Rebecca M. Blank University of Michigan and NBER May 2002 (revised)

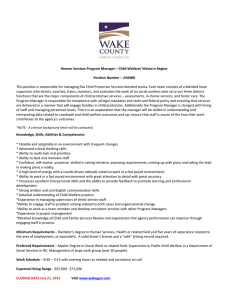

advertisement