Lesson Plan

advertisement

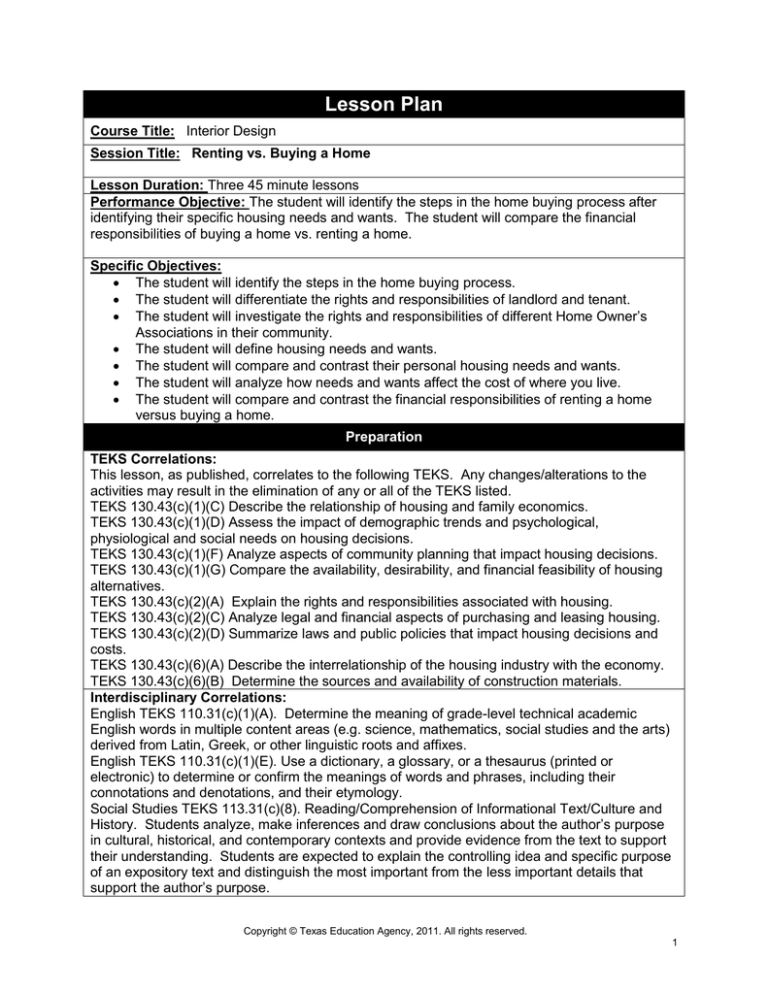

Lesson Plan Course Title: Interior Design Session Title: Renting vs. Buying a Home Lesson Duration: Three 45 minute lessons Performance Objective: The student will identify the steps in the home buying process after identifying their specific housing needs and wants. The student will compare the financial responsibilities of buying a home vs. renting a home. Specific Objectives: The student will identify the steps in the home buying process. The student will differentiate the rights and responsibilities of landlord and tenant. The student will investigate the rights and responsibilities of different Home Owner’s Associations in their community. The student will define housing needs and wants. The student will compare and contrast their personal housing needs and wants. The student will analyze how needs and wants affect the cost of where you live. The student will compare and contrast the financial responsibilities of renting a home versus buying a home. Preparation TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. TEKS 130.43(c)(1)(C) Describe the relationship of housing and family economics. TEKS 130.43(c)(1)(D) Assess the impact of demographic trends and psychological, physiological and social needs on housing decisions. TEKS 130.43(c)(1)(F) Analyze aspects of community planning that impact housing decisions. TEKS 130.43(c)(1)(G) Compare the availability, desirability, and financial feasibility of housing alternatives. TEKS 130.43(c)(2)(A) Explain the rights and responsibilities associated with housing. TEKS 130.43(c)(2)(C) Analyze legal and financial aspects of purchasing and leasing housing. TEKS 130.43(c)(2)(D) Summarize laws and public policies that impact housing decisions and costs. TEKS 130.43(c)(6)(A) Describe the interrelationship of the housing industry with the economy. TEKS 130.43(c)(6)(B) Determine the sources and availability of construction materials. Interdisciplinary Correlations: English TEKS 110.31(c)(1)(A). Determine the meaning of grade-level technical academic English words in multiple content areas (e.g. science, mathematics, social studies and the arts) derived from Latin, Greek, or other linguistic roots and affixes. English TEKS 110.31(c)(1)(E). Use a dictionary, a glossary, or a thesaurus (printed or electronic) to determine or confirm the meanings of words and phrases, including their connotations and denotations, and their etymology. Social Studies TEKS 113.31(c)(8). Reading/Comprehension of Informational Text/Culture and History. Students analyze, make inferences and draw conclusions about the author’s purpose in cultural, historical, and contemporary contexts and provide evidence from the text to support their understanding. Students are expected to explain the controlling idea and specific purpose of an expository text and distinguish the most important from the less important details that support the author’s purpose. Copyright © Texas Education Agency, 2011. All rights reserved. 1 Related Industries that utilize the skill set in this lesson: Architecture and Design, Interior Design, Facilities Management, Real Estate Agent, Property Development, Zoning and Regulations, Building Codes and Construction Management. Relevant Core Curriculum Concepts: 1. Determine the meaning of various technical terms found in a lease. 2. Determine the meaning of various technical terms found in a loan agreement. 3. Use a dictionary to confirm the meanings of vocabulary words. 4. Use a variety of texts, analyze contemporary context found in legal documents. Occupational Correlations: (reference O-Net http://www.onetonline.org/) 11-9141.00 Property, Real Estate, and Community Association Managers Tasks: Meet with prospective tenants to show properties, explain terms of occupancy, and provide information about local area. Determine and certify the eligibility of prospective tenants, following government regulations. Plan, schedule, and coordinate general maintenance, major repairs, and remodeling or construction projects for commercial or residential properties. Knowledge: Sales and Marketing – knowledge of principles and methods for showing, promoting, and selling products or services. This includes marketing strategy and tactics, product demonstration, sales techniques and sales promotion. SOFT SKILLS: Speaking, active listening, negotiation, coordination, critical thinking, persuasion 19-3051.00 Urban and Regional Planners (Green) TASKS: Hold public meetings with government officials, social scientists, lawyers, developers, the public, or special interest groups to formulate, develop, or address issues regarding land use or community plans. Discuss with planning officials the purpose of land use projects, such as transportation, conservation, residential, commercial, industrial or community use. Conduct field investigations, surveys, impact studies, or other research to compile and analyze data on economic, social, regulatory or physical factors affecting land use. Keep informed about economic or legal issues involved in zoning codes, building codes or environmental regulations. KNOWLEDGE: Geography – knowledge of principles and methods for describing the features of land, sea, and air masses, including the physical characteristics, locations, interrelationships, and distribution of plant, animal, and human life Design – knowledge of design techniques, tools, and principles involved in production of precision technical plans, blueprints, drawings and models Law and Government – knowledge of laws, legal codes, court precedents, government regulations, executive orders, agency rules, and the democratic political process SOFT SKILLS: Active listening, speaking, critical thinking, judgment and decision making, writing, complex problem solving 13-1041.00 Government Property Inspectors and Investigators (Bright Outlook) TASKS: Prepare correspondence, reports of inspection or investigation or recommendation for action. Copyright © Texas Education Agency, 2011. All rights reserved. 2 Investigate applications for special licenses or permits, as well as alleged violations. Inspect government-owned equipment or materials in the possession of private contractors to ensure compliance with contracts or regulations or to prevent misuse. KNOWLEDGE: Building and Construction – knowledge of materials, methods and tools involved in the construction or repair of houses, buildings or other structures such as highways and roads. Mathematics – knowledge of arithmetic, algebra, geometry, calculus, statistics and their applications. SOFT SKILLS: Active listening, speaking, writing, critical thinking, reading comprehension, complex problem solving, instructing and monitoring. 47-4011.00 Construction and Building Inspectors (Green) TASKS: Issue violation notices and stop-work orders, conferring with owners, violators and authorizes to explain regulations and recommend rectifications. Inspect bridges, dams, highways, buildings, wiring, plumbing, electrical circuits, sewers, heating systems, or foundations during and after construction for structural quality, general safety or conformance to specifications and codes. Approve and sign plans that meet required specifications. Review and interpret plans, blueprints, site layouts, specifications or construction methods to ensure compliance to legal requirements and safety regulations. Inspect and monitor construction sites to ensure adherence to safety standards, building codes and plans. KNOWLEDGE: Building and Construction – knowledge of materials, methods, and the tools involved in the construction or repair of houses, building or other structures such as highways and roads. Design – knowledge of design techniques, tools, and principles involved in production of precision technical plans, blueprints, drawings and models. Law and Government – knowledge of laws, legal codes, court procedures, precedents, government regulations, executive orders, agency rules, and the democratic political process. SOFT SKILLS: Active listening, reading comprehension, complex problem solving, judgment and decision making, speaking, writing, time management. Teacher Preparation: Prior to this Lesson, Teacher should have knowledge and experience with: Types of homes available for rent or to buy in their area. Be familiar with parts of a lease. Contact the local Chamber of Commerce to find out what type of information is given to people moving into the area/community. Review the Housing Decisions Lesson Plan. Student Preparation: Prior to this Lesson, students should have knowledge and experience with: Types of housing Factors that affect housing choices Planning Process References: Homes Today and Tomorrow by Ruth F Sherwood (Student Edition) ISBN 0-07-825144-3 Copyright © Texas Education Agency, 2011. All rights reserved. 3 Glencoe McGraw Hill Publishing Housing Teachers Instruction Guide from Texas Tech University Exam View Test Bank for Homes Today and Tomorrow by Ruth F Sherwood Texas Apartment Association – www.texasapartmentassociation.com Instructional Aids: 1. Renting a Place To Live Worksheet 2. Renting a Place To Live PowerPoint 3. Purchasing a Home PowerPoint 4. Purchasing a Home Worksheet 5. Renter’s Rights and Responsibilities TA – 27 6. Demographic Case Studies TA – 13/14 7. Basic Lease Handout 8. Sample Rental Application 9. Homes Today and Tomorrow Chapter 9 & 10 10. www.texasapartmentassociation.com 11. www.taa.org Materials Needed: 1. Pencils with erasers 2. Local newspaper with classified section 3. Worksheets listed above Equipment Needed: 1. Teacher computer workstation 2. Printer, capable of black and white printing on 8 ½” x 11” papers 3. Overhead projection screen that can exhibit teacher’s monitor Learner Preparation: Each student is placed into a team of 3-4 students; preferably these groups are balanced with students of varied skill levels and learning styles. Definition of various vocabulary words should be prominently placed in a visible location in the room. Will refer back to Housing through the Lifecycle Notes from Housing Decisions Lesson Plan. Introduction Introduction (LSI Quadrant I): Students enter and gather at their assigned seat/table. Each seat has a handout SAY: Today we are going to define and explore terms related to leasing or renting a home. ASK: By a show of hands, how many of you live in an apartment? How many of you live in a home that your parents pay rent for? How many of you live in a home that your parents own? (Prompt and wait for students’ response. Then discuss the percentage of the class that lives in a leased property vs. a bought property). SHOW: Renting vs Buying Lesson 2 PowerPoint Slide 2 – Warm Up/Bell Ringer. Have students define the following words: Evict – A legal action that requires tenants to move out before the lease has expired Lease – The legal document a tenant signs when agreeing to rent housing for a specific period of time Copyright © Texas Education Agency, 2011. All rights reserved. 4 Sublet – To move out of a rental unit before the lease is up and rent the unit to someone else while retaining legal responsibility for the original lease Landlord – a person who owns a property and rents it to someone else Tenant – Someone who pays rent to use or occupy property owned by someone else Security Deposit – A fee paid by renters to cover the cost of any future damage that may be caused to the unit Renter’s Insurance – An insurance policy that covers personal property against loss by theft, fire, or other hazards SHOW: (Hold up a copy of Renting a Place to Live Worksheet) Using the worksheet on your desk, define in your own words the new vocabulary words – these words can also be found on the overhead screen.(Slide 2 of the Lesson PowerPoint) SAY: Now that you have defined these terms, what role do you think a landlord and a tenant plays with a leased piece of property? (Prompt and wait for students’ response. Then discuss the various answers that students come up with.) SHOW: Renting a Home PowerPoint. Students are to continue using their Renting a Place to Live Worksheet to take notes from the PowerPoint. (For students who are absent they can use Chapter 9 and 10 from “Homes Today & Tomorrow” to complete.) Slide 2 Renting means paying money to live in a dwelling owned by someone else. These homes can range from an apartment to a single-family home and can come furnished or unfurnished. Slides 3, 4 & 5: What do you think the Pro’s and Con’s of Renting would be? (Prompt and wait for student’s response.) Show slides 3, 4 and 5 listing the pro’s and con’s of renting. (Discuss the answers the students came up with and what is on the slide.) Slide 6: Whenever you move into a rented place, there are several fees that you will have to pay before you take possession of the property. The first fee is an application fee. This is paid to the landlord/manager to show your interest and so they can run your application. Sometimes, there is also a Credit Check Fee. This tells the landlord if you pay your bills on time. All renters have to pay a security deposit. This covers the cost of any repairs that need to be made when you move out of the dwelling. If you have pets, there may be an additional deposit that may or may not be refundable, to cover any damage done to the dwelling or the yard by the pet. The last fee paid to the landlord/manager will be the first month’s rent. This is sometimes pro-rated if you do not move in on the first of the month. The last two fees you may pay when you move in are the moving cost to a moving company or you can rent/borrow a truck and get a few friends to help you move furniture and boxes, and installation costs for utilities. Slide 7: Now that you have moved into your rental home, you will have some costs that you have to pay every month. These include rent, renter’s insurance, utilities and in some cases parking fees. It is always a good idea to have renter’s insurance to cover your personal property in case something happens to the home like fire, flood and theft. Slide 8: Now let’s talk about how to find a rental home. Before you go looking, you need to ask yourself a few questions and be honest in your answers. These questions include: What can I afford? What location am I interested in? What kind of housing unit will suit me? And, How much space do I need? Financial experts recommend not spending more than 28% of your gross monthly income on housing. Then look at where you are interested in living in a large city, small city, or suburb. Once you know the location you will look in, you can see what types of housing are available and then decide do you want an apartment, a small house or duplex or do you want to share with someone else – cutting your expenses in half. Slide 9: If you decide to look at apartments there are a few guidelines to keep in mind about noise, costs and safety. Also, when you are looking at housing look at the types of ceilings. Copyright © Texas Education Agency, 2011. All rights reserved. 5 Cathedral ceilings are nice, but they cost a lot to heat/cool. Slide 10: The first step in renting a place to live is finding out what is available in the area. There are many ways of finding what types of housing are available; The first is to drive around or even walk around the different neighborhoods you’re interested in and look for “For Rent” signs. Write down the numbers and call about them. You can also look online and in the classified section of the newspaper for available housing. Another option is to call the local Chamber of Commerce and get names of local realtors or apartment location services. Sometimes these services charge a fee to the person looking and sometimes it’s charged to the landlord/manager of the home. SHOW Slide 11 and SAY: (Pass out a copy of the Newspaper Scavenger Hunt.) We are going to stop here for a short while and do a Newspaper Scavenger Hunt. You will need to get a copy of the local paper off of the table. In the classified section as well as in the advertising throughout the paper, you will look for examples of an Advertisement for a Real Estate Agent/Realtor Company, an Advertisement for Apartment Complex, A house for sale, A house for lease, a Housing Loan Advertisement, and for extra credit an Advertisement showing the current Loan Interest Rate. (Allow about 15 minutes for students to complete this assignment OR you can assign as homework if students do not finish before the end of class.) SAY: Use the Day One Wrap Up and Summary Questions to have a brief discussion over what they have learned today. (Renting vs Buying Lesson 2 PowerPoint Slide 4) As we have talked about today, there are both pro’s and con’s to renting a home. You as an individual need to decide what your criteria are before you go looking at rental places. (END OF DAY ONE) Introduction (LSI Quadrant I): Students enter and gather at their assigned seat/table and complete warm up/bell ringer. SAY and SHOW: Slide 5 of Renting vs Buying Lesson 2 PowerPoint. Yesterday, we learned about some terms and definitions of words related to renting a home, as well as the first step in finding a rental unit. Today, we are going to look at the types of housing most commonly seen when renting. But first, we are going to look over the new rental terms you defined as your bell ringer/warm up. Assign – To transfer a tenant’s lease and all legal responsibility for a rental unit to someone else before the end of the lease period. Breach of Contract – A legal phrase for failure to meet all terms of a contract or agreement. Subsidized Housing – Housing available at low cost to families with low income through programs in which the government provides assistance payments to private housing owners. ***Have students pull out their Renting a Place to Live Worksheet to continue taking notes. SAY and SHOW: Renting a Home PowerPoint (Start with slide 12) Slide 12: There are three types of affordable housing. The first is a privately owned dwelling put up for rent by the owner. This can include an apartment or house. Slide 13: The second type is public housing which is designed for low-income families, senior citizens and those with disabilities. These are homes that the government has built and rents out at lower prices. Each one has rules on how much money you can make to live there. Slide 14: The third type is Subsidized Housing. This is when the government pays a portion of the cost of the rent and the tenant pays the rest to a privately owned residence/apartment. Again there are income guidelines that must be followed to receive this aid. Copyright © Texas Education Agency, 2011. All rights reserved. 6 Slide 15: The second step is to look at and compare the different housing units. Always make sure you look at the actual place up for rent. Many times, apartment complexes will have a display unit. Since this is not lived in you will not see normal wear and tear. If possible, talk to the people who will be your neighbors and find out what they think of the apartment complex or the neighborhood and what amenities are available in the area. Take notes about what you like and dislike about the unit. This will help you make your final decision after viewing what is available. Make sure you ask questions about pets if you have any. Some rental properties do not allow any pets at all. Slide 16: As you make your notes about the different properties you looked at, if possible get a copy of the floor plan or draw your own. This will enable you to evaluate the overall layout of the home. Is there room for all your furniture? Is there enough closet space for your clothes? Are there any storage areas and is it big enough for storing decorations, laundry baskets, etc. Slide 17: Make sure you ask questions about what facilities are offered at the complex as well. Do they have a laundry facility or is there a laundry room in the unit? Is there a pool or exercise room available to tenants? For apartment complexes is there an assigned parking spot, covered parking or is there an additional fee for this? Slide 18: The last thing to evaluate about a unit is the safety and security of the place. Is the entrance to the home as well as the complex well lighted? Do they change the locks on the home every time a tenant moves out? Does the door have a deadbolt? Are there smoke detectors or carbon monoxide detectors present? Slide 19: The last few questions you will want to ask is about the maintenance and care of the unit. Who will do what maintenance to the home? If you have to call someone, who are they and how do you contact them? Are there provisions in the lease for when the landlord can come in and how much notice do they need to give? Slide 20: Now that you have all your questions answered, you need to pick which unit you have seen best suits you. Once an agreement is reached, you then need to look over the Lease very carefully. Even read the fine print. If you don’t understand anything in the lease ASK! Never sign a lease until all blanks have been filled in and all your concerns have been answered. Make sure that any damage you find in the home before you move in is recorded in the lease by the landlord before you move in. Otherwise, you can be held responsible for this damage when you move out. Slide 21: This is a list of everything that should be spelled out in the lease. If any of the information is missing, do not sign the lease until it has been filled in. Occasionally, you will have a landlord/manager that will not remember what was discussed and put in different information to blanks. The landlord/manager should sign the lease at the same time you do. You should also receive a copy for your records. Slide 22: Congratulations you can move in now. It’s up to you whether you hire someone to move your furniture or you bribe your friends with a home cooked meal in exchange for their muscles. Slide 23: Now that you have moved in, don’t forget that you have rights and responsibilities that you have to abide by as well. You have the right to a safe living environment. This means that the landlord has to make sure that the heating and plumbing systems work. You are also entitled to privacy. If the landlord needs to check on things or do maintenance, they need to follow the guidelines set up in the lease for coming over unless it is an emergency. Slide 24: As a tenant you also have responsibilities like paying your rent on time and abiding by the rules and regulations that are in the lease. Make sure you read what those are and are familiar with any rules or regulations for common areas in apartment complexes as well. Remember if you don’t pay your rent, this is considered a “breach of contract” which can lead to you being evicted from the unit. *** Pass out copies of TA-27 Renter’s Rights and Responsibilities Worksheet from the Housing Copyright © Texas Education Agency, 2011. All rights reserved. 7 Instructors Guide from Texas Tech University; and a copy of a Basic Lease. (You can get one from your local area or use the attached Basic Lease Handout) SAY and SHOW: Using the Renter’s Right and Responsibilities Worksheet, have students pretend that they have just signed the lease agreement. They are to look over the lease and answer the questions. (If you do not have TA-27, the questions are below) First I would like you to look over the Basic Lease Agreement and become familiar with some of the information we have just finished talking about. I am going to ask you some questions, and I would like you to locate the information in the lease. 1. According to the lease agreement, under what conditions will the security deposit be returned? 2. If you decide to move when the lease agreement expires, what condition must the rental property be in when you move out? 3. According to the lease, what happens if you damage the landlord’s property? 4. Can you install new locks? 5. Can you paint and paper the walls? 6. Are you allowed to have a pet? 7. If your television is stolen, is your landlord liable for your loss? 8. If a pipe bursts in your apartment, who is liable for the damage? 9. Can you operate a business from your apartment? 10. If you decide to move out before the lease expires, what are the possible consequences? 11. If you fail to pay your lease payment on time, what are the possible consequences? 12. Under the lease agreement, can you sublet the apartment to another person? 13. Are there provisions in the lease agreement allowing the landlord to enter the apartment without notice? 14. Who is responsible for the gas, electricity, water and other utility bills? 15. Is the lease renewal automatic? SAY and SHOW: On the overhead show students a copy of a sample rental application. You can also pass out a copy of this document to students. Have them identify the areas that need to be filled in with information. Point to different areas of the rental application and ask students the relevance of the information and why it would be important to have that information. SAY and ASK: Now that you know all the steps into looking for a rental home, how many of you are Seniors and may be doing this a year from now? When we completed the Housing Through the Lifestyle Worksheet in Lesson 1, you wrote down where you planned to live after graduating high school. Is your choice that you wrote down still feasible? Why or why not? (Prompt and wait for students’ response. Then discuss their answers.) SAY: Use the Day Two Wrap Up and Summary Questions to have a brief discussion over what they have learned today. (Renting vs Buying Lesson 2 PowerPoint Slide 4) As we have talked about today, there are lots of steps in finding a rental home and signing a lease. Sometimes we have to look at a lot of lemons before we find the home that is a perfect fit for our needs. (END OF DAY TWO) Introduction (LSI Quadrant I): Students enter and gather at their assigned seat/table and complete warm up/bell ringer. Copyright © Texas Education Agency, 2011. All rights reserved. 8 SAY: Yesterday, we learned about the terms and definitions of words related to renting a home, as well as the steps in finding a rental unit. We looked at what information is required to be in a lease and some do’s and don’ts before signing a lease. SAY and SHOW: Renting vs Buying Lesson 2 PowerPoint Slide 5. Today we are going to learn about words and their definitions as they pertain to buying a house. Many of the steps for looking for a home are the same, but instead of a lease, you will sign loan papers with a bank or lender to pay for the house you are buying. Our warm up today has some words for you to define. Let’s talk about these for a minute. Earnest Money – A deposit a potential buyer pays to show that he or she is serious about buying a home. Equity – The difference between the market value of a piece of property and the principal owed on the mortgage. Escrow – Money held in trust by a third party until a specified time; often pertains to payments for property taxes and insurance. Amortization - Gradual elimination of the principal of a mortgage. ***Pass out Purchasing a Home Worksheet for student to complete as we go through the PowerPoint Purchasing a Home. SHOW and SAY: (Hold up a copy of Purchasing a Home Worksheet) Using the worksheet on your desk, complete the notes as we go through the PowerPoint. SHOW: Purchasing a Home PowerPoint. Slide 2: We are going to begin with some new vocabulary words. Some you may be familiar with but some may be new to you. When you decide on what home you are going to buy, you put down earnest money to show that you are interested. When you go in and sign the papers to take possession of the house, you pay the down payment. A down payment is a percentage of the total cost you pay up front. At the same time, you pay the closing costs which are fees due at the time of finalizing your purchase. Slide 3: A mortgage is another name for a home loan. It is broken up into two parts. The first part is the principal; this is the original amount of the loan. The second part, is the interest, this is the percentage that the bank or loan company charges you for lending you the money. Slide 4: Continuing with financial terms, we have escrow which is the money held in an account from your mortgage payment to pay for the property taxes and your home owners’ insurance. Equity is the difference between what you owe to the lender and the current market value of the property. Amortization happens as you pay your mortgage and the amount of the principal that you owe goes down. Slide 5 and 6: Let’s talk about the advantages of owning a home. Some people buy a home for the investment value, so they can show they have something after paying out money. For others, owning a home gives them a feeling of being independent and stable. Another advantage is that as long as you pay your mortgage on time, you will have a good credit record, which in turn can help you get other things you would like to buy. And finally, you get a tax credit each year on your income tax. Slide 7: Just remember that owning a home is a long term investment and if you sell within just a few years you are more likely to lose money. Slide 8: There are also disadvantages to owning your own home. The first is unexpected expenses. The water heater may go out, the air conditioner needs to be repaired, things like that. You are also responsible for all upkeep on the house. Unless you pay someone else to do it for you, you have to do it all. Slide 9: Now it’s time to decide what type of home you want to purchase. The first type of Copyright © Texas Education Agency, 2011. All rights reserved. 9 home is a development home. These homes are built by a developer but have limited floor plans to choose from. Slide 10: The next type of home is a spec home. These homes are built by a builder before a buyer is found. The buyer has no say on some of the interior and exterior features, because the house is built before they buy. Slide 11: The next type of home comes from Stock Home Plans. These are plans that people can buy and have a builder build for you. Slide 12: The last type of home is a custom built home. The buyer has an architect draw up house plans to their specifications. The buyer owns the house plans and no one else can use them without their permission. Slide 13: There are many advantages to buying a new home. These include the house being clean, in good condition, has up-to-date appliances, and has more than one bathroom. Because the house is new, it is easier to get a loan and maintenance costs are minimum until the house gets older. Slide 14: The main disadvantage of buying a new home is that you may have to landscape the yard. Most new homes have a landscaped front yard, so it is the backyard that you will have to put ground cover on. Slide 15: The advantages of buying an older home include more space for the money, has character, the landscaping is complete and is located in an established neighborhood. Slide 16: There are several disadvantages of buying an older home that include cost of repairs and updating electrical wiring, plumbing and exterior surfaces that have aged. There may be structural problems like cracks, little or no insulation and older heating/cooling units that may need to be replaced. Slide 17: Older homes may need a larger down payment, as well as new landscaping because the house does not have curb appeal. Slide 18: Now that you have chosen the type of home you are looking to buy. Let’s begin the home buying process by contacting a real estate agent or searching yourself by looking in the classifieds and driving or walking the neighborhood you’re interested in. Slide 19: The second step is to evaluate the home based on your needs and what you are looking for specifically. Slide 20: The third step is to make an offer on the house and put down earnest money. The earnest money is held in trust until closing. Earnest money can be (but probably won’t be because you are backing out) returned if you back out of buying the house. Slide 21: The next step is to get financing. Some people actually do this step first, so that they know how much money they have to spend on buying a home. Financial experts agree that no more than 28% of your income should go toward a mortgage payment. They also agree that all other debt payments should not equal more than 36% of the buyer’s gross monthly income. Slide 22: There are three types of mortgages. The first type is a conventional mortgage that pays a fixed interest rate for the length of the loan. The second type is an adjustable rate mortgage where the interest rate changes based on the current market price. Based on this, every time the interest rate changes your payment changes. The third type is a graduated payment mortgage. This type starts out with low payments and over the life of the loan, the payments get bigger. It has also been called “balloon payments. Slide 23: On the other hand, there are four types of home loans. The first is an FHA loan that is guaranteed by the Federal Housing Administration. The FHA guarantees the lender will get paid. The second type is a VA loan for people who have served in the armed forces. These loans are guaranteed by the department of Veterans Affairs. There is no down payment required for this type of loan. Slide 24: The next loan is through the Rural Housing Service that helps low to moderate income families buy homes in smaller communities. The last type of loan is part of the First Time Buyers Program. This is a government program to help people purchase their first home with Copyright © Texas Education Agency, 2011. All rights reserved. 10 easier qualifying and low down payments. Slide 25: The fifth step in the home buying process is to have the home inspected. Homes are required to be inspected for termites, radon, asbestos, lead if the house was built before 1971, and general structures like the roof, foundation, plumbing and heating/cooling systems. Slide 26: The next step is to obtain home owners’ insurance. This property insurance covers the actual home and contents against fire, theft, and windstorms. Slide 27: Step seven is to have the down payment. Most down payments range between 5 - 25 % of the purchase price. The standard down payment today is 20%. Slide 28: The last step in the home buying process is to close the deal. When closing the deal, there are several fees that have to be paid to various people. The first one is an Origination Fee to the lender to process the mortgage. Sometimes this is included in the loan amount. The next fee is for the cost of a survey to determine the boundaries of the property; as well as a fee to appraise the value of the property. Slide 29: There is another fee to complete a Title Search. This search is done through court records to make sure the seller really owns the property. The next fee is a one time charge by the lending company called points. Each point generally equals 1 percent of the mortgage amount. Usually they are paid in advance, but sometimes they are added to the mortgage and paid out over the length of the loan. Another fee is for Title Insurance. Title insurance is a form of indemnity insurance predominantly found in the United States which insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage liens. It is meant to protect an owner's or a lender's financial interest in real property against loss due to title defects, liens or other matters. It will defend against a lawsuit attacking the title as it is insured, or reimburse the insured for the actual monetary loss incurred, up to the dollar amount of insurance provided by the policy. The last fee is to an attorney to make sure the contract is legal and binding. Slide 30: Other costs the buyer may have include moving costs, utility connections and landscaping the property. Slide 31: Congratulations. Once all the paperwork is signed you become the proud owner of a new home. The next step is moving in and putting your stamp on the house. Remember that your monthly mortgage payment includes principal, interest, property taxes and insurance that will be paid out of your escrow account. SAY: Use the Day Three Wrap Up and Summary Questions to have a brief discussion over what they have learned today. As we learned today the steps between looking for a rental house and looking to buy a home are similar. Each one has steps that are unique to them. A lot of times, finding the right type of home is different for each person as we all have preconceived ideas of what the perfect home will be. Day Four – Test over material. This could be a joint test of Housing Decisions Lesson Plan and Renting vs Buying Lesson Plan. Outline Outline (LSI Quadrant II): Instructors can use the PowerPoint presentation, slides, handouts, and note pages in conjunction with the following outline. Instructor will ensure that all students get copies of the PowerPoint notes. Instructor will review the Notes to the Instructor below that correlates with sequencing and pacing, handouts, and note pages. Copyright © Texas Education Agency, 2011. All rights reserved. 11 MI Outline I. Define renting/leasing terms A. Evict B. Lease C. Sublet D. Landlord E. Tenant F. Security Deposit G. Renter’s Insurance H. Assign I. Breach of Contract J. Subsidized Housing II. Renting a Place to Live Worksheet A. Define terms in own words B. Role of Landlord Discussion C. Role of Tenant Discussion D. www.rentlaw.com Notes to Instructor Poll students who live in rental/owned homes. Students will put definitions on notebook paper that they can add to each day. These are the words for days one and two. Found on Renting vs Buying Lesson 2 PowerPoint Slide 2 and Slide 5 Have students define new terms into their own words. Identify roles of tenant and landlord III. Renting a Home PowerPoint A. PowerPoint Notes (Renting a Place to Live Worksheet) B. Additional Script Notes C. What kind of rental home can I afford? D. What location am I interested in? E. How much space do I need? IV. Newspaper Scavenger Hunt A. Local newspapers B. Scavenger Hunt Rubric C. Individual Activity or Group Activity Additional information to talk about with each slide included above. PowerPoint will be divided into two days. Instructions found on Slide 11 of the Renting a Home PowerPoint. V. Renting a Home PowerPoint A. Types of Affordable Housing B. Compare Housing Types C. Do’s and Don’ts when looking D. Questions to ask when looking E. Advantages of Renting F. Disadvantages of Renting G. The Lease H. Costs with Renting a Home Continue with PowerPoint on day two. Start with slide number 12. VI. Renter’s Rights and Responsibilities A. TA-27 from Housing Instructors Guide – Texas Tech University Curriculum Center Have students look into rights and responsibilities of Copyright © Texas Education Agency, 2011. All rights reserved. 12 B. C. D. E. F. Verbal Linguisti c Basic Lease Handout Sample Rental Application www.texasappartmentassociation.com www.taa.org Homes Today & Tomorrow Chapter 9 & 10 tenants. Identify unfamiliar terms found in the Lease Agreement. VII. Define Buying a Home Terms A. Earnest Money B. Equity C. Escrow D. Amortization Day three definitions. Found on Renting vs Buying Lesson 2 PowerPoint Slide 8 VIII. Purchasing a Home PowerPoint A. PowerPoint Notes B. Additional Script Info C. Advantages of Home Ownership D. Disadvantages of Home Ownership E. Advantages & Disadvantages of New Home F. Advantages & Disadvantages of Older Homes G. Types of New Homes H. Steps in Buying a Home I. Types of Mortgages J. Types of Loans K. Costs with Buying a Home Additional information to talk about with each slide included above. IX. Test This can be a combined test with Housing Decisions Lesson or a stand alone test. Logical Mathematic al Visual Spatial Musical Rhythmic Bodily Kinesthetic Intrapersonal Interperson al Naturali st Existentiali st Application Guided Practice (LSI Quadrant III): Student groups as described above in the Introduction, Outline, Student Handouts, PowerPoint Presentation and Notes and Activities. Independent Practice (LSI Quadrant III): Have students research the rental options in town and what information they require potential tenants to furnish when filling out a rental application. Students can also contact local banks and find out what the current loan interest rate is. They can compare the various banks in town to see if they all charge the same rate or if the rates are different. Summary Copyright © Texas Education Agency, 2011. All rights reserved. 13 Review (LSI Quadrants I and IV): Questions can also be found in the PowerPoint Renting vs Buying Lesson 2 Day One Wrap Up and Summary, Day Two Wrap Up and Summary and Day Three Wrap Up and Summary. Questions for Day One: 1. What is renting? 2. What are the pros and cons of renting? 3. What are the initial costs to renting and why do you have to pay them? 4. What are some of the questions to ask yourself when looking for a rental home? Answers: 1. Renting is when you pay money to live in a dwelling owned by someone else. 2. Pros of Renting: predictable housing costs, limited maintenance, flexibility, mobility. Cons of Renting: limited control or freedom on how maintained or managed, lack of permanence leads to no sense of community, not knowing neighbors, and financial disadvantages like the landlord raising the rent, no investment in property and may cost more than a monthly loan payment. 3. Initial costs of renting include application fee to show your interest, credit check fee to ensure you pay your bills on time, security deposit against future damage to the unit which can be returned when you move out if you clean the unit and meet other criteria, advance on rent which is normally the first month’s rent and can be pro-rated, moving costs to move your furniture and personal items into the unit and the installation of utilities like electricity, gas, cable and phone. 4. What can I afford? What location am I interested in? What kind of housing unit will suit me? And, How much space do I need? Questions for Day Two: 1. What are the responsibilities of a tenant? 2. What are the responsibilities of a landlord? 3. Can a landlord enter your home at any time they want? 4. Can you change the interior of a rental home? Answers: 1. Tenant responsibilities include paying rent on time, taking care of the unit by keeping it and the surrounding area clean and in good condition, learn the difference between normal wear and tear and damages or abuse, maintain the smoke detector, fire extinguisher and carbon monoxide detector, use common sense and good manners, maintain renter’s insurance, 2. Landlord responsibilities include having habitable housing (comply with all building, housing and health codes), give 24 hour notice before entering the dwelling unless it is an emergency, clean and maintain common areas, provide properly working plumbing and heating, notify tenants of violations in writing, respond to maintenance requests in a timely manner, provide information on tenant’s security deposit as required by law, provide written receipts for rent and deposits, do a walk through when tenant moves in and out that is documented and agreed to by both tenant and landlord, understand normal wear and tear. 3. Landlords need to give you 24 hours notice that they will be coming into the unit to do maintenance, etc., unless it is an emergency. 4. Changing the interior of a rental home is up to the landlord. This information will be included in the lease of what can and cannot be done. Copyright © Texas Education Agency, 2011. All rights reserved. 14 Questions for Day Three: 1. 2. 3. 4. 5. How does income and saving help determine what price range homebuyers can afford? What percentage of your income should your mortgage or rent be? What are the advantages of owning a home? What are the disadvantages of owning a home? What is meant when you say “It’s a buyer’s market”? Answers: 1. A prospective buyer’s income is one of the factors that lenders look at carefully to determine how much money they are willing to lend. Another consideration is how much cash the buyer has for initial expenses like the down payment, closing costs. If you don’t have any money in savings you will either have to wait or go with a lower price house to have the money for a down payment and closing costs. 2. Your mortgage or rent should be no more than 28% of your gross monthly income. 3. Advantages of home ownership include stability of having a place to live without having to move, the independence to change the dwelling to meet your needs, investing in real estate, building a good credit report, receiving a tax break each year when you do your income taxes, and having limited mobility. 4. Disadvantages of home ownership include time spent on maintenance of the property and the inside of the home, unexpected expenses when the water heater or other appliance goes out and has to be replaced. 5. A buyer’s market is when there are quite a few houses on the market for sale and the buyer can ask for a lower price, if they do not get it they can move on to the next house for sale. This is really good for the buyer because so many houses are for sale that the seller will agree to many details in order to sell their home. Evaluation Informal Assessment (LSI Quadrant III): During times that students are working in groups, teacher practices active classroom monitoring and regular checking for understanding by individuals by moving from group to group. During PowerPoint summary questions, teacher practices checking for understanding by calling on different students to answer the questions. Formal Assessment (LSI Quadrant III, IV): Students should be able to exhibit knowledge independently the completeness of their understanding on types of loans, types of mortgages, types of rental units, right and responsibilities of the tenant, rights and responsibilities of the landlord, as well as the steps in finding a rental unit or home to buy. Extension Extension/Enrichment (LSI Quadrant IV): Advanced students can take the lesson further by investigating rental properties in the town and the requirements each has for prospective renters to meet. The lesson can be taken further by having students go to model homes in the community and talk to builders about the features they put into a standard home versus features they put into custom homes. Copyright © Texas Education Agency, 2011. All rights reserved. 15 Common Abbreviations Found in Rental Advertisements Abbreviation appl incl appt only apt avail Nov 1 BB heat bldg BR c/a conven all trans cpts & drps D/W EIK furn gar grt clst spc grt vw hrdwd flrs Immed occ Incl h/hw Kit Ldry LR w/fpl MBR No lse Nr bus Nr bus dist Pvt entr Refs req’d Sep DR Utils w/ W/D WWC Xtra lg $400/mo + util What It Means Appliances included By appointment only Apartment Available November 1 Baseboard heat Building Bedroom Central air conditioning Convenient to all transportation Carpets and drapes Dishwasher Eat-in-kitchen Furnished Garage Great closet space Great view Hardwood floors Immediate occupancy Includes heat and hot water Kitchen Laundry Living room with fireplace Master bedroom No lease Near bus Near business district Private entrance References required Separate dining room Utilities paid With Washer and dryer Wall-to-wall carpeting Extra large Rent is $400 a month Utilities paid by tenant Copyright © Texas Education Agency, 2011. All rights reserved. 16 LEASE BASIC RENTAL AGREEMENT OR RESIDENTIAL LEASE This Rental Agreement or Residential Lease shall evidence the complete terms and conditions under which the parties whose signatures appear below have agreed. Landlord/Lessor/Agent, _____________________________, shall be referred to as "OWNER" and Tenant(s)/Lessee, _____________________________, shall be referred to as "RESIDENT." As consideration for this agreement, OWNER agrees to rent/lease to RESIDENT and RESIDENT agrees to rent/lease from OWNER for use solely as a private residence, the premises located at _____________________________________________in the city and state of __________________________________. 1. TERMS: RESIDENT agrees to pay in advance $______ per month on the ____ day of each month. This agreement shall commence on _____,___ and continue; (check one) A.__ until _______, ___ as a leasehold. Thereafter it shall become a month-to-month tenancy. If RESIDENT should move from the premises prior to the expiration of this time period, he shall be liable for all rent due until such time that the Residence is occupied by an OWNER approved paying RESIDENT and/or expiration of said time period, whichever is shorter. B.__ until ____________, ______ on a month-to-month tenancy until either party shall terminate this agreement by giving a written notice of intention to terminate at least 30 days prior to the date of termination. 2. PAYMENTS: Rent and/or other charges are to be paid at such place or method designated by the Owner as follows _____________________________________. All payments are to be made by check or money order and cash shall be acceptable. OWNER acknowledges receipt of the First Month's rent of $__________, and a Security Deposit of $__________, and additional charges/fees for ______________________________, for a total payment of $__________. All payments are to be made payable to __________________________________. 3. SECURITY DEPOSITS: The total of the above deposits shall secure compliance with the terms and conditions of this agreement and shall be refunded to RESIDENT within _____ days after the premises have been completely vacated less any amount necessary to pay OWNER; a) any unpaid rent, b) cleaning costs, c) key replacement costs, d) cost for repair of damages to premises and/or common areas above ordinary wear and tear, and e) any other amount legally allowable under the terms of this agreement. A written accounting of said charges shall be presented to RESIDENT within _____ days of move-out. If deposits do not cover such costs and damages, the RESIDENT shall immediately pay said additional costs for damages to OWNER. 4. LATE CHARGE: A late fee of $_____, (not to exceed ___% of the monthly rent), shall be added and due for any payment of rent made after the ____________ of the month. Any dishonored check shall be treated as unpaid rent, and subject to an additional fee of $_________. 5. UTILITIES: RESIDENT agrees to pay all utilities and/or services based upon occupancy of the premises except ____________________________________. 6. OCCUPANTS: Guest(s) staying over 15 days without the written consent of OWNER shall be considered a breach of this agreement. ONLY the following individuals and/or animals, AND NO OTHERS shall occupy the subject residence for more than 15 days unless the expressed written consent of OWNER obtained in advance __________________________________________________. 7. PETS: No animal, fowl, fish, reptile, and/or pet of any kind shall be kept on or about the premises, for any amount of time, without obtaining the prior written consent and meeting the requirements of the OWNER. Such consent if granted, shall be revocable at OWNER'S option upon giving a 30 day written notice. In the event laws are passed or permission is granted to have a pet and/or animal of any kind, an additional deposit in the amount of $_________ shall be required along with additional monthly rent of $_______ along with the signing of OWNER'S Pet Agreement. RESIDENT also agrees to carry insurance deemed appropriate by OWNER to cover possible liability and damages that may be caused by such animals. 8. LIQUID FILLED FURNISHINGS: No liquid filled furniture, receptacle containing more than ten gallons of liquid is permitted without prior written consent and meeting the requirements of the OWNER. RESIDENT also agrees to carry insurance deemed appropriate by OWNER to cover possible losses that may be caused by such items. Copyright © Texas Education Agency, 2011. All rights reserved. 17 9. PARKING: When and if RESIDENT is assigned a parking area/space on OWNER'S property, the parking area/space shall be used exclusively for parking of passenger automobiles and/or those approved vehicles listed on RESIDENT'S Application attached hereto. RESIDENT is hereby assigned or permitted to park only in the following area or space ____________________________. The parking fee for this space (if applicable is $________ monthly. Said space shall not be used for the washing, painting, or repair of vehicles. No other parking space shall be used by RESIDENT or RESIDENT'S guest(s). RESIDENT is responsible for oil leaks and other vehicle discharges for which RESIDENT shall be charged for cleaning if deemed necessary by OWNER. 10. NOISE: RESIDENT agrees not to cause or allow any noise or activity on the premises which might disturb the peace and quiet of another RESIDENT and/or neighbor. Said noise and/or activity shall be a breach of this agreement. 11. DESTRUCTION OF PREMISES: If the premises become totally or partially destroyed during the term of this Agreement so that RESIDENT'S use is seriously impaired, OWNER or RESIDENT may terminate this Agreement immediately upon three day written notice to the other. 12. CONDITION OF PREMISES: RESIDENT acknowledges that he has examined the premises and that said premises, all furnishings, fixtures, furniture, plumbing, heating, electrical facilities, all items listed on the attached property condition checklist, if any, and/or all other items provided by OWNER are all clean, and in good satisfactory condition except as may be indicated elsewhere in this Agreement. RESIDENT agrees to keep the premises and all items in good order and good condition and to immediately pay for costs to repair and/or replace any portion of the above damaged by RESIDENT, his guests and/or invitees, except as provided by law. At the termination of this Agreement, all of above items in this provision shall be returned to OWNER in clean and good condition except for reasonable wear and tear and the premises shall be free of all personal property and trash not belonging to OWNER. It is agreed that all dirt, holes, tears, burns, and stains of any size or amount in the carpets, drapes, walls, fixtures, and/or any other part of the premises, do not constitute reasonable wear and tear. 13. ALTERATIONS: RESIDENT shall not paint, wallpaper, alter or redecorate, change or install locks, install antenna or other equipment, screws, fastening devices, large nails, or adhesive materials, place signs, displays, or other exhibits, on or in any portion of the premises without the written consent of the OWNER except as may be provided by law. 14: PROPERTY MAINTENANCE: RESIDENT shall deposit all garbage and waste in a clean and sanitary manner into the proper receptacles and shall cooperate in keeping the garbage area neat and clean. RESIDENT shall be responsible for disposing of items of such size and nature as are not normally acceptable by the garbage hauler. RESIDENT shall be responsible for keeping the kitchen and bathroom drains free of things that may tend to cause clogging of the drains. RESIDENT shall pay for the cleaning out of any plumbing fixture that may need to be cleared of stoppage and for the expense or damage caused by stopping of waste pipes or overflow from bathtubs, wash basins, or sinks. 15. HOUSE RULES: RESIDENT shall comply with all house rules as stated on separate addendum, but which are deemed part of this rental agreement, and a violation of any of the house rules is considered a breach of this agreement. 16. CHANGE OF TERMS: The terms and conditions of this agreement are subject to future change by OWNER after the expiration of the agreed lease period upon 30-day written notice setting forth such change and delivered to RESIDENT. Any changes are subject to laws in existence at the time of the Notice of Change Of Terms. 17. TERMINATION: After expiration of the leasing period, this agreement is automatically renewed from month to month, but may be terminated by either party giving to the other a 30-day written notice of intention to terminate. Where laws require "just cause", such just cause shall be so stated on said notice. The premises shall be considered vacated only after all areas including storage areas are clear of all RESIDENT'S belongings, and keys and other property furnished for RESIDENT'S use are returned to OWNER. Should the RESIDENT hold over beyond the termination date or fail to vacate all possessions on or before the termination date, RESIDENT shall be liable for additional rent and damages which may include damages due to OWNER'S loss of prospective new renters. 18. POSSESSION: If OWNER is unable to deliver possession of the residence to RESIDENTS on the agreed date, because of the loss or destruction of the residence or because of the failure of the prior residents to vacate or for any other reason, the RESIDENT and/or OWNER may immediately cancel and terminate this agreement upon written notice to the other party at their last known address, whereupon neither party shall have liability to the other, and any sums paid under this Agreement shall be refunded in full. If neither party cancels, this Agreement shall be prorated and begin on the date of actual possession. Copyright © Texas Education Agency, 2011. All rights reserved. 18 19. INSURANCE: RESIDENT acknowledges that OWNERS insurance does not cover personal property damage caused by fire, theft, rain, war, acts of God, acts of others, and/or any other causes, nor shall OWNER be held liable for such losses. RESIDENT is hereby advised to obtain his own insurance policy to cover any personal losses. 20. RIGHT OF ENTRY AND INSPECTION: OWNER may enter, inspect, and/or repair the premises at any time in case of emergency or suspected abandonment. OWNER shall give 24 hours advance notice and may enter for the purpose of showing the premises during normal business hours to prospective renters, buyers, lenders, for smoke alarm inspections, and/or for normal inspections and repairs. OWNER is permitted to make all alterations, repairs and maintenance that in OWNER'S judgment is necessary to perform. 21. ASSIGNMENT: RESIDENT agrees not to transfer, assign or sublet the premises or any part thereof. 22. PARTIAL INVALIDITY: Nothing contained in this Agreement shall be construed as waiving any of the OWNER'S or RESIDENT'S rights under the law. If any part of this Agreement shall be in conflict with the law, that part shall be void to the extent that it is in conflict, but shall not invalidate this Agreement nor shall it affect the validity or enforceability of any other provision of this Agreement. 22. NO WAIVER: OWNER'S acceptance of rent with knowledge of any default by RESIDENT or waiver by OWNER of any breach of any term of this Agreement shall not constitute a waiver of subsequent breaches. Failure to require compliance or to exercise any right shall not be constituted as a waiver by OWNER of said term, condition, and/or right, and shall not affect the validity or enforceability of any provision of this Agreement. 23. ATTORNEY FEES: If any legal action or proceedings be brought by either party of this Agreement, the prevailing party shall be reimbursed for all reasonable attorney's fees and costs in addition to other damages awarded. 24. JOINTLY AND SEVERALLY: The undersigned RESIDENTS are jointly and severally responsible and liable for all obligations under this agreement. 25. REPORT TO CREDIT/TENANT AGENCIES: You are hereby notified that a nonpayment, late payment or breach of any of the terms of this rental agreement may be submitted/reported to a credit and/or tenant reporting agency, and may create a negative credit record on your credit report. 26. LEAD NOTIFICATION REQUIREMENT: For rental dwellings built before 1978, RESIDENT acknowledges receipt of the following: (Please check) ___ Lead Based Paint Disclosure Form ___ EPA Pamphlet 27. ADDITIONS AND/OR EXCEPTIONS _______________________________________________________________ _______________________________________________________________. 28. NOTICES: All notices to RESIDENT shall be served at RESIDENT'S premises and all notices to OWNER shall be served at _______________________________________________________________. 29. INVENTORY: The premises contains the following items, that the RESIDENT may use. _______________________________________________________________. 30. KEYS AND ADDDENDUMS: RESIDENT acknowledges receipt of the following which shall be deemed part of this Agreement: (Please check) ___ Keys #of keys and purposes ___________________________________________ ___ House Rules ___ Pet Agreement ___ Other ________________________________ 31. ENTIRE AGREEMENT: This Agreement constitutes the entire Agreement between OWNER and RESIDENT. No oral agreements have been entered into, and all modifications or notices shall be in writing to be valid. 32. RECEIPT OF AGREEMENT: The undersigned RESIDENTS have read and understand this Agreement and hereby acknowledge receipt of a copy of this Rental Agreement. Copyright © Texas Education Agency, 2011. All rights reserved. 19 RESIDENT'S Signature ___________________________________________________ Date__________________ RESIDENT'S Signature ___________________________________________________ Date__________________ OWNER'S or Agent's Signature ____________________________________________ Date__________________ . . (Note: Lease courtesy of TenantCreditChecks.com. No representation is made as to the legal validity of any provision in this Agreement.) Copyright © Texas Education Agency, 2011. All rights reserved. 20 Name____________________________________________________Date_______________ Purchasing a Home Terms to Know 1. Closing Costs - ____________ that are due at the time the ____________ is finalized. 2. Down payment – required amount of __________payment to be made at the time of ______________. 3. Earnest Money – money that the _____________ puts down to show that they are _____________ in the property. 4. Interest – Money that the ________________ company charges the ___________ for the loan. 5. Mortgage – a ______________loan 6. Principal – the _________________amount of the ___________. 7. Homeowner’s Insurance – insurance that covers the __________________ and the ___________. 8. Equity – the difference between the _____________value and the amount of money ____________ on the mortgage. 9. Escrow – Money held by a ___________party until a specified ____________. 10. Amortization – the _______________ elimination of the ________________ on the loan. II. Advantages of Home Ownership 1. Feeling of _________________ 2. Independence – can change the _________________ to meet their __________. 3. Investment value – investing ____________in real _____________. 4. Good credit record – helps one build their credit ___________________. 5. Tax advantages – can deduct ________________ taxes and _______________ on their income tax. 6. Limited mobility – should be a _________term investment. III. Disadvantages of Home Ownership 1. Unexpected Expenses – appliances may need to be _________ or replaced. 2. Time spent on ________________ - responsible for the ______________. Copyright © Texas Education Agency, 2011. All rights reserved. 21 IV. Purchasing a New Home 1. Development Homes – built by the _____________ and have a ____________ number of _________plans to choose from. 2. Spec Homes – built by the builder on speculation. The home is built __________ a _____________ is secured. 3. Stock Home Plans – Purchase a ____________plan from a _________ and have a __________ build it for you. 4. Custom-built homes – Architect __________ up the plans according to your desires. You _________ the plans and no one can use them without your _______________. V. Advantages of a New Home 1. ________________ 2. In _____________condition 3. Modern __________________. 4. More than _________bathroom 5. Can choose the _________/ exterior material and _____________. 6. Easier to _________________. 7. Low _______________________costs. VI. Disadvantages of a New Home 1. Possible cost of ___________________- most likely the __________yard. VII. Advantage of Older Home a. More ____________for the money. b. Greater __________________ character c. Often located in ___________established ______________. d. Landscaping is ________________. VIII. Disadvantages of Older Homes a. Possible cost of repairs – electrical wiring, _______________, and exterior and ____________ surfaces deteriorate with ____________. Copyright © Texas Education Agency, 2011. All rights reserved. 22 b. Possible ______________problems – cracks, little or no ______________, inefficient ______________and cooling. c. May need a _______________down payment d. May need to ____________________. e. May need new _________________________ as it has no ___________appeal. IX. Home Buying Process 1. Contact a _____________ _____________ Agent or begin the search by oneself by using ________________, internet, ______________________, or driving through neighborhoods. 2. Evaluate the ____________one sees according to what you are looking for. Key rooms that buyers look at today are the _____________ and the master ___________. 3. Make an ___________ by depositing _____________money. 4. Obtain __________________. Must quality for the loan to cover the cost. Monthly payments should not be more than _________ of the person(s) gross monthly income. Buyers will have to pay for a _______________________ to be done. Debt payments for the buyer should be no more than ___________ of monthly gross income. 5. Types of Mortgages a. Conventional – pays a ___________ interest rate for the length of the loan (15 to _____years) b. Adjustable Rate Mortgage – interest rate changes ____________ on the current market rate. Every time the rate changes, the __________payments change. c. Graduated Payment Mortgage – payments start out __________ and increase in the ____________years of the loan. 6. Home Loans a. FHA Loan – insured by the Federal ______________ Administration b. VA Loan – for people who have served in the _________forces. No ___________ payment is required. c. Rural Housing Service – helps __________ to moderate income families buy homes in _____________communities. d. First Time Buyer Program – government program that helps ______________ purchase their ________home. Features ________down payments and easier _______________. Copyright © Texas Education Agency, 2011. All rights reserved. 23 7. Have the Home Inspected a. ______________ b. Radon – naturally occurring ___________ that causes _________problems c. Asbestos _________________. d. Lead testing – especially in homes constructed prior to __________. e. General structure such as __________, foundation, ______________, heating and ______________systems. 8. Obtain homeowners Insurance a. Property insurance that insures the ___________ and the ____________ against fire, windstorms and other ____________. It also includes ____________ liability coverage that protects you in case ____________ injuries themselves on your _____________. 9. Down Payment a. Must have money for a ___________ payment, usually ______ to 25% of the purchase price. The standard amount today is _________. 10. Closing the Deal a. Origination fee – fee to the ____________ to process the mortgage. b. Cost of survey – to determine the __________ boundaries of the __________. c. Cost of appraisal – estimate the ____________ of the property. d. Title Search – investigate the __________records to make sure the ________ really owns the property. e. Points – a one _____________ fee charged by the lending _______________. f. Attorney fee – to make sure the __________________ is legal and binding. 11. Other Costs to the Buyer a. _____________costs b. Utility connections – having them ___________on. c. Landscaping if not included in the _____________ with a new home. 12. Congratulations a. When all paperwork is signed and _________ payment and _________costs made, the buyer make take possession of the ___________. b. Your monthly __________________ will include payment of principal, _____________, property _____________ and ______________. Copyright © Texas Education Agency, 2011. All rights reserved. 24 RESIDENTIAL RENTAL APPLICATION Application Date: ____/____/____ APPLICATION NUMBER or ID LEGAL NAME OF APPLICANT – FIRST APPLICANT INFORMATION MIDDLE Last CURRENT ADDRESS DATE OF BIRTH Equal Housing Opportunity CITY OCCUPPATION – Full or Part Time YEARLY INCOME EMPLOYER SS# STATE and ZIP HOME PHONE CELL PHONE EMPLOYER ADDRESS HOW LONG ON JOB EMPLOYER CONTACT NUMBER IN CASE OF EMERGENCY NOTIFY CURRENT LANDLORD LANDLORD PHONE YEARS WITH LANDLORD LEASE EXPIRATION DATE CURRENT RENT AUTO LIC PLATE PETS? IF YES, WHAT KIND HOW MANY and SIZE NAME OF CO APPLICANT – FIRST CO - APPLICANT INFORMATION MIDDLE Last CURRENT ADDRESS DATE OF BIRTH CITY OCCUPPATION YEARLY INCOME EMPLOYER SS# STATE and ZIP HOME PHONE CELL PHONE EMPLOYER ADDRESS HOW LONG ON JOB EMPLOYER CONTACT NUMBER IN CASE OF EMERGENCY NOTIFY CURRENT LANDLORD LANDLORD PHONE YEARS WITH LANDLORD LEASE EXPIRATION DATE CURRENT RENT: AUTO LIC PLATE PETS? IF YES, WHAT KIND HOW MANY and SIZE NAME APPLICANT’S REFERENCES (OTHER THAN RELATIVES) Address 1. 2. CO-APPLICANTS REFERENCES 1. 2. APPLICANT’S BANK REFERENCES CHECKING SAVINGS. CREDIT CARDS/OTHER CO-APPLICANTS BANK REFERENCES CHECKING SAVINGS CREDIT CARDS/OTHER Copyright© Texas Education Agency, 2011. All rights reserved PHONE YOUR CREDIT HISTORY Have you declared bankruptcy in the past seven (7) years? Yes___________ No____________ Have you ever been evicted from a rental residence? Yes___________ No____________ Have you had two or more late rental payments in the past year? Yes___________ No____________ ADDITIONAL SOURCES OF INCOME If you have other sources of income for us to consider, please list income, source, and person (banker, employer, etc.) who we may contact. You do not have to reveal alimony, child support, or spouse's annual income unless you want us to consider it in this application. 1. 3. 2. 4. ADDITIONAL INFORMATION: Please give us any additional information that might help the owner/management to evaluate your application. NOTICES: I/We hereby warrant that all representations set forth above are true. To verify the above statements, I/We direct those persons named in this application to ask questions about me or us. I/We waive all rights of actions for consequences as a result of such information. I/We agree and authorize and give permission to the management company , owner or servicing company to perform a credit on me/us. I/We agree to pay $___________ for the credit check as permitted by state law. APPLICANT: PLEASE DO NOT WRITE BELOW (FOR OFFICE USE ONLY) Credit Fee $ ____________ Date: __________ Security Deposit: $ _____________ Date: ________ Credit Report Requested Date: _____________ Review Date __________by: ________ Approved Y____ N_____ OFFICE NOTES: If the application is not approved or accepted by the owner or agent, the deposit will be refunded, the application hereby waiving any claim for damages by reason of non-acceptance which the owner or agent may reject. I recognize that as a part of your procedure for processing my application, an investigative consumer report may be prepared whereby information is obtained through personal interviews with others with whom I may be acquainted. This inquiry includes information as to my character, general reputation, personal characteristics and mode of living as permitted by state law. ____________________________ Name of Applicant __________________________________ Date __________________________________ Name of co Applicant __________________________________ Date Copyright© Texas Education Agency, 2011. All rights reserved AUTHORIZATION Release of Information I authorize an investigation of my credit, tenant history, banking and employment for the purposes of renting a house, apartment, or condominium from this owner, manager, brokerage, finder, agent or leasing company _______________________________________ Name (please print) _______________________________________ Signature __________________________ Date Name (please print) _______________________________________ Signature __________________________ Date Copyright© Texas Education Agency, 2011. All rights reserved Name____________________________________Date______________Class Period ________ Renting a Place to Live Worksheet Renting a Home PowerPoint & Chapters 9 & 10 Homes Today and Tomorrow 1. Define the following terms: a. evict b. lease c. sublet d. landlord e. tenant f. security deposit g. renter’s insurance 2 . Answer the following: a. List the advantages of renting b. List the disadvantages of renting 3. Explain the costs that renters have before moving in: Copyright© Texas Education Agency, 2011. All rights reserved 4. Define a lease and name six types of information that a lease should contain. 5. What are three rights and three responsibilities of being a tenant? Copyright© Texas Education Agency, 2011. All rights reserved Newspaper Scavenger Hunt Rubric Name _____________________________________ Date ________________ Class _____________ Instructions: Using the classified section of the local paper locate the following, cut out and place in order on white paper. Item Description Points 1. Advertisement for a Realtor/Realtor Company ______/20 2. Advertisement for Apartment Complex ______/20 3. A house for sale ______/20 4. A house for lease ______/20 5. Housing Loan Advertisement ______/20 6. Current Interest Rate Advertisement (Extra Credit) ______/10 EX Credit Total Score: ____________/100 Copyright © Texas Education Agency, 2011. All rights reserved.