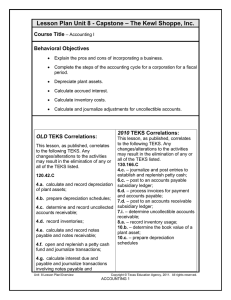

Lesson Plan 8.4 - End-of-Fiscal Period Activities Course Title Session Title Lesson Purpose

advertisement

Lesson Plan 8.4 - End-of-Fiscal Period Activities Course Title – Accounting I Session Title –End-of-Fiscal Period Activities Lesson Purpose – Demonstrate skill in completing the accounting procedures for end-of-the fiscal period for a corporation. Behavioral Objectives Analyze and journalize adjusting entries for a merchandising business formed as a corporation. Calculate net income or net loss. Prepare financial statements for a corporation. Perform period-end closing for a fiscal period. Journalize reversing entries if needed. Preparation OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.a. calculate and record depreciation of plant assets; 4.b. prepare depreciation schedules; 4.c. determine and record uncollected accounts receivable; 4.e. calculate and record notes payable and notes receivable; 4.f. open and replenish a petty cash fund and journalize transactions; 4.g. calculate interest due and payable and journalize transactions involving notes payable and receivable; 4.h. calculate bad debts expense and journalize transactions involving uncollected accounts. 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled. 7.c. make decisions using appropriate accounting concepts; This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 4.c. – journalize and post entries to establish and replenish petty cash; 6.c. – post to an accounts payable subsidiary ledger; 7.d. – post to an accounts receivable subsidiary ledger; 7.h. – prepare an accounts receivable schedule 7.i. – determine uncollectible accounts receivable; 10.b. – determine the book value of a plant asset; 10.c. – prepare depreciation schedules Lesson Plan 8.4 – End-of-Fiscal Period Activities Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Lesson Plan 8.4 – End-of-Fiscal Period Activities Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Materials, Equipment and Resources: Textbook Accounting Software Journal Input Forms Spreadsheet Software Teaching Strategies: Observation Lesson Content: Students work independently to complete the end-of-fiscal period activities for a corporation. Assessment: Observation Graded Assignment Additional Resources: Textbooks: Guerrieri, Donald J., Haber, Hoyt, Turner. Glencoe Accounting RealWorld Applications and Connections. Glencoe McGraw-Hill, 2000. ISBN/ISSN 0-02-815004-X. Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 Accounting Multicolumn Journal Anniversary Edition, 1st Year Course. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43524-0 Ross, Kenton, Gilbertson, Lehman, and Hanson. Century 21 General Journal Accounting Anniversary Edition, 7th Edition. SouthWestern Educational and Professional Publishing, 2003. ISBN/ISSN: 0-538-43529-1. Lesson Plan 8.4 – End-of-Fiscal Period Activities Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 8.4.1 – Analyzing and Journalizing Adjusting Entries Course Title – Accounting I Session Title – End-of-Fiscal Period Activities Activity Purpose - Demonstrate skill in analyzing and journalizing adjusting entries for a corporation OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 4.a. calculate and record depreciation of plant assets; 4.b. prepare depreciation schedules; 4.c. determine and record uncollected accounts receivable; 4.e. calculate and record notes payable and notes receivable; 4.f. open and replenish a petty cash fund and journalize transactions; 4.g. calculate interest due and payable and journalize transactions involving notes payable and receivable; 4.h. calculate bad debts expense and journalize transactions involving uncollected accounts. 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 4.c. – journalize and post entries to establish and replenish petty cash; 6.c. – post to an accounts payable subsidiary ledger; 6.d. – process invoices for payment and accounts payable; 7.d. – post to an accounts receivable subsidiary ledger; 7.i. – determine uncollectible accounts receivable; 10.b. – determine the book value of a plant asset; 10.c. – prepare depreciation schedules Activity 8.4.1 – Analyzing and Journalizing Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Accounting Software Teaching Strategies: Observation Activity Outline: 1 Analyze adjusting entries given this information: a. Uncollectible Accounts Expense is estimated at 0.5% of Sales. b. FIFO method is used for calculating cost of merchandise inventory. Using the following information, calculate the ending inventory value on 196 items. Please note: under normal circumstances, you would calculate inventory on each type of item with a SKU number (inventory number), but for this exercise, you only need to demonstrate your skill in calculating cost of inventory. Date 1-01-03 1-02-03 1-09-03 1-11-03 1-15-03 1-23-03 1-30-03 Number Purchased 200 100 150 100 100 150 25 Cost of each unit $12 $10 $11 $8 $9 $14 $7 c. Ending Supplies Inventory is $131.50. d. Value of Prepaid Insurance is $500.00. e. Calculate the Depreciation Expense on the Delivery Truck for this fiscal period. Use the stock record to get the information needed. f. Interest Expense accrued on Note Payable 1. (Refer back to the transaction for needed information.) 2 Enter adjusting entries. Activity 8.4.1 – Analyzing and Journalizing Adjusting Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Assessment: Observation Graded Assignment Quality Feature Accurate amounts for adjusting entries Accounts analyzed accurately Completes in a timely manner Activity 8.4.1 – Analyzing and Journalizing Adjusting Entries Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 8.4.2 – Preparing Financial Statements Course Title – Accounting I Session Title – End-of-Fiscal Period Activities Activity Purpose - Demonstrate skill in preparing financial statements for a corporation. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Accounting Software Teaching Strategies: Observation Activity 8.4.2 – Preparing Financial Statements Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: 1 Have your students print these financial statements: a. Income Statement b. Statement of Stockholder’s Equity c. Balance Sheet 2 Ask your students to answer these questions: a. What is the net income or net loss for the fiscal period? b. What are the total operating expenses? c. What is the component percentage for net income before Federal Income Tax? d. What is the net increase to retained earnings? e. What is the total stockholder’s equity? f. What is the proving total on the balance sheet? g. What was the highest operating expense? h. What suggestions would you make to this company to improve net income for the next fiscal period? Assessment: Observation Graded Assignment Quality Feature Score Amounts on all financial statements accurate No grammar or typing errors Questions answered accurately Logical suggestions that demonstrate thought given on the last question Completes in a timely manner Activity 8.4.2 – Preparing Financial Statements Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 8.4.3 – Performing Period-End Closing Course Title – Accounting I Session Title – End-of-Fiscal Period Activities Activity Purpose - Demonstrate skill and understanding in performing period-end closing for a corporation. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 3.j. – prepare a post-closing trial balance TAKS Correlation: WRITING Objective 5: The student will produce a piece of writing that demonstrates a command of the conventions of spelling, capitalization, punctuation, grammar, usage, and sentence structure. Objective 6: The student will demonstrate the ability to revise and proofread to improve the clarity and effectiveness of a piece of writing. Materials, Equipment and Resources: Textbook Accounting Software Teaching Strategies: Observation Activity 8.4.3 – Performing Period-End Closing Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity Outline: Have your students: 1. Work independently to perform period-end closing for a corporation. 2. Print a Post-Closing Trial Balance. 3. Answer these questions about period-end closing: a. b. c. d. What are the proving totals on the Post-Closing Trial Balance? List the accounts with a zero balance. List the accounts that were affected by the closing entries Write a brief explanation of the procedures that take place in closing entries. Include what is debited and credited and why. Assessment: Observation Graded Assignment Quality Feature Performs Period-end closing effectively Post-Closing Trial Balance accurate Summary well-written Summary thorough No errors in summary Completes in a timely manner Activity 8.4.3 – Performing Period-End Closing Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 Activity 8.4.4– Reversing Entries Course Title – Accounting I Session Title – End-of-Fiscal Period Activities Activity Purpose - Demonstrate skill in journalizing reversing entries at the beginning of a new fiscal period. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.c. make decisions using appropriate accounting concepts; 7.e. perform accounting procedures using manual and automated methods; 7.g. demonstrate use of the numeric keypad by touch This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C N/A TAKS Correlation: MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Materials, Equipment and Resources: Textbook Accounting Software Journal Input Form Teaching Strategies: Observation Activity Outline: Have your students: 1. Determine if there are any accounts that need a reversing entry. Activity 8.4.2 – Reversing Entries Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 2. Using an input form, journalize the entry for any of these accounts. Assessment: Observation Graded Assignment Quality Feature Reversing entry or entries accurate in amount and accounts. Completes in a timely manner. Activity 8.4.2 – Reversing Entries Score Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1