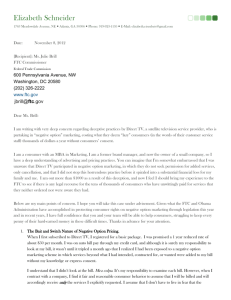

Antitrust and Trade Regulation Group

May 13, 2008

FTC Permits Resale Price Maintenance

In its first resale price maintenance (RPM) decision since the Supreme Court’s opinion last summer in

Leegin1, the Federal Trade Commission (FTC) decided 4-0 to partially grant Nine West Group, Inc.’s

petition to modify a 2000 FTC Consent Order. This FTC decision provides important insight into how

the FTC will analyze RPM policies under Leegin. The decision may also be influential with federal

courts deciding challenges to RPM policies under the Sherman Act. At the same time, the comment

submitted to the FTC by a number of states opposing modification, suggests that many states will take

a more restrictive approach to RPM under their state antitrust laws.

The 2000 Consent Order barred Nine West, a women’s shoe manufacturer, from “fixing, controlling, or

maintaining the resale price a dealer may advertise, promote, or offer for sale any Nine West Products,

or coercing, pressuring, or otherwise securing a commitment from any dealer to maintain a resale price

for Nine West Products.” Under the modified Consent Order, Nine West will be permitted to enter into

agreements with retailers setting the prices the retailers will charge consumers for Nine West products.

However, the FTC is requiring Nine West to provide periodic reports on its RPM policy so that the FTC

may monitor the competitive effects of the policy.

Last June, the Supreme Court, in Leegin overruled a 96-year-old precedent that made RPM a per se

violation of the antitrust laws. Instead, Leegin held that such practices must be judged under the rule-ofreason and are unlawful only upon proof that the practice has had an anticompetitive effect in the

relevant market. Promptly after the Supreme Court’s decision, Nine West petitioned the FTC for a

modification of its 2000 Consent Order based on a substantial change in the law.

A number of states submitted a joint comment to the FTC opposing Nine West’s petition. The states

argued that even after Leegin RPM should be viewed as “inherently suspect” because such policies

inevitably increase prices to consumers. The states claimed that Nine West should have the burden of

proving that its implementation of an RPM policy is procompetitive.

The FTC rejected the states’ position. It noted that the Supreme Court had identified those situations in

which RPM has anticompetitive potential, i.e., when the manufacturer or a retailer has a significant

market share, when the RPM policy originates with a retailer, or when a number of other manufacturers

in the same industry are employing an RPM policy. The FTC found none of those circumstances

present in this case. It specifically found that Nine West originated the implementation of an RPM policy

and it had only a “modest market share.” The FTC noted that because Nine West lacked market power

“the forces of interbrand competition will discipline any supra-competitive pricing.”

1

Leegin Creative Leather Products, Inc. v. PSKS, Inc., 127 S.Ct. 2705 (2007)

CHICAGO ● SAN DIEGO● WASHINGTON

The FTC stated that even if Nine West had market power, or its policy originated with its retailers, Nine

West could still justify modification of the Consent Order by showing that its RPM policy is

procompetitive. According to the FTC, a firm can justify its RPM policy “by presenting evidence that

while the practice might increase resale prices for its products over what they would otherwise be, it

enhances output. That might suggest that consumers place a higher value on non-price factors (such

as service) than they do on price, so that the practice may be viewed as efficiency-enhancing.”

However, the FTC held that Nine West had not presented sufficient evidence that its RPM policy would

be procompetitive. Therefore, the FTC is requiring Nine West to submit reports on the first, third and

fifth anniversaries of the Order modification so that FTC can “monitor the effects of Nine West’s use of

resale price maintenance.”

For further information, please contact Scott Mendel (312-807-4252, smendel@bellboyd.com).

This publication has been prepared by the Antitrust and Trade Regulation Group of Bell, Boyd & Lloyd LLP for clients and

friends of the firm and is for information only. It is not a substitute for legal advice or individual analysis of a particular legal

matter. Readers should not act without seeking professional legal counsel. Transmission and receipt of this publication does

not create an attorney-client relationship.

© 2008 Bell, Boyd & Lloyd LLP All Rights Reserved

www.bellboyd.com

70 West Madison Street

Chicago, Illinois 60602

t. 312-372-1121

f. 312-827-8000

3580 Carmel Mountain Road

San Diego, California 92130

t. 858-509-7400

f. 858-509-7466

1615 L Street, N.W.

Washington, D.C. 20036

t. 202-466-6300

f. 202-463-0678

2