BT Group plc Q3 2007/8 results February 7 2008

BT Group plc

Q3 2007/8 results

February 7 th 2008

Forward-looking statements - caution

Certain statements in this presentation are forward-looking and are made in reliance on the safe harbour provisions of the US Private Securities Litigation Reform Act of 1995. These statements include, without limitation, those concerning: continuing growth in revenue, EBITDA, earnings per share and dividends; growth in new wave revenue mainly from networked IT services and broadband; transforming the cost base; delivery of 21CN; and Global Services’ cost reductions and EBITDA margin.

Although BT believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. Because these statements involve risks and uncertainties, actual results may differ materially from those expressed or implied by these forward-looking statements.

Factors that could cause differences between actual results and those implied by the forward-looking statements include, but are not limited to: material adverse changes in economic conditions in the markets served by BT; future regulatory actions and conditions in BT’s operating areas, including competition from others; selection by BT of the appropriate trading and marketing models for its products and services; technological innovations, including the cost of developing new products, networks and solutions and the need to increase expenditures to improve the quality of service; the anticipated benefits and advantages of new technologies, products and services, including broadband and other new wave initiatives, not being realised; developments in the convergence of technologies; fluctuations in foreign currency exchange rates and interest rates; prolonged adverse weather conditions resulting in a material increase in overtime, staff or other costs; the timing of entry and profitability of BT in certain communications markets; and general financial market conditions affecting BT’s performance and ability to raise finance. BT undertakes no obligation to update any forward-looking statements whether as a result of new information, future events or otherwise.

Q3 2007/8 – Group financial headlines

Group revenue £5.2bn

EBITDA*

Operating profit*

£1.5bn

£0.7bn

1%

2%

6%

Earnings per share* 5.9p

2%

Capital expenditure £0.9bn

Free cash outflow £0.2bn

* Before specific items and leavers

Q3 2007/8 – revenue by customer

Corporate

Q3 - Global Services

• Improvement in EBITDA margin of 140bp to 10.9%

• 22% growth in non-UK revenue

• Robust £29bn prospect order book pipeline

Corporate market trends

• Globalisation

• Convergence

• Optimisation

• Growth

* 2006/7 growth rates not restated for reorganisation

Business

Q3 – Retail Business

• Continued strong revenue growth

• Value packages

- c38% take-up amongst SMEs

• Good growth from BT Enterprises

SME market trends

• Decline in spend on hardware

• Simplify technology for customers

• Increased spend on networked

IT services

* 2006/7 growth rates not restated for reorganisation

Consumer

Q3 – Retail Consumer

• Continued ARPU growth

• BT remains UK’s No.1 broadband provider

– Resilient broadband market share*, 35%

Consumer market trends

• Broadband now a necessity

• Inclusive call bundles

• Highly competitive market

* DSL & LLU

Carrier

Q3 – Openreach

• Steady performance driven by LLU line growth

• Cost efficiencies

• Service improvements

Market trends

• Continued LLU migration

• Slowing LLU build out

• More demand for backhaul

• Principle based regulation

• Regulatory pricing review

Carrier

Q3 – Wholesale

• Expected decline in low margin transit and PRS revenue continues, down £68m YoY

• Ongoing migration from

IPstream to LLU

• Focus on managed services

– £98m Virgin Media contract

Market trends

• Network rationalisation

• More outsourcing

• Further transit declines

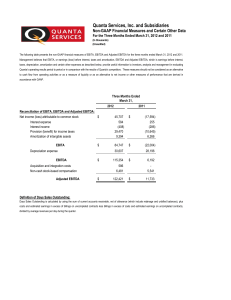

Transforming the cost base – Q3 YTD

£468m of cost efficiencies

* Before specific items and leavers

Transforming the cost base – opportunities

• Ongoing efficiency opportunities

• Right first time focus for customer service

– Reduce cost of complexity and failure

• Overhead Value Analysis

• Global sourcing

• Ongoing re-investment for the future

• 21CN

On track to exceed FY target of £600m

21CN - update

Services driven migration

• >35% of UK core network already rebuilt

• Wholesale Broadband Connect

– ADSL2+ rollout from Spring 2008 with speeds of up to 24Mb available

• Next generation Ethernet Services

– More bandwidth, more reach, more flexibility

Platform operational in more than 160 countries

NGA

• Openreach deploying fiber technology at Ebbsfleet

Overall objective remains unchanged

Summary

Q3 highlights

• Global Services - EBITDA margin improvement

• Retail - continued strong EBITDA growth

• Openreach - strong operational performance

• Wholesale - decline in transit and migration to LLU

• Cost savings - on track to exceed target

Q4 Outlook

• Expect continued growth in revenue, EBITDA*, EPS* and dividends and significant cash inflow

Continue to deliver for customers and shareholders

* Before specific items and leavers

BT Group plc

Hanif Lalani – Group Finance Director

Q3 2007/8 – line of business analysis

First quarter of reporting under new structure

- Increased line of sight of end to end profitability

- Significant reduction in internal trading

- No material change to

Openreach

Transformation into software driven services company

* Before specific items and leavers

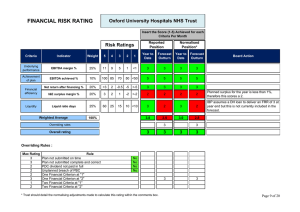

Q3 2007/8 – lines of business dashboard

Group Global Retail Wholesale Openreach

1% Revenue 6% 2% 11% 1%

7%

New wave growth

9% 18% (23%) 31%

2% EBITDA* 23%

28.5%

EBITDA* margin

10.9%

* Before specific items and leavers

12%

18.7%

9%

28.5%

2%

37.1%

Global Services – Revenue £2.0bn

EBITDA £0.22bn

BT Global Services – Q3 total order intake £1.9bn

Q3

Revenue

6%

EBITDA

23%

EBITDA margin

10.9%

Rolling 12 months intake £8.6bn

BT Global Services – margin expansion

Q3

Revenue

6%

EBITDA

23%

EBITDA margin

10.9%

• EBITDA margin up 140bp

• Contract maturity

– c60% of top 100 contracts now in 2 nd half of life, rising to two thirds by year end

• Cost transformation

– Rebalancing of workforce

– De-layering management structures

– Rationalisation of networks and IT systems

Medium term EBITDA margin target 15%

BT Retail – Revenue £2.1bn

EBITDA £0.4bn

Q3

Revenue

2%

EBITDA

12%

EBITDA margin

18.7%

BT Retail

Broadband

• Q3 gross installs 404k

• c65% take Option 2 or 3

• 177k net additions

• Market share* 35%

• Currently > 150k Vision subscribers

Consumer ARPU

• £273 up £2

• 69% contracted

* DSL & LLU

BT Wholesale – Revenue £1.2bn

EBITDA £0.3bn

Q3

Revenue

11%

EBITDA

9%

EBITDA margin

28.5%

Revenue

• Transit & PRS

– Continued decline

– Low margin

• Broadband

– Price reductions

– Migration volumes

Cost base

• SG&A reduced by 10%

• EBITDA margin up 60bp from 27.9%

– Revenue £1.3bn

EBITDA £0.5bn

Q3

Revenue

1%

Revenue

• External up 15%

- LLU & WLR growth

• Rest of BT down 3%

- WLR migration

EBITDA

2%

EBITDA margin

37.1%

Cost efficiencies

• Operating cost down £17m

• 50% improvement in average provisioning and repair lead times

Q3 2007/8 results

Revenue

POLOs

Revenue (net of POLOs)

EBITDA (pre leavers)

Depreciation & amortisation

Operating profit (pre leavers)

Operating margin

Leaver costs

Associates

Finance costs (net)

Profit before tax

Tax

Profit for the period

Earnings per share

Earnings per share

(post leavers)

(pre leavers)

Q3 2007/8

£m

5,154

1,023

4,137

1,469

(732)

737

14.3%

(20)

(2)

(134)

581

(120)

461

5.7p

5.9p

Q3 2006/7

£m

5,126

1,051

4,075

1,439

(741)

698

13.6%

(27)

7

(62)

616

(150)

466

5.6p

5.8p

Note: all numbers are before specific items. Q3 2007/8 specific charge £134m pre tax.

Change

£m

28

28

56

30

9

39

7

(9)

(72)

(35)

30

(5)

0.1p

0.1p

Q3 2007/8 - free cash flow

Q3 2007/8

£m

EBITDA*( post leavers

Interest & Tax

) 1,449

(414)

Capex

Working capital

(877)

(294)

Pension deficiency contribution

Other ( incl specific items )

---

(85)

Free cash flow (221)

Q3 2006/7

£m

1,412

(436)

(777)

(212)

(500)

(12)

(525)

* Before specific items

Change

£m

37

22

(100)

(82)

500

(73)

304

Balance sheet - as at 31 December 2007

Pension

• Q3 IAS19 surplus £0.9bn

£1.6bn deficit last year

• Previous mitigation of exposure to equity market risk

Net debt

• Currently £10.2bn

• Seasonal turnaround in

FCF expected in Q4

Buy back

• Repurchased £281m of shares in Q3

• YTD repurchased £1.0bn of planned £2.5bn buy back by March 2009

Liquidity

• Raised debt of €1.0bn and

$1.2bn in the quarter

• 5 year facility of £1.5bn

Earnings per share

* Before exceptional items and goodwill from continuing activities

** Before specific items and leavers

BT Group plc

Q3 2007/8 results