Document 13662174

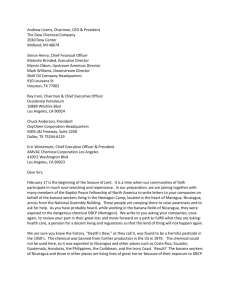

advertisement