Lesson Plan 7.3 Governmental Accounting – Course Title Lesson Title

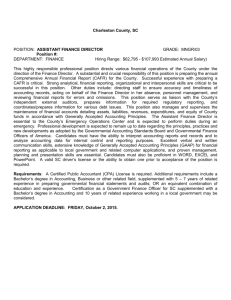

advertisement

Lesson Plan 7.3 Governmental Accounting Course Title – Accounting II Lesson Title – Governmental Accounting Specific Objective – Understand and apply concepts and procedures related to accounting for not-for-profit governmental organizations. Performance Objectives: Prepare a budget for a governmental organization; Prepare a work sheet for a governmental organization; Prepare financial statements for a governmental organization; Record adjusting and closing entries for a governmental organization; Define accounting terms related to the lesson. TEKS: 130.167.c. 6.A.-C – process preliminary budget detail; prepare budget reports; and determine relevant cost and revenue data for decision-making purposes. TAKS: R1, M9, M10 Preparation Materials Needed: Projection system Century 21’s Textbook, Chapters 23 and 24. Accounting software and spreadsheet software Sponge/Focus Activity: Explain that a vast majority of workers in this country work for the government; therefore they deal with accounting procedures for governmental agencies. Accounting in Your Career, in Century 21’s Textbook Lesson Content: See Century 21’s Textbook, Chapters 23 and 24. Here is an outline: I. Budgeting and Accounting for a Not-for-Profit Governmental Organization A. Purpose of governmental organizations 1. Characteristics of governmental accounting systems 2. Fund accounting balance sheets i. Modified accrual accounting Lesson Plan 7.3 – Governmental Accounting opyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II II. 3. Difference between expenses and expenditures 4. Financial reporting emphasis 5. Budgeting 6. Chart of accounts for a governmental organization 7. Developing an annual governmental operating budget 8. Procedures to prepare annual operating budget 9. Journalizing an approved annual operating budget B. Journalizing revenues 1. Journalizing current property tax revenues 2. Collection of current property taxes 3. Other revenue 4. Accounting for delinquent property taxes C. Journalizing expenditures, encumbrances and other transactions 1. Journalizing expenditures 2. Journalizing encumbrances 3. Journalizing expenditures for amounts encumbered 4. Journalizing expenditures benefiting future periods 5. Journalizing the issuance of liabilities 6. Journalizing the payment of liabilities 7. Investing in short-term investments 8. Receiving cash from short-term investments Financial reporting for a governmental organization A. Preparing a work sheet for a governmental organization 1. Recording a trial balance on a work sheet 2. Adjustment for inventory of supplies 3. Adjustment for interest revenue and reserve for encumbrances 4. Extending amounts to revenues/expenditures and balance sheet columns 5. Calculating the excess of revenues over expenditures 6. Completing the work sheet B. Preparing financial statements for a government organization 1. Statement of revenues, expenditures, and changes in fund balance—budget and actual 2. Balance sheet C. Recording adjusting and closing entries for a governmental organization 1. Adjusting and closing entries 2. Closing entries 3. Preparing a post-closing trial balance for governmental organization Teaching Strategies: Discuss with students the types of revenue collected by your local governments, state governments, and the U.S. government also explain how these revenues are collected. With the Century 21 textbook, complete the Work Together problems with Lesson Plan 7.3 – Governmental Accounting opyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II your class, then give students the On Your Own problems to complete by themselves and go over the answers as a class. Assessment: For problems you can use Peachtree Accounting from Glencoe, Glencoe Accounting Software, Century 21 Accounting Software, or a spreadsheet. From Century 21’s Textbook o Guided Practice Work Together: Journalizing governmental operating budgets On Your Own: Journalizing governmental operating budgets Work Together: Journalizing governmental revenue transactions On Your Own: Journalizing governmental revenue transactions Work Together: Journalizing governmental encumbrances, expenditures, and other transactions On Your Own: Journalizing governmental encumbrances, expenditures, and other transactions Work Together: Preparing a work sheet for a governmental organization On Your Own: Preparing a work sheet for a governmental organization Work Together: Preparing financial statements for a governmental organization On Your Own: Preparing financial statements for a governmental organization Work Together: Journalizing adjusting and closing entries for a governmental organization On Your Own: Journalizing adjusting and closing entries for a governmental organization o Independent Practice 23-1 Journalizing governmental operating budgets 23-2 Journalizing governmental revenue transactions 23-3 Journalizing governmental encumbrances, expenditures, and other transactions 23-4 Journalizing governmental transactions 23-5 Journalizing governmental transactions 24-1 Preparing a work sheet for a governmental organization 24-2 Preparing financial statements for a governmental organization 24-3 Journalizing adjusting and closing entries for a governmental organization 24-4 Completing the end-of-fiscal-period work for a governmental organization 24-5 Completing the end-of-fiscal-period work for a Lesson Plan 7.3 – Governmental Accounting opyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II governmental organization o Additional Activities: Applied Communication, and Cases for Critical Thinking o Open Notes and textbook Quiz: Study Guide for Chapters This lesson is also assessed through the Unit Test at the end of the Unit. Additional Resources: Textbooks: Ross, Kenton E., CPA, Mark W. Lehman, CPA, Claudia Bienias Gilbertson, CPA, Robert D. Hanson, Century 21 Accounting Advanced, Anniversary Edition, Thomson South-Western: Mason, OH, 2003. Multimedia: Century 21’s Teacher Resource CD Websites: http://accounting.swpco.com Lesson Plan 7.3 – Governmental Accounting opyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II