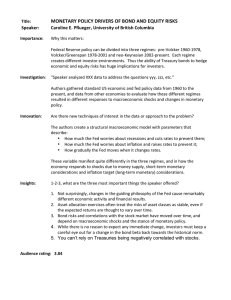

Beyond Shocks: What Causes Business Cycles? An Overview

advertisement