Tick-by-Tick Analysis and the Retur n Efficiency Theor y for ... Vladimir Pr elov, Ph.D.

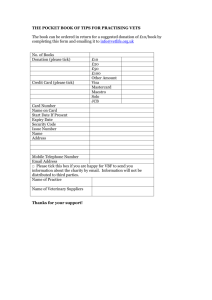

advertisement

Tick-by-Tick Analysis and the Retur n Efficiency Theor y for Financial Mar kets Vladimir Pr elov, Ph.D. Russian Academy of Sciences, IMASH RAN, RUSSIAN FEDERATION 101990 MOSCOW Maliy Kharitonievskiy per., 4 Tel.: +7(499)135-7771, Fax: +7(495)624-9800 prelov@iitp.ru ABST R AC T 7KLV GLVFXVVLRQ SDSHU SUHVHQWV QHZ PDUNHWPDNLQJ DQG ULVNPDQDJHPHQW LGHDV FRPLQJ IURP WKH ORQJ DQG VKRUWWHUP DQDO\VLV RI LQYHVWPHQW¶V HIILFLHQF\ DW different global financial markets. We have investigated official tick-by-tick records and results of market participants (speculators & investors) trading activity such as an average rate of at-the-moment return for the decade period starting with 1999 and up-to-date. We have exploited a dealing rate of return at-the-moment (profitability) r, to design an alarm parameter, so-called Efficiency, E, of financial market transactions as a standard mean for the ratio r/R over k periods, where R was observed as the theoretically available floating maximum for the trading period in question. During tick data processing we noticed the asymptotic stability phenomenon in the E behavior over all the financial instruments at both the global and emerging markets. Investigating this, we established some relations in E with Shannon's entropy and Maxwell distribution and proved our result should be stated as a financial PDUNHW¶VIXQGDPHQWDOLQYDULDQW:HDSSOLHGVRPHWKHRUHWLFDOQXPEHULGHDVHQIRUFHGZLWKD/DUJH6\VWHPWKHRU\WRSUHVHQWDQDV\PSWRWLFK\SRWKHVLVDQGJXHVVD behavior of so-called E-waves for show that waves ranges are restricted not only with inverse exponent, 1/e=0.367880, and the constant of the famous Fibonacci retracement target, 0.381966, which is rather popular within the global financial market traders, but as well are corresponded with )LERQDFFLQXPEHU¶V LQWHUYDO bounds [1/3,1/2] under some wide assumptions. We realize a theory of E-waves and present a family of E-curves as new sensitive toolset for both operational and market-making activity, which are of a special interest for both portfolio- and risk managers and for regulators at the global financial markets, as well, while a post-crisis reality. PRESENTATION A lot of approaches to foresee any fatal, including financial markets, event are based on the concept of the precursor - a sharp change in the local dynamics of some parameters given. W e propose a new approach to the "precursor" as to a special, multi-level structure that reflects the complexity of the classical concept. Variations of the market environment are reflected in the signals of finance- information field &%¶V interventions, investments, speculations, rumors). The aim of any research on this point is to interpret the anomalies of financial fields (tick flows, level of activity of market makers, dynamics of the trading system applications, etc.), bearing both permanent and casual character. The goal of this paper is to show a deep two-sided, so called ³EHIRUHDIWHU´ interlink extracted over time for some transformation of operational parameters of the financial environment in order to obtain the reliable proof for the strength\weakness of the market and the potential risks, financial and economic threats inspired with activity of operators E\ PHDQV RI QHZ (ZDYHV¶ DQG (FXUYHV¶ WKHRU\ W e start with the Russian Ruble show in a form of the plane E-curves extracted out of the Moscow Interbank Currency Exchange (MICEX) tick database official records for the beginning of 2012. Fig.1. Impact and Reflected E-waves in a form of self-intersecting E-curves junction done for 926489 ticks of Russian Ruble at MICEX in 2012 (real dealing rate of return normalized and vectorized for the period given, the Central Bank of Russian Federation intervention volumes included, % scale). Detailed analysis done for these E-waves allow us to conclude that financial markets are not what they seem. It is easy to see after some routine mathematical transformations that a period for assets targeting with intervention tools is restricted with a cumulative th volume. Starting with a total tick volume accumulated with different market assets by the early 2000 , fulfilling the %ROW]PDQQ¶V limit conditions of the Large System Theory, we have a self-organized system of the chaos controlled by now when the monetary tools period is coming to be over. It is understandable if we consider the geometry probabilistic interpretation for an entropy as a standard measure of chaos. The %ROW]PDQQ¶VHQWURS\IDFWRUIRUSODQHFXUYHVDERYHLVMXVW>@ *[22.5;47.5]=9/80=11.25%!!! So, we have now to present THE MAIN STATEMENTS · · The global financial markets institution has established itself as a full self-completed chaos controlled IT-system. The %ROW]PDQQ¶V WKHRU\ FRQILUPV WKDW D SDJH IRU PRQHWDU\ FRQWUROOHG ILQDQFLDO PDUNHWV LV WXUQHG RYHU XQGHU WKH GLVSXWDEOHDVVXPSWLRQWKDWERWK*OREDO)LQDQFLDO0DUNHWV¶LGHRORJ\DQGWKHVKRZPXVWJRRQ INTRODUCTION The above figures have visualized some of joint E-waves followed tick data of FX and stock sections at MICEX provided below. Fig.2. Direct\Indirect E-waves done for 926489 ticks of USDRUB in 2012, and E-waves averaged for Russian blue chips in 2007 and for Russian FX in 2011. Rapid IT stream opens a wide spectrum of new opportunities and set new requirements for market-making and trading efficiency as well as for both financial markets forecasting and risk-management. E-ZDYHV?FXUYHV¶ WKHRU\ LOOXVWUDWHV QHZ PHWKRG IRU estimating the risk. We follow a cross-disciplinary paradigm in approaching this complex scientific problem, and use some new non-statistical forecasting methods to detect patterns hidden in catalogues of recorded transactions data. First of all, we suppose that all records collected at tick-by-tick database reflect the processes at an open dynamical system which is chaotic in both standard and systemic time. Then, we suppose that every financial spurt has a set of precursors, related in both time scales, leading to the self-organized criticality which triggers the event. The challenge is to use these data to create a logical procedure to identify precursors for turmoils as well as to filter out false events. New opportunities to collect the trading info and to analyze the data flows let us rely on solving the problems such as crucial events forecasting, the problem of short-term takeprofit & stop-loss control in a real-time mode. Both general practical and theoretical results obtained with analytical processing of catalogues are illustrated below. For example, an entropy method could be applied to reduce a complexity of FX targets forecasting problem. DATA COLLECTION We have deal with an official dataset of Russian blue chips and FX (Russian and Global) presented at this table LKOH 1999 2000 2001 2002 2003 2004 2005 2006 2007 Total tick # 18178 64748 275196 474730 905194 1576935 2646763 4686483 4188999 Cumulative tick # 18178 82926 358122 832852 1738046 3314981 5961744 10648227 14837226 MICEX, Mb 5237 Mb zipped UTS, Mb 33 Mb zipped 22 36 60 94 133 141 345 447 1,6 blns of ticks Stock Section 3 3 3 2 2 3 4 4 2008 2009 2010 2011 2012 SBER 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 6225467 9371378 7235391 9426456 1109598 Total tick # 40597 86071 72817 202693 186916 406064 401691 945860 2618297 8596686 25646567 21062693 30434071 37669462 47 095 918 Cumulative tick # 40597 126668 199485 402178 589094 995158 1396849 2342709 4961006 13557692 39 204 259 592 1103 1018 1098 148 FX Interbank 2001 Q1 2001 Q2 2001 Q3 2001 Q4 2002 Q1 2002 Q2 2002 Q3 2002 Q4 7 11 17 27 7 USDJPY 241750 345791 298994 216762 798556 280526 409394 557083 EURUSD 252512 285498 237869 181777 440269 174908 347536 322319 TOTAL ticks 3 148 856 2 242 688 We use here a standard notations as LKOH = Lukoil (RF), SBER = Sberbank (RF) etc. A cumulative effect for LKOH and SBER total tick number approximation is shown at Fig.A5 in Appendix. SKETCH OF METHOD The best way to check up the result of our efforts is to see Fig.A1 in Appendix done for Russian Ruble at MICEX for the period since 01.01.2007 to 30.06.2009 (about 610 trading days and 730000 ticks processed) with a 86'58%¶VGHYDOXDWLRQSHULRG included. We arrange so-called Efficiency Waves (or E-waves) on the basis of the tick volumes distribution dynamics over the period in question. Histogram for Cumulative Wave at this Figure shows that first alarm we had 10.07.2008, i.e. 6 days before the USDRUB minimum, 23.1255, occurred (16.07.2008). The next alarm we got 05.02.2009, i.e. 14 days before the final local devaluation target was done in USDRUB, i.e. maximum value of 36.4629 in CBRF official rate (19.02.2009). We introduce EWaves as follows. If we consider the volume distribution over the trading range [p0,p1] in question V([p0(t),p1(t)],t)=V(t), W « 1VHHVDPSOHDW)LJWKHQ(ZDYHVGHILQHGDVIXQFWLRQVRIIORDWLQJ9WLH(W (9>@WDV1WHQGVWRLQILQLW\ Fig.3. LKOH as of 01/01/2000 and SBER as of 01/01/2007 tick volume distribution samples We have to note that E-waves are very sensitive to the database quality. This follows the brief analysis of the E distortions inspired with Internet data incompleteness (MICEX, intraday records for 19.07.2011) provided in the short Table below Official MICEX Data as of 20110719 [a] EUR_RUB__TOM Free Internet Data 20110719 [b] USD000000TOD Free Internet Data 20110719 USD000UTSTOM Free Internet Data 20110719 r 0,202672 R 0,434536 E= = r/R 46,64092 0,335364 0,629907 53,24025 0,246627 0,785925 31,38054 0,18587 0,307198 0,229568 0,434536 0,622773 0,785925 Sources: [a]. EOD official records (MICEX data for 19.07.2011), http://rts.micex.ru [b]. Free Internet database, see for example http://www.mfd.ru 42,77429 49,3275 29,20986 # Ticks total 940 937 2535 7086 Database Completeness +3 99,6809 2540 +5 7111 +25 99,8031 99,6484 Distortion in E 9,04% 7,93% 7,43% Our methods operate with financial interpretations [1-9] for a benchmark of the %ROW]PDQQ¶V/DUJH6\VWHP7KHRU\>@ Let us consider, without loss of generality, one trading period series pik = p0k + i, i = 0...N k , N k ® ¥ , Sk for the financial market with unit step in quoting a price and where we use a notation p0k and p Nk k = p 0k + N k for daily prices of the asset Dk be the total number of two-side anonymous deals done with the asset during Sk . t j = ( pt j ,Vt j , Tt j ), j = 1...Dk ± VWDQGDUG vectorized record for every transaction done for the under consideration. Let Def.1. Tick pt j , Vt j , Tt j ±WLFNSULFHYROXPHDQGWXUQRYHUUHVSHFWLYHO\ Def.2. Cash and volume turnover T Sk and V Sk rk = T Def.5. At-the-moment Efficiency E = lim Sk k® ¥ are T Rk = N k Def.3. Nominal rate of at-the-moment return Def.4. Profitability at-the-moment Sk for given ¦ ¦ k p ik V i k Ek Sk p 0k = ¦ Tt . , where Vi k = j ¦ , V Sk = ¦ Vt k j asset given, where . Vt kj d ( p ik ) , i = 0...N k . Our result is formulated as a THEOREM-1 FOR INTERNATIONAL FINANCIAL MARKETS The Efficiency of the transactions at the global markets asymptotically tends to the value of E » 37 ,8 %. This result depends neither on asset nor market in question. SKETCH OF PROOF Let us assume that Sk is over and omit index k. Let cash and volume turnovers T and V be fixed now. To get the key parameter, we have to obtain the additional conditions Vi distribution of the maximal probability, i.e. we meet problem to minimize ¦ p V = T , ¦V = V i with the well known %ROW]PDQQ¶V UHVXOW i i i i ¦V Vi = ae - bp i i i ln Vi under , L «1, where a , b - const, b [0;1]. It is easy to see that E follows the normalization in the unit cube and we estimate E from the averaging formula ³ [ b N - ln e b N +1 2 ( b ( p - N ) + ln e b N +1 2 - e - b N ln e b N +1 2 ] + 1 ) - e - b N ( b ( p + N ) + 1 - ln e b N +1 2 ) dW Data processing with Russian blue chips shows that we have some troubles with recalculating the targets due to the huge amount of information and, moreover, we can apply this approach only for the long-term analysis to fulfill the %ROW]PDQQ¶V FRQGLWLRQ N> T/V-p at real financial market transactions flows. NUMERICAL VALUE E ( p, N , b ) ~ [36 ( N + 4 p ) (N + 4 p ) p / 18 2 3 E ~ Note that our E flirts with the Golden Mean 157 1080 + 25 18 + 12 ( N + 4 p ) N 2 b + ( N 2 - 18 Np - 24 p 2 ) N 2 b ln 5 - 26 9 2 ] ln 2 » 0 . 37827562 . j = 1 - ( 5 - 1) / 2 » 0.381966 and the inverse exponent 1 / e » 0.367880 (Fig.2). Now, if NBD (No Bad Deals) assumption is valid, i.e. all the transactions are profitably closed, then, as a side result of the both crisis and just post-crisis tick-by-tick data processing we have proved and present a THEOREM-2 FOR INTERNATIONAL FINANCIAL MARKETS Under NBD assumption an asymptotic behavior of the global financial markets is ruled with two functions of r ± F1 is valid for up-trends, F2 for down-trends, and r as above. As mentioned above, a huge amount of information gives problem to fulfill %ROW]PDQQ¶V FRQGLWLRQ >@ DW UHDO ); DQG RWKHU ILQDQFLDOPDUNHWV: HKDYHWRFRQVLGHUVRPHFUHDWLYHPHWKRGVWRUHGXFHWKHFRPSOH[LW\±IRUH[DPSOHIRUWKHVKRUWWHUPDQDO\VLV we recommend to apply another interdisciplinary point of view [11]. This number-theoretical and entropy combined method applied for Efficiency (under the direct trading rules) gives us a number-theoretical THEOREM-3 FOR INTERNATIONAL FINANCIAL MARKETS Efficiency is well approximated with an integral-differential combined formula as follows d dq ­ ® q ¯ s1 s 2 j=1 1 - q s3 + 1 - q j j ½ ¾ ¿ ³ ­ ® q ¯ b1 b 2 j=1 1 - q b3 + 1 - q j j ½ ¾ dq ¿ APPENDIX Figures below present new results of tick database processing to comment the statement of E-Theory via E-waves/-curves presented above for different classes of trading ranges, for different financial markets of the high liquidity level. Fig.A1. USDRUB_TOM dynamics and some E-Waves for the period since 01.01.2007 as of 30.06.2009. Fig.A2. Two types, Aggregand and Segregand, of E-waves (USDJPY Q1-2001, global FX dealing) for R=9,87%. Fig.A3. Long- and short-term E-waves at Russian interbank dealing (USDRUB_TOM 2011, RTS-MICEX) for R=21,23%. Fig.A4. The same phenomenon in E-waves for the Russian blue chips (Gazprom 2007, MICEX) for R=61,42%. Fig.A5. Russian blue chips, LKOH and SBER, polynomial approximation for cumulative tick number as of 2011. CONCLUSION REMARK ON EARLY WARNING SYSTEMS We have omitted all proofs of Theorems for short here. Our goal at-the-moment is to complete a parallel processing of official tick-by-tick data collections from different financial markets (RTS-MICEX, NYSE, LIFFE, ICE, FX etc.) and to present a new tools for forthcoming crises early alarm system based on Theorems for E-Waves as well as a new paradigm for both high frequency trading and open market operations efficiency control. This reason is a strong motivation to launch the joint international research project for global crises forecasting and control methods design on the basis of data processing opportunities all over the world. REFERENCES [1] P r elov V.V. ± The New Financial Theorem: Russian Blue Chips and Global Commodities Evidence.//ISSN 1931-0285 CD, v. 3, No. 2, 2008, pp. 39-43. [2] P r elov V.V. ± On the Efficiency Theorem.// ISSN 1931-0285 CD, v. 4, No. 2, 2009, pp. 88-91. [3] P r elov V.V. ± Data Mining and Crisis Forecasting Opportunities.// ISSN 1931-0285 CD, v. 4, No. 2, 2009, pp. 60-64. [4] P r elov V.V. ± Large Systems Theory and Crisis Precursors.// ISSN 1931-0285 CD, v. 5, No. 1, 2010, pp. 94-97. [5] P r elov V.V. ± Information Analysis and Target Simulation.// ISSN 1931-0285 CD, v. 5, No. 1, 2010, pp. 98-104. [6] P r elov V.V. ± Some Remarks on Crisis Forecasting.//BAI P roceedings CD , 2008. th [7] P r elov V.V. ±2Q*DXVV4SRO\QRPLDOVDQG(IILFLHQF\(YDOXDWLRQRI7UDGLQJ Operations.//VI Intern. Conference on Ma th. Simula tion P roceedings: Yakutsk, 2011, pp. 102-103 (in Russian). [8] P r elov V.V., M a k h u tov N.A.±Descriptorial Analysis of the Crisis Syndromes.//Sa fety a nd Emergencies P roblems , 2004, v. 4, pp. 11-17 (in Russian). [9] P r elov V.V., M a k h u tov N.A.±$QDO\VLVDQG)RUHFDVWLQJRIWKH)LQDQFLDOTurmoils.//Sa fety a nd Emergencies P roblems , 2004, v. 2, pp. 47-57 (in Russian). [10] Boltzm a n n L .±W ien. %HU%GV± [11] An d r ews G .E .±7KH7KHRU\RI3DUWLWLRQV$GGLVRQ: HVOH\Publ. Comp., 1976.