banknotes contents

advertisement

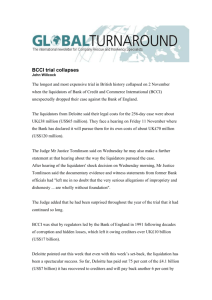

Lawyers to the finance industry banknotes Summer 2004 contents Charges over book debts 1 Consumer credit legislation 2 UCP 500 2 Lender benefits from another’s 3 security Bad news for liquidators 4 Who to contact 4 Welcome to the Summer edition. It has been a quarter for overturning decades of accepted law! Bankers' ability both to have a fixed charge over uncollected book debts and yet let their customers deal with the proceeds has been overturned by the Courts in Re Spectrum Plus. In the Leyland Daf decision, the Lords held that where a company is at the same time in receivership and being wound up, recourse may not be had to the receivership assets in order to meet the expenses of liquidation. Charges over book debts The original position A fixed charge over present and future book debts enables lenders, on a liquidation, to have priority over preferential creditors and holders of floating charges with regard to uncollected debts. It has always been possible for lenders to take a valid fixed charge over book debts providing that the lender is in control of the debts. Generally, this is achieved by the debts being paid into a blocked account with the lender. This arrangement is resisted by borrowers as it does not allow them control over their cash flow. A floating charge gives borrowers the flexibility they require but does not give the lender priority. This issue considers these judgments and also changes proposed in relation to consumer credit and UCP 500. www.ngj.co.uk Siebe Gorman & Co. Ltd v Barclays Bank Ltd ([1979] 2 Lloyds Rep 142) established the premise that it was possible to create a fixed charge over present and future book debts if the proceeds were paid into an ordinary account with the lending bank. Standard debentures used by lenders today often contain clauses based on the Siebe Gorman debenture, creating a fixed charge over outstanding debts which are to be paid into a specified account with the lender on collection. The monies in the account are then subject to a floating charge unless the company is otherwise notified by the bank. The Brumark decision The decision of the Privy Council in Re Brumark ([2001] 2AC 710) cast doubt on the Siebe Gorman position. Here the Privy Council had to consider a charge over book debts which was expressed to banknotes be fixed but was only floating over the proceeds unless and until the lender required the company to pay them into an account with itself or otherwise crystallised the floating charge. The Privy Council held that, in deciding whether a charge is fixed or floating, the Courts must first consider "…the nature of the rights and obligations which the parties intended to grant each other in respect of the charged assets. Once these have been ascertained, the Court can then embark on the second stage of the process which is one of categorisation." account for them to the bank. The bank sought a declaration that the debenture created a fixed charge over the book debts due to the company and an order to the liquidators to account to the bank in respect of them. The Court applied the two stage test set out in Brumark. The Court found that the obligations of the company set out in the debenture in relation to the book debts were: J J The Privy Council held that the nature of the rights given over the charged assets was the relevant distinction regardless of whether the charge was expressed to be fixed or floating. A charge over uncollected book debts which left the company free to collect them and use the proceeds in the ordinary course of its business was inconsistent with a fixed charge. Although Privy Council decisions are not binding authority in the English domestic Courts they are persuasive, particularly because the Privy Council is made up of members of the House of Lords. Re Spectrum Plus Ltd In order to settle the position a test case was brought in the English Courts by National Westminster Bank PLC. Spectrum Plus Ltd had opened an account with the bank and obtained an overdraft facility secured by a debenture in the standard Siebe Gorman form. The company subsequently went into creditors' voluntary liquidation. The liquidators collected in the proceeds of the book debts but refused to 2 J "to pay the proceeds of any book debt into the company's account with the bank, not to sell, factor, discount or otherwise charge or assign the book debt in favour of any other person without the consent of the bank and if called on so to do to execute legal assignments of such book debts." The Court then looked at the intentions of the parties and whether it was intended that the book debts should be under the control of the company or the bank. The account with the bank was an ordinary current account with no express restrictions on its operation. The company was free to use the proceeds of the book debts in the ordinary course of its business unless and until the bank facility was withdrawn or reduced on notice or a demand for repayment was made. The Court held that the charge could only be categorised as floating and that Siebe Gorman was wrongly decided. The bank has been given leave to appeal and it is expected that the appeal will be expedited in order for the matter to be clarified as quickly as possible. In the meantime lenders and insolvency practitioners should act with caution. Consumer credit legislation The Department of Trade and Industry has published its white paper on the consumer credit market entitled "Fair clear and competitive: the consumer credit market in the 21st century". One of the key reforms proposed is that the financial limit of £25,000 for the application of the Consumer Credit Act be abolished so that all consumer credit agreements, other than first mortgages, will be subject to the new rules. However, loans to small businesses currently covered by the rules will continue to be subject to a limit of £25,000. UCP 500 The Uniform Customs & Practice for Documentary Credits (UCP 500) is currently being redrafted to take account of changes in international trade since UCP 500 was adopted in 1993. The drafting committee is supported by a consultation group which includes representatives from around the world. The UK consultation group has already commented on Articles 1 to 19 (excluding 13 and 14) and is now focussing on the remainder of the articles. If you would like to contribute to the revision or to the ICC initiative on common practices in factoring and forfaiting please contact Carolanne Cunningham at Nicholson Graham & Jones, a member of the ICC UK Committee on Banking Technique and Practice. Summer 2004 Lender benefits from another’s security In Cheltenham & Gloucester plc v Appleyard and another [2004] EWCA 291 (Court of Appeal) the defendants, Mr and Mrs Appleyard had purchased a property with a loan from Bradford & Bingley Building Society ("B&B") secured by a first charge registered against the property. The Bank of Credit and Commerce International ("BCCI") subsequently registered a second charge over the property. The charge contained a provision that no further charges or mortgages were to be registered against the property without the consent of BCCI. The defendants entered into refinancing arrangements with Cheltenham & Gloucester ("C&G") and executed a mortgage in favour of C&G. Cheques were forwarded to B&B and BCCI to discharge the amounts owing to them. On the same day as the cheque was forwarded to BCCI, provisional liquidators were appointed and BCCI ceased trading. BCCI refused to supply C&G with confirmation of discharge of their charge and refused to give consent to the C&G mortgage being registered. An unregistered mortgage of registered land only operates as an equitable charge. The holder of an equitable charge is not entitled to obtain possession of the charged property or sell the property with good title. subrogated to the rights of B&B under the B&B mortgage. C&G argued that, because their money was used to pay off the B&B mortgage, they were entitled to be regarded in equity as having an assignment of B&B's rights as a secured creditor. The Appleyards argued that C&G were prevented from being subrogated to the rights of B&B because they had obtained valid contractual security in the form of the C&G mortgage regardless of the fact that it was not registrable (and due to the fact that BCCI had subsequently agreed to C&G registering the mortgage). The Court held that C&G were entitled to be subrogated to the rights of B&B under the B&B mortgage to the extent of that mortgage at the time it was paid off together with interest. Subrogation J Subrogation is the right of one person to take over the legal rights of another in certain circumstances. For example where A pays money to B, (a secured creditor), to redeem the debts of C, A will then be entitled to step into the shoes of B as a secured creditor of C J Subrogation is a flexible remedy aimed at preventing unjust enrichment J A lender cannot claim subrogation if he has obtained all of the security for which he has bargained J The fact that a lender has obtained some security for which he has bargained does not prevent him from claiming to be subrogated to another security J The absence of a common intention on the part of the borrower and the lender that the lender should be secured is not fatal to a subrogation claim but is a relevant consideration J The capital sum in respect of which a lender claims to be subrogated cannot normally be greater than the amount of the secured debt that has been discharged The Appleyards did not make any payments to C&G and C&G began proceedings for possession on the basis that they were entitled to be 3 banknotes Bad news for liquidators In Buchler and Another v Talbot and Others (The Times 5 March 2004) the House of Lords was called upon to address the extent of a liquidator's priority in relation to assets which are subject to a floating charge. In particular, could a liquidator claim any shortfall in its expenses and costs out of the assets held by a receiver in respect of a crystallised floating charge? Leyland Daf Ltd (“LDL”) was part of the DAF NV group of companies. It granted a mortgage debenture to a Dutch foundation containing fixed and floating charges to secure monies loaned to the group. The DAF NV group collapsed and the mortgage holder appointed receivers under its debenture whereupon the floating charge crystallised into a fixed charge. The receivers then proceeded to collect in the charged assets. LDL subsequently went into creditors' voluntary winding up. The liquidators realised the remaining assets and found that they were far short of the estimated liquidation costs and expenses. The liquidators therefore sought a declaration from the Court that the liquidation expenses were payable out of the charged assets in Who to contact For further information contact Richard Hardwick richard.hardwick@ngj.co.uk tel: 020 7360 8125 4 the receivers' hands in priority to the charge holder. The Court of Appeal, bound by its earlier decision in Re Barleycorn Enterprises Ltd (1970), found in favour of the liquidators. However, the House of Lords held that Re Barleycorn was wrongly decided and should not be followed. The House of Lords, analysing the true construction of sections 40 and 175 of the Insolvency Act 1986, found that assets of a company being wound up are in two distinct funds: J the proceeds of the free assets which belong to the Company and are administrated by the liquidator; and J the proceeds of the assets comprised in a floating charge which belong to the charge holder to the extent of the security and are administered by the receiver. subject to the floating charge until all principal and interest owed to the floating charge holder had been paid. Comment Although this decision is good news for secured lenders it will not be welcomed by liquidators and creditors. Liquidators will require evidence that the free assets will be sufficient to meet their expenses prior to agreeing to act in a liquidation and may be unwilling to be appointed where a company is subject to a crystallised floating charge. Creditors may now find that liquidators are unwilling to act unless their expenses are underwritten or funded by creditors. The House of Lords upheld the appeal and stated that the costs of administering each fund should be borne by the fund in question. The costs and expenses of the liquidation were not payable out of the assets Nicholson Graham & Jones 110 Cannon Street, London EC4N 6AR tel: 020 7648 9000 Internationally a member of GlobaLex The contents of these notes have been gathered from various sources. You should take advice before acting on any material covered in banknotes. © Nicholson Graham & Jones 2004