Lesson Plan By the Numbers Banking and Financial Services Finance

advertisement

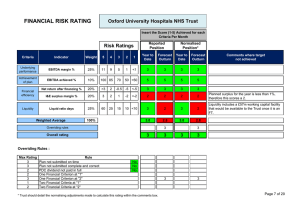

By the Numbers Banking and Financial Services Finance Lesson Plan Performance Objective Students will understand and analyze data to assess banking performance. Specific Objective Understand the importance of Balance Sheet components in ratio analysis. Describe the CAMELS model financial institution rating system. Identify terminology associated with banking ratios. Terms Financial Analysis – evaluation of a business through ratio analysis of financial statements Balance Sheet – a financial document that shows a company’s assets, liabilities, and stockholder’s equity Assets – things that are owned by the bank Liabilities – what is owed by the bank Stockholder’s Equity – the difference between assets and liabilities, also known as capital Ratio Analysis – a method of making comparisons to make numbers meaningful Net Interest Margin (NIM) – measures how much interest is being earned on assets Net interest income ‐ the difference between interest earned and interest paid Return on Assets (ROA)– measures how much profit a bank earns for each dollar value of its assets Return on Equity (ROE) – measures how well a bank can make a return for its investors, or stockholders Spread – the difference between what the bank receives from customers in loan interest and what it pays out in interest on its customers’ deposits CAMELS Model – an international bank rating system originally developed in 1979 in the U. S. and called the Uniform Financial Institutions Rating System renamed CAMELS by the Federal Reserve and Office of the Comptroller of the Currency in 1995. Capital ratio – a measure of the amount of capital a financial institution has compared to its assets Undercapitalized ‐ not enough capital to handle any losses Asset quality – the risks associated with the bank’s assets Liquidity – having enough cash on hand Market risk – the possibility of a change in an asset’s value depending upon market conditions Risk – the probability of an event occurring which may include the likelihood of profit or loss due to the level of the risk Interest‐rate risk – the chance that an interest rate can change which can cause a loss for a bank Liquidity risk ‐ risk that a bank cannot raise enough cash when needed Credit risk ‐ risk that a borrower may not be able to repay a loan Copyright © Texas Education Agency, 2014. All rights reserved. 1 Time When taught as written, this lesson should take approximately 5‐6 days to teach. Preparation TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.163. (c) Knowledge and Skills (8) The student maintains, monitors, controls, and plans the use of financial resources to enhance banking performance. The student is expected to: (B) use financial formulas commonly used in banking to aid in the growth and stability of banking services, including key ratios and terms in banking, banking calculations such as interest and annual percentage rate, capital adequacy, asset quality, management administration, earnings, liquidity, and sensitivity to market risk. Interdisciplinary Correlations: English‐English I 110.31(b) (1). Reading/Vocabulary Development. Students understand new vocabulary and use it when reading and writing. 110.3(b) (11). Reading/Comprehension of informational text/procedural texts. Students understand how to glean and use information in procedural texts and documents. Math‐Algebra I 111.32(b) (1) (C). Interpret and make decisions, predictions, and critical judgments from functional relationships. Social Studies‐World Geography 113.34(c) (20) (A) Describe the impact of new technologies, new markets, and revised perceptions of resources. Occupational Correlation (O*Net – www.onetonline.org/): Job Title: Financial Analysts O*Net Number: 13‐2051.00 Reported Job Titles: Securities Analyst, Investment Analyst, Equity Research Analyst Tasks: Inform investment decisions by analyzing financial information to forecast business, industry, or economic conditions. Monitor developments in the fields of industrial technology, business, finance, and economic theory. Interpret data on price, yield, stability, future investment‐risk trends, economic influences, and other factors affecting investment programs. Copyright © Texas Education Agency, 2014. All rights reserved. 2 Soft Skills: Mathematics, Judgment and Decision Making, Complex Problem Solving Accommodations for Learning Differences It is important that lessons accommodate the needs of every learner. These lessons may be modified to accommodate your students with learning differences by referring to the files found on the Special Populations page of this website. Preparation Review and familiarize yourself with the terminology and website links Have materials and websites ready to go prior to the start of the lesson. References http://www.frbsf.org/economic‐research/publications/economic‐letter/1999/june/using‐camels‐ ratings‐to‐monitor‐bank‐conditions/ http://www.federalreserve.gov/BoardDocs/press/general/1996/19961224/default.htm Banking and Financial Services, Goodheart‐Wilcox, 2013 Instructional Aids Textbook Lesson Presentation Instructor Computer/Projection Unit Online Websites Introduction The main purposes of this lesson are to help students understand the different types of risk a bank is subject to. the importance of looking at a bank’s ratings to assess how it is performing. the different ratios used to assess a bank’s performance. Ask students if they think that a bank is doing well if it is still in business. Ask students if they know how to research on the Internet to locate a company’s financial information. Copyright © Texas Education Agency, 2014. All rights reserved. 3 Outline I. Types of Analysis A. balance sheet analysis B. ratio analysis C. CAMELS model D, risk analysis Ask students how they know if a bank is doing well. Is merely being open and not closed down a way to tell if it is successful? II. Balance sheet vocabulary A. balance sheet – a financial document that shows a company’s assets, liabilities, and stockholder’s equity B. assets – things that are owned by the bank C. liabilities – debts that are owed by the bank D. stockholder’s equity – the difference between assets and liabilities, also known as capital III. Ratio Analysis – NIM A. ratio analysis – a method of making comparisons to make numbers meaningful B. net interest margin (NIM) – measures how much interest is being earned on assets 1. net interest income-the difference between interest earned and interest paid 2. NIM= (interest incomeinterest expense)/total assets x 100 3. the higher the percent, the better Tell students that there is much more that goes into assessing how well a bank is doing. Locate a company’s balance sheet and show the students the parts that will be involve in ratio analysis. Have student volunteers write down the calculations that you direct them to write. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 4 Visual/Spatial IV. Ratio analysis – ROA IV. A. return on assets (ROA) – measures how much profit a bank earns for each dollar value of its assets B. ROA=net income/total assets x 100 C. shows how well a bank’s assets are generating profits D. the higher the percent the better V. Ratio analysis – ROE A. return on equity (ROE) – measures how well a bank can make a return for its investors, or stockholders B. stockholder’s equity = assets – liabilities C. ROE = (net income/ stockholder’s equity) x 100 D. the higher the percent the better VI. Spread – actually not a ratio A. spread – the difference between what the bank receives from customers in loan interest and what it pays out in interest on its customers’ deposits B. the higher the percent the better C. largest income for a bank is interest from loans D. largest expense is interest paid on deposits Again demonstrate how to calculate the ratios, then having student pairs calculate the ratios that are next to be discussed. Have the students volunteer their answers and share with the class. Ask students what they think the largest income is for a bank. Then ask what the largest expenses are. Explain the concept of spread and show visually the differences in interest rates on loans versus deposits by looking at a bank’s web site. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 5 Visual/Spatial VII. CAMELS model A. an international bank rating system B. originally developed in 1979 in the U. S. C. was called the Uniform Financial Institutions Rating System D. renamed CAMELS by the Federal Reserve and Office of the Comptroller of the Currency in 1995 E. rating scale of 1 to 5, with 1 being the best rating F. only available to management, not to the public VIII. CAMELS acronym A. C=capital adequacy B. A=asset quality C. M=management D. E=earnings E. L=liquidity F. S=sensitivity to market risk IX. Capital adequacy A. means having enough capital to help cover any losses B. capital ratio – a measure of the amount of capital a financial institution has compared to its assets Explain the concept of the international rating system called CAMELS. Have students search for CAMELS and ask them the information they are finding about it. Ask them why an international rating could be important for a bank. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 6 Visual/Spatial X. XI. C. capital ratio = (total capital/total assets) x 100 D. good ratio is greater than 10% and bank receives a better rating E. less than 5% can mean bank is undercapitalized, not enough capital to handle any losses Asset quality A. Bank assets consist of the loans they make and the investments they make. B. If loans are not repaid, the bank cannot make the income it expects. If investments are too risky, the returns may not be what is expected either. C. asset quality – the risks associated with the bank’s assets D. Good asset quality shows that a bank can continue making income with its loans and investments. Management A. difficult to measure B. holding a financial institution’s Board of Directors more accountable C. must be able to take corrective action in possible crisis situations Clarify with students that loans that a bank makes are its assets, and if the borrowers are paying back their loans on time, that is considered to be good asset quality. Assets are lower quality if the payments are not being made. Although it is difficult to measure, a bank’s management plays an important role in its rating. Ask students if they think management should be responsible for a bank failing or losing money. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 7 Visual/Spatial XII. Earnings A. good rating created with positive earnings B. A positive trend in earnings also creates a good rating. C. Earnings that have consistent projections for the future are positive, such as from loans, fees, and investments. XIII. XIV. Liquidity A. means having enough cash on hand B. Reserve requirements exist to ensure there is a minimum percentage of deposits on hand for customer withdrawals C. New customer deposits are harder to predict than long‐ term customer deposits. D. Does the bank have assets on hand that can quickly be converted to cash or will it have to borrower from the Federal Reserve? Positive earnings for a year in a row are good, but a consistent trend of positive earnings is even better. Ask students why it would be important for a bank to have cash on hand instead of investing it all and making more money. Sensitivity to market risk A. market risk – the possibility of a change in an asset’s value depending upon market conditions B. Market risk, as well as a bank’s profitability, can be affected by the state of the economy. C Th l i k th b tt Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 8 Visual/Spatial XV. Risk analysis A. risk – the probability of an XV. analysis of each customer event occurring which may include the likelihood of profit or loss due to the level of risk B. types of risk: 1. interest‐rate 2. liquidity 3. credit XVI. Risk comparison A. interest‐rate 1. risk of changes in interest rates reducing income for banks 2. can lead to less revenue if interest rates decline on deposits 3. need better forecasting or planning for interest‐rate fluctuations B. liquidity risk 1. risk that a bank cannot raise enough cash when needed 2. Fed requires minimum of 10% cash on hand 3. invest in more liquid securities in case they need to be sold for cash. C. credit risk 1. risk that a borrower may not be able to repay a loan 2. can be affected by economy 3. better credit How a business deals with risk is important. It must be able to deal with it effectively and make adjustments where and when needed. Ask students what types of risk that a business has control over. Multiple Intelligences Guide Existentialist Interpersonal Intrapersonal Kinesthetic/ Bodily Logical/ Mathematical Musical/Rhythmic Naturalist Verbal/Linguistic Copyright © Texas Education Agency, 2014. All rights reserved. 9 Visual/Spatial Application Guided Practice In a group of three or four, students will research a company’s financial statement and calculate the ratios presented in the lesson. Independent Practice Students can search for a specific company’s ratios and read the comments that are made on the web site that is located with the search results. This will serve as added reinforcement to the student’s understanding of the purpose for the ratio analysis. Summary Review Ask students the following questions on exit tickets: Question #1: What are four types of analysis used to assess a bank’s performance? Answer #1: Balance sheet analysis ratio analysis, CAMELS model, and risk analysis. Question #2: What does the CAMELS acronym stand for? Answer #2: Capital adequacy, asset quality, management, earnings, liquidity, and sensitivity to market risk. Question #3: What are three types of risk that concerns banks and financial institutions? Answer #3: Interest‐rate, liquidity, and credit. Question #4: What does liquidity mean? Answer #4: Liquidity is basically having enough cash on hand or the ability to convert assets to cash in need of emergency. Question #5: What does being undercapitalized mean? Answer #5: It means that a company does not have enough capital to handle losses. Evaluation Informal Assessment Any and all of the following can be used as informal assessments… Exit tickets with vocabulary Pair‐share activities Class discussion and participation Formal Assessment The following can be considered a formal evaluation: Copyright © Texas Education Agency, 2014. All rights reserved. 10 Ratio Analysis Assignment #1 – Have students go online and locate financial statements for a bank of the student’s choosing. Using the appropriate financial statements, students will calculate the ratios presented in this lesson. Then they will summarize their results explaining which ratios are favorable and which ones are not. They should create a chart of their results. They may do this manually or on the computer depending on whether or not there is lab access. Spread Calculation Report Assignment #2 – To help students understand the concept of a spread, students will research a bank web site and determine what the average interest rate charged on a home loan is and then the average rate on savings accounts. Then they will take the difference between the rates. This is the spread. In a one‐page report they will explain this process, the interest‐ rate calculations for the mortgage and savings rates, and the difference. Then they will summarize the importance of spread to the income or profit of a bank. CAMELS Comic Strip Assignment #3 – Students will create a six‐eight panel comic strip demonstrating their knowledge of the CAMELS rating system. They will include speaking bubbles that show discussions into what the acronym stands for, what countries may use the rating system, what the ratings mean, and any other information they can include in their comic strip. Enrichment Extension Have students speak with a bank employee such as a financial analyst or branch manager about banking ratios. Ask them which ratios they feel are the most important indicator of a bank’s performance. Also ask them what other information they feel is also a good assessment. Copyright © Texas Education Agency, 2014. All rights reserved. 11 By the Numbers Ratio Analysis Assignment #1 Student Name: ________________________________________ CATEGORY 20 15 8 All required elements are included on the chart. 1 Required Elements The chart includes all required elements as well as additional information. Knowledge Gained Student can Student can Student can Student appears accurately accurately accurately to have answer all answer most answer about insufficient questions related questions related 75% of questions knowledge about to facts in the to facts in the related to facts in the facts or chart. chart. the chart. processes used in the chart. Labels All ratios on the Almost all ratios Several ratios on No ratios labeled chart are clearly on the chart are the chart are on the chart. labeled. clearly labeled. clearly labeled. Grammar There are no grammatical mistakes on the chart. Summary Statement All ratios are Almost all ratios summarized with are summarized favorable or with favorable or unfavorable. unfavorable. There is 1 grammatical mistake on the chart. All but 1 of the Several required required elements were elements is missing. included on the chart. There are 2 grammatical mistakes on the chart. There are more than 2 grammatical mistakes on the chart. Half of the ratios are summarized with favorable or unfavorable. One or less of the ratios are summarized with favorable or unfavorable. Maximum Points Possible 100 Student Points _________ Copyright © Texas Education Agency, 2014. All rights reserved. 12 By the Numbers Spread Calculation Report Assignment #2 Student Name: ________________________________________ CATEGORY 20 15 8 1 Quality of Information Information clearly relates to the main topic. It includes several supporting details and/or examples. Information clearly relates to the main topic. It provides 1‐2 supporting details and/or examples. Information Information has little clearly relates to or nothing to do with the main topic. the main topic. No details and/or examples are given. Paragraph Construction All paragraphs include introductory sentence, explanations or details, and concluding sentence. Most paragraphs include introductory sentence, explanations or details, and concluding sentence. Paragraphs included related information but were typically not constructed well. Amount of Information All topics are addressed. Most topics are Less than half of One or more topics addressed. the topics are were not addressed. addressed. Internet Use Successfully uses suggested internet links to find information. Usually able to use suggested internet links to find information. Occasionally able Needs assistance or to use suggested supervision to use internet links to suggested internet find information. links and/or to navigate within these sites. Organization Information is very organized with well‐ constructed paragraphs and subheadings. Information is organized with well‐constructed paragraphs. Information is organized, but paragraphs are not well‐ constructed. Paragraphing structure was not clear and sentences were not typically related within the paragraphs. The information appears to be disorganized. Maximum Points Possible 100 Student Points _________ Copyright © Texas Education Agency, 2014. All rights reserved. 13 By the Numbers CAMELS Comic Strip Assignment #3 Student Name: ________________________________________ CATEGORY 20 15 8 1 Knowledge Can accurately tell Can Can somewhat tell Has trouble what the CAMELS adequately what the CAMELS remembering rating system means. tell what the rating means. CAMELS concepts. CAMELS rating means. Vocabulary Uses a varied vocabulary appropriate for the audience. Written Copy The student turns in The student an attractive and turns in a complete copy of the complete comic strip. copy of the comic strip. Uses a varied vocabulary that is appropriate for the reader. Uses a varied vocabulary that is a little too simple or a little too hard for the reader. The vocabulary was not varied OR was routinely inappropriate for the intended reader. The student turns The student turns in in a complete an incomplete copy copy of the comic of the comic strip. strip, but the format was not correct. Connections/Transitions Connections between ideas are creative, clearly expressed and appropriate. Connections between ideas are adequately expressed and appropriate. Connections The comic seems between ideas are very disconnected. sometimes hard to figure out. More detail is needed. Required Elements 4‐5 panels present. Only 3 panels are Less than 3 panels present. present. At least 6‐8 panels present. Maximum Points Possible 100 Student Points _________ Copyright © Texas Education Agency, 2014. All rights reserved. 14