Accounting II Lesson Plan: Current & Long-Term Assets Simulation

advertisement

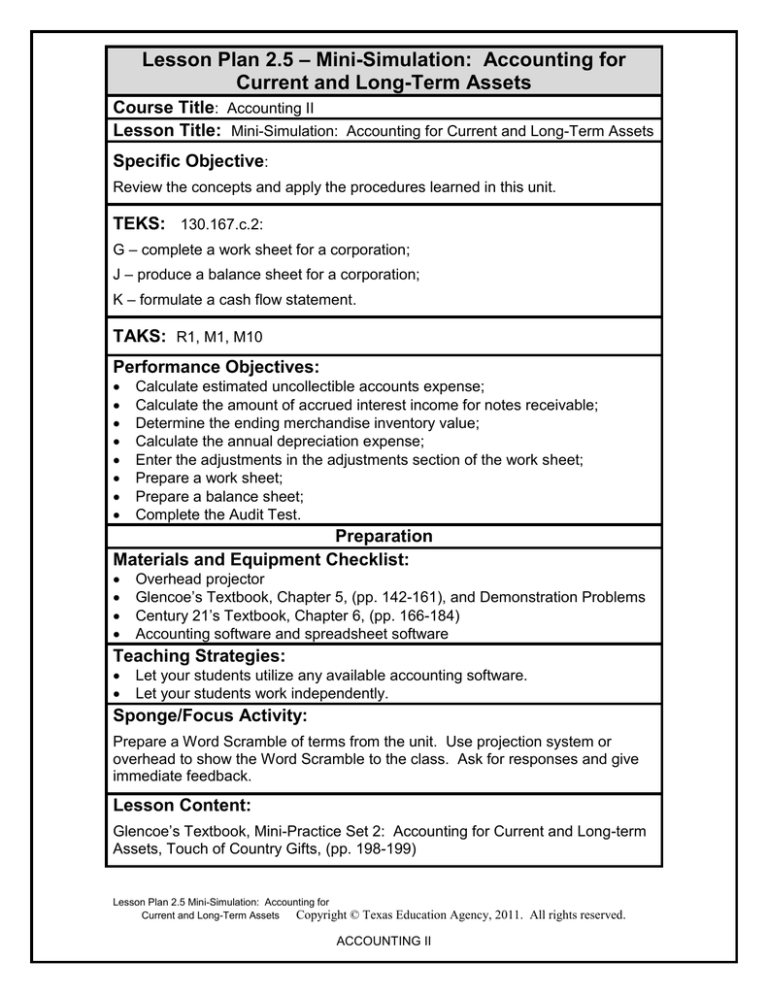

Lesson Plan 2.5 – Mini-Simulation: Accounting for Current and Long-Term Assets Course Title: Accounting II Lesson Title: Mini-Simulation: Accounting for Current and Long-Term Assets Specific Objective: Review the concepts and apply the procedures learned in this unit. TEKS: 130.167.c.2: G – complete a work sheet for a corporation; J – produce a balance sheet for a corporation; K – formulate a cash flow statement. TAKS: R1, M1, M10 Performance Objectives: Calculate estimated uncollectible accounts expense; Calculate the amount of accrued interest income for notes receivable; Determine the ending merchandise inventory value; Calculate the annual depreciation expense; Enter the adjustments in the adjustments section of the work sheet; Prepare a work sheet; Prepare a balance sheet; Complete the Audit Test. Preparation Materials and Equipment Checklist: Overhead projector Glencoe’s Textbook, Chapter 5, (pp. 142-161), and Demonstration Problems Century 21’s Textbook, Chapter 6, (pp. 166-184) Accounting software and spreadsheet software Teaching Strategies: Let your students utilize any available accounting software. Let your students work independently. Sponge/Focus Activity: Prepare a Word Scramble of terms from the unit. Use projection system or overhead to show the Word Scramble to the class. Ask for responses and give immediate feedback. Lesson Content: Glencoe’s Textbook, Mini-Practice Set 2: Accounting for Current and Long-term Assets, Touch of Country Gifts, (pp. 198-199) Lesson Plan 2.5 Mini-Simulation: Accounting for Current and Long-Term Assets Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II Assessment: Check your students’ work and let them make corrections. Students take the Audit Test on Touch of Country Gifts. Students also take a Unit Test covering the terms, concepts, and applications covered in this unit. Additional Resources: Textbooks: Guerrieri, Donald J., F. Barry Haber, William B. Hoyt, and Robert E. Turner, Glencoe Accounting Real-World Applications & Connections, Advanced Course, Fourth Edition, Glencoe McGraw-Hill: New York, New York. Ross, Kenton E., CPA, Mark W. Lehman, CPA, Claudia Bienias Gilbertson, CPA, Robert D. Hanson, Century 21 Accounting Advanced, Anniversary Edition, Thomson South-Western: Mason, OH, 2003. Multimedia: Century 21’s Teacher’s Resource CD Lesson Plan 2.5 Mini-Simulation: Accounting for Current and Long-Term Assets Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING II