. R Ltd. is owned 100% by Government of Gujarat. It makes sales to K Ltd., in which 60% holding is of Government of Maharashtra. iv. C Ltd. owned 25 % shares of E Ltd. However, its holding reduced to 5 % in E Ltd. as it sold the shares in open market. C Ltd. sold goods to E Ltd. after the reduction of its holding in E Ltd. v. T Ltd. sold goods to its subsidiary S Ltd. However, the sales to S Ltd. are less than 5 % of total sales of T Ltd. vi. J Ltd. sells to L Ltd. Mr. ABC, a non-executive director, is on the board of both the companies. (b) On 30th June 2011, A Ltd. incurred Rs.2,00,000 net loss from disposal of a business segment. Also, on 30th July 2011, the company paid Rs.60,000 for property taxes assessed for calendar year 2011. How shall these transactions be included in determination of net income of A Ltd. for the six months interim period ended on 30th September 2011? (c) ABC Ltd. has three segments namely A, B and C. The segment assets of the three segments are Rs.200 lakhs, Rs.500 lakhs and Rs.1,300 lakhs respectively. Deferred tax assets included in the assets of each segment are – A: Rs.30 lakhs; B: Rs.50 lakhs and C: Rs.25 lakhs. Applying the test of segment assets of AS 17 decide, which are the reportable segments? (9 + 3 + 3 = 15 Marks) 1 Downloaded from www.ashishlalaji.net Q2 (a) (b) R Pvt. Ltd. is a company registered in India. It is into the business of chemicals (contributing 25% of its revenue), paints and dyes (contributing 45% of its revenue) and detergents and soaps (contributing balance of its revenue). The total revenue (turnover) of the company for the year ended 31st March 2013 is Rs.25 crores and it has borrowings of only Rs.15 lakhs. No shares or any security of R Pvt. Ltd. is listed or in the process of listing in India. The borrowings of R Pvt. Ltd. represent FCCB which are listed on Luxemburg Stock Exchange. The accountant of the company is of the view that R Pvt. Ltd. is a Small and Medium Company (SMC) to which AS 17 is not applicable and hence segment report need not be provided. The FCCB represent Foreign Currency Convertible Bonds and not shares and hence the accountant argues that its listing on foreign exchange does not matter. Do you agree with the view of the accountant? Explain giving the definition of SMC. (4 Marks) Determine Basic and Diluted EPS (mandatory and voluntary) on the basis of following information: Profit before interest and tax Equity Shares as on 01.04.13 (Face value Rs.10) Extraordinary gain included in above profit New issue of equity shares on 01.06.13 (ex-bonus) Bonus shares on 01.06.13 Convertible Debentures (Face value Rs.1,000) issued on 01.04.09 Coupon rate of Convertible Debentures Debentures convertible into equity shares on 01.04.16 5 % Non cumulative preference shares (non convertible) Preference dividend is in arrears since last 2 years Current year preference dividend is also not provided in books Tax rate Rs.19,05,000 2,10,000 1,15,000 1,20,000 1:1 Rs.5,00,000 6% 10 : 1 Rs.4,00,000 30 % (11 Marks) th (Assessed answer papers shall be returned latest by 24 October 2015) 2 Downloaded from www.ashishlalaji.net Solution of Test of Disclosure Accounting Standards Conducted on 10th October 2015 Q1 (a) i. As per AS 18 separate disclosure has to be given for transactions between reporting enterprise and any entity where key management personnel (KMP) and their relatives have control or significant influence. In this case, transaction of N Ltd. is with G Ltd., where the managing director (KMP) of N Ltd. has significant influence (30%). Hence, separate disclosure is required ii. As per AS 18 separate disclosure is required for transactions between reporting enterprise and its associates. An associate of subsidiary is not a related party of the reporting enterprise. Hence, separate disclosure is not required. iii. As per AS 18 transactions between state or central government entities are exempt from disclosures. Hence, separate disclosure is not required. iv. As per AS 18 related party relationship exists if one party has ability to control or significantly influence another party at any point of time during the period. In the given case, transaction has taken place between C Ltd. (investor) and E Ltd. (associate) after related party relationship came to an end. Hence, separate disclosure is not required. v. As per AS 18 separate disclosure is required for transactions between reporting enterprise and its subsidiaries. There is no condition under AS 18 about the volume of transaction for disclosure. Hence, separate disclosure is required. vi. As per AS 18, two or more companies are not related party simply because they have a common director. Further, the director that is common between the two given entities in the case is a non-executive director, which normally is excluded from the definition of KMP. Hence, separate disclosure is not required. (1 ½ Marks each i.e. 9 Marks) (b) According to AS 25 “Interim Financial Reporting” an enterprise should treat an interim period to be a separate accounting period (discrete approach). As on 30th September 2011, A Ltd. will have to report entire Rs.2,00,000 loss on the disposal of business segment since the loss was incurred during the period. Such loss cannot be deferred and taken to another interim period. However, a cost charged on an annual basis can be allocated to interim periods on accrual basis. Since Rs.60,000 property taxes is for the entire calendar year 2011, Rs.30,000 shall be reported as an expense for six months ended on 30th September 2011; while remaining Rs.30,000 would be reported as prepaid expenses. (3 Marks) (c) As per AS 17 “Segment Reporting”, a segment is reportable if segment assets are 10 % or more than the total segment assets. However, segment assets do not include income tax assets. Hence, deferred tax asset (DTA) should be excluded from the segment assets to apply the test of segment assets for identifying reportable segments. Solution prepared by CA. Ashish Lalaji 3 Downloaded from www.ashishlalaji.net (Rs. in lakhs) Segment A B C Current DTA to be Revised Segment Excluded Segment Assets Assets 200 30 500 50 1,300 25 Total Segment Assets 170 450 1,275 1,895 Thus, segments having assets of Rs.189.5 lakhs or more are reportable i.e. segments B and C. (3 Marks) Q2 (a) Small and Medium Company (SMC) as defined in Clause 2 (f) of the Companies (Accounting Standards) Rules, 2006: Small and Medium-sized Company (SMC) means, a company – i. whose equity or debt securities are not listed or are not in the process of listing on any stock exchange, whether in India or outside India; ii. which is not a bank, financial institution or an insurance company; iii. whose turnover (excluding other income) does not exceed Rs.50 crores in the immediately preceding accounting year; iv. which does not have borrowings (including public deposits) in excess of Rs.10 crores at any time during the immediately preceding accounting year; and v. which is not a holding or subsidiary company of a company which is not a small and medium-sized company In the given case, R Pvt. Ltd. fulfills condition (ii) to (v) but it fails to fulfill condition (i). FCCBs issued by R Pvt. Ltd. are a debt security listed on a stock exchange outside India. R Pvt. Ltd. is not SMC and hence AS 17 shall be applicable. The view of the accountant is incorrect. (2 Marks for definition; 2 marks for final conclusion) (b) Calculation of Profit to Equity Shareholders: Amount (Rs.) PBIT as given Less: Interest (5,00,000 X 6%) PBT Less: Tax @ 30% PAT / Profit to equity shareholders 19,05,000 30,000 18,75,000 5,62,500 13,12,500 Notes: i. Profit to equity shareholders is inclusive of extraordinary gain ii. Preference dividend for non-cumulative preference shares is deducted only if provided in books; otherwise ignored (2 Marks) Solution prepared by CA. Ashish Lalaji 4 Downloaded from www.ashishlalaji.net Calculation of Weighted Average Number of Equity Shares (WANES) for the year ended 31st March 2014: Date Particulars No. of shares Time Weight Weighted Product 01.04.13 At the beginning Bonus shares* 2,10,000 2,15,000 12 / 12 12 / 12 2,10,000 2,15,000 01.06.13 Issued for cash 1,20,000 10 / 12 1,00,000 5,25,000 (3 Marks) * Determination of Bonus shares issued: Bonus ratio is 1:1 and bonus shares are issued on equity shares outstanding as on 01.04.13 i.e. 2,10,000 shares. Hence, bonus shares issued is 2,10,000. Further, a company having convertible debentures shall have to issue bonus shares, through reservation of shares, also on the convertible portion of such debentures. 500 debentures X 10 i.e. 5,000 equity shares X 1/1 = 5,000 bonus. Thus, total bonus shares issued is 2,15,000 on 01.06.13. However, for the purpose of WANES it shall be presumed as if the bonus shares were issued from the beginning of the earliest reporting period. (1 Mark) Computation of Basic EPS for the year ended 31st March 2014: Basic EPS = 13,12,500 / 5,25,000 = Rs.2.50 (1 Mark) st Computation of Diluted EPS for the year ended 31 March 2014: On conversion of debentures, additional 5,000 (500 X 10) equity shares shall be issued. There shall be savings of interest of Rs.30,000, which net of tax savings shall increase the profit by Rs.21,000. Diluted EPS = 13,12,500 + 21,000 / 5,25,000 + 5,000 = Rs.2.52 The EPS is increasing i.e. Convertible Debentures are anti-dilutive and hence ignored. In other words, the given company does not have any diluted EPS. (3 Marks) Additional disclosure allowed by AS 20 (Voluntary): A company can additionally also disclose EPS excluding extraordinary item. The extraordinary gain net of tax is: 1,15,000 – 30% i.e. Rs.80,500 Basic EPS = 13,12,500 – 80,500 / 5,25,000 = Rs.2.35 Solution prepared by (2 Marks) CA. Ashish Lalaji 5