– Financial Reporting for Departmentalized Lesson Plan 8.4 Business Course Title

advertisement

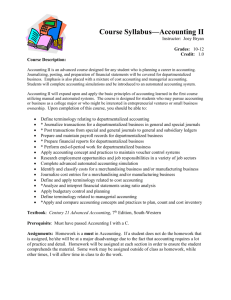

Lesson Plan 8.4 – Financial Reporting for Departmentalized Business Course Title – Accounting II Lesson Title – Financial Reporting for Departmentalized Business Specific Objective - Understand concepts, procedures, and applications related to the financial reporting for a departmentalized business. Performance Objectives: Identify accounting concepts and practices related to financial reporting for a departmental business; Prepare interim departmental statement of gross profit; Prepare a work sheet for a departmentalized business; Prepare financial statements for a departmentalized business; Analyze financial statements using selected component percentages; Complete end-of-period work for a departmentalized business; Define accounting terms related to the lesson. TEKS: 130.167.c. 1 – use equations, graphical representations, accounting tools, strategies, and systems in real-world situations to maintain, monitor, control, and plan the use of financial resources. The student is expected to communicate how accounting procedures affect financial statements. 2.F-H – understand that internal accounting controls exist to ensure the proper recording of financial transactions; complete a work sheet for a corporation; generate an income statement for a corporation; J – produce a balance sheet for a corporation. TAKS: R1, M9, M10 Preparation Materials Needed: Overhead projector Century 21’s Textbook, Chapter 4. Glencoe’s Textbook, Chapter 18, and Demonstration Problems Accounting software and spreadsheet software Sponge/Focus Activity: Accounting in Your Career, in Century 21’s Textbook Lesson Plan 8.4 – Financial Reporting for Departmentalized Business Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II Lesson Content: See Century 21’s Textbook, Chapter 4. Here is an outline: I. II. III. IV. Interim departmental statement of gross profit A. Departmental statement of gross profit B. Estimating ending merchandise inventory C. Interim departmental statement of gross profit D. Analyzing an interim departmental statement of gross profit E. Cost of merchandise sold and gross profit percentages F. Determining acceptable levels of performance Preparing a work sheet for a departmental business A. Proving the accuracy of posting to subsidiary ledgers B. Trial balance and adjustments columns C. Departmental work sheet 1. Merchandise inventory adjustments 2. Supplies adjustments 3. Prepaid insurance adjustment 4. Depreciation expense adjustments 5. Federal income tax expense adjustment D. Balance sheet columns of a work sheet E. Income statement columns of a work sheet F. Net income on a work sheet G. Net loss on a work sheet Financial statements for a departmentalized business A. Departmental statement of gross profit B. Target component percentages C. Income statement D. Calculating component percentages E. Statement of stockholders’ equity F. Balance sheet End-of-period work for a departmentalized business A. Journalizing adjusting entries for a departmentalized business B. Journalizing closing entries for a departmentalized business C. Explanation of closing entries D. Post-closing trial balance for a departmentalized business E. Summary of accounting cycle Teaching Strategies: With the Century 21 textbook, complete the Work Together problems as a class, then let your students finish the On Your Own problems by themselves and go over the answers together. Glencoe’s Demonstration Problems. Assessment: For problems you can use Peachtree Accounting from Glencoe, Glencoe Lesson Plan 8.4 – Financial Reporting for Departmentalized Business Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II Accounting Software, Century 21 Accounting Software, or a spreadsheet. From Century 21’s Textbook o Guided Practice Work Together: Preparing an interim departmental statement of gross profit On Your Own: Preparing an interim departmental statement of gross profit Work Together: Analyzing adjusting entries On Your Own: Analyzing adjusting entries Work Together: Preparing an income statement with component percentages On Your Own: Preparing an income statement with component percentages Work Together: Journalizing closing entries On Your Own: Journalizing closing entries o Independent Practice 4-1 Estimating ending merchandise inventory 4-2 Preparing an interim departmental statement of gross profit; calculating component percentages 4-3 Preparing subsidiary schedules 4-4 Calculating and analyzing component percentages for total operating expenses 4-5 Completing a work sheet for a departmentalized business, 4-6 preparing financial statements for a departmentalized business, 4-7 Journalizing adjusting and closing entries for a departmentalized business 4-8 Preparing end-of-fiscal period work for a departmentalized business 4-9 Preparing a 10-column work sheet for a departmentalized business o Additional Activities: Applied Communication, and Cases for Critical Thinking o Open Notes and textbook Quiz: Study Guide for Chapter From Glencoe’s Textbook Problems: A combination of Lessons 1-4. o Guided Practice 18-1 Determining Gross Profit on Sales 18-2 Allocating Rent Expense 18-3 Analyzing a Source Document 18-4 Determining Contribution Margin o Independent Practice 18-5 Calculating Contribution Margins 18-6 Reporting Departmental Gross Profit on Sales 18-7 Reporting Contribution Margins and Net Income Lesson Plan 8.4 – Financial Reporting for Departmentalized Business Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II 18-8 Allocating Expenses and Completing a Departmental Work Sheet 18-9 Reporting Contribution Margins and Net Income 18-10 Evaluating a Department’s Contribution Margin o Additional Activities: Using Key Terms, Understanding Accounting Concepts and Procedures, Case Study, Conducting an Audit with Alex, Internet Connection, and Workplace Skills o Open Notes and textbook Quiz: Study Guide for Chapter This lesson is also assessed through the Unit Test at the end of the Unit. Additional Resources: Textbooks: Guerrieri, Donald J., F. Barry Haber, William B. Hoyt, and Robert E. Turner, Glencoe Accounting Real-World Applications & Connections, Advanced Course, Fourth Edition, Glencoe McGraw-Hill: New York, New York. Ross, Kenton E., CPA, Mark W. Lehman, CPA, Claudia Bienias Gilbertson, CPA, Robert D. Hanson, Century 21 Accounting Advanced, Anniversary Edition, Thomson South-Western: Mason, OH, 2003. Multimedia: Century 21’s Teacher Resource CD Websites: http://accounting.swpco.com Lesson Plan 8.4 – Financial Reporting for Departmentalized Business Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II