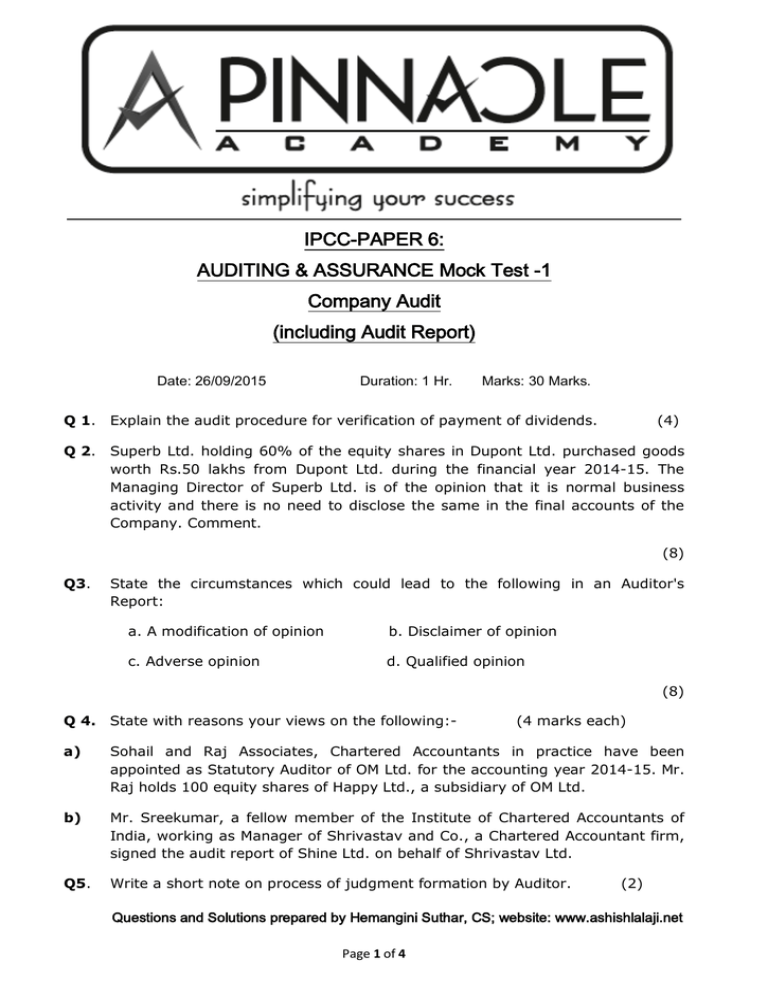

IPCC-PAPER 6: AUDITING & ASSURANCE Mock Test -1 Company Audit

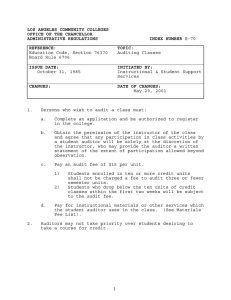

advertisement

IPCC-PAPER 6: AUDITING & ASSURANCE Mock Test -1 Company Audit (including Audit Report) Date: 26/09/2015 Duration: 1 Hr. Marks: 30 Marks. Q 1. Explain the audit procedure for verification of payment of dividends. (4) Q 2. Superb Ltd. holding 60% of the equity shares in Dupont Ltd. purchased goods worth Rs.50 lakhs from Dupont Ltd. during the financial year 2014-15. The Managing Director of Superb Ltd. is of the opinion that it is normal business activity and there is no need to disclose the same in the final accounts of the Company. Comment. (8) Q3. State the circumstances which could lead to the following in an Auditor's Report: a. A modification of opinion b. Disclaimer of opinion c. Adverse opinion d. Qualified opinion (8) Q 4. State with reasons your views on the following:- (4 marks each) a) Sohail and Raj Associates, Chartered Accountants in practice have been appointed as Statutory Auditor of OM Ltd. for the accounting year 2014-15. Mr. Raj holds 100 equity shares of Happy Ltd., a subsidiary of OM Ltd. b) Mr. Sreekumar, a fellow member of the Institute of Chartered Accountants of India, working as Manager of Shrivastav and Co., a Chartered Accountant firm, signed the audit report of Shine Ltd. on behalf of Shrivastav Ltd. Q5. Write a short note on process of judgment formation by Auditor. (2) Questions and Solutions prepared by Hemangini Suthar, CS; website: www.ashishlalaji.net Page 1 of 4 SUGGESTED ANSWERS A1. The procedure for verification of payment of dividends is stated as follows:1. Examine the company’s Memorandum and Articles of Association to ascertain the dividend rights of different classes of shares. 2. Confirm that the profits appropriated for payment of dividend are distributable as per the provisions contained in Section 123 of the Companies Act, 2013. 3. Inspect the Shareholder’s Minute Book to verify the amount of dividend declared. 4. Check the particulars of members as are entered in the Dividend Register or List and test the calculation of gross amount of dividend payable to each shareholder and also examine the dividend warrant. 5. Verify the transfer of any dividend which remained unpaid or unclaimed within thirty days of the declaration of dividend to a special account entitled “Unpaid Dividend Account”. The transfer shall be made within 7 days from the date of expiry of thirty days. If amount in this account remains unclaimed for a period of 7 years from the date of transfer, it shall be transferred to Investor Education and Protection Fund. A2. Disclosure of Related Party Transactions As per definition given in the AS 18 “Related Party Disclosure”, parties are considered to be related if at any time during the reporting period one party has the ability to control the other party or exercise significant influence over the other party in making financial or operating decisions. Related party transactions means a transfer of resources or obligations between related parties, regardless of whether or not a price is charged. Superb Ltd. is the holding company of Dupont Ltd. as it holds more than 50% of the voting power of Dupont Ltd. and thus should be treated as related parties as per AS 18. As per AS-18, in the case of related party transactions, following facts should be disclosed:1. Related party transactions, name and nature of relationship 2. If there is transaction between the related parties then descriptions of the nature of transaction, volume of the transaction outstanding at the balance sheet date, etc. As per Section 188 of the Companies Act, 2013 it is necessary to take permission of the Board of Directors by resolution at board meeting for such a transaction. In the instant case since there is a related party transaction, the contention of Managing Director of Superb Ltd. is not correct. The auditor is required to verify the compliance of Section 188 of the Companies Act, 2013. Page 2 of 4 A3. 1. Modification of opinion : the auditor shall modify the opinion in the auditor’s report when – a. The auditor concludes that based on the audit evidence obtained, the financial statements as a whole are not free from material misstatement; or b. The auditor is unable to obtain sufficient appropriate audit evidence to conclude. 2. Disclaimer of opinion : the auditor shall disclaim an opinion when the he is unable to obtain sufficient appropriate audit evidence on which to base the opinion and he concludes that the possible effects on the financial statements of undetected misstatements could be both material and pervasive. 3. Adverse Opinion : the auditor shall express an adverse opinion when having obtained sufficient audit evidence, auditor concludes that misstatements individually or in aggregate are both material and pervasive to the financial statements. 4. Qualified Opinion : the auditor shall express a qualified opinion when – a. Having obtained sufficient appropriate audit evidence, he concludes that misstatements are material but not pervasive or b. He is unable to obtain sufficient appropriate audit evidence to base the opinion and concludes that misstatements could be material but not pervasive. A4. (a) Auditor holding securities of a company As per Section (3)(d)(i) of the Companies Act, 2013 along with Rule 10 of the Companies(Audit and Auditors) Rule, 2014 a person shall not be eligible for appointment as an auditor of a company, who, or his relative or partner is holding any security of interest in the company or its subsidiary, or of its holding or associate company or subsidiary of such company provided that the relative may hold the security or interest in the company of face value not exceeding Rs.1 lakh. In the present case, Mr. Raj, Chartered Accountant, a partner of M/s Sohail and Raj Associates, holds 100 equity shares of Happy Ltd. which is a subsidiary of OM Ltd. therefore the firm would be disqualified to be appointed as Statutory Auditors of OM Ltd. as per the provisions. Page 3 of 4 (b) Signature on Audit Report Section 145 of the Companies Act, 2013 requires that the person appointed as an auditor of the company shall sign the auditor’s report or sign or certify other document of the company in accordance with theprovisions of Section 141(2) where a firm including a LLP is appointed as an auditor of a company, only the partners who are Chartered Accountants shall be authorized to act and sign on behalf of the firm. Therefore, Mr. Sreekumar who is a fellow member of the Institute and a manager of M/s Shrivastav and Co.Chartered Accountants cannot sign on behalf of the firm in view of the specific requirements of the Companies Act,2013. A5. Process of Judgement Formation by Auditor After the audit, the opinion that the auditor expresses is the result of exercise of judgement on facts, evidence and circumstances which he comes across in the course of audit. The judgement is formed on the following basis:- 1. 2. 3. 4. 5. Identification of the assertions to be examined Evaluation of the assertions Collection of information or evidences about the assertions Evaluation of the evidences as valid or invalid Formulating a judgment as to the fairness of the assertions Page 4 of 4