Inequality in the Americas: An International Perspective Andrés Solimano,

advertisement

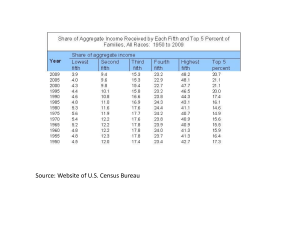

Inequality in the Americas: An International Perspective Andrés Solimano, President, CIGLOB. Presentation: Institute of the Americas University College of London October 7th, 2015 Agenda A. Global Picture: Inequality and social structure in 21st century capitalism. B. Latin America and North America: conflicting inequality trends? C. Growing wealth concentration at the top: in the Americas and in European austerity countries C. Interpretation. D. What can be done to reduce inequality? 2 A. Global Picture I: Inequality • Rise of inequality (Gini) in US, UK, Russia, China following neoliberal polices and transition to capitalism. • Decline in (labor) income inequality in Latin America starting from a high level BUT high income and wealth concentration at the top. • Differences in Gini coefficients within the OECD (USA Chile, Mexico, Turkey on the high side). • The problem of wealth concentration at the top. • GDP per capita Convergence in big developing countries: China and India but not in all the developing world. 3 Global Picture II: A Polarizing Social Structure? • Strenghtening of Economic Elites and the Super Rich Income and wealth concentration at the top, boosted by privatization, lower top income tax rates, high CEO compensation. • The fragmentation of the Middle Class: Divide between upper middle class and lower middle class. • Weakening of the traditional working class due to outsourcing and de-localization of firms, de-unionization, labor saving technical progress, immigration. 4 Economic elites: Top 1 % income shares in English speaking countries, 1913-2013 5 Inequality harms the middle class (Gini and 3rd to 9th deciles income share) 6 A working class squeeze? Declining labor shares 7 Raising inequality in the USA and UK (Gini coefficients) 50 United Kingdom United States 45 40 35 30 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 1968 1966 1964 1962 1960 1958 1956 1954 1952 1950 25 Source: All the Ginis database (2013) 8 Rising inequality in Russia and China: Gini coefficients 50 40 Russia 30 20 10 0 Source: 1988-2009: "All the Ginis Database" (2013), 2010-2012: IBGE (2014) 9 B. Inequality in Latin America • Latin America has higher inequality of income and wealth than the OECD and the world average. • The An ineffectual tax state? Economic elites block redistribution (moderate overall tax revenues as share of GDP and tilted to indirect taxation). • Similar Gini coefficients for gross income and disposable income. 10 Inequality in the Americas: An International Perspective Comparing Latin America, OECD, World 2008-2010 (Gini for Gross and disposable income) Gini coefficients for Income and Wealth (OECD and World, 2008-2010) OECD Latin America World Gross income Disposable Income Wealth 46.8 31.6 71.7 53 49 - - 39.8 81.6 Source: Credit Suisse (2013), OECD Stats and WDI (World Bank) 11 Total tax revenue in LAC and OECD(% of GDP) 40.0 35.0 34.3 33.6 32.2 32.7 33.3 32.8 33.7 34.1 30.0 25.0 20.1 20.0 15.0 19.5 19.8 20.5 21.2 21.3 17.0 14.4 10.0 5.0 0.0 1990 2000 2008 2009 LAC (20) 2010 2011 2012 2013 OECD (34) Source: OECD Stats 12 Gini coefficients after and before taxes and transfers Gini coefficients before and after T&T 70 60 50 58.1 53.6 53.2 2.6 2.9 40 30 51.0 34.5 34.2 3.1 3.1 49.9 50.8 12.0 11.9 49.3 56.8 50.6 26.9 46.8 47.2 15.9 16.3 26.8 20.5 21.3 28.8 29.3 31.2 30.0 30.9 31.0 2009 2011 2009 2011 2009 2011 50.3 20 38.9 37.9 31.4 31.1 2009 2011 10 0 2009 2011 Chile Korea 2009 USA After T&T Source: OECD Stats 2011 Germany Ireland OECD Difference 13 A complex story of inequality in the Americas • Chile, Mexico, Turkey and the US among the most unequal within the OCED. • Top income shares from tax-files information have increased in USA, Argentina, Colombia, Chile. • Declining Gini in LAC in last 10 years (household surveys). 14 Gini coefficient USA, CAN and LAC Gini Coefficient 55 50 45 40 35 30 25 20 1997 1998 1999 2000 2002 2004 2005 LAC USA CAN 2007 2008 2010 2012 Source: USA, CAN: “All the Ginis database” (Milanovic), LAC: ECLAC 15 Inequality within the OECD 0.50 30 S90/S10 income decile share (right scale) 0.45 25 0.40 20 0.35 15 0.30 10 0.25 5 0.20 0 Source: OECD (2011), Divided we stand: Why inequality keeps rising, OECD Publishing. 16 S90/S10 income decile share Gini coefficient Gini coefficient (↗) Top 1 percent's income share in the Americas 30 Canada Argentina 25 United States Colombia 20 15 10 5 1913 1916 1919 1922 1925 1928 1931 1934 1937 1940 1943 1946 1949 1952 1955 1958 1961 1964 1967 1970 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 0 Source: World Top Income Database (2015) 17 GDP and Income Inequality (1950-2011) Source: The data on real GDP per capita (log) is from Penn World Tables 8.1 and Gini coefficients are from SWIID (2014). 18 The income share of the top 1 percent : Chile Top 1% in Chile: Different estimates Author Year 2010 2005-2010 López et. al (2013) Fairfield & Jorrat (2014) Method Income declared to SII Income declared to SII (adjusted to National Accounts and by evasion) Result 15% 21% 2005-2010 Accrued profits reported by SII (adjusted to National Accounts and by evasion) 33% 2005-2010 Income reported by SII (adjusted to National Accounts and including capital gains) 31% 2009 Income declared to SII Distributed profits reported by SII (adjusted to National Accounts) Accrued profits reported by SII Accrued profits reported by SII (adjusted to National Accounts) Accrued profits reported by SII (adjusted to National Accounts and including capital gains) 15% 22% 19% 32% 33% Source: Own elaboration in base of Lópezet al. (2013) and Fairfield & Jorrat (2014). Notes: SII is "Servicio de Impuestos Internos" the tax agency of Chile. While both studies used the same source, the data available in each one is different. The first one is public gross grouped data, the second one has the full universe for individual tax returns. 19 C. A look at wealth concentration at the top: 2008-2014. • a) The wealth share of the top 1 percent increased substantially in Argentina, Brazil and Chile (between 18 percent to 60 percent). • b) Large increases in the top 1 percent wealth share in austerity countries: between 20 percent and 40 percent in Greece, Spain and Italy. • c) Rising wealth share for top 1 percent in Poland, Czech Republic, France and the UK. January 2014 - Routgers University 20 Wealth inequality change: Top 10 percent and top 1 percent Changes in wealth distribution of the top decile and percentile: 2000-20014 Percentage change of the top decile wealth(%) 2000-2008 2008-2014 2000-2014 Argentina Brazil Canada Chile Colombia Czech Republic Denmark France Germany Italy Mexico Norway Poland Sweden United Kingdom United States -5.9 -1.0 -6.3 -8.6 -4.8 -6.4 -10.2 -9.9 -3.8 -9.7 -8.6 -1.8 -14.0 -1.7 1.2 0.3 20.7 6.7 -1.0 11.4 -1.4 14.5 8.9 4.5 0.3 8.4 2.2 0.0 4.4 0.1 3.8 -0.3 13.8 5.6 -7.3 1.9 -6.1 7.3 -2.0 -5.9 -3.4 -2.1 -6.5 -1.8 -10.2 -1.6 5.0 0.0 Percentage change of the top percentile wealth (%) 2000-2008 2008-2014 2000-2014 -14.4 -2.5 -15.8 -18.3 -13.8 -13.7 -20.4 -27.0 -11.0 -24.6 -22.0 -5.3 -29.1 -7.0 2.9 1.0 Source: Davies, Lluberas and Shorrocks, Credit Suisse Global Wealth Databook 2014 60.4 18.3 -2.7 27.4 -4.3 35.2 17.5 16.0 1.8 25.4 6.8 0.7 10.0 0.6 10.5 -1.3 38.2 15.4 -18.1 4.6 -17.6 17.3 -6.4 -15.1 -9.4 -4.8 -16.6 -4.6 -21.8 -6.4 13.7 -0.3 21 Top wealth shares in Austerity Countries Changes in wealth distribution of the top decile and percentile: 200020014 Percentage change of the Percentage change of the top top decile wealth (%) percentile wealth (%) 2000- 2008- 20002000200820002008 2014 2014 2008 2014 2014 Core Economies Canada -6.3 -1.0 -7.3 -15.8 -2.7 -18.1 France -9.9 4.5 -5.9 -27.0 16.0 -15.1 Germany -3.8 0.3 -3.4 -11.0 1.8 -9.4 Japan -3.5 -1.4 -4.9 -8.9 -3.2 -11.8 United 1.2 3.8 5.0 2.9 10.5 13.7 Kingdom United States 0.3 -0.3 0.0 1.0 -1.3 -0.3 European Periphery Greece -12.2 16.5 2.4 -26.7 41.5 4.7 Italy -9.7 8.4 -2.1 -24.6 25.4 -4.8 Ireland -0.9 1.4 0.5 -2.2 2.2 0.0 Portugal -2.9 3.9 0.9 -10.2 13.8 2.3 Spain -4.3 7.3 2.8 -10.8 20.8 8.0 Source: Davies, Lluberas and Shorrocks, Credit Suisse Global Wealth Databook 2014 January 2014 - Routgers University 22 Wealth shares of top 1 and top 10 percent by region 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Top percentile Africa 38 38.6 38.2 40.0 39.8 40.0 39.4 39.5 42.4 42.8 42.9 44.8 44.2 46.1 39.7 Asia-Pacific 39.0 38.4 38.1 37.8 37.6 37.1 36.8 36.8 37.2 37.6 37.9 38.6 39.2 39.4 40.4 China 24 25.5 27.2 29.1 30.3 31.6 33.1 34.6 35.4 37.2 19.0 19.8 20.6 21.6 22.8 Europe 31 30.4 29.7 29.1 28.6 28.3 27.8 27.7 28.2 28.8 29.6 30.3 30.6 31.1 31.7 India 43 36.8 37.9 39.0 40.2 41.6 44.6 46.4 48.1 48.3 48.6 48.7 48.8 48.9 49.0 Latin America 39.6 38.9 38.2 37.9 37.1 36.5 35.8 35.1 34.3 36.1 37.1 38.3 39.0 39.5 40.5 North America 38.5 38.5 38.5 38.3 38.3 38.3 38.3 37.9 38.1 37.6 37.5 37.5 37.4 37.5 37.5 World 44 45 46.0 47.1 48.2 48.7 48.4 46.9 46.3 46.3 46.9 46.1 44.7 44.2 44.4 top decile Africa 76 77 74.4 72.9 73.5 73.1 74.9 74.6 74.7 73.9 74.0 76.0 76.3 77.8 78.3 Asia-Pacific 86.4 85.5 85.1 84.6 84.0 83.1 82.2 81.1 83.4 83.8 83.6 84.8 84.7 84.2 85.3 China 48.6 49.4 50.2 51.1 52.2 53.3 54.6 56.1 57.6 58.7 59.7 60.8 62.0 62.7 64.0 Europe 70.1 69.4 68.8 68.2 67.8 67.2 66.9 66.3 66.2 66.7 67.0 67.8 68.2 68.4 68.8 India 65.9 66.7 67.4 68.3 69.2 70.1 71.2 72.3 73.4 73.6 73.8 73.8 73.9 73.9 74.0 Latin America 70 69.0 68.9 68.6 68.1 67.5 66.8 66.1 67.2 68.1 68.7 69.5 70 70.4 70.8 North America 73 73.0 73.1 73.1 74.1 74.2 74.1 73.9 73.8 73.7 73.7 73.4 73.4 73.1 73.0 World 88.5 87.9 87.3 87.1 87.3 87.2 86.5 85.1 85.7 85.4 85.0 85.5 86.0 86.4 87.4 Source: Davies, Lluberas and Shorrocks, Credit Suisse Global Wealth Databook 2014 23 Total tax revenue (% of GDP) Argentina Barbados Bolivia Brazil Chile Colombia Costa Rica Dominican Republic Ecuador El Salvador Guatemala Honduras Jamaica Mexico Nicaragua Panama Paraguay Peru Uruguay Venezuela Unweighted average: LAC (20) OECD (34) Source: OECD Stats 1990 12,4 23,0 7,0 28,2 17,0 9,0 16,1 8,3 7,1 10,5 9,0 16,2 23,0 15,5 .. 14,7 5,4 12,1 19,6 18,7 2000 18,0 30,2 14,7 30,1 18,8 14,6 18,2 12,4 10,1 12,2 12,4 15,3 22,8 16,5 13,0 16,7 14,5 14,5 21,6 13,6 2008 24,7 31,5 20,1 33,8 21,4 18,8 22,7 15,0 14,0 15,1 12,9 18,9 25,0 20,7 16,8 16,9 14,6 19,0 26,1 14,1 2009 25,6 30,6 22,3 33,1 17,2 18,6 21,2 13,1 14,9 14,4 12,2 17,1 24,8 17,2 16,9 17,4 16,1 17,0 26,8 14,1 2010 26,7 30,7 20,4 33,2 19,5 18,0 20,8 12,8 16,3 14,8 12,4 17,3 25,0 18,5 17,6 18,1 16,5 18,0 27,0 11,4 2011 27,7 32,3 23,8 35,0 21,2 18,9 21,3 12,9 17,3 14,9 12,7 16,9 24,5 19,5 18,6 18,1 16,8 18,5 26,8 13,1 2012 29,5 34,0 25,5 35,6 21,4 19,6 21,2 13,5 19,4 15,1 12,8 17,5 24,5 19,6 19,2 18,7 17,7 18,8 27,4 13,9 2013 31,2 29,8 27,6 35,7 20,2 20,1 22,4 14,0 19,3 15,8 13,0 18,0 25,0 19,7 19,2 18,9 16,4 18,3 27,1 14,2 14,4 17,0 20,1 19,5 19,8 20,5 21,2 21,3 32,2 34,3 33,6 32,7 32,8 33,3 33,7 34,1 24 C. Summary and Interpretation a) Inequality has been increasing in mature capitalist countries (USA, UK) that embraced neoliberal policies and in large countries that underwent post socialist transitions ( Russia and China). b) Latin America has seen, according to household surveys, a decline in labor inequality in the 2000s-2010s. This may be due to : – more rapid GDP growth – education and pro -poor social policies. c) But just moderate levels of tax collection hamper the scope for effective redistribution (role of economic elites). 25 Summary and Interpretation (cont.) a) But top income shares and wealth shares remain high in Latin America a) Wealth inequality has worsen in several LAC countries also in countries under austerity policies Greece, Spain, Italy, France, UK and other European countries. January 2014 - Routgers University 26 D. What can be done to reduce inequality? a) Recognize inequality is a problem. b) How to manage redistribution economically and politically? How to overcome a blockade by the elites? c) Mobilize middle class and working class support. d) Keep the economy growing. e) Increase the contribution of direct taxation in Latin America (below OECD standards). f) Increase top marginal income tax rates. g) A wealth tax. 27 What can be done to reduce inequality? (cont.) a) b) c) d) Control tax evasion and tax heavens. Pro-equity wage- setting institutions More universal social policies. Curb concentration of wealth and high market shares by big conglomerates. e) Democratic public ownership versus privatization. January 2014 - Routgers University 28