Document 13725515

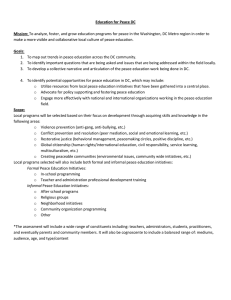

advertisement