Statistics and Risk Management Forecast Data Performance Objective:

advertisement

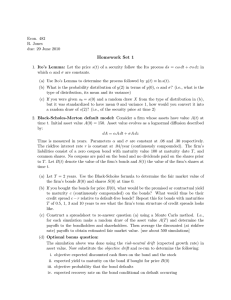

Statistics and Risk Management Forecast Data Performance Objective: After completing this lesson, the student will understand the basic concepts of acquiring internally or externally the financing needed to further a company or organizational goals and operations. Approximate Time: When taught as written, this lesson should take 4-5 days to complete. Specific Objectives: The student will discuss the importance of financing within anorganization’s structure. The student will understand the pros and cons of financing using bonds. The student will understand the pros and cons of financing using stocks. This lesson corresponds with Unit 3 of the Statistics and Risk Management Scope and Sequence. Copyright © Texas Education Agency, 2012. All rights reserved. 1 TEKS Correlations: This lesson, as published, correlates to the following TEKS for Regression. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.169 (g)(6)(C) …generate a spreadsheet to collect, collate, organize, and analyze quantitative data;… InterdisciplinaryTEKS: English: 110.31 (C) (21) (B) … organize information gathered from multiple sources to create a variety of graphics and forms (e.g., notes, learning logs)… 110.31 (C) (22) (B) …evaluate the relevance of information to the topic and determine the reliability, validity, and accuracy of sources (including Internet sources) by examining their authority and objectivity… 110.31 (C) (23) (C) … use graphics and illustrations to help explain concepts where appropriate… Copyright © Texas Education Agency, 2012. All rights reserved. 2 110.31 (C) (23) (D) … use a variety of evaluative tools (e.g., self-made rubrics, peer reviews, teacher and expert evaluations) to examine the quality of the research… Math: 111.36 (C) (4) (A) … compare theoretical and empirical probability; 111.37. (C) (3) (B) … use probabilities to make and justify decisions about risks in everyday life Occupational Correlation (O*Net - http://www.onetonline.org/) Financial Examiner 13-2061.00 Similar Job Titles: Compliance Officer, Compliance Vice President, Compliance Director, Community Reinvestment Act Officer (CRA Officer) Tasks: Investigate activities of institutions to enforce laws and regulations and to ensure legality of transactions and operations or financial solvency. Review and analyze new, proposed, or revised laws, regulations, policies, and procedures to interpret their meaning and determine their impact. Plan, supervise, and review work of assigned subordinates. (Soft) Skills: Critical Thinking; Reading Comprehension; Speaking; Active Listening Copyright © Texas Education Agency, 2012. All rights reserved. 3 Instructional Aids: 1. Display for presentation, websites for assignments and class discussion 2. Assignment Worksheets 3. Supporting Spreadsheets Materials Needed: 1. Printer paper 2. Assignments and website information ready to distribute to students. Student projects will be displayed to increase interest in Statistics Equipment Needed: 1. Computer with presentation and Internet Access 2. Computers for Students to Conduct Research and Collect Data for Projects Copyright © Texas Education Agency, 2012. All rights reserved. 4 References: Convertible Bonds and other Convertible Securities Basic definitions and a link to a case study involving convertible bonds. http://people.stern.nyu.edu/igiddy/convertibles.htm Equity Financing While most business owners are familiar with traditional financing available through local banks, there are many other sources of capital that can meet your needs for growth and expansion. http://www.mbda.gov/node/432 Introduction – Sources of Finance This article explores the different sources of internal and external financing along with multiple other sources of financing. It provides descriptions and or links to descriptions to the different types of internal and external sources for further reading. http://www.bized.co.uk/learn/accounting/financial/sources/index.htm Copyright © Texas Education Agency, 2012. All rights reserved. 5 Teacher Preparation: Teacher will: 1. presentation, and handouts. 2. resources and websites. 3. websites ready. Review terms in outline, Locate and evaluate various Have assignments and Learner Preparation: It is time to wrap up what the students have learned about statistics. You will briefly describe commercial software for statistics with examples the student might find interesting. Then the student will get to apply what they have learned to analyzing data. Introduction: STUDENTS will watch the Unit video found here: jukebox.esc13.net/untdeveloper/Videos/Forecast%20Data.mov STUDENTS will take the practice test and review using the Key, found in Common/Student Documents. EXHIBIT: Excitement for the lesson. INTRODUCE: Financially sound companies. ASK: Ask students if they know the difference between stocks and bonds. Copyright © Texas Education Agency, 2012. All rights reserved. 6 I. Corporate Financing A. Finance B. The "optimal mix" of financing. C. The capital structure that results in maximum value D. Initial Finance E. Operational Cash F. Receivables G. Deposits H. Inventory I. Equipment J. Real Estate K. Expansion Finance L. New Product Line M. Buy Competitor N. Acquire Equipment O. Acquire Real Estate P. Working Capital Finance Q. Short Term Assets R. Short Term Liabilities S. Reorganization Finance T. Pay Off Back-loaded Bills U. Refinance Debt V. Stock Buy Back Use 11.1_Corporate Financing.pptx Use 11.1a_Corporate Financing.docx Use 11.2_Corporate FinancingBonds.pptx Provide Assignment sheets and discuss and answer any questions about assignment (In class or take homeInstructor’s Option) II. Corporate Financing - Using Bonds A. Why Bonds? 1. Issuing Bonds do not convey ownership. 2. Considered Debt only. 3. Bond Sales 4. Bonds have a face value. 5. Discounts 6. Premiums 7. Interest Rates 8. Maturity Dates 9. Defaults Copyright © Texas Education Agency, 2012. All rights reserved. 7 10. Interest payments and bond pay off have been put in default. 11. Bond Holders get available funds before Stock Holders do. 12. Bonds Ratings 13. Through the years, businesses have been established who rate the risk of bonds being issued. 14. Base Ratings the bond is evaluated 15. Insured Ratings is when the bond is insured and the rating only applies to the insurer. B. Special Bonds 1. Some special bodies and agencies can issue Municipal Bonds that pay interest that is non-taxable (Federal Income tax) to the Bond Holder Provide Assignment sheets and discuss and answer any questions about assignment (In class or take homeInstructor’s Option) III. Corporate Financing - Using Stock A. Privately Held Corporations 1. Stock ownership is with Owner/Operator 2. Family 3. Partners 4. Publicly Help Corporations 5. Preferred Stock 6. Dividends (Normal) 7. First to receive funds after Bond Holders 8. Common Stock 9. Capital Gains 10. Dividends (sometimes) 11. Public Offerings 12. IPO Initial Public Offerings 13. SEO Secondary Public Offerings 14. Re-Investment Plans 15. Common Stock 16. Capital Gains 17. Dividends (sometimes) 18. Public Offerings Use 11.2a_Corporate FinancingBonds.docx Use 11.3_Corporate FinancingStock.pptx Copyright © Texas Education Agency, 2012. All rights reserved. 8 19. IPO Initial Public Offerings 20. SEO Secondary Public 21. Offerings 22. Re-Investment Plans 23. Instead of Dividends a Stock 24. Holder can be issued more shares each year based upon their existing holdings. 24. Stock Splitting a. If the market price of a share of stock is too high the company can split the stock. b. If you owned 100 shares you would then own 200 shares. 25. Stock Spin-off a. A company may want to divest itself from a part of its operations and give all of its Stock Holders new stocks in the newly created company. Provide Assignment sheets and discuss and answer any questions about assignment (In class or take homeInstructor’s Option) Use 11.3a_Corporate FinancingStocks.docx Copyright © Texas Education Agency, 2012. All rights reserved. 9 Guided Practice: See assignments. Independent Practice: Review document “Spreadsheets for Statistical Purposes” – in Common Documents. See assignments. Review: Question: What are the benefits of using bonds for corporate financing? Question: What is an IPO? Informal Assessment: Instructor should observe student discussion and monitor interaction. Formal Assessment: Completion of provided assignments using included keys for grading. Copyright © Texas Education Agency, 2012. All rights reserved. 11 Student Assignment 11.1a Corporate Financing Key Name: ____________________ As the Vice President of Financial Operations for a New GMC Truck Dealership, you have been assigned the task of determining what kind of operational capital will be needed. You have estimated sales for the first 6 months of $5,500,000.00 You expect a 6 month payroll of $300,000.00 Other Expenses for 6 months of $200,000.00 You have to buy $7,000,000.00 of inventory that will be delivered over the six months. However, General Motors has a floor plan where you have to pay about $1,000,000.00 per month for the vehicles. Using these figures, how much cash would you have at the end of the six months assuming you had $1,000,000.00 in cash to start out with. Should you borrow more to fund the remaining operations for the fiscal year? What are your explanations for your conclusions? Copyright © Texas Education Agency, 2012. All rights reserved. 12 Student Assignment 11.1a Corporate Financing Key Name: ____________________ Answer: I am starting out with $1 million and have $5.5 million in sales for the first 6 months which gives me an ending cash balance (before expenditures) of $6.5 million at the end of 6 months. However, I am expecting $.5 million in operating expenses and $6 million in payments to General Motors or cash expenditures of $6.5 million for the first 6 months. If my calculations are accurate, I will have no cash reserve at the end of 6 months and that is a very risky position to be in. I would feel more comfortable having a cash balance of $1 million in reserve. I would want to establish a line of credit for an additional $1 million before I open my doors. Copyright © Texas Education Agency, 2012. All rights reserved. 13 Student Assignment 11.2a Using Corporate Bonds Key Name: ____________________ As CFO of a large Corporation you are charge will be selling corporate 10 year bonds with a face value of $20,000,000.00. The bonds will pay investors 6.75% per year. However, the brokerage company will receive 1% of the face value for handling the bonds and the bonds sold with a discount of 4.23%. How much did you initially raise from the sales of these bonds (less fees and discount)? Answer : $20 million - .2 million in fees - .846 million in discount or $18.954 million What was the amount of interest on the bonds you will pay for each of the 10 years? Answer: 1.35 million per year. What is the effective rate of interest based upon the discounted yield for each of the 10 years? Answer: NOT 1.35 / 20 or .0675 but 1.35 / 18.954 = .071225 Copyright © Texas Education Agency, 2012. All rights reserved. 14 Student Assignment 11.3a Using Corporate Stocks Key Name: ____________________ Your company has been very successful. The company’s common stock price has reflected your success. Currently, a single share of your company sells for $289.78. Your board of directors believes that the stock price is too high for the average investor to find appealing. They have suggested a stock split of 3 to 1. You company has 1,300,000 shares of capital stock on hand. They have issued 2,700,000 share through IPOs in the past. After they split the stock value by 3 by issuing 3 shares for every one that exists, what will be the immediate value of a share? Answer: $99.59 per share. Because the shares are more affordable, the price of the individual share rises to $104.98 within a month. How much total value has your company made on the shares of capital stock they have in their treasury from this increase? The administrative cost of the Stock Split was $500,000.00. Was the split worth it to your Company? Answer: (1.3 million shares x 3 x $5.38) - (.5 million) or $20.48 Million Copyright © Texas Education Agency, 2012. All rights reserved. 15 NAME:________________________________ DATE:____________________________ CLASS:_________________ DECIDE IF THE FOLLOWING LISTED IS AN ASSET OR LIABILITY: 1. Cash A. Asset 2. Prepaid Expenses A. Asset 3. Inventory A. Asset 4. Accounts Payable A. Asset 5. Income Taxes Payable A. Asset 6. Notes Payable A. Asset B. Liability B. Liability B. Liability B. Liability B. Liability B. Liability MATCHING: A. B. C. D. E. Share Coupon Interest Rate Call Provision Par Value Current Yield 7. __________ Provides the issuer of the bond with the right to redeem or retire a bond before it matures 8. __________ Units of ownership 9. __________ Ratio of the annual interest payment to the bond’s current market price 10. __________ The principal that must be repaid to the bondholder at maturity 11. __________ The percentage of the par value of the bond that will be paid out annually in the form of interest MULTIPLE CHOICE: 12. A class of stock that pays fixed and regular interest income, instead of a dividend is _____. A. Bond B. Treasury Bond C. Preferred Stock D. Common Stock 13. The money used to pay for the everyday trading activities carried out by the business. A. Finances B. Working Capital C. Personal Savings D. Operations 14. A stock dividend exceeding 25% of the number of shares currently outstanding is ______. A. Bond B. Preferred Stock C. Common Stock D. Stock Split 15. A form of equity security that represents the residual ownership of the firm is _____. A. Bond B. Treasury Bond C. Preferred Stock D. Common Stock 16. Short term sources of finance such as stocks, debtors and cash the business has at any one time are defined as ____________. Copyright © Texas Education Agency, 2012. All rights reserved. 16 A. Current Assets C. Current Liabilities B. Working Capital D. Operations NAME:________________________________ DATE:____________________________ 17. 18. 19. 20. 21. 22. CLASS:_________________ Short term requirements for cash including trade and expense creditors or tax and dividend owing are defined as ______. A. Current Assets B. Working Capital C. Current Liabilities D. Operations The ____ of a share is the issue value of the share. A. Premium B. Nominal Value C. Par D. Market Value The ______ of a share is the amount at which a share is being sold on the stock exchange. A. Premium B. Market Value C. Par D. Nominal Value ________ is the legal agreement between the firm issuing the bonds and the bond trustee who represents the bondholders. A. Indenture B. Priority of Claim C. Par Value D. Call Provision When discussing stock splits, accountants consider distributions less than 25% to be ______ and those greater than 25% to be __________. A. Stock Splits, Stock Dividends B. Stock Dividends, Yields C. Stock Splits, Yields D. Stock Dividends, Stock Splits This bond rating is the highest quality and lowest credit risk. A. Aaa B. Aa2 C. Ba1 D. B2 USE THE FOLLOWING TO ANSWER QUESTIONS 23‐25: Company ABC has 5,000 shares of stock priced at $10 per share. The market capitalization is $50,000. The company later decides on a 2‐for‐1 stock split. 23. How many shares of stock are there now? A. 5,000 B. 10,000 C. 15,000 D. 20,000 24. What is the new price of each share of stock? A. $5 B. $10 C. $15 D. $20 25. If the company decided on a 3‐to‐1 split, how many total shares of stock would you have? A. 5,000 B. 10,000 C. 15,000 D. 20,000 Copyright © Texas Education Agency, 2012. All rights reserved. 17 Forecast Data Test Key 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. A A A B B B C A E D B C B D D A C B B A D A B A C Copyright © Texas Education Agency, 2012. All rights reserved. 18