ANNUAL Financial Report

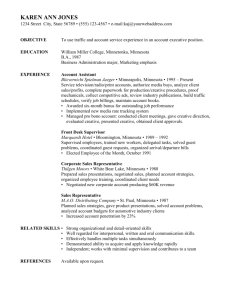

advertisement