The Marshall Plan: History’s Most Successful Structural Adjustment Program Barry Eichengreen

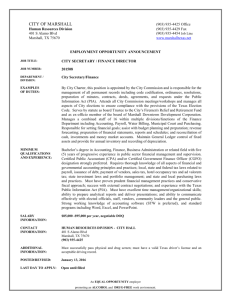

advertisement