Pinnacle Academ y Mock Tests for

advertisement

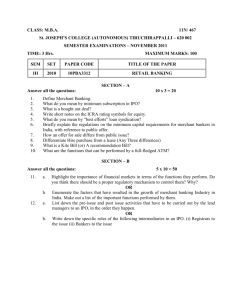

Downloaded from www.ashishlalaji.net Pinnacle Academy Mock Tests for November 2015 C A Final Examination 201-202, Florence Classic, Besides Unnati Vidhyalay, 10, Ashapuri Society, Jain Derasar Rd., Akota, Vadodara-20. ph: 98258 561 55 FR Mock Test 3 Time Allowed-3 hours 9th October 2015 Maximum Marks- 100 Q 1 is compulsory. Answer any 5 from the remaining. Q1 (a) A company organizing trade fairs and exhibitions charges 5% contingency charges from the participants and outside agencies. The rent for the space booked by the participants in the trade fair includes the contingency charges. In dealing with outside agencies, the contingency charges are levied separately in the invoice. The intention of levying these charges is to meet any unforeseen liability, which may arise in future. The instances of such unforeseen liabilities may be on account of injury or loss of lift to visitors or exhibitors due to fire, terrorist attack, stampede, natural calamities and other public and third party liability. The chance of occurrence of these events are high because of large crowds that visit the fair. The decision to levy 5% contingency charges was based on assessment only as actual liability cannot be estimated. The following accounting treatment and disclosure was made by the company in its financial statements: a. 5% contingency charges are treated as income and matching provision for the same is also made in accounts b. A suitable disclosure to this effect is also made in the notes forming part of accounts Required: (i) Whether the creation of provision for contingencies under the facts and circumstances of the case is in conformity with AS 29 (ii) If the answer to (i) above is no then what should be the treatment of the provision which is already created in the balance sheet (5 Marks) 1 Downloaded from www.ashishlalaji.net (b) i. ii. iii. iv. v. Net profit of Rs.5,40,000 has been determined before tax for third quarter ended 31st December 2010. The net profit has been calculated considering following items: Extra-ordinary loss of Rs.50,000 has been incurred on 2nd November 2010. 50% has been allocated to 4th quarter Extra-ordinary gain of Rs.90,000 was earned on 1st May 2010. It has been allocated equally to 1st, 2nd and 3rd quarter. Bad debts of Rs.80,000 was incurred on 5th September 2010. 50 % has been allocated to 3rd quarter. Provision for warranty costs is Rs.20,000. Out of this Rs.15,000 provision relates to 2nd quarter due to wrong estimate in 2nd quarter. However, Rs.20,000 deducted in 3rd quarter. Depreciation method was changed on 31st December 2010. Excess depreciation of Rs.75,000 has been provided in 3rd quarter. However, only Rs.15,000 of excess depreciation is related to current quarter. Calculate income for the quarter ended 31st December 2010. (5 Marks) (c) Take Ltd. has borrowed Rs.30 lakhs from SBI during the year 2012 – 13. The borrowings are used to invest in shares of Give Ltd., a subsidiary of Take Ltd., which is implementing a new project, estimated to cost Rs.50 lakhs. As on 31st March 2013, since the said project is yet not complete, the directors of Take Ltd. have decided to capitalize the interest cost of Rs.4 lakhs and add it to the cost of investments. Comment on the basis of requirements of AS 13. (4 Marks) (d) Grant Medicare Ltd. acquired 5 units of Brain Scan Equipment for USD 5,00,000 in April 2010 incurring Rs.20,00,000 on sea freight and USD 12,000 per unit towards transit insurance, bank charges, etc. Purchase was partly funded by government grant of Rs.94 lakhs. Prevailing exchange rate is Rs.50 per USD. Company estimated useful life of equipment at 4 years with an estimated salvage value of approximately 13%. Grant was considered as deferred income up to 2012 – 13 and in April 2013 company had to return the entire grant received due to non fulfillment of certain conditions. You are required to show depreciation and the grant that is to be recognized in profit and loss account for the period commencing from 2010 – 11 and onwards. What accounting entry shall be passed for return of grant in April 2013? Company follows WDV method of depreciation. (6 Marks) (Assessed answer papers should be collected from NEW CLASS on 17th October 2015) 2 Downloaded from www.ashishlalaji.net Q2 (a) Following information is available about Lookdown Ltd.: Equity shares of Rs.100 each of which Rs.75 has been called up Equity shares in respect of which calls are in arrears @ Rs.25 per share General reserve Profit and Loss account (balance at beginning of the year) Profit / (Loss) for the year Industry average profitability 8% Debentures of Rs.10 each 5,00,000 Rs.1,00,000 Rs.10,00,000 (Rs.25,00,000) (Rs.1,80,000) 12.50 % 8,00,000 Lookdown Ltd. is proposing to hire the services of Mr. X to turn the company around. Minimum take home salary per month demanded by Mr. X Average income tax rate on salaries Provident fund contribution by employer per month Profits over and above target profit expected by hiring Mr. X Rs.4,00,000 25 % Rs.50,000 10 % You are required to analyse the proposal and see whether it is worthwhile to employ Mr. X and also suggest the maximum emoluments that could be paid to him. Notes: a. PF contributions are tax exempt b. Take home salary is that remaining after employee’s contribution to PF @ Rs.50,000 per month and after deduction of income tax on salary (6 Marks) (b) From the following Profit & Loss Account for the year ended 31st March 2014 of XYZ Ltd. prepare Gross Value Added Statement: Notes Sales less return Trading Profit Less: Depreciation Interest 1 2 Add: Other income Provision for tax Profit after tax Less: Extraordinary items Less: Proposed Dividend Retained Profit Amount Amount (Rs. 000) (Rs. 000) 21,350 3 4 1,920 302 140 442 1,478 80 1,558 688 870 15 855 340 515 Notes: 3 Downloaded from www.ashishlalaji.net Amount Amount (Rs. 000) (Rs. 000) 1. Trading Profit is arrived at after charging the following: Salaries, wages, etc. to employees Directors’ remuneration Audit Fees Hire of equipment 3,685 360 220 290 2. Interest figure is ascertained as below: Interest paid on bank loans and overdraft Less: Interest Received 160 20 140 35 20 15 3. Extra-ordinary items are: Loss of goods by fire Less: Surplus on sale of properties 4. Charge of taxation include a transfer of Rs.1,48,000 to the credit of deferred tax account (10 Marks) Q3 Following is the consolidated balance sheet of A Ltd. and its subsidiary S Ltd. and its jointly controlled entity B Ltd. as on 31st March 2014: Liabilities Share Capital of Rs.100 each General Reserve Profit and Loss account 6% Debentures Creditors Assets Fixed Assets Stock Debtors 6% Debentures of B Ltd. acquired at par Shares of B Ltd. (1,500 shares at Rs.80) Cash at bank Profit and loss account A Ltd. B Ltd. 6,00,000 2,00,000 80,000 ----75,000 9,55,000 2,00,000 --------1,50,000 67,500 4,17,500 A Ltd. B Ltd. 4,50,000 1,40,000 80,000 90,000 1,20,000 75,000 --------9,55,000 1,50,000 60,000 45,000 --------12,500 1,50,000 4,17,500 A Ltd. acquired the shares on 1st August 2013. The profit and loss account of B Ltd. showed a debit balance of Rs.2,25,000 on 1st April 2013. During June 2013, goods costing Rs.9,000 were destroyed against which the insurer paid only Rs.3,000. Creditors of B include Rs.30,000 for goods supplied by A Ltd. on which A Ltd. has made profit of Rs.3,000. Half of these goods were still in stock of B Ltd. as on 31.03.14. Prepare consolidated balance sheet of A Ltd. following the proportionate consolidation method. (16 Marks) 4 Downloaded from www.ashishlalaji.net Q4 As part of its expansion strategy, White Ltd. has decided to amalgamate its business with that of Black Ltd. and a new company, Black and White Ltd., is to be incorporated from 1st September 2010 having authorized equity capital of 2 crore shares of Rs.10 each. Black and White Ltd. shall in turn acquire the entire ownership of White Ltd. and Black Ltd. in consideration for issuing its equity at 25% premium on 1st October 2010. It has also agreed that the consideration be based on the product of profits available to equity shareholders of each entity, times its PE multiple. The preference shareholders and the debenture holders are to be satisfied by the issue of similar instruments in Black and White Ltd. on 1st October 2010 in lieu of their existing holdings. Accordingly, following information is made available to you: Ordinary shares of Rs.10 each (Nos.) 8% Preference shares of Rs.10 each (Nos.) 5 % Debentures of Rs.10 each (Nos.) Profit before interest and tax (Rs.) Average PE Ratio White Ltd. 3 lakh 6,00,000 15 Black Ltd. 1.2 lakh 1 lakh 0.8 lakh 4,40,000 10 To augment the cash retention level of Black and White Ltd., it is decided that on 1st October 2010, Black and White Ltd. shall collect full share application money for the issue of 20,00,000 equity shares at 40% premium under private placement. The allotment of the shares will be made on 31st December 2010 and such shares shall qualify for dividend from 2011 only. Black and White Ltd. shall also avail a 12.5% TOD of Rs.15 lakhs to meet its preliminary expenses and cost of working amounting to Rs.12 lakhs and Rs.2 lakhs respectively. The TOD will be availed on 1st November 2010 and closed on 31st December 2010. Preliminary expenses are tax deductible at 20% each year. Due to an accounting omission the opening inventory of Black Ltd. of Rs.5 lakhs (actual value) and the closing stock of White Ltd. of Rs.2.2 lakhs was understated and overstated by 5% and 10% respectively. The dividend schedule proposed is that all companies would pay interim dividend for equity for the period from 1st October 2010 to 31st December 2010. The rates of dividend being White Ltd. @ 5%, Black Ltd. @ 2% and Black and White Ltd. @ 3.5%. The preference shareholders and debenture holders dues for the post take over period are discharged on 31.12.2010. It is proposed that in the period October-December 2010, Black and White Ltd., would carry out trade in futures that would generate an absolute post tax return by 18% by using the funds generated from private placement. The trades would be squared off on 31st December 2010. Proceeds from such transactions are not liable to withholding taxes. You are required to prepare projected Profit and Loss A/c for the period ended 31st December 2010 and a Balance Sheet on that date for Black and White Ltd. Consider corporation tax rate for the company to be 40%. (16 Marks) 5 Downloaded from www.ashishlalaji.net Q5 (a) Quite Ltd. announced SAR Scheme to its employees on 1st April 2011. The salient features of the scheme are given below: (1) (2) (3) (4) (5) (6) (7) (8) The scheme will be applicable to employees who have completed three years of continuous service with the company Each eligible employee can claim cash payment amounting to excess of Market Price of the company’s shares on exercise date over exercise price in respect of 60 (sixty) shares Exercise price is fixed at Rs.75 per share Option to exercise SAR is open from 1st April 2014 for 45 days and the same vested on 975 employees Intrinsic value of SAR on date of closing (15th May 2014) was Rs.30 per share Fair value of SAR was Rs.20 in 2011 – 12; Rs.25 in 2012 – 13 and Rs.27 in 2013 – 14 In 2011 – 12 expected rate of employee attrition was 5% which rate was doubled in the next year Actual attrition year wise was as under: 2011 – 12 2012 – 13 2013 – 14 35 employees of which 5 had served the company for less than 3 years 30 employees of which 20 employees served for more than 3 years 20 employees of which 5 employees served for less than 3 years You are required to show Provision for SAR Account by fair value method. (10 Marks) (b) Capital structure of Define Ltd. is as under: 80,00,000 Equity shares of Rs.10 each: 1,00,000 12% Preference shares of Rs.250 each: 1,00,000 10% Debentures of Rs.500 each: Term Loans from Bank @ 10%: Rs.800 lakhs Rs.250 lakhs Rs.500 lakhs Rs.450 lakhs Company’s statement of profit and loss for the year showed retained profit after tax of Rs.100 lakhs after payment of preference dividend and equity dividend @ 20%. Tax rate is 40%. T-Bill yield is 6.5% p.a. and beta of company is 1.5. Long run market rate of return is 16.5%. Calculate Economic Value Added (EVA). (6 Marks) Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 6 Downloaded from www.ashishlalaji.net Q6 (a) Jade Ltd. has earned Rs.48 lakhs in the year 2013. It wants you to ascertain the value of business based on following information: I. Tax rate for 2013 is 36 %. Future tax rate is estimated at 34 %. II. Company’s equity shares are quoted at Rs.120 on balance sheet date. The company has equity share capital of Rs.100 lakhs divided into shares of Rs.50 each. III. Profit for the year 2013 has been calculated after considering following in the Profit and Loss Account: i. Subsidy of Rs.2 lakhs received from government has been withdrawn and hence is not receivable in future. ii. Interest of Rs.8 lakhs is on term loan. Final instalment of this term loan was fully settled in this year. iii. Managerial remuneration is Rs.15 lakhs, which is going to increase by Rs.6 lakhs from next year. iv. Loss on sale of fixed assets and investments amounting to Rs.8 lakhs (8 Marks) (b) Provider Ltd. is a non-banking finance company who accepts public deposits and also deals in hire purchase business. It provides you with the following information regarding major hire purchase deals as on 31.03.09: Few machines were sold on hire purchase basis. The hire purchase price was set as Rs.100 lakhs against the cash price of Rs.80 lakhs. The amount was payable as Rs.20 lakhs down payment and balance in 5 equal instalments. The hire vendor collected 1st instalment as on 31.03.10 but could not collect the second instalment which was due on 31.03.11. The company was finalizing accounts for the year 31.03.11. Till 15.05.11; the date on which the Board of Directors signed the accounts, the second instalment was not collected. Presume IRR to be 10.42%. (i) What should be the principal outstanding as on 01.04.10? Should the company recognize financial charge for the year 2010 – 11 as income? (ii) What should be the net book value of assets as on 31.03.11 so far as Provider Ltd. is concerned as per NBFC prudential norms requirement for provisioning? (iii) What should be the amount of provision to be made as per prudential norms for NBFC laid down by RBI? (8 Marks) 7 Downloaded from www.ashishlalaji.net Q7 Answer any four: (a) Perfect Ltd. manufactures machinery used in Power Plants. In response to the tenders issued by Power Plants, Perfect Ltd quotes its price. As per terms of contract, full price of machinery is not released by the power plants, but 10% thereof is retained and paid after one year if there is satisfactory performance of the machinery supplied. From past experience, it is observed that Perfect Ltd. normally performs satisfactorily and fulfills the expectations of Power Plants. Perfect Ltd. accounts for only 90% of the invoice value as sales revenue and books the balance amount in the year of receipt to the extent of actual receipts only. Comment on the treatment done by the company. (4 Marks) (b) Win Ltd. has entered into a three year finance lease arrangement with a Sports Club in respect of fitness equipments costing Rs.16,99,999.50. Annual lease payments to be made at the end of each year are structured in such a way that the sum of the Present Values of the lease payments and that of the residual value together equal to the cost of the equipments leased out. The residual value of the equipment at the expiry of the lease is estimated to be Rs.1,33,500. The assets would revert to the lessor at the end of the lease. IRR is 10%. You are required to compute annual lease rent and the total unearned finance income. Consider PVF at 10 % for 3 years to be 2.486 and for 3rd year to be 0.751. (4 Marks) (c) P Ltd. has three business segments which are FMCG, Batteries and Sports Equipment. Battery segment is consistently underperforming and P Ltd. has decided to discontinue the same. Under the agreement with Labour Union the employees of Battery Segment will earn no further benefit except the benefits already accrued till the segment got discontinued. As a result of curtailment, the company’s obligations that were arrived on the basis of actuarial valuations before the curtailment have come down. Following information is available: a. Value of gross obligations before the curtailment on actuarial basis was Rs.4,000 lakhs b. Value of unamortised past service cost is Rs.100 lakhs c. Curtailment will bring down gross obligations by Rs.500 lakhs and P Ltd. anticipates a proportional decline in value of unamortised past service cost as well d. Fair value of plan assets on date is estimated at Rs.3,250 lakhs You are required to determine gain from curtailment and also show liability to be recognized in balance sheet of P Ltd. after curtailment. (4 Marks) 8 Downloaded from www.ashishlalaji.net (d) You are required to identify equity and liability components and prepare Amortisation Schedule on the basis of following information: Number, Value and Period Proceeds received Interest rate Conversion Prevailing market rate PVF 4,000 bonds issued having face value of Rs.1,000 each per bond (validity 3 years) Rs.40,00,000 6 % p.a. payable annually 250 ordinary shares per bond at discretion of bond holder 9 % p.a. for bonds issued without conversion option 6%: 3 years: 2.673 3rd Year: 0.840 9%: 3 years: 2.531 3rd Year: 0.772 (4 Marks) (e) Option Ltd. is engaged in manufacturing of steel. For its steel plant, it required machineries of latest technology. It usually resorts to Long Term Foreign Currency Loans (LTFCL) for its fund requirements. On 1st April 2011, it borrowed USD 1 million from International Funding Agency, USA when exchange rate was 1 $ = Rs.52. The funds were used for acquiring machines on the same date to be used in three different steel plants. The useful life of the machineries is 10 years and their residual value is Rs.20,00,000. Earlier, also the company used to purchase machineries out of LTFCL. The exchange differences arising on such borrowings were charged to Profit and Loss account and were not capitalized even though the company had an option to capitalize it as per amended AS 11. Now, for this new purchase of machinery, Option Ltd. is interested to avail the option of capitalizing the same to the cost of asset. Exchange rate on 3st March 2012 is 1 $ = Rs.51. Assume that on 31st March 2012, Option Ltd. is not having any old LTFCL except for the amount borrowed for machinery purchased on 1st April 2011. Can Option Ltd. capitalize the exchange difference to the cost of the asset on 31st March 2012? If yes, calculate amount of depreciation on machineries as on 31st March 2012. Answer in lakhs of rupees. (4 Marks) (Assessed answer papers should be collected from NEW CLASS on 17th October 2015) Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 9 Downloaded from www.ashishlalaji.net Solution of FR Mock Test 3 Conducted on 9th October 2015 Q1 (a) As per AS 29 “Provisions, Contingent Liabilities and Contingent Assets” a provision should be recognized if – (i) (ii) (iii) There is present obligation on account of past event It is probable that there shall be an outflow of resources to settle such obligation and A reliable estimate can be made for the amount of obligation (1 Mark) (i) In the given case, there is neither any present obligation as a result of past event, nor a reliable estimate can be made of the amount of obligation. Accordingly, a provision cannot be recognized for such contingencies under the facts and circumstances of the case. (2 Marks) (ii) “Provision” is the amount retained by the way of providing for any known liability. Since the contingencies stipulated by the company are not known at the balance sheet date, the provision in this regard cannot be created. Therefore, the provision so created by the company shall be treated as a “Reserve”. (2 Marks) (b) AS 25 “Interim Financial Reporting” prescribes discrete view i.e. it considers each interim period as a separate financial period. Hence, allocation of income and deferment of expenditure of one interim period to another interim period is not permissible. Further, if any accounting policy is changed in current interim period effect of such change of previous interim periods should be provided in previous interim periods since an accounting policy is changed retrospectively. However, if an accounting estimate is changed in current interim period, its entire effect shall be given in current interim period since an accounting estimate is changed prospectively. Calculation of Net Income for the quarter ended 31st December 2010: Net Profit as given Extra-ordinary loss wrongly allocated to 4th quarter Extra-ordinary gain of 1st quarter wrongly allocated to 3rd quarter Bad debts of 2nd quarter wrongly allocated to 3rd quarter Change in provision is change in accounting estimate Excess Depreciation related to previous quarters 5,40,000 (25,000) (30,000) 40,000 No Effect 60,000 5,85,000 (5 Marks) Solution prepared by CA. Ashish Lalaji 10 Downloaded from www.ashishlalaji.net (c) As per AS 13 “Accounting for Investments”, the cost of investments includes acquisition charges such as brokerage, commission and duties. (2 Marks) In the present case, Take Ltd. has used borrowed funds for purchasing shares of its subsidiary Give Ltd. The interest cost of Rs.4 lakhs cannot be considered to be acquisition charge / cost of investment and hence cannot be capitalized to the cost of investment. (2 Marks) (d) Determination of Landed Cost of Brain Scan Equipment: Particulars Amount (Rs. in lakhs) Purchase Cost ($5 X 50) Add: Sea Freight Transit Insurance, bank charges, etc. ($.12 X 5 X 50) Landed Cost on 01.04.10 250 20 30 300 Company follows WDV method of depreciation, but WDV rate is not given. WDV Rate of Depreciation = 1 – (Residual Value / Cost of asset) 1/n = 1 – (39 / 300) ¼ = (1 – 0.6) i.e. 0.4 i.e. 40% (2 Marks) Government grant of Rs.94 lakhs was received on 01.04.10, which has been treated as deferred income. Every year transfer shall be taken from deferred government grant account to profit and loss account in proportion of depreciation charged. This is shown as under – Year 2010 – 11 2011 – 12 2012 – 13 2013 – 14 Depreciation Deferred Grant @ 40% Recognized in P & L A/c 120.00 43.20* 72.00 25.92 43.20 15.55 25.92 9.33 261.12 94.00 * 94 X (120 / 261.12) Government grant is refunded on 01.04.13, on which date balance in deferred government grant account is Rs.9.33 lakhs. Accounting Entry: Deferred Government Grant A/c Dr. 9.33 Profit and Loss A/c Dr. 84.67 To Bank A/c (being return of grant received in April 2010 due to non-fulfillment of conditions) 94 (4 Marks) 11 Downloaded from www.ashishlalaji.net Q2 (a) Determination of Cost to Company in Employing Mr. X: Salary before tax (4,00,000 X 12 i.e. 48,00,000 / 75%) Add: Employee’s PF Contribution (50,000 X 12) Employer’s PF Contribution (50,000 X 12) Amount (Rs.) 64,00,000 6,00,000 6,00,000 76,00,000 (2 Marks) Determination of Capital Base: Paid-up Equity Share Capital (5,00,000 shares X Rs.75) Less: Calls in arrears General Reserve Profit and Loss Account (opening balance) Profit for the year 8 % Debentures Capital Base Amount (Rs.) 3,75,00,000 1,00,000 3,74,00,000 10,00,000 (25,00,000) (1,80,000) 80,00,000 4,37,20,000 (2 Marks) Determination of Maximum that can be paid to Mr. X: Target Profit = 4,37,20,000 X 12.5% i.e. Rs.54,65,000 Profit that can be achieved if Mr. X is employed = 54,65,000 (1.1) = Rs.60,11,500 (1 Mark) Conclusion: Company is advised not to employ Mr. X as his CTC Rs.76,00,000 is more than Rs.60,11,500 (1 Mark) (b) Determination of Cost of Bought-in materials and Services: Sales Less: Trading Profit Total Cost Less: Salaries and Wages Director’s remuneration Cost of bought-in materials and services Amount (Rs. in ‘000s) 21,350 1,920 19,430 3,685 360 15,385 (2 Marks) Solution prepared by CA. Ashish Lalaji 12 Downloaded from www.ashishlalaji.net Gross Value Added Statement of XYZ Ltd. for the year ended 31st March 2014: (Rs. in ‘000s) VALUE ADDED Amount Amount Sales less return 21,350 Less: Cost of bought-in materials and services 15,385 Value Added by manufacturing and trading activities 5,965 Add: Interest received 20 Other income 80 100 Less: Extraordinary items Surplus on sale of properties 20 Loss of goods by fire (35) (15) Gross Value Added 6,050 VALUE APPLIED To Pay Employees: Salaries, wages and other benefits 3,685 To Pay Directors: Director’s remuneration 360 To Pay Government: Income Tax (688 – 148) 540 To Pay Providers of Capital: Interest on loans and overdraft Proposed Dividend 160 340 To Provide for Maintenance and Expansion: Depreciation Transfer to Deferred Tax Retained Profit 302 148 515 500 965 6,050 (8 Marks) Q3 Holding of A Ltd. in JCE is 75%. However, proportionate consolidation method is to be followed. Hence, JCE is not deemed to be subsidiary of A Ltd. Working Notes: (1) Profits earned by B Ltd. during 2013 – 14: Amount (Rs.) Profit and Loss account as on 31.03.14 (1,50,000) Add: Loss by fire (9,000 – 3,000) 6,000 (1,44,000) Less: Profit and Loss account as on 01.04.13 (2,25,000) 81,000 (2 Marks) 13 Downloaded from www.ashishlalaji.net (2) Analysis of Profits of B Ltd.: Capital Revenue Profits Profits (Rs.) (Rs.) Profit and Loss account as on 01.04.13 (2,25,000) --------Profit in 2013 – 14 (4:8) 27,000 54,000 (1,98,000) 54,000 Loss by fire in June 2013 (6,000) --------(2,04,000) 54,000 A Ltd. (75%) (1,53,000) 40,500 (2 Marks) (3) Determination of Goodwill / Capital Reserve: Cost of Shares Less: Paid up Value Share in capital profits Goodwill Amount (Rs.) 1,20,000 1,50,000 (1,53,000) 1,23,000 (2 Marks) (4) Consolidated Profit and Loss Account: Profit and Loss account as on 31.03.14 of A Ltd. Add: Share in Revenue Profits Unrealised profit (3,000 X 50% X 75%) Amount (Rs.) 80,000 40,500 (1,125) 1,19,375 (2 Marks) st Consolidated Balance Sheet of A Ltd. as on 31 March 2014 I. 1. (a) (b) Equity and Liabilities: Shareholders’ Funds Share Capital Reserves and Surplus 2. Non Current Liabilities Long Term Borrowings (6% Debentures) 3. II. 1. Current Liabilities Trade Payables (1,25,625 – 22,500) Total Assets: Non Current Assets Fixed Assets - Tangible - Intangible (Goodwill) Non Current Investment (Debentures of B Ltd.) Note No. Amount 1 6,00,000 3,19,375 Amount 9,19,375 1,12,500 1,12,500 1,03,125 1,03,125 11,35,000 7,75,500 5,62,500 1,23,000 90,000 14 Downloaded from www.ashishlalaji.net 2. Current Assets Inventories Trade Receivables (1,13,750 – 22,500) Cash and Cash Equivalents Total 3,59,500 2 1,83,875 91,250 84,375 11,35,000 See accompanying notes to Consolidated Balance Sheet. Notes forming part of Consolidated Balance Sheet Note No. 1 2 Amount (Rs.) Reserves and Surplus General Reserve 2,00,000 Consolidated Profit and Loss Account 1,19,375 Inventories As given [1,40,000 + (60,000 X 75%)] Less: Unrealised Profit Amount (Rs.) 3,19,375 1,83,875 1,85,000 1,125 (8 Marks) Q4 Determination of Number of Equity Shares to be issued: Particulars White Ltd. Black Ltd. Profit before interest and tax (given) Opening stock is understated (5,00,000 X 5%) Closing stock is overstated (2,20,000 / 110% X 10%) Debenture interest (80,000 X Rs.10 X 5%) Adjusted Profit before tax Less: Tax @ 40% Adjusted Profit after tax Less: Preference Dividend (1,00,000 X Rs.10 X 8%) Adjusted Profit to equity shareholders X PE Ratio Total Value of Equity Shares Agreed Issue price per equity share New equity shares to be issued 6,00,000 ----------(20,000) ----------5,80,000 2,32,000 3,48,000 ----------3,48,000 15 52,20,000 12.5 4,17,600 4,40,000 (25,000) ----------(40,000) 3,75,000 1,50,000 2,25,000 80,000 1,45,000 10 14,50,000 12.5 1,16,000 (2 Marks) Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 15 Downloaded from www.ashishlalaji.net Determination of Bank Balance: Particulars Amount (Rs.) From issue of shares (20,00,000 X 14) 12.5 % Term Deposit (TOD) Profit from trading in futures (pre-tax) (2,80,00,000 X 18%) / 60% Dividend Received from White (3,00,000 X Rs.10 X 5%) Black (1,20,000 X Rs.10 X 2%) Dividend Paid [4,17,600 + 1,16,000 i.e. 5,33,600 X 10 X 3.5%] Preliminary expenses Working expenses TOD interest (15,00,000 X 12.5% X 2/12) TOD settled Debenture interest (80,000 X Rs.10 X 5% X 3/12) Preference Dividend (1,00,000 X Rs.10 X 8% X 3/12) 2,80,00,000 15,00,000 84,00,000 1,50,000 24,000 (1,86,760) (12,00,000) (2,00,000) (31,250) (15,00,000) (10,000) (20,000) 3,49,25,990 (3 Marks) Determination of Provision for Tax: Particulars Amount (Rs.) Profit from trading in futures (pre-tax) Less: Preliminary expenses (12,00,000 X 20%) Working expenses TOD interest Debenture interest Taxable Income X Tax Rate Provision for tax 84,00,000 2,40,000 2,00,000 31,250 10,000 79,18,750 40% 31,67,500 Notes: (a) In balance sheet preliminary expenses shall be netted from securities premium. Hence, it does not represent a timing difference. Thus, deferred taxes need not be provided for. (b) Dividends received are tax free and hence not considered in above working. (2 Marks) Solution prepared by CA. Ashish Lalaji 16 Downloaded from www.ashishlalaji.net Statement of Profit and Loss of Black and White Ltd. for the period 1st October 2010 to 31st December 2010: Particulars Note No. I. Revenue from Operations (Dividend Received) II. Other Income (Profit from futures) III. Total Revenue (I + II) IV. Expenses: Working expenses TOD interest Debenture interest V. Profit before tax (III – IV) VI. Tax Expenses (a) Current tax (b) Deferred tax VII. Profit for the period (V – VI) Amount (Rs.) Amount (Rs.) 1,74,000 84,00,000 85,74,000 2,41,250 2,00,000 31,250 10,000 83,32,750 31,67,500 31,67,500 ------------51,65,250 (3 Marks) Balance Sheet of Black and White Ltd. as on 31st December 2010: Note No. I. 1. (a) (b) Equity and Liabilities: Shareholders’ Funds Share Capital Reserves and Surplus 2. Non Current Liabilities Long Term Borrowings (5% Debentures) 3. II. 1. 2. Amount Amount 3,94,28,490 1 2 2,63,36,000 1,30,92,490 8,00,000 8,00,000 Current Liabilities Short Term Provision (Provision for tax) Total Assets: Non Current Assets Non Current Investment in subsidiaries: Equity Shares (52,20,000 + 14,50,000) Preference shares Debentures Current Assets Cash and Cash Equivalents 31,67,500 31,67,500 4,33,95,990 84,70,000 66,70,000 10,00,000 8,00,000 3,49,25,990 3,49,25,990 Total 4,33,95,990 See accompanying notes: 17 Downloaded from www.ashishlalaji.net Note No. 1 Amount (Rs.) Share Capital: 2,63,36,000 (a) Equity Share Capital: 5,33,600 + 20,00,000 i.e. 25,33,600 equity shares of Rs.10 each fully paid up 2,53,36,000 (of which 5,33,600 shares issued for consideration other than cash) (b) Preference Share Capital: 8 %, 1,00,000 Preference shares of Rs.10 each 2 Amount (Rs.) Reserves and Surplus Securities Premium [(5,33,600 X 2.5) + (20,00,000 X 4)] Less: Preliminary expenses Profit and Loss Account Opening Balance Add: Profit for the period Less: Dividend Paid Equity Preference 10,00,000 93,34,000 12,00,000 81,34,000 ------------51,65,250 51,65,250 1,86,760 20,000 49,58,490 1,30,92,490 (6 Marks) Q5 (a) Number of employees on 01.04.11 is not available. No. of No. of No. of Employees = Employees + Employees completing 3 years On 01.04.11 With vested options but leaving the organization = 975 + (35 – 5) + 20 + (20 – 5) = 975 + 30 + 20 + 15 = 1,040 (2 Marks) Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 18 Downloaded from www.ashishlalaji.net Expense to be recognized for each year: Date Expected Fair Value of SAR Provision p.a. based on FV Cumulative Provision to be recognized Provision Already Recognised Provision to be Recognised 31.03.12 1,040 X .95 X .95 X .95 X 60 X 20 i.e. 10,70,004 10,70,004 3 i.e. 3,56,668 3,56,668 --------- 3,56,668 (1,040 – 30) i.e. 1,010 X .9 X .9 X 60 X 25 i.e. 12,27,150 12,27,150 3 i.e. 4,09,050 4,09,050 X 2 i.e. 8,18,100 3,56,668 4,61,432 975 X 60 X 27 i.e. 15,79,500 15,79,500 3 i.e. 5,26,500 5,26,500 X 3 i.e. 15,79,500 8,18,100 7,61,400 17,55,000 15,79,500 1,75,500 31.03.13 31.03.14 15.05.14 Cash to be paid: 975 X 60 X 30 i.e. 17,55,000 (4 Marks) Provision for SAR Account 31.03.12 To Balance c/d 3,56,668 31.03.12 By Employee Compensation A/c 3,56,668 31.03.13 To Balance c/d 8,18,100 3,56,668 01.04.12 By balance b/d 3,56,668 31.03.13 By Employee Compensation A/c 4,61,432 8,18,100 31.03.14 To Balance c/d 15,79,500 8,18,100 01.04.13 By balance b/d 8,18,100 31.03.14 By Employee Compensation A/c 7,61,400 15,79,500 15.05.14 To Bank A/c 17,55,000 3,56,668 15,79,500 01.04.14 By balance b/d 15.05.14 By Employee Compensation A/c 17,55,000 15,79,500 1,75,500 17,55,000 (4 Marks) Solution prepared by CA. Ashish Lalaji 19 Downloaded from www.ashishlalaji.net (b) Determination of NOPAT: PAT = Retained PAT + Preference Dividend + Equity Dividend PAT = 100 + 30 + 160 = Rs.290 lakhs PBT = PAT / 1 – t = 290 / 1 – 0.4 = Rs.483.33 lakhs PBIT = PBT + Interest = 483.33 + 50 + 45 = Rs.578.33 lakhs NOPAT = EBIT – Taxes = 578.33 – 40% = Rs.347 lakhs (3 Marks) Determination of Total Capital Employed (TCE): Particulars Equity Capital Preference Capital Long Term Debt (500 + 450) TCE Amount (Rs. in lakhs) 800 250 950 2,000 Determination of WACC (ko): Ke = 6.5 + 1.5 (16.5 – 6.5) = 21.5 % Ko = 21.5 (800) + 12 (250) + 10 (1 - .4) (950) / 2,000 = 12.95 % (2 Marks) Computation of EVA: EVA = NOPAT – [TCE X WACC(%)] = 347 – (2,000 X 12.95%) = Rs.88 lakhs (1 Mark) Q6 (a) Determination of Future Maintainable Profit (FMP): Particulars Amount (Rs. in lakhs) PBT for 2013 [48 / .64] Add: Subsidy not receivable in future Interest on term loan not payable in future Additional managerial remuneration Loss on sale of fixed assets and investments FMP before tax Less: Tax @ 34 % FMP to equity shareholders 75.00 (2.00) 8.00 (6.00) 8.00 83.00 28.22 54.78 (4 Marks) Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 20 Downloaded from www.ashishlalaji.net Determination of Capitalisation Rate and Value of Business: Particulars Amount (Rs. in lakhs) (a) PAT for the year 2013 (b) Number of equity shares (100 / 50) (c) EPS (a / b) (d) MPS (e) PE Ratio (d / c) (f) Capitalisation Rate [ 1 / PE Ratio] (g) Value of Business [54.78 / 20%] 48.00 2.00 24.00 120.00 5.00 20 % 273.90 (4 Marks) (b) (i) Determination of Principal Outstanding as on 01.04.10: Cash price is Rs.80 lakhs and down payment is Rs.20 lakhs. Hence, principal amount of asset is Rs.60 lakhs on 31.03.09. Interest is to be determined @ 10.42%. Loan repayment schedule is prepared as under: Date 31.03.10 31.03.11 31.03.12 31.03.13 31.03.14 Loan at Interest beginning @ 10.42% 60 6.25 50.25 5.24 39.49 4.11 27.60 2.88 14.48 1.52* Total Instalment Loan at Dues the end 66.25 16.00 50.25 55.49 16.00 39.49 43.60 16.00 27.60 30.48 16.00 14.48 16.00 16.00 ---* balancing figure It is evident from above table that principal outstanding on 01.04.10 is Rs.50.25 lakhs. Interest income in 2nd instalment for the year 2010 – 11 is Rs.5.24 lakhs. The instalment was due on 31.03.11 but has not yet been collected till 15.05.11. The instalment is not overdue for more than 12 months and hence is a performing asset. Interest income of Rs.5.24 lakhs shall be recognized as income in 2010 – 11. (3 Marks) (iii) Determination of provision to be recognised: Amount (Rs. in lakhs) 16.00 48.00 64.00 Overdue instalment Instalments not due (16 X 3) Less: Finance charge not matured and hence not credited to P & L A/c (4.11 + 2.88 + 1.52) Less: Depreciated value of the underlying asset [80 – (80 X 20% X 2 years) i.e. 80 – 32] Provision to be recognized 8.51 55.49 48.00 7.49 The instalment is not overdue for more than 12 months and hence is a standard asset. Hence, no further provision is required (3 Marks) 21 Downloaded from www.ashishlalaji.net (ii) Determination of Net Book Value as on 31.03.11: Amount (Rs. in lakhs) 16.00 48.00 64.00 Overdue instalment Instalments not due (16 X 3) Less: Finance charge not matured and hence not credited to P & L A/c (4.11 + 2.88 + 1.52) 8.51 55.49 7.49 48.00 Less: Provision recognized Net Book value as on 31.03.11 (2 Marks) Q7 (a) As per AS 9 “Revenue Recognition”, revenue from sale of goods should be recognsied when – (i) Property in goods has been transferred from seller to buyer, or significant risks and rewards incident to ownership has been transferred from seller to buyer and Collection of revenue is certain (ii) (2 Marks) In the present case, the goods, as well as risks and rewards incident to ownership has been transferred to the power plants. Even the invoice is raised for full amount by Perfect Ltd. though it receives 90 % and balance 10 % is kept as retention money. Perfect Ltd. should recognize revenue at full invoice price i.e. 100% of sales price. The company should make a separate provision for the balance 10 % amount to reflect the uncertainty rather than to adjust the amount of revenue. Thus, the practice adopted of recognizing only 90 % of sales price as revenue by Perfect Ltd. is not in consonance with AS 9. (2 Marks) (b) Computation of Lease Rent: Let the lease rent charged at the end of the year be Rs.X. Year Lease PVF Receipt (10%) 1–3 X 2.486 3 1,33,500 0.751 PV 2.486X 1,00,258.5 1,00,258.5 + 2.486X (2 Marks) It is given that the above Present Value shall be equal to cost of asset i.e. 16,99,999.5. Thus – 1,00,258.5 + 2.486X = 16,99,999.5 X = 15,99,741 / 2.486 = Rs.6,43,500 (1 Mark) Solution prepared by CA. Ashish Lalaji 22 Downloaded from www.ashishlalaji.net Total Unearned Finance Income = [(6,43,500 X 3) + 1,33,500] – 16,99,999.5 = 20,64,000 – 16,99,999.5 = Rs.3,64,000.5 (1 Mark) (c) Determination of Net Liability Before and After Curtailment: Rs. in lakhs Particulars Before Curtailment After Curtailment Present Value of Obligation 4,000 Less: Fair Value of Plan Assets Unamortised Past Service Cost Net Liability 3,250 100 650 3,500 (4,000 – 500) 3,250 87.5* 162.5 (3 Marks) Net Liability has reduced i.e. gain due to curtailment is Rs.487.5 lakhs (650 – 162.5) (1 Mark) * Proportion of reduction of obligation = 500 / 4,000 i.e. 12.5 % Hence, past service cost has reduced by Rs.12.5 lakhs (100 X 12.5%) (d) Determination of Value of Debt Component: Year 1–3 3 Cash Outflows 2,40,000 40,00,000 PVF (9%) 2.531 0.772 PV 6,07,440 30,88,000 36,95,440 Determination of Value of Equity Component: Equity Component = Total Amount Collected – Value of Debt = 40,00,000 – 36,95,400 = Rs.3,04,560 (2 Marks) Amortised Cost Schedule: Year (a) 1 2 3 Amortised Cost at Beginning (b) 36,95,440 37,88,030 38,88,953 Interest Expense @ 9% (c) 3,32,590 3,40,923 3,51,047* Total Amount Instalment Paid (d) = b + c 40,28,030 41,28,953 42,40,000 (e) 2,40,000 2,40,000 2,40,000 Amortised Cost at the End (f) = d - e 37,88,030 38,88,953 40,00,000 * Balancing Figure (2 Marks) Solution prepared by CA. Ashish Lalaji 23 Downloaded from www.ashishlalaji.net (e) Amended AS 11 provides an alternate treatment of exchange differences arising on translation of LTFCL, whereby such exchange differences are adjusted to cost of depreciable fixed assets acquired from use of such LTFCL. Option Ltd. can avail this alternative treatment but once this option is exercised, it is irrevocable. (2 Marks) Determination of amount of depreciation: Particulars Amount (Rs. in lakhs) Cost of machineries on 01.04.11 ($ 10 lakhs X 52) Less: Exchange gain on translation of LTFCL [$ 10 lakhs (52 – 51)] Less: Depreciation for 2011 – 12 [510 – 20 / 10 years] Carrying amount of machineries as on 31.03.12 520 10 510 49 461 (2 Marks) Solution prepared by CA. Ashish Lalaji Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / ashishlalaji@rediffmail.com 24