Pinnacle Academ y June 2015 Revision Tests

advertisement

Downloaded from www.ashishlalaji.net

Pinnacle Academy

June 2015 Revision Tests

201-202, Florence Classic, Besides Unnati Vidhyalay,

10, Ashapuri Society, Jain Derasar Rd., Akota, Vadodara-20. ph: 98258 561 55

Strategic Financial Management

Revision Test

Conducted on 23rd June 2015

[Solution is at the end with marking for self-assessment]

Time Allowed-1.5 hours

Q1

Maximum Marks- 80

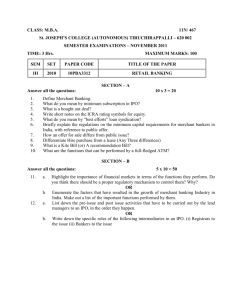

Amazon Ltd. wishes to take over Nile Ltd. Following details are available:

% Shareholding of Promoters

Share Capital

Free Reserves

Paid up value per share

Free Float Market Capitalization

PE Ratio (times)

Amazon Ltd.

Nile Ltd.

50%

Rs.200 lakhs

Rs.900 lakhs

Rs.100

Rs.500 lakhs

10

60%

Rs.100 lakhs

Rs.600 lakhs

Rs.10

Rs.156 lakhs

4

For swap ratio, 25 % weight is assigned to BVPS, 50 % to EPS and 25 % to MPS.

Determine:

(i)

Swap ratio

(ii)

EPS and MPS of Amazon Ltd. after merger assuming PE ratio of Amazon

Ltd. prevails even after merger

(iii)

Post merger free float market capitalization

(12 Marks)

Q2

A Ltd. has 1,00,000 shares and B Ltd. has 50,000 shares. Current MPS of A Ltd. is

Rs.100. A Ltd. wishes to take over B Ltd. for which it has two offers, which are:

(i) Buy B Ltd. in cash by paying 25 % premium over its current MPS of Rs.40.

(ii) Issue shares at swap ratio of 0.25

It is expected that the post merger MPS for each of the offer shall be:

Only cash offer: Rs.150; Only stock offer: Rs.120

You are required to determine the NPV of each offer for A Ltd.

(8 Marks)

1

Downloaded from www.ashishlalaji.net

Q3

An analyst intends to value an IT company in terms of the future cash generating

capacity. He has projected following after-tax cash flows:

(millions of rupees)

Year

EBITDA

Depreciation

Interest

1

266

66

17.1

2

75

15

17.1

3

105

15

17.1

4

151

11

17.1

5

210

10

17.1

It is further estimated that beyond the 5th year, cash flows will perpetuate at a

constant growth rate of 7% p.a. mainly on account of inflation. The perpetual cash

flow is estimated to be Rs.968 million at the end of 5th year. Tax rate is 50%.

(a)

What is the value of the company based on expected future cash flows? You

may assume cost of capital to be 20% and CFAT of each year to be FCF.

(b)

The company has outstanding 5 % debt of Rs.342 million and cash / bank

balance of Rs.256 million. Calculate value of one equity share, if number of

equity shares is 15.15 million.

(c)

The company has received takeover bid of Rs.190 per share. Is it a good offer?

(6 + 3 + 1 = 10 Marks)

Q4

(a)

As an investment manager you are given the following information:

Investment in

Equity shares

of---A. Cement Ltd.

Steel Ltd.

Liquor Ltd.

B. Government of

India Bonds

Initial Price

(Rs.)

25

35

45

1,000

Dividends

(Rs.)

Market Price

at the end of

Year (Rs.)

Beta

risk

factor

2

2

2

50

60

135

0.80

0.70

0.50

140

1,005

0.99

Risk free return may be taken at 14%. You are required to calculate:

(i) Expected rate of returns of portfolio in each using Capital Asset Pricing Model

(ii) Average return of portfolio

(6 Marks)

(b)

An investor is seeking the price to pay for a security, whose standard deviation is 3

%. The correlation coefficient for the security with the market is 0.8 and the market

standard deviation is 2.2 %. The return from government securities is 5.2 % and

from the market portfolio is 9.8 %. What is the required rate of return on which the

price of the security shall be based?

(6 Marks)

2

Downloaded from www.ashishlalaji.net

(c)

The current risk free rate is 10% and the expected return on the market portfolio is

15%. The expected returns for four scrips are listed together with their expected

betas.

Scrip

Infosys

Bank of Baroda

Reliance Industries

TCS

Expected

Return (%)

17

14.5

15.5

18

Expected

beta

1.3

0.8

1.1

1.7

i.

Given the above, which of these shares should the fund manager buy and why?

ii.

If the risk free rate were to rise to 12% and the expected return on the market

portfolio rose to 16.5%, other factors remaining the same, would the fund manager’s

decision change?

(6 Marks)

Q5

(a)

Shares of D Ltd. are currently selling at Rs.500 per share. A 3-month call option and

put option are available at a strike price of Rs.520 at a premium of Rs.5 and Rs.3 per

share respectively. The expected market price of the share at the end of the option

period is predicted to be Rs.540 by one stock-analyst, while another stock-analyst

predicts the same to be Rs.510.

Determine net pay off of the investor at the two probable spot prices for –

(i) Long Call

(ii) Long Put

(iii) Long Straddle

Which strategy do you suggest?

(8 Marks)

(b)

A Brazilian exporter has sold coffee for $1,000,000 and will receive payment in 6

months. The current spot rate of the dollar is R$2.43. The 6-month forward rate is

R$2.49. The Brazilian interest rate is 10.6 % p.a. and the US interest rate is 6% p.a.

Currency put option is available for 6 months at strike price of R$2.5 at premium of

R$0.0352. Currency call option is available for 6 months at strike price of R$2.5 at

premium of R$0.0350. Ignore time value of options premium. Analyse forward

market hedge, money market hedge and currency options as method of hedging.

Recommend best hedging method.

(12 Marks)

Q6

Beta Ltd. is planning to import a multi-purpose machine from Japan at a cost of

Rs.7,200 lakhs yen. The company can avail loans at 15% interest p.a. with quarterly

rests with which it can import the machine. However there is an offer from Tokyo

branch of an India based bank extending credit of 180 days at 2% p.a. against

opening of an irrevocable letter of credit. Other Information:

3

Downloaded from www.ashishlalaji.net

Present exchange rate

180 days’ forward rate

Rs.100 = 360 yen.

Rs.100 = 365 yen.

Commission charges for letter of credit at 2% per 12 months.

Advice whether the offer from the foreign branch should be accepted?

(12 Marks)

Solution prepared by

CA. Ashish Lalaji

Be free to send your suggestions / comments to

CA. Ashish Lalaji at 9825856155 /

ashishlalaji@rediffmail.com

4

Downloaded from www.ashishlalaji.net

Solution of

SFM Revision Test

Conducted on 23rd June 2015

Q1

(i) Calculation of Pre-merger BVPS:

(a) Share Capital

(b) Free Reserves

(c) Equity Funds

(d) No. of equity shares

(e) BVPS (c / d)

Amazon Ltd. Nile Ltd.

200

100

900

600

1,100

700

2

10

550

70

Share exchange ratio based on BVPS = 70 / 550 = 0.1273

(2 Marks)

Calculation of Pre-merger EPS:

Amazon Ltd. Nile Ltd.

(a) Free Float Market Capitalisation

500

156

(b) Non Promoter Holding

50%

40%

(c) Total Market Capitalisation (a / b)

1,000

390

(d) No. of equity shares

2

10

(e) MPS (c / d)

500

39

(f) PE Ratio

10

4

(g) EPS (e / f)

50

9.75

Share exchange ratio based on EPS = 9.75 / 50 = 0.195

(3 Marks)

Share exchange ratio based on MPS = 39 / 500 = 0.078

(1 Mark)

Agreed Swap Ratio = 0.1273 (.25) + 0.195 (.50) + 0.078 (.25) = 0.1488

(1 Mark)

(ii)

New shares issued = 10 X .1488 = 1.488 lakhs

Post Merger Shares = 2 + 1.488 = 3.488 lakhs

Post Merger EPS = (2 X 50) + (10 X 9.75) / 3.488 = Rs.56.62

Post Merger MPS = 56.62 X 10 = Rs.566.20

(2 Marks)

(iii)

New shares issued to promoters of Nile = (10 X 60%) X .1488 = 0.8928 lakhs

Total shares owned by promoters = (2 X 50%) + .8928 = 1.8928 lakhs

% of promoters holding post merger = 1.8928 / 3.488 i.e. 54.27 %

Public holding = 45.73 %

Free Float Capitalisation = 3.488 X 45.73% X 566.2 = Rs.903.12 lakhs

(3 Marks)

Solution prepared by

CA. Ashish Lalaji

5

Downloaded from www.ashishlalaji.net

Q2

Determination of Pre-Merger Market Value of Firm:

A

B

(a) No. of shares

1,00,000

50,000

(b) Pre-Merger MPS

100

40

(c) Pre-merger Market Value [a X b] 1,00,00,000 20,00,000

(2 Marks)

Determination of Net Present Value [NPV]:

(i) Only Cash Offer:

Market Value of Combined Entity = 1,00,000 shares X Rs.150 = Rs.1,50,00,000

Synergy = 1,50,00,000 – 1,00,00,000 - 20,00,000 = Rs.30,00,000

Cost of Merger = [50,000 shares X Rs.50*] – 20,00,000 = Rs.5,00,000

* Rs.40 + 25% Premium

NPV of merger = 30,00,000 – 5,00,000 = Rs.25,00,000

(3 Marks)

(ii) Only Stock Offer:

New shares issued = 50,000 X .25 = 12,500 shares

Market Value of Combined Entity = 1,12,500 shares X Rs.120 = Rs.1,35,00,000

Synergy = 1,35,00,000 – 1,00,00,000 - 20,00,000 = Rs.15,00,000

Cost of merger = [12,500 / 1,12,500 {1,35,00,000}] – 20,00,000

= (Rs.5,00,000)

NPV of merger = 15,00,000 – (-5,00,000) = Rs.20,00,000

(3 Marks)

Q3

(a)

Determination of Value of Firm as per FCFF Approach:

(millions of rupees)

Year EBITDA Depreciation PBT

1

2

3

4

5

266

75

105

151

210

66

15

15

11

10

5 Continuing Value

200

60

90

140

200

Taxes PAT

@ 50%

100

30

45

70

100

CFAT /

PVF

FCFF (20%)

100

30

45

70

100

166

45

60

81

110

PV

.833

.694

.579

.482

.402

138.28

31.23

34.74

39.04

44.22

287.51

7,967.38

.402 3,202.89

Value of Firm (as a whole) 3,490.40

(5 Marks)

th

th

Continuing Value at end of 5 year = FCFF (at end of 6 year) / ko – g

= 968 (1.07) / 20 % - 7% = Rs.7,967.38 million

(1 Mark)

Solution prepared by

CA. Ashish Lalaji

Be free to send your suggestions / comments to

CA. Ashish Lalaji at 9825856155 /

ashishlalaji@rediffmail.com

6

Downloaded from www.ashishlalaji.net

(b)

Computation of value per share:

Particulars

Amount

(Rs. in millions)

3,490.40

256.00

3,746.40

342.00

3,404.40

15.15

224.71

Value of Firm (as a whole)

Add: Cash and Bank

Less: Outstanding Debt

Value of Firm (for equity shareholders)

No. of equity shares

Value per share

(3 Marks)

Solution prepared by

(c)

CA. Ashish Lalaji

True worth of the share of company is Rs.224.71. Takeover bid of Rs.190 per share

is lower than the real value of the share. It is not a good offer.

(1 Mark)

Q4

(a)

There is absence of information related to market return. It is assumed that the

securities given in the question are the only securities trading in the market. On the

basis of this assumption, market return is determined as under:

Investment

Cement Ltd.

Steel Ltd.

Liquor Ltd.

GOI Bonds

Closing

MPS

50

60

135

1,005

Purchase

Price

25

35

45

1,000

1,105

Capital

Appreciation

25

25

90

5

Dividend /

Interest

2

2

2

140

Total

Return

27

27

92

145

291

Market return (km) = 291 / 1,105 = 26.33 %

(3 Marks)

Determination of Required Return as per CAPM:

As per CAPM –

E(r) = Rf + β (km – Rf)

E(r) = 14 + β (26.33 – 14)

E(r) = 14 + 12.33β

Cement:

Steel:

Liquor:

GOI Bond:

14 + 12.33 (0.80)

14 + 12.33 (0.70)

14 + 12.33 (0.50)

14 + 12.33 (0.99)

= 23.86 %

= 22.63 %

= 20.17 %

= 26.21 %

(2 Marks)

Average return = 23.86 + 22.63 + 20.17 + 26.21 / 4 = 23.22 %

(1 Mark)

7

Downloaded from www.ashishlalaji.net

(b)

Determination of Beta:

Beta = 0.8 (3) / 2.2 = 1.09

(3 Marks)

Determination of Required Return as per CAPM:

As per CAPM –

E(r) = Rf + β (km – Rf)

E(r) = 5.2 + 1.09 (9.8 – 5.2) = 10.21 %

(3 Marks)

(c)

(i) Analysis of shares to be purchased / sold:

Scrip

Actual Return as per CAPM

Return

Infosys

BOB

Reliance

TCS

17 %

14.5%

15.5%

18%

10 + 1.3 (5) = 16.5%

10 + 0.8 (5) = 14.0%

10 + 1.1 (5) = 15.5%

10 + 1.7 (5) = 18.5%

Nature

of scrip

Investment

Decision

Under-priced

Under-priced

Correctly priced

Over-priced

BUY

BUY

HOLD

SELL

(3 Marks)

Solution prepared by

CA. Ashish Lalaji

(ii) Analysis of shares to be purchased / sold:

Scrip

Actual

Return

Return as per CAPM

Nature

of scrip

Investment

Decision

Infosys

BOB

Reliance

TCS

17 %

14.5%

15.5%

18%

12 + 1.3 (4.5) = 17.85%

12 + 0.8 (4.5) = 15.60%

12 + 1.1 (4.5) = 16.95%

12 + 1.7 (4.5) = 19.65%

Over-priced

Over-priced

Over-priced

Over-priced

SELL

SELL

SELL

SELL

(3 Marks)

Q5

(a)

(i) Statement showing net payoff for Long Call:

Spot Price

Strike Price

Gross Pay off

Premium paid

Net Pay off

540 510

520 520

20

0

5

5

15 (5)

(2 Marks)

(ii) Statement showing net payoff for Long Put:

Spot Price

Strike Price

Gross Pay off

Premium paid

Net Pay off

540 510

520 520

0

10

3

3

(3)

7

(2 Marks)

8

Downloaded from www.ashishlalaji.net

(iii) Statement showing net payoff for Long Straddle:

Spot Price

Strike Price

Call

Put

Gross Pay off

Call

Put

Premium paid

Net Pay off

540 510

520 520

520 520

20

0

20

8

12

0

10

10

8

2

(3 Marks)

Conclusion: Investor is better-off with the Straddle Position.

(1 Mark)

(b)

Analysis of Forward Contract:

Enter into forward contract to sell $ 10 lakhs at 6-months forward rate of

R$2.49 / $

Amount received after 6 months = 10 X 2.49 = R$ 24.9 lakhs

(2 Marks)

•

•

•

Analysis of Money Market Hedge:

As on today:

Borrow $ 9.709 lakhs [10 / [ 1 + .06X 6 / 12]] at 6 % p.a. for 6 months in US

At current spot rate, R$-equivalent of $ 9.709 lakhs is R$ 23.593 lakhs [9.709

X 2.43]

Invest R$ 23.593 in Brazil at 10.6 % p.a. for 6 months

(2 Marks)

•

•

After 6 months:

The US client shall make the payment. Use the money received to repay the

US borrowing

Investment in Brazil shall mature. Amount received after 6 months is –

23.593 + [23.593 X 10.6 % X 6 / 12] i.e. R$ 24.843 lakhs

(2 Marks)

Analysis of Currency Options:

The Brazilian exporter needs to sell $ 10 lakhs received after 6 months and

hence shall prefer currency put option.

Options premium = 10 X 0.0352 = R$ 0.352 lakhs

(1 Mark)

Net pay off is determined as under:

Spot rate after 6 months (assumed same as forward rate)

Strike price for long put

Gross pay off p.u. of deal size

X Deal size (in lakhs)

Total gross payoff (in lakhs)

Premium paid (in lakhs)

Net pay off (in lakhs) (Cash outflow)

2.49

2.50

0.01

10

0.1

0.352

0.252

(3 Marks)

9

Downloaded from www.ashishlalaji.net

Currency options shall simply result into settlement on net basis. Actual sale

of currency shall take place in cash market. $ 10 lakhs shall be sold at

R$2.49 / $ to receive R$ 24.9 lakhs.

Amount received after 6 months = 24.9 lakhs – 0.252 = R$ 24.648 lakhs

(2 Marks)

Conclusion: The firm is better off by selecting forward market hedge in view

of highest cash inflow after 6 months.

Q6

Following direct quotes are obtained:

Spot rate: 1 ¥ = Re.0.2778

180 days forward rate: 1 ¥ = Re.0.2740

(1 Mark)

Analysis of Loan Option:

Amount

(Rs. in lakhs)

Cost of Machine [¥ 7,200 X 0.2778]

Add: Interest @ 15% for –

• 1st quarter [2,000 X 15% X 3/12]

• 2nd quarter [2,075 X 15% X 3/12]

∑ PVCO

2,000

75.00

77.81

2,152.81

(4 Marks)

Analysis of Letter of Credit Option:

Amount

(Rs. in lakhs)

Commission for LC [2,000 X 2% X 180 / 360]

Add: Opportunity cost @ 15% for –

• 1st quarter [20 X 15% X 3/12]

• 2nd quarter [20.75 X 15% X 3/12]

Cost of machine after 180 days

[¥ 7,200 X 0.2740]

Interest cost of Letter of Credit

[1,972.80 X 2% X 180 / 360]

∑ PVCO

20.00

0.75

0.78

1,972.80

19.73

2,014.06

(6 Marks)

Conclusion: The offer of the foreign branch of opening letter of credit should

be accepted in view of lower ∑ PVCO.

(1 Mark)

Solution prepared by

CA. Ashish Lalaji

10