THE NEW ZEALAND CONSUMER MARKET FOR CUT FLOWERS IN THE 90's

advertisement

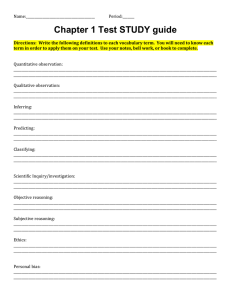

THE NEW ZEALAND CONSUMER MARKET FOR CUT FLOWERS IN THE 90's Charles G Lamb 1 Dennis J Farr Patrick J McCartin3 Research Report No. 212 January 1992 Agribusiness & Economics Research Unit PO Box 84 lincoln University CANTERBURY Telephone No: (64) (3) 325 2811 Fax No: (64) (3) 325 3847 2 3 Charles G Lamb is a Senior Lecturer in Marketing in the Department of Economics and Marketing at Lincoln University. Dennis J FaIT is a Lecturer in the Department of Horticulture at Lincoln University. Patrick J McCartin is a Private Computer Consultant. ISSN 1170 7682 AGRIBUSINESS & ECONOMICS RESEARCH UNIT The Agribusiness and Economics Research Unit (AERU) operates from Lincoln University providing research expertise for a wide range of organisations concerned with production, processing, distribution, finance and marketing. The AERU operates as a semi-commercial research agency. Research contracts are carried out for clients on a commercial basis and University research is supported by the AERU through sponsorship of postgraduate research programmes. Research clients include Government Departments, both within New Zealand and from other countries, international agencies, New Zealand companies and organisations, individuals and farmers. Research results are presented through private client reports, where this is required, and through the publication system operated by the AERU. Two publication series are supported: Research Reports and Discussion Papers. The AERU operates as a research co-ordinating body for the Economics and Marketing Department and the Department of Farm Management and Accounting and Valuation. This means that a total staff of approximately 50 professional people is potentially available to work on research projects. A wide diversity of expertise is therefore available for the AERU. The major research areas supported by the AERU include trade policy, marketing (both institutional and consumer), accounting, finance, management, agricultural economics and rural sociology. In addition to the research activities, the AERU supports conferences and seminars on topical issues and AERU staff are involved in a' wide range of professional and University related extension activities. Founded as the Agricultural Economics Research Unit in 1962 from an annual grant provided by the Department of Scientific and Industrial Research (DSIR), the AERU has grown to become an independent, major source of business and economic research expertise. DSIR funding was discontinued in 1986 and from April 1987, in recognition of the development of a wider research activity in the agribusiness sector, the name of the organisation was changed to the Agribusiness and Economics Research Unit. An AERU Management Committee comprised of the Principal, the Professors of the three associate departments, and the AERU Director and Assistant Director administers the general Unit policy. AERU MANAGEMENT COMMITTEE 1992 Professor A C Bywater, B.Sc., Ph.D. (Professor of Farm Management) Professor A C Zwart, B.Agr.Sc., M.Sc., Ph.D. (Professor of Marketing) R L Sheppard, B.Agr.Sc. (Hons), B.B.S. (Assistant Director, AERU) • AERU STAFF 1992 Director Professor AC Zwart, B.Agr.Sc., M.Sc., Ph.D. Assistant Director R L Sheppard, B.Agr.Sc. (Hons), B.B.S. Research Officers G Greer, B.Agr.Sc. (Hons) T P Grundy, B.Sc. (Hons), M Research Officers J R Fairweather. B.Agr.Sc., BA, M.A., Ph.D. S. S. F. Gilmour, BA, MA (Hons) T. M. Ferguson, B.Com. (Ag) Secretary J Clark CONTENTS Page (i) UST OF TABLES (iii) LIST OF FIGURES (v) PREFACE (vii) ACKNOWLEDGEMENTS (ix) SUMMARY CHAPTER 1 CHAPTER 2 INTRODUCTION 1 1.1 Influences on Consumer Purchase and New Zealand's Changing Society 1 RESEARCH METHODOLOGY 3 2.1 2.2 2.3 2.4 The Sample The Questionnaire The Interviews The Analysis 3 3 3 4 2.4.1 2.4.2 2.4.3 Univariate and Bivariate Analysis Multivariate Analysis Cluster Descriptions 4 4 4 2.4.3.1 2.4.3.2 2.4.3.3 2.4.3.4 2.4.3.5 5 5 5 6 2.4.3.6 2.4.3.7 Cluster One: Older Males, Less Active Cluster Two: Young Actives Cluster Three: Single Women (20-50) Cluster Four: Outdoor Men Cluster Five: Middle-Aged and Older Housewives Cluster Six: Young Males Cluster Seven: Middle -Aged 2.5 Factor Descriptions 6 6 6 7 CHAPTER 3 SURVEY RESULTS 9 3.1 Introduction 3.2 General Purchase Behaviour 3.2.1 Frequency of Purchase 9 9 9 3.3 3.4 3.5 3.6 3.7 3.8 3.9 3.10 Reasons for Flower Purchase Major Competitors for Cut Flowers Popular Flower Types and Colours Cost of Most Recent Purchase Purchase Outlet Quality and Price Perceptions of VariOllS Outlets Why Individuals do not buy Cut Flowers Summary 10 12 14 15 16 17 18 19 20 REFERENCES APPENDIX ONE QUESTIONNAIRE 21 APPENDIX TWO TECHNICAL DETAILS 31 LIST OF TABLFS Page No. 1 2 3 4 5 6 7 8 Frequency of Cut Flower Purchase Reasons for Cut Flower Purchase Alternatives for Cut Flowers by Reason for Cut Flower Purchase Most Popular Flower Types Favourite Flower Colour Amount Spent on Most Recent Cut Flower Purchase Outlet of Last Flower Purchase Reasons for Not Buying Cut Flowers A2-1 Cluster Demographic Description A2-2 Demographics of General Purchase Patterns A2-3 Frequency of Flower Purchase and Associated Demographic/Psychographic Details of Cut Flower Buyers A2-4 Cluster Description of Reasons for Buying Cut Flowers A2-5 Cluster Description of Most Popular Flower Types A2-6 Cluster Description by Amount Spent on Most Recent Cut Flower Purchase A2-7 Outlet Cut Flower Purchased from by Frequency of Purchase and Cost of Purchase A2-8 Cluster Description by Outlet of Last Flower Purchase A2-9 Demographic and Psychographic Details of Those not Buying Cut Flowers i 10 11 13 14 15 16 17 18 32 34 35 36 37 38 39 40 41 LIST OF FIGURES Page No. A2-1 Perceptions of Respective Retail Outlets iii 42 PREFACE The Agribusiness & Economics Research Unit (AERU) has a close relationship with the Department of Economics & Marketing and assists with research within the Department and the publication of research results. This Research Report presents the results of research carried out in the Marketing Section of the Department and represents the outcome of research which was undertaken through the use of marketing undergraduates in the course of their study during 1989. The practical application of research techniques by undergraduates is seen as a central part of teaching in the marketing skills area. The AERU is pleased to be able to publish the results of the work both from the point of view of presenting material of relevance to investors in the cut flower industry and in the practical demonstration of the use of research techniques to analyse consumer demand. A C Zwart DIRECTOR v ACKNOWLEDGEMENTS The author wishes to acknowledge the considerable time and effort put in by the following undergraduate and postgraduate students. Apart from carrying out the interviews, they also participated in the design and coding of the questionnaire. CAdam M Aitchison EAng P Bishop L Brooks T Chaffey A Chambers L Chin D Clark R Clark P Caddaro S Crosson W Dodson A Domingo W Dowling A Drayton KEllett D Ellison-Smith E Fermin M Francis H Fraser C Hamilton B Hargreaves M Harris G Hay S Hayes R Hill E Heywood E Jervis Holguin P Jones F Kalma C Kyle J Lake A Lamers R Ludbrook C MacDonald G McFelin R McIntosh R McMillan S Neal B Nugroho A Plunket GRoss J Roy BRyan H Scott R Small G Stevens R Stewart J Swinbum RSyme M Thomas E Ward-Smith S Waters A Wilkinson Thanks also to Ms S Clemes for entering the data. G G Lamb September 1991 vii SUMMARY This report presents infonnation about cut flower purchase behaviour and was obtained from a survey of Christchurch households. Whilst primarily being a segmentation study, a comparison is also made with a Dutch consumer research programme. The focus for this segmentation study was lifestyle segments with differing purchase patterns being observable across the different groups. These purchase patterns include frequency of purchase, retail outlet, price sensitivity as well as reason for purchase. In analysing reason for purchase, attention has been paid to the importance of "situation" or "occasion" as a purchase detenninant. Other information presented in this report included popularity of flower variety and colour preferences. The study concludes with possible suggestions for alternative marketing strategies targeted at the different market segments. ix CHAPTER 1 INTRODUCTION Production of cut flowers in New Zealand is generally believed to have increased several-fold during the past decade. Support for this belief can be gained from statistics of annual value of export cut flowers over this period, which show steady growth. It can be presumed that there must have been growth in sales on the local New Zealand market also, but there does not appear to be any published data to show this. If the cut flower industry is to continue successful development, it is desirable that a sound local market is established as well as continued growth in exports. Such aims will be more readily achieved if adequate, reliable information is available. At present there is very little published information about the New Zealand cut flower market in terms of either its structure or purchaser behaviour. A small survey of the public in Christchurch by Kissel (1988) provided some initial information about flower purchase behaviour and this was useful in determining approaches used in the study described in this report. Van Tilburg (1984), in a very comprehensive study of consumer behaviour in choice of cut flowers and pot plants in the Netherlands, has drawn some useful conclusions with respect to that market. For example about 36% of households were habitual buyers, purchasing flowers about once per week. Seventy-five percent of flower purchases were for the home and 25% for gifts. In addition, Chrysanthemums were the most popular flower type, making up 25% of total purchases, while only five other crops, freesias, tulips, roses, carnations and daffodils, accounted for 60%. All other flowers made up less than 20% of total purchases. The main objective of this study was to determine whether such patterns as shown by Van Tilburg can be found in a culture such as that in New Zealand. In addition we aimed to determine if there are particular market segments which can be defined in terms of cut flower purchase behaviour. Such information will enable industry participants to better understand the attitudes towards, and perceptions of, cut flower products by New Zealanders. As a result it should be possible to develop marketing strategies, appropriate for those segments identified, as a means of establishing a more clearly defined and sound local market. This paper continues by describing the influence on consumer behaviour of changes in New Zealand society, and then describes a methodology for developing a market segmentation strategy for the cut-flower market. 1.1 Influences on Consumer Purchase and New Zealand's Changing Society It has become accepted in recent years that the average consumer is a sophisticated and complex individual. Understanding and explaining influential factors on consumer choice behaviour has become more important for the marketing manager wishing to improve his business performance. 1 2 These influential factors, often referred to as environmental (Loudon and Della Bitta), are things such as culture, social class, family influence as well as changing demographic and life style patterns. For example, van Tilburg's study highlights some major differences in flower purchase behaviour between New Zealand and the Netherlands. One explanation for this difference is the obvious cultural diversity between the two countries. Another environmental factor which Engel et al (1990) consider important is situational influence on consumption. Examples of this in flower purchase behaviour would be buying roses on Valentines Day or flowers for a funeral. The effect of situational determinants on cut-flower purchase behaviour is explicitly described in later sections of this report. In order to take account of these environmental factors, other than situation, it is important to initially discuss the changes in New Zealand which are likely to have some impact on businesses through the 1990's. In a study by Feigler et al in 1990, the impact of change in New Zealand Society was highlighted. It was noted that there has been a marked shift from the restless, fast-pace days of the 1980's. That was a decade of yuppies and dine's, of significant and rapid change, of wealth polarisation, of high fliers and BMW's, and of technology affecting and fragmenting families. The 1990's is recognised for the eclectic shift in life style, the move to family and quality of life. Technology in the 90's is being used to simplify life styles. There is a move from confrontation and self-focus of the 80' s to co-operation and enjoyment in the 90' s. The days of high income and no children are passing as couples in their 30's, previously dines, are now deciding to have children, with a consequent greater choice of family-work-career alternatives. Consumers are purchasing more products which relate to their interests, family and enjoyment of life eg health, fitness, and food. Quality of products and service is becoming more important. Whilst it has become more recently recognised that solely relying on demographics as a basis for market segmentation is unwise, the characteristics of the population, and changes in these characteristics, is still very important. In recent years New Zealand has experienced a reduction in the rate of population growth as well as a move towards an older population. There has also been a reduction in the size of households and a change in family relationships. This is exemplified with the increase in ex nuptial births and children staying longer at home. The northern-urban drift continues, and, as well as an increase in the average educational level of the population, the continued increase of women in the work force is noticeable. All of these changes in society will have a major impact on the sale of goods and services in New Zealand throughout the 1990's. The implication for producers, wholesalers and retailers is the necessity to take account of these changes in considering their future market opportunities. In light of this necessity this study explores a market segmentation methodology based on psychographic and demographic information from the Christchurch urban population. The report concludes with suggestions for possible market strategy formulation. CHAPTER 2 RESEARCH METHODOLOGY The research programme followed a two stage design similar to those proposed by Churchill (l987) and Aaker et al (l986). The first exploratory stage provided an extensive background to the cut flower industry through both qualitative techniques and searching relevant secondary information. The qualitative approach took the form of non-directive discussions with members from various sectors of the flower industry. This included producers, wholesalers and retailers, and provided valuable insights into the industry and its problems. The literature search encompassed areas such as industry statistics, trade association information and relevant consumer studies. Following this preliminary phase, and using information from it, a survey was designed to elicit information from the Christchurch population. 2.1 The Sample The population was defined as all adults in the Christchurch area aged 18 years and over. The sampling unit from which these individuals were drawn was each household. The planned sample of 684 households was drawn as follows: 1. Using Wises Directory (l979), Christchurch was divided into fifty-seven suburbs. 2. These suburbs were then allocated among five stratal. 3. The number of interviews drawn per strata and suburb were calculated proportionately on the number of streets per strata and suburb. From each suburb an address was randomly selected as a starting point for the required number of interviews. Every dwelling to the right of the start-point (on exit) was interviewed until the required number was achieved. 2.2 The Questionnaire A four page questionnaire of 140 variables was used after pilot testing and redrafting. The questionnaire elicited responses regarding purchase behaviour, care, usage, quality and price perceptions of cut flowers. Respondents were also asked to provide psychographic and demographic information. A copy of the questionnaire is attached as Appendix One. 2.3 The Interviews The interviews were carried out on 29th and 30th April 1989. The team of interviewers was IThe suburbs were divided into five strata based on socio-economic data supplied by the Sociology Department, University of Canterbury. 3 4 made up of 57 senior Lincoln College students. A total of 664 interviews were completed of which 647 were usable after editing and coding. The final sample has a tolerable error level of 4% at the 95% confidence interval. 2.4 The Analysis The data was coded and edited for computer analysis. This analysis took the form of univariate, bivariate and multivariate techniques within the SAS computer package. 2.4.1 Univariate and Bivariate Analysis The results were initially analysed in marginal frequency form. Chi-square tests were used to examine the relationships between variables and only those statistically significant at the 90% level of confidence are presented. 2.4.2 Multivariate Analysis Both factor and cluster analysis were performed on the data using the SAS computer package. The psychographic lifestyle information collected in question twenty of the questionnaire was used as input for the clustering method. The clustering approach taken followed the procedure suggested by Punj and Stewart (1983). Initially an average linkage hierarchical procedure was used which provided an indication of a candidate number of clusters and cluster centroids, but more importantly, it identified a number of outlying cases. After removing the outliers, a 'K' means, geometric iterative partitioning method was used on the seven candidate number of clusters selected. Seven clusters were selected from the initial method on the basis of variance reduction and interpretability. Descriptions of the seven clusters are outlined below. Factor analysis was performed on those variables which provided indications of how respondents felt when receiving flowers. This reduced the twenty seven variables concerned to three factors. Principal components analysis was used as a first factor method to suggest a likely number of factors. On the basis of eigenvalue reduction and common constructs within factors, it was decided to use a maximum likelihood factor method incorporating a varimax rotation, on three factors. An explanation of the three resultant factors are outlined below. 2.4.3 Cluster Descriptions Although the clusters were developed on the basis of lifestyle activities they are also described by their demographic characteristics. The description of each cluster relates to the characteristics which predominate in that cluster more than the sample average. However, it should be noted that the characteristics do vary within each cluster. For a detailed description of the clusters refer to Appendix 2, Table A2-1. The cluster sizes are as follows: 5 Cluster Number of Respondents 1 2 3 4 5 6 7 TOTAL 2.4.3.1 % 109 65 69 44 144 71 95 19.2 11.4 12.2 7.8 20.1 12.5 .16.8 567 100.00 Cluster One: Older Males, Less Active This cluster is comprised of older individuals, 50 plus, predominantly males, who exhibit a less active lifestyle. They tend to occupy themselves with passive "at-home" activity such as gardening, reading etc. This group has the highest level of retired individuals and a large number of beneficiaries. Cluster One's educational level is one mainly of primary and secondary education. As expected there are a larger number of widows and widowers in this cluster and in line with their age, income is also somewhat lower. 2.4.3.2 Cluster Two: Young Actives This cluster exhibits an extremely active lifestyle. They are very exercise conscious, being keen joggers, playing both solo and team sports frequently, yachting, tramping and surfing. Cluster 2 are the most avid snow-skiers and also enjoy swimming and visiting beaches. This group also appear to be the most social, "going out on the town" frequently, attending parties and visiting friends. This group are also the most conscious oftheir appearance, frequently buying fashionable clothes. Whilst their main media interest is watching TV2, a common past time is either watching or listening to sports. This group is comprised of a large number of males under the age of 30. Their educational level is reasonably high consisting of university entrance, higher school certificate, degree and trade qualifications. Although there are some students in this group, accounting for the high proportion of household income under $10,000 per annum, the majority of cluster two are employed in professional/managerial, clerical, sales and service areas. As a consequence this cluster also has a high proportion of its members residing in households where gross income is over $40,000 per annum. There is a very low level of married individuals in Cluster Two with a consequently high proportion of single, separated and divorced individuals. 2.4.3.3 Cluster Three: Single Women (20-50) This cluster is composed primarily of females in the 20 to 50 age group. They tend to have a reasonably high level of education, with university entrance, higher school certificate, degree or trade qualifications. As a consequence the majority are employed in professional/managerial areas or in service vocations. Cluster Three has a high percentage of its members earning $20,000 to $30,000 per annum and also more than $45,000 per 6 annum. This group has a high percentage of single, separated and divorced members as well as those living in defacto relationships. Members of this group frequently go walking, go to the movies, read novels, dine out and go shopping just for fun. Whilst this cluster are avid Listener readers, they have the lowest frequency of television viewing behaviour, of either television channel. 2.4.3.4 Cluster Four: Outdoor Men This group exhibits an outdoors life-style, frequently fishing, hunting, power boating and camping. They are predominantly males in the thirty to fifty age group. They are employed, in the professional/managerial, clerical, technical, services and tradesman occupations. Generally, their education level is one of secondary level only. They fall predominantly in the $30,000 to $50,000 income groups and have higher than average married and defacto marital status. 2.4.3.5 Cluster Five: Middle-Aged and Older Housewives This group has a high percentage (approximately 60%) of its individuals aged forty years and over. They tend to have passive interests, working in the garden, making handcrafts and spending time on hobbies. These individuals frequently watch TVI and read the Christchurch Star. Whilst a number have only a secondary education with school certificate, this group also contains a large number of individuals who have attended training college. There are a high number of beneficiaries, housewives and widows or widowers in this group. The gross household income levels of this cluster fall predominantly in the $10,000 to $20,000 and $25,000 to $35,000 salary ranges. 2.4.3.6 Cluster Six: Young Males This cluster has a high percentage (65%) under the age of thirty. The group is comprised mainly of males who frequently visit "pubs", and do not like visiting relatives or working in the garden. These individuals are qualified to university entrance and higher school certificate standard and vocations can be described as either tradesmen, labourers, unemployed or students. Consequently their gross household incomes are either very low, Le. under $10,000 per annum, or at a medium level, $35,000 to $40,000. This group consists predominantly of individuals who are either single, separated or divorced. 2.4.3.7 Cluster Seven: Middle-Aged This cluster has a high number of individuals in the 30 to 40 age group and also aged 50 and over. There is a higher than average number of individuals who are retired or housewives, and associated with this is a higher than average level of married and widowed individuals in this group. Cluster Seven has a reasonably high level of education having a larger than average number who have a university degree or training college qualification. This group have quite passive life-styles, reading the Christchurch Press frequently and listening to the National Radio programme. Cluster Seven has a high percentage of its households grossing $35,000 to $50,000 and $60,000 plus per annum. 7 2.5 Factor Descriptions Three distinctively different factors were identified from the twenty-seven feeling variables which were used as input in the factor analysis. The first factor described as a "Romantic Factor" accounted for the most variation in the twenty-seven input variables. The main variables contributing to this factor were those indicating feelings of being loved, feeling important, special, uplifted, thrilled, happy, emotional, cheerful, excited, bright etc. Factor two is one described by feelings of anger, suspicion, embarrassment, blandness and feelings of inappropriateness. The third factor is one associated with bereavement and highlight those variables associated with feelings of tearfulness, sadness, depression and general feelings of "nothing". CHAPI'ER 3 SURVEY RFSULTS 3.1 Introduction The following section reports the findings of the survey under six general headings. These are: (1) (2) (3) (4) (5) (6) general purchase behaviour, effects of situation on buying behaviour, popular flower types, cost considerations, distributional considerations and aspects of quality, non purchase behaviour. Appendix two contains specific tabular results pertaining to the fmdings reported in the following section. 3.2 General Purchase Behaviour The majority of the population (84 percent) have purchased cut flowers at some time in the past, and it appears that a slightly larger percentage of purchasers are female (87 percent) rather than males (80 percent). When examined on the basis of age and by cluster it appears that younger more active individuals are flower buyers. For instance, of those who purchase flowers, 50 percent are aged between twenty and thirty-nine years of age. Sixty-nine percent of flower buyers are aged between twenty and forty-nine. The clusters with the largest buying percentages were Cluster Two (91 percent) and Cluster Three (96 percent). (See Appendix Two, Table A2-2 for a detailed breakdown.) 3.2.1 Frequency of Purchase The majority of the population (56 percent) purchase flowers three to four times per year or more frequently. However only approximately 15 percent of the population purchase flowers once per month or more often. (Table 1 refers.) 9 10 Table 1 Frequency of Cut Flower Purchase Cluster 3 2,3 3,5 1,2,5 4,6 4,6 1,4,6 Frequency % Once per week Once per fortnight Once per month Once every two months 3-4 times per year Twice per year Once per year Less often Don't buy 2.9 0.6 11.6 9.3 23.1 11.9 13.9 10.5 16.1 TOTAL Valid cases Van Tilbufg 36.0 100.0 = 646 When frequency of purchase is analysed by demographic and psychographic indications, it is interesting to note females tend to purchase flowers with greater frequency, i.e. at least once every two months or more often. Consequently male flower buyers purchase flowers less frequently. It is also apparent that those aged between twenty and fifty years of age purchase flowers with greater frequency. These individuals also exhibit fairly active lifestyles. The older, less active members of the public tend to purchase flowers less frequently, i.e. once per year or less often. Table A2-3 in Appendix 2 provides a detailed analysis of purchase frequency. When frequency of purchase is analysed by cluster membership it is apparent that clusters two and three are more frequent purchasers of cut flowers. (Table A23 in Appendix 2 refers.) A comparison is provided in Table 1 of the frequency of flower purchase observed by Van Tilburg (1984) in his study of flower purchase in the Netherlands. 3.3 Reasons for Flower Purchase It is considered that specific situations or occasions such as Mothers' Day, St Valentine's Day etc are important determinants of flower purchase behaviour. In observing the reasons for purchase of flowers, the behaviour has been divided up into "degrees" of occasion. Zero-degree occasions are defined as those for which a number of alternatives could be given at any time. First-degree occasions are those for which flowers are commonly given, and second degree occasions are those for which flowers may more commonly be given. Table 2 provides a detailed analysis of reasons for cut flower purchase. 11 Table 2 Reasons for Cut Flower Purchase Zero Degree Occasion Reason % Birthday Impulse As a gift For the home Christmas To say 'Thank you' 15.0 5.0 Total 11.0 11.2 VT 75.0 0.7 3.4 46.3 First Degree Occasion For funeral Visit hospital or someone ill St Valentine's Day To give female/male friend As a romantic gift Visit a grave Flowers for a wedding 11.7 11.4 1.9 6.0 1.9 2.3 0.7 35.9 Second Degree Occasion To cheer someone up For Mothers' Day Anniversary For birth of a baby 2.2 1.5 4.5 2.9 11.1 Other 100.0 Valid Responses Note: 100.0 = 580 Percentages are expressed relative to the total number of responses. Allowance was made for respondents to make two responses. 12 It can be seen from Table 2 those reasons for purchase which are not strongly occasionbased, Le. Zero Degree Occasions, are virtually equal in number to the occasion-based reasons. As is indicated by a comparison to the results of Van Tilburg's (1984) study, New Zealand has exhibited a more "occasion based" purchase behaviour. When the segments, or clusters, are analysed by buying occasion some interesting patterns are noted. For instance, clusters one and seven share similar purchase behaviour. This tends to be associated with specific occasions such as funerals, hospital visits, grave visits, anniversaries and birth of a child. Clusters two and three are more associated with zero degree occasions. These seem to be more "one-off" impulse type purchases, such as gifts, for the home or romantic presents. Cluster four appear to mix their purchases across traditional flower buying occasions and occasional "non-flower" situation type purchases. Clusters five and six are more traditional situation flower buyers. Table A2-4 in Appendix 2 describes this behaviour in more detail. 3.4 Major Competitors for Cut Flowers It is also possible to identify the major competitive products for cut flowers for the broad groups of reasons identified above. Table 3 provides an indication of alternative products individuals might select instead of cut-flowers. Cut flowers have an advantage in those purchase situations where "nothing" is cited by a larger percentage of the sample, for example "flowers for a wedding", "visit to a grave", "for funeral, "Mothers Day", etc. 13 Table 3 Alternatives for Cut Flowers by Reason for Cut Flower Purchase Reason Major Alternatives2 Birthday No specific Alternative (all have equal weighting) Impulse Nothing (50%) Chocolate (15%) As a gift Chocolate (34%) Nothing (25%) Small gift (18%) Pot Plant (7%) For the house Nothing (52%) Pot Plant (10%) Dried Flowers (8%) Christmas No specific alternative (all have equal weighting) To say 'thank you' Chocolate (50%) Nothing (25%) Wine (12.5%) For funeral Nothing (61%) Donations (12%) Visit hospital/someone ill Nothing (32%) Fruit (25%) Chocolate (16%) Pot Plants (7%) St Valentine's Day Chocolate (38%) Nothing (25%) Small gift (25%) Card (12%) To give female/male friend Chocolate (42%) Nothing (29%) Small gift (8%) As romantic gift Nothing (57%) Chocolate (29%) Visit a grave Nothing (100%) Flowers for wedding Nothing (100%) To cheer someone up Chocolate (25%) Nothing (17%) For Mothers' Day Chocolate (60%) Pot Plant (40%) Anniversary Chocolate (37%) Nothing (26%) For birth of baby Chocolate (33%) Nothing (17%) Fruit (8%) Cards (8%) Dried flowers (8%) pot plant (8%) Valid Cases = 464 20nly those alternatives receiving more than 5% of total respnses for that reason are included. 14 3.5 Popular Flower Types and Colours It can be seen from Table 4 Carnations and Roses seem to be the most favoured type of flower. This table compares what individuals last purchased with what their favourite types are. Interestingly, both VanTilburg's study and this research demonstrate a similar total percentage of individuals purchasing five common flower types. Table 4 Most Popular Flower Types Cluster 6,3,2 4,1 7,5,4 7,4,1 6,3,1 6,1 7,3 7,6,4 6,5,2 6,5,4,3,1 3 6 6 2 7,4 Flower Type Leucodendron Roses + Chrysanthemums Carnations + Lillies Daffodils + Tulips + Daisies Gladiolus Gypsophila Orchids Freesias + Geraniums Iris Aster Protea Dahlia Cornflowers Limonium Caspea Violets Jonquil Mixed Bunch Posie Bowl Spring flowers Whatever's in season Other + Valid responses Note: Last Purchase = = 61.2 TOTAL Favourite Type 0.6 20.6 6.9 37.8 0.9 1.6 0.3 2.2 1.9 4.0 3.0 0.9 0.2 0.2 0.5 0.2 0.5 0.3 0.2 0.2 0.2 12.2 0.2 1.3 1.9 1.2 0.2 33.5 5.4 25.2 3.2 4.9 2.0 2.2 1.9 1.4 3.3 4.6 0.2 1.1 1.0 0.4 1.8 0.4 0.1 1.0 0.2 0.2 0.0 1.7 4.2 2.2 100.0 100.0 630 Van Tilburg * 25.0 * * * * * = 60.0 1250 Percentages expressed relative to the total number of responses. Allowance was made for respondents to make more than one choice. 15 When those popular flower types and the cluster characteristics are looked at in detail it is apparent that roses, daffodils, daisies, orchids, freesias, violets and iris are more preferred by cluster two and cluster three. Whilst clusters four and five share a similar liking of carnations and freesias, Cluster four also prefers chrysanthemums, lillies, spring flowers and freesias. Cluster six, as with clusters one and two, likes roses but also shows a demand, greater than the average population, for daffodils, tulips, gladiolis, orchids, and freesias. Clusters one and seven with its older core population has a varied preference for flower types. (Table A2-5 in Appendix 2 refers.) Table 5 indicates that red, pink and yellow are the most preferred flower colours. Table 5 Favourite Flower Colour Colour % Red Pink Yellow White Blue Purple Orange Pastels Bright Other No specific favourite 32.2 19.6 15.3 8.9 TOTAL 3.9 3.7 3.0 1.4 0.4 1.9 9.7 100.00 Valid Response = 980 Note: Percentages are expressed relative to the total number of responses. Respondents could indicate more than one preferred colour. 3.6 Cost of Most Recent Purchase As is apparent from Table 6 the majority of the buying population (53 percent) spend less than $10.00 on an average flower purchase. 16 Table 6 Amount Spent on Most Recent Cut Flower Purchase Amount % $1.00 to $4.99 $5.00 to $9.99 $10.00 to $14.99 $15.00 to $19.99 $20.00 to $24.99 $25.00 to $29.99 $30.00 to $34.99 $35.00 to $39.99 $40.00 to $44.99 $45.00 to $49.99 $50.00 to $59.99 $60.00 to $69.99 $70 and over Don't know Don't remark 23.8 29.6 8.7 4.8 5.9 6.3 3.7 3.0 2.3 0.2 3.0 0.6 1.1 2.0 --.iJl 100.00 Valid cases = 538 When purchase behaviour and frequency of purchase are analysed together, those individuals purchasing flowers more frequently, Le. once every two months or more often (24 percent of the population) generally spend less on each purchase, Le. $15.00 or less. Those who purchase flowers less frequently, Le. twice per year or less often (36 percent of the population) tend to spend more ($25.00 plus) on each purchase. Clusters one and five exhibit similar flower expenditure behaviour by tending to spend less on cut flowers. Clusters six and seven have medium to high expenditure levels on cut flowers with clusters two and three exhibiting lower to medium flower expenditure patterns. (Table A2-6 refers.) 3.7 Purchase Outlet The most popular distributional outlet for purchasing cut flowers is a florist. When respondents were questioned where they most recently purchased from it was apparent that florists, followed by dairy's and road-side stalls were the most popular. Table 7 provides an indication of the relative market share of cut flower outlets. 17 Table 7 Outlet of Last Flower Purchase Cluster Outlet % 7,2 7,6,3,1 6,5,4,3,1 3,1 5,3 5,4,2 1 3,5,7 Florist Dairy Roadside Stall/Grower Flower Barrow Supermarket Service Station Restaurant Other 57.9 17.1 12.4 4.3 3.6 3.0 0.2 ---.L.2 TOTAL 100.00 Valid Cases = 532 When analysed by frequency of purchase and dollar amount spent, the choice of cut flower outlet follows a particular pattern. For instance, growers, road-side stalls, dairies and flower barrows tend to be used for more frequent purchases, i.e. for purchases made once per month or more often. Florists tend to be more popular for less frequent purchases, three to four times per year and less often. There is a similar pattern when outlet is analysed by amount spent on cut flowers. In this situation buyers spending under $15.00 tend to buy from supermarkets, growers, road-side stalls, dairies and flower barrows. Those individuals spending $25.00 or more on cut flowers almost exclusively purchase from florists. Table A2-4 in Appendix 2 provides further information. It is apparent that clusters three and five consider convenience and availability important purchasing from supermarkets, stalls, fruit shops, dairies and service stations. Clusters two and seven patronise florists more than the average population with cluster seven also buying from dairies and fruit shops. Clusters one and six are similar in purchasing from growers and dairies more than the average member of the population. Refer to Table A2-8 in Appendix 2 for a detailed explanation. 3.8 Quality and Price Perceptions of Various Outlets Respondents were asked to provide an indication of expected cut flower quality and price of various distributional outlets. To do this the respondents had to indicate on a 7 point scale what quality and price of cut flowers they would expect from various outlets. The mean value of each of these attributes was calculated and acted as input into a perceptual map. 18 Also included on the map are the relative market shares as shown in Figure 2-1 of Appendix 2. It is noticeable from this that there are two general clusters of outlets, with florists being established on their own. Supermarkets, dairies and petrol stations are one group clustered at a medium perceived level of price and quality. Road-side stalls, growers, flower barrows and restaurants are clustered on a similar medium-high perceived quality level, however, this group vary a great deal on perceived price. Florists are singularly isolated with the highest level of quality and price. 3.9 Why Individuals do not buy Cut Flowers The single largest reason for individuals not buying cut flowers is the fact they grow their own. (Table 8 refers.) TABLE 8 Reasons for Not Buying Cut Flowers Reason % Grow Own Not interested Too expensive No need Not a flower person Allergic Don't like flowers Never thought of it Other 36.9 8.1 TOTAL Valid responses 6.3 16.2 5.4 1.8 4.5 6.4 14.4 100.0 = 111 From Table A2-9 in Appendix 2 it is apparent that older individuals particularly in clusters one and five grow their own flowers and this tends to be a major factor in them not buying flowers. It is also noticeable that it is mainly males who are not interested, don't like flowers or don't perceive a need to buy them. When asked whether or not they intended buying flowers in the future only 12 percent of the sample emphatically stated that they would not. These individuals tended to be males who were aged over 60. These non future buyers were in clusters one and seven. Again, the major reason for probably not buying in the future related to individuals growing their own flowers. Similarly it was predominantly 19 males who definitely did not want to receive flowers at any time in the future. However, these individuals tended to be in the thirty to sixty age group and were predominantly in clusters one, four, six and seven. 3.10 Summary The findings presented in this report provide information useful in the development of marketing for the cut flower industry. By targeting appropriate segments (clusters) and using a strategy more oriented to the individual cluster, there should be improvement in sales. For example the following broad strategies would be appropriate. Clusters two and three show a tendency for more frequent purchase, being primarily for nonoccasion based reasons. These individuals could be targeted in the low to medium price range primarily by florists and those retailers with a greater convenience coverage e.g. roadside stalls, flower barrows, dairies, supermarkets etc. These motivations and psychographic details provide ample opportunity for a promotion programme to be developed. Clusters one and seven show a tendency of less frequent purchase primarily for very specific occasions e.g. funerals, hospital visits or birth of a child. Whilst they would purchase for some occasions from a florist, they also are convenience and cost conscious often buying from growers or dairies and generally spending small to medium amounts on each purchase. Clusters five and six are similar in their type of purchase being more occasion determined e.g. hospital visits, i.e. a gift for a partner or friend; for mothers day or birth of a child. These two clusters do however vary a little with cluster five purchasing a little more frequently but perhaps spending less on each purchase than cluster six. Both of these clusters exhibit similar "convenience" behaviour purchasing from supermarkets, growers, dairies, stalls, service stations and fruit shops. Cluster four tends to purchase less often for a wide range of reasons, however, their expenditure is quite low. They also tend to be "convenience" buyers. These examples indicate the value of such segmentation study for product positioning, pricing, promotion and distributional strategies. REFERENCES Aaker, D A, Day, G S (1986), "Marketing Research", Wiley, 3rd edition. Churchill, G A (1987), "Marketing Research. Methodological Foundations". Dryden Press, NY, 4th edition. Engel, J F, Blackwell, R D, and Miniard, P W (1990), "Consumer Behaviour", The Dryden Press, 6th Edition, Chap 7 pp 204-221. Feigler, B, Lawson, R, Mueller-Heumann, G, and Rumnel, A (1989), "New Zealand into the 1990's: A Comprehensive Survey of New Zealanders' Opinions and Lifestyles", Readers Digest Ltd, November. Kissel, R (1988), Market Survey Canterbmy Commercial Flower Growers' Association, MAP Tech, Lincoln. Loudon, D and Della Bitta, A J (1988), "Consumer Behaviour. Concepts and Applications" , McGraw Hill, 3rd edition, Part 3, pp 163-349. Punj, D and Stewart, D W (1983), "Cluster Analysis in Marketing Research: Review and Suggestion for Application", Journal of Marketing Research, 20 pp 134-148. Tilburg, A van (1984), "Consumer Choice of Cut Flowers and Pot Plants: A Study Based on Consumer Panel Data of Households in the Netherlands", Agricultural University Wageningen Papers 84-2. Wises Post Office Directory (Volume 4, 1979). 20 APPENDIX ONE QUESTIONNAIRE 21 22 Questionnaire No. c=J 1989 CUT FLOWER SURVEY Good morning/afternoon, I am from Lincoln College Marketing Department. We are doing a survey about the cut flower market. Would you help us by answering a few questions. Ask to speak to someone in the household who is aged 18 years or over. If this is not possible thank the respondent and close the interview. FOR OFFICE USE 1. 2. (a) Have you ever purchased cut flowers? IF NO, GO TO QUESTION 3. (b) About how often would you buy fresh cut flowers? Once per month [ Once per week [ ] Once every two months [ ] 3-4 times per year [ ] Twice per year [ ] Less often [ ] Once per year [ ] No [ ] o o What was the reason(s) for buying the flowers? •••••••••••••••••••••••••••••••••••• 11II • 11II •••••••••••••••••••••••••• (b) What else could you have purchased instead of flowers for this purpose? (NOTE: PROBE FOR UP TO THREE POSSIBLE ALTERNATIVES.) (c) Why were flowers appropriate? (d) What type of flowers did you buy in this instance? (e) How were the flowers presented, e.g., bouquet, cut bunch, prepackaged, etc. . 11II •••••••••••••••••••••••••••••••• (f) Could you recall, very approximately, about how much they cost? (g) What outlet did you buy these flowers from? GO TO QUESTION 4. Why have you never purchased cut flowers? • 4. Yes [ ] Would you please think back to the last time you purchased cut flowers. (a) 3. (TICK) ••••••••••••••••••••••••••••••••••• 11II •••• 0 •••••••••••••••••••••••••••• B Are you likely to buy flowers at any time in the future? Yes [ ] Don' t know [ ] No [ ] IF NO, WHY NOT? .••.....•.............•.......................... IF NO, GO TO QUESTION 6. o Line 1 23 5. I would now like to give you a card (GIVE RESPO NDENT CARD A) and ask you what sort of quali ty of cut flowe rs YOU WOULD EXPECT if you bough t them at the follow ing outle ts. Pleas e indic ate with the appro priate numbe r from the card. (a) (b) (c) 6. (a) Gates Sales of Comm ercial Growe r (Road -Side Stall ) [ J Dairy J Super marke t [J Flori st J Flowe r Barrow [ ] In a Resta urant ] Petro l Statio n [ J I would also like you to take the secon d card and give an indic ation of the price of flowe rs you would expec t if you were to purch ase flowe rs from the follow ing outle ts. Pleas e indic ate with the appro priate numbe r from the card. Dairy [ J Super marke t [J Gate. Sales of Comm ercial Growe r (Road -Side Stall ) Flori st [ J Flowe r Barrow [ ] In a Resta urant [ ] Petro l Statio n [ J How long would you expec t any cut flowe rs you buy to last? Have you ever been given flowe rs or purch ased them for yours elf? Yes [ ] No [ ] IF NO, GO TO QUESTION 7. o o Line 2 Think ing back to the last time you eithe r recei ved flowe rs from someo ne else or purch ased them for yours elf. (b) Who did you recei ve them from? (NOTE: PROBE FOR GENDER AND RELATIONSHIP OF THE GIVER IF NOT IMMEDIATELY OBVIO US.) (C) What was the reaso n(s) for being given /purc hasin g the flowe rs? (d) Give respo ndent CARD C and ask them to indic ate how they felt about gettin g/rec eivin g flowe rs in this situa tion [ ] (e) Tick any or all of the follow ing which would descr ibe how you felt about gettin g/buy ing the flowe rs at that time. I felt speci al [ J I felt loved I was suspi cious [ J I felt angry I felt embar rassed [ ] I felt tearf ul I felt impor tant [ ] I felt amuse d I felt uplif ted [ ] I felt happy I thoug ht it INapp ropria te [ ] I felt sad I felt confu sed [ ] I felt surpr ised I felt thrill ed [ ] I thoug ht it appro priate I was being thoug ht of [J I felt emoti onal I felt cheer ful [ ] I felt brigh t I felt depre ssed [ ] They cheer ed me up I felt nothi ng [ ) It made me remem ber I felt excit ed [ J I felt bland I thoug ht it would brigh ten up the place [ ) o CD o [ [ [ [ [ [ [ [ [ [ [ [ [ J J ] ] ] ] ] ) ] ) ) ] ) '-- Line 3 24 7. Would you like to be given flowers at some time in the future? Yes [ ] No [ ] Don' t know [ ] IF NO, WH'Y NOT? 8 •••••••••••••••••••••••••••••••••••••••••••• IF NO, GO TO QUESTION 13. 8. Tick any or all of the following which you would do when you receive flowers, i.e., how you would look after them. Keep in a cool place Put them in a vase and leave them Cut the stems Put vinegar in water Change the water every few days Burn the stems Recut the stems every few days 9. [ [ [ [ [ [ [ Put them in cold water Hammer the stems Put salt in the water Keep them in a warm place Put them in warm water Add a preservative to the water ] ] ] ] ] ] ] [ [ [ [ [ [ ] ] ] ] ] ] '-- Give respondent CARD D and ask them to indicate how they would rate the statements using the scale on the card. (a) (b) (c) (d) (e) (f) Means more to me ... Only like particular types Makes place brighter Quality varies Flowers are luxury Flowers are feminine [ [ [ [ [ [ ] ] ] ] ] ] Line 4 10. What are your favourite types of flower? RECORD AS STATED.) (ALLOW FOR THREE TYPES AND o o o l. 2. 3. 11. What are your favourite flower colours? (RECORD FIRST TWO GIVEN.) o o l. 2. 12. What characteristics do good quality flowers have? (RECORD FIRST THREE.) l. ......................................................... 2. . 3. .. . . 13. Do you grow flowers in your garden? 14. Gender of respondent. Male [ ] Yes [ ] Female [ ] No [ ] o o o o o Line 5 25 15. To what age group do you belon g? Under 20 [ ] 20 - 30 [ ] 30 - 40 [ ] 40 - 50 50 - 60 [] 60 and over [ ] Will not discl ose o 16. What is your occup ation? o o o 17. What is the highe st level of educa tiona l quali ficati on you have attain ed? ,. . 18. What is your marit al statu s? 19. What is your house hold's appro ximat e gross annua l incom e? less than $10,0 00 [ ] $10-$ 15,00 0 [ ] $15-$ 20,00 0 $20-$ 25,00 0 [ ] $25-$ 30,00 0 [ ] $30-$ 35,00 0 $35-$ 40,00 0 [ ] $40-$ 45,00 0 [ ] $45-$ 50,00 0 $50-$ 55,00 0 [ ] $55-$ 60,00 0 [ ] over $60,0 00 Don' t know [ ] Will not disclo se [ ] o 20. On the follow ing scale indic ate how often you under take the follow ing activ ities? (SPEC IFY APPROPRIATE NUMBER BESID E ACTIV ITY.) never rarel y occas ional ly frequ ently very frequ ently Line 6 1---------------1---------------1---------------1---------------1 2 3 4 5 1 Go for walks [ ] Go joggi ng [ ] Watch or listen to sport s [ ] Work in the garde n [ ] Visit pubs [ ] Snow ski [ ] Visit relat ives [ ] Read novel s [ ] Watch telev ision (chan nel 1) [ ] Read the Chch Star [ ] Go tramp ing [ ] Play solo sport s [ ] Read the Chch Press [ ] Liste n to stere o [ ] Spend time on a hobby [ ] Go shopp ing for fun [ ] Watch telev ision (chan nel 2) [ ] Exerc ise [ ] Liste n to Natio nal Radio Progra mme Go to the movie s Go fishin g Buy fashio nable cloth es Atten d parti es Go hunti ng Go yacht ing Go out on the town Dine out Go power boati ng Go campi ng Play team sport s Go swimm ing Make handc rafts Visit friend s Go surfin g Atten d conce rts Visit the beach Read the Liste ner [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ [ ] ] '-- END OF DATA MARKER o Line 7 INTERVIEWER NAME: DATE: TIME: RESPONDENT PHONE NO: 26 CARD A Qual itv Very Poor Neith er Poor Nor Good Very Good 1--- ----- 1--- ----- 1--- ----- 1--- ----- 1--- ----1 ----- --1 1 2 3 4 5 6 7 27 CARD B Price Very Low Reas onab le Very High 1--- ----- 1--- ----- 1--- ----- 1--- ----- 1--- ----1 ----- --1 1 2 3 4 5 6 7 28 CARD C On the fol low ing sc ale , be ing giv en flo we rs in th ple ase in di ca te how mu ch bu yin g or is sit ua tio n me an t to yo u. It me ant no thi ng to me 1------------1------------1------------1 1 2 3 4 It me ant a gr ea t de al ------------1 5 29 CARD D Ple ase se lec t the num ber clo se ly sho ws how yo u fee of the fol low ing sc ale wh ich mo st l ab ou t the fol low ing sta tem en ts. Str on gly Di sag ree Di sag ree Ne utr al Ag ree 1------------1------------1------------1 1 2 3 Str on gly Ag ree ------------1 4 5 (a) When som eon e giv es me flo if the y had giv en me we rs it me ans mo re to me tha n an oth er typ e of gi ft, ch oc ola tes , a ca rd , etc . e.g ., (b) I on ly re all y lik e a pa rti cu lar typ e of flo we r. (c) Ha vin g flo we rs aro un d the ho use br ig ht er and mo re ple as an t. (d) Th e qu ali ty of gr ea t de al. (e) Flo we rs are a lux ury ite m. (f) Flo we rs are a ve ry fem ini ne thi ng . cu t flo we rs I ma kes the pla ce see m ha ve rec eiv ed va rie s a APP END IX TWO TECH NICA L DETAILS 31 32 TABLE A2-1 Cluste r Demographic Description Cluster Sample (Average) 1 2 45.0 55.0 51.0 49.0 66.2 33.8 30.4 69.6 WND 6.2 25.6 22.2 17.6 9.3 18.0 1.1 0.0 11.9 11.0 20.2 18.4 35.8 2.8 23.1 43.1 29.2 3.1 0.0 0.0 1.5 Occupation Prof/M gr Trades/ lab Cler/Sales & Svc Technical Service Ind Unemployed Retired Housewife Studen t Self Employed Beneficiary Other WND 8.2 8.9 8.2 3.4 16.3 3.4 15.1 23.3 8.9 1.9 0.9 0.9 0.7 6.4 9.2 6.4 2.7 9.2 4.6 36.7 19.3 0.9 1.8 1.8 0.0 0.9 Education Primar y only Secondary only School Cert UElHS C Trg Col Trade Qual Degree Other WND 4.4 25.1 17.0 21.8 2.0 9.7 14.7 2.8 2.6 12.6 34.0 20.4 12.6 0.0 3.4 8.7 2.9 4.9 Gender Male Females Age < 20 20-29 30-39 40-49 50-59 60+ 3 4 5 6 68.2 31.8 12.3 87.7 69.0 31.0 45.3 54.7 7.2 43.5 29.2 20.3 5.8 0.0 0.0 6.8 13.6 31.8 27.3 4.6 15.9 0.0 0.9 14.0 24.6 20.2 13.2 26.3 0.9 14.1 50.7 18.3 15.5 1.4 0.0 0.0 1.1 16.8 25.3 16.8 11.6 27.4 1.1 13.9 10.8 12.3 3.9 21.5 6.2 0.0 3.1 27.7 1.5 0.0 0.0 0.0 13.0 4.4 8.7 7.3 26.1 2.9 1.5 18.8 13.0 1.5 0.0 1.5 1.5 13.6 18.2 11.4 4.6 15.9 0.0 20.5 11.7 2.3 0.0 0.0 2.3 0.0 1.8 1.8 4.4 1.8 17.7 0.0 14.2 51.3 27.7 1.8 1.8 0.0 0.9 8.5 16.9 11.3 1.4 14.1 9.9 0.0 9.9 18.3 5.6 1.4 2.8 0.0 7.6 8.7 7.6 4.4 14.2 1.1 20.7 27.2 5.4 1.1 0.0 1.1 1.1 0.0 10.9 7.8 50.0 0.0 12.5 17.2 0.0 1.6 1.5 13.0 10.1 27.5 1.4 14.5 26.1 1.5 4.4 2.3 32.6 16.3 14.0 2.3 16.3 11.6 2.3 2.3 5.7 28.7 25.0 15.7 2.8 7.4 5.6 7.4 1.9 2.9 27.1 15.7 24.3 0.0 10.0 18.6 0.0 1.4 1.1 24.7 16.9 16.9 6.7 10.1 20.2 2.3 1.1 (continued) 7 33 TABLE A2-1 (continued) Cluster Sample (Average) 1 2 3 4 5 6 7 Gross Household Income (000) <$10 $10-$14.9 $15-$19.9 $20-$24.9 $25-$29.9 $30-$34.9 $35-$39.9 $40-$44.9 $45-$49.9 $50-$54.9 $55-$59.9 $60+ Don't know WND 7.2 10.9 6.4 8.3 7.8 7.4 7.8 8.3 4.6 2.7 2.1 6.0 9.4 11.1 7.3 18.4 7.3 8.3 5.5 5.5 5.5 7.3 1.8 0.9 0.9 3.7 13.8 13.8 12.3 3.1 1.5 10.8 6.2 6.2 4.6 9.2 7.7 1.5 3.1 16.9 10.8 6.2 5.8 2.9 2.9 10.1 10.1 8.7 7.3 8.7 8.7 7.3 5.8 10.1 7.3 4.4 0.0 9.1 4.6 6.8 6.8 11.4 15.9 15.9 6.8 0.0 0.0 2.3 9.1 11.4 4.4 19.3 14.0 7.0 11.4 9.7 6.1 3.5 3.5 1.8 1.8 0.0 8.8 8.8 16.9 5.6 5.6 11.3 8.5 5.6 8.5 5.6 4.2 4.2 1.4 4.2 7.0 11.3 4.3 8.5 3.2 5.3 5.3 6.4 10.6 12.8 3.2 3.2 2.1 8.5 7.5 19.2 Marital Status Married Single Sep/Div Defacto Widow(er) 60.8 23.3 5.9 1.4 8.7 70.1 7.5 6.5 1.9 14.0 30.8 60.0 6.2 1.5 1.5 52.9 33.8 7.4 4.4 1.5 75.0 11.4 2.3 4.6 6.8 67.5 10.5 5.3 0.0 16.7 39.4 50.7 8.5 0.0 1.4 77.7 8.5 4.3 0.0 9.6 Valid Cases Note: = 567 All figures are percentages. 34 TABLE A2-2 Demographics of General Purchase Patterns Sample Average Purchase Cut Flower Yes No Gender Male Female 80.0 86.5 20.0 13.5 71.0 86.2 88.1 88.0 86.8 73.5 66.7 29.0 13.8 11.9 12.0 13.2 26.5 33.3 73.4 90.8 95.7 86.4 86.0 73.2 85.3 26.6 9.2 4.3 13.6 14.0 26.8 14.7 Age <20 20-29 30-39 40-49 50-59 60+ WND Cluster 1 2 3 4 5 6 7 Valid Cases = 567 35 TABLE A2-3 Frequency of Flower Purchase and Associated Demographic/Psychographic Details of Cut Flower Buyers Once/ week Once/ fortnight Once/ mth Frequency (%) Once/ 3-4/yr 2 mths 2/yr l/yr Less Often Sample Average 3.4 0.7 13.7 10.6 29.9 13.9 15.4 12.4 Gender Male Female 3.4 3.3 0.5 0.7 10.3 16.3 8.8 11.9 30.9 29.3 15.2 13.0 16.2 14.8 14.7 10.7 4.0 2.4 5.4 5.7 0.0 1.3 0.0 0.0 0.0 1.8 0.0 0.0 1.3 0.0 28.0 17.6 14.4 10.2 15.2 4.0 25.0 4.0 11.2 9.9 13.6 10.9 9.3 0.0 24.0 33.6 29.7 25.0 37.0 28.0 25.0 8.0 16.0 10.8 14.8 10.9 17.3 25.0 24.0 10.4 14.4 17.1 17.4 18.7 25.0 8.0 8.8 13.5 13.6 8.7 20.0 0.0 1.3 3.4 12.1 2.6 3.1 1.9 0.0 0.0 0.0 0.0 5.3 1.0 0.0 0.0 10.0 20.3 21.2 13.2 10.2 13.5 11.1 7.5 11.9 16.7 5.3 13.3 11.5 6.2 33.8 35.6 25.8 26.3 31.6 21.2 30.9 15.0 10.2 13.6 18.4 13.3 15.4 13.6 15.0 10.2 9.1 15.8 14.3 17.3 24.7 17.5 8.5 1.5 13.2 13.3 19.2 13.6 Age <20 20-29 30-39 40-49 50-59 60+ WND Cluster 1 2 3 4 5 6 7 Valid Cases = 474 TABLE A2-4 Cluster Description of Reasons for (J' Birth- Impulse Occasion Gift day Sample Average Buyin~ Cut Flowers Z' Occasion 1° Occasion For home Xmas Thank You Funeral Hospital Illness Valentine Day Give Male IFemale Romantic Gift Visit Grave Wedding Cheer Up For Mother's Day Anniversary Birth of Child 17.6 4.6 10.2 12.3 0.9 3.7 13.4 13.0 1.9 6.3 1.6 2.5 0.9 2.8 1.2 4.4 2.8 1 16.7 2.8 12.5 8.3 0.0 4.2 18.1 15.3 0.0 4.2 0.0 4.2 0.0 2.8 1.4 5.6 4.2 2 19.6 0.0 14.3 21.4 3.6 3.6 8.9 3.6 3.6 5.4 3.6 0.0 0.0 5.4 0.0 5.4 1.8 3 19.7 9.8 13.1 16.4 0.0 4.9 6.6 8.2 3.3 6.6 3.3 1.6 0.0 1.6 0.0 4.9 0.0 4 22.2 8.3 2.8 16.7 0.0 2.8 5.6 16.7 5.6 5.6 0.0 5.6 0.0 0.0 2.8 2.8 2.8 5 12.6 3.4 8.0 16.1 0.0 5.7 19.5 17.2 0.0 2.3 0.0 3.4 0.0 2.3 3.4 1.1 4.6 6 20.8 6.3 6.3 2.1 4.2 2.1 8.3 16.7 4.2 14.6 4.2 0.0 0.0 4.2 0.0 4.2 2.1 7 17.4 4.3 11.6 5.8 0.0 1.4 18.8 l3.0 0.0 8.7 1.4 2.9 1.4 2.9 0.0 7.2 2.9 Cluster TABLE A2-5 Cluster Description of Most Popular Flower Types TYPE Roses Camations Chrys Lillies Daffs Tulips Daisies Spring Gladis Gypsoph Orchids Freesias Violets Iris Aster Protea Dahlias 55.0 22.7 3.2 I.1 2.5 I.1 2.0 0.9 I.1 0.5 3.2 4.8 0.2 0.5 0.5 0.2 0.5 1 48.0 18.7 8.0 2.7 5.3 2.7 1.3 0.0 1.3 0.0 1.3 6.7 0.0 1.3 1.3 0.0 1.3 2 68.4 19.3 0.0 0.0 1.8 1.89 1.8 0.0 0.0 0.0 5.3 0.0 1.8 0.0 0.0 0.0 0.0 3 67.3 18.2 0.0 0.9 3.6 0.0 3.6 0.0 0.0 0.0 1.8 3.6 0.0 1.8 0.9 0.0 0.0 4 42.4 30.3 9.1 3.0 0.0 0.0 0.0 3.0 3.0 0.0 0.0 9.1 0.0 0.0 0.0 0.0 0.0 5 53.1 26.5 3.1 0.0 1.0 1.0 2.0 1.0 0.0 1.0 4.1 6.1 0.0 0.0 1.0 0.0 0.0 6 58.3 14.6 2.1 0.0 4.2 2.1 2.1 0.0 2.1 0.0 6.3 4.2 0.0 0.0 0.0 2.1 2.1 7 48.6 29.7 1.4 2.7 1.4 0.0 2.7 2.7 2.7 1.4 2.7 4.1 0.0 0.0 0.0 0.0 0.0 Sample Av Cluster TABLE A2-6 Cluster Description by Amount Spent on Most Recent Cut Flower Purchase AMOUNT $1$4.99 $5$9.99 $10$14.99 $15$19.99 $20$24.99 $25$29.99 $30$34.99 $35$39.99 $40$44.99 $45$49.99 $50$59.99 $60$69.99 $70+ 26.6 31.5 9.8 5.3 6.2 6.6 3.9 3.0 2.7 0.2 3.2 0.7 0.9 1 29.6 33.8 7.0 2.8 9.9 8.5 1.4 1.4 1.4 0.0 2.8 0.0 1.4 2 19.0 37.9 10.3 5.2 8.6 3.4 1.7 0.0 5.2 1.7 1.7 1.7 3.4 3 28.1 32.8 6.3 6.3 4.7 3.1 4.7 4.7 4.7 0.0 1.6 1.6 1.6 4 12.1 48.5 15.2 6.1 0.0 9.1 6.1 3.0 0.0 0.0 0.0 0.0 0.0 5 32.6 29.3 9.8 6.5 3.3 6.5 3.3 2.2 2.2 0.0 4.3 0.0 0.0 6 24.4 28.9 8.9 6.7 6.7 11.1 4.4 4.4 2.2 0.0 0.0 2.2 0.0 7 25.3 20.0 13.3 4.0 8.0 6.7 6.7 5.3 2.7 0.0 8.0 0.0 0.0 Sample Av Cluster 00 (V) TABLE 2-7 Outlet Cut Flower Purchased from by Frequency of Purchase and Cost of Purchase Outlet Sample Average Florist Supennarket Grower Road! Side Stall Dairy Flower Barrow Service Station Fruit Shop Restaurant Other 56.8 3.2 12.4 15.9 4.7 3.2 1.3 0.2 1.1 37.5 66.7 41.5 44.0 60.3 65.6 64.8 61.4 0.0 0.0 4.6 10.0 1.4 1.6 1.4 5.3 18.8 33.3 15.4 12.0 14.2 14.1 5.6 8.8 25.0 0.0 26.2 18.0 14.9 7.8 14.1 14.0 12.5 0.0 7.7 8.0 3.6 3.1 1.4 5.3 0.0 0.0 3.1 8.0 2.1 3.1 5.6 0.0 6.3 0.0 0.0 0.0 1.4 0.0 2.8 1.8 0.0 0.0 0.0 0.0 0.0 0.0 1.4 0.0 0.0 0.0 1.5 0.0 1.4 3.1 0.0 0.0 25.2 39.6 61.9 87.0 89.0 93.0 88.0 100.0 91.7 100.0 100.0 100.0 100.0 8.1 3.7 2.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 20.7 15.7 11.9 8.7 7.4 3.5 11.8 0.0 8.3 0.0 0.0 0.0 0.0 30.6 23.9 11.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 7.2 5.2 9.5 4.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.8 9.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 3.6 0.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.8 0.8 2.4 0.0 3.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Frequency Once/week Once/fortnight Once/Month Once 2 months 3-4/year 2/year l/year Less often Cost of Purchase $1-4.99 $5-9.9 $10-14.99 $15-19.99 $20-24.99 $25-29.99 $30-34.99 $35-39.99 $40-44.99 $45-49.99 $50-59.99 $60-69.99 $70 plus Valid cases = 474 TABLE A2-8 Cluster Description by Outlet of Last Flower Purchase OUTLET Florist Super Market Grower Dairy Stall Flower Barrow Service Station Fruit Shop Restaurant 58.3 3.3 3.7 16.2 9.0 4.8 3.3 1.3 0.2 1 52.6 3.9 7.9 17.1 7.9 7.9 0.0 1.3 1.3 2 66.7 1.8 1.8 15.8 5.3 3.5 5.3 0.0 0.0 3 9.4 9.4 3.1 21.3 25.0 15.6 3.1 3.1 0.0 4 44.4 2.8 5.6 16.7 13.9 2.8 13.9 0.0 0.0 5 56.4 5.3 1.1 13.8 10.6 4.3 6.4 2.1 0.0 6 59.6 1.9 7.7 17.3 9.6 3.8 0.0 0.0 0.0 7 67.1 1.3 2.6 18.4 5.3 2.6 0.0 2.6 0.0 Sample Average Cluster TABL E A2-9 Demo eraph ic and Psych oerap hic Details of Those not Burln e Cut Flowers Reason Grow Own Not Interested Too Expensive No Need Not Flower Person Allergic Don't Like Flowers Never Thought of Other Sample Average 36.6 7.5 6.5 18.3 3.2 1.1 5.4 5.4 16.1 Gender Male Female 27.5 47.6 11.8 2.4 3.9 9.5 23.5 11.9 3.9 2.4 1.9 0.0 7.8 2.4 3.9 7.1 15.7 16.7 Age < 20 20-29 30-39 40-49 50-59 60+ WND 0.0 15.0 20.0 25.0 100.0 66.7 0.0 10.0 5.0 13.3 0.0 0.0 7.4 50.0 0.0 20.0 13.3 0.0 0.0 0.0 0.0 60.0 10.0 20.0 33.3 0.0 3.7 50.0 0.0 5.0 6.7 0.0 0.0 3.7 0.0 0.0 0.0 0.0 0.0 0.0 3.7 0.0 0.0 20.0 0.0 0.0 0.0 3.7 0.0 10.0 10.0 13.3 0.0 0.0 0.0 0.0 20.0 15.0 13.3 42.0 0.0 11.1 0.0 Cluster 1 2 3 4 5 6 7 48.3 0.0 33.3 16.7 56.3 10.5 50.0 10.3 0.0 0.0 0.0 0.0 15.8 7.1 3.5 0.0 33.3 0.0 6.3 10.5 7.1 6.9 33.3 0.0 66.7 12.5 21.1 21.4 6.9 16.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 7.1 3.5 16.7 0.0 0.0 6.3 10.5 0.0 6.9 16.7 0.0 0.0 12.5 0.0 0.0 13.8 16.7 33.3 16.7 6.3 31.6 7.1 Valid Cases = 474 42 Figure 2- 1 Perceptions of R es pe ct iv e R etail Outlets Qu ali ty HIGH 7 .. .. -- -- -- -- -- -- -- -- -- -- -- -- -- -. * Flo ris t / (57.9%) 6R/S Sta ll (12.4%) 5- Supermarket (3.6%) * * Flower * Bar row */ Re(0.1staura%) nt (4.3%) I ~ I Dairy (17 .1% ) * Pet rol Sta tio n (3.0%) 21- LOW 1 L -_ _---1 I 1 LOW 2 --!. - 3 -.L - 4 -l.- ~I 5 6 Perceived Pr ic e Av era ge pre fer en ce of 53 9 res po nd en ts in Ch Ch Ho us eh old Su rve y, Ma y 19 89 __J 7 HIGH 43 MAR KET SEGM ENT DETAll.S FOR STRATEGY DEVELOP:MENT Clusters 2 and 3 More frequent purchasers, primarily impulse type buying or non occasion based purchasing. Target low to medium prices. Outlets using convenience (wide availability) and quality as positioning statement. Promotion aimed at appropriate sources (print media eg More, North and South). Advertising must have appropriate creative content. Clusters 1 and 7 Purchase less frequently for primarily specific occasions. Whilst often purchase from a florist convenience of availability very important. Tend to be more cost conscious. Less frequent purchasers. Promotion message more appropriate to tradition - and occasion. Cluster 5 Tends to be more occasion based than impulse. While this group tend to purchase slightly more frequently than average they spend a little less than average on each purchase. This group are very convenience oriented purchasing mainly from outlets such as service stations, supermarkets, fruit shops etc. Media advertising would be a Womens Weekly type of approach. Cluster 6 Whilst also exhibiting occasion based buying characteristics, these individuals tend to purchase for non traditional occasions eg birthdays, to cheer someone up, for romance, or to friend of the opposite gender etc. They tend to spend a medium amount on each purchase but infrequently. Media promotion should be thought of as Hot Rod, Rugby News, or Body Builder type of approach. Cluster 4 This group purchases infrequently often spending quite a small amount on each purchase for a wide range of reasons, generally from convenience outlets. They could be thought of as the Southern Man and a Rod and Gun type media approach. This group would not appear to be a very profitable segment to target. RESEARCH REPORT 182 A Financial and Economic Survey 01 South Auckland Town Milk Producers i1nd Factory Supply Dairy Farmers, 198485, n G Moffitt. 1986 183 An Economic Survey 01 New Zealand Town Milk Producers, 1984-85, R G Moffitt. 1986 184 An Economic Survey 01 NZ Wheatgrowers: Financial Analysis, 1984-85; R.D Lough. PJ McCartin. 1986 185 The Ellect on Horticulture 01 Dust and Ash: Proposed Waikato Coal-Fired Power Station, PR McCrea. October 1986 186 A Study 01 the Determinants 01 Fattening and Grazing Farm Land Prices in New Zealand, 1962 to 1983. PG Seed. RA Sandrey. B.D. Ward. December 1986 • 187 Farmers' Responses to Economic Restructuring in Hurunui and Clutha Counties: Preliminary Analysis 01 Survey Data. JR Fairweather. July 1987 188 Survey 01 NZ Farmer Intentions and Opinions, OctoberDecember 1986. J.G Pryde. PJ McCartin. July 1987 189 Economic Adjustment in New Zealand: A Developed Country Case Study of Policies and Problems, R G Lattimore. July 1987 197 Demand for Wool by Grade A. C. Zwart, T. P. Grundy, November 1988 198 Financial Market Liberalisation in New Zealand: an Overview, A. L. St Hill, December 1988. 199 An Economic Evaluation of Coppice Fuelwood Production for Canterbury, J. R. Fairweather, A. A. Macintyre, April 1989 200 An Economic Evaluation of Biological Control of RoseGrain Aphid in New Zealand, TP. Grundy, May 1989 201 An Economic Evaluation of Biological Control of Sweet Brier, T P. Grundy, November 1989 202 An Economic Evaluation of Biological Control of Hieracium, T P. Grundy, November 1989 203 An Economic Evaluation of the Benefits of Research into Biological Control of Clematis Vitalba, G. Greer, R. L. Sheppard, 1990. 204 The Q Method and Subjective Perceptives of Food in the 1990s, J. R. Fairweather 1990 205 Management Styles of Canterbury Farmers: a study of goals and success from the farmers' point of view. J. R. Fairweather, N: C. Keating, 1990 206 Tax Shields: their implications for farm project investment, risk and return. P. A. McCrea, T P. Grundy, D. C. Hay, 1990 190 An Economic Survey of New Zealand Town Milk Producers 1985-86, A.G. Moffitt, November 1987. 191 The Supplementary Minimum Price Scheme: a Retrospective Analysis, G.A. Griffith, T.P. Grundy, January 1988 207 192 New Zealand Livestock Sector Model: 1986 Version. Volumes 1 and 2, T.P Grundy, R.G. Lattimore, A.C. Zwart, March 1988. Public Drinking and Social Organisation in Methven and Mt Somers. J. R. Fairweather and H. Campbell, 1990. 208 Generations in Farm Families: Transfer of the Family Farm in New Zealand. N. C. Keating, H. M. Little, 1991 An Economic Analysis of the 1986 Deregulation of the New Zealand Egg Industry, J. K. Gibson, April 1988. 209 Determination of Farmland Values in New Zealand: the Significance of Financial Leverage, G. A. Anderson, G. A. G. Frengley, B. D. Ward, 1991. 210 Attitudes to Pests and Pest Control Methods R. L. Sheppard, L. M. Urquhart, 1991. 211 Administered Protection in the United States During the 1980's: Exchange Rates and Institutions, D. A. Stallings, 1991. 212 The New Zealand Consumer Market For Cut Flowers in the 90s, C. G. Lamb, D. J. Farr, P. J. McCartin, 1992 124 Some Recent Changes in Rural Society in New Zealand, J. R. Fairweather, July 1989 125 Papers Presented at the Fourteenth Annual Conference of the N.Z. Branch of the Australian Agricultural Economics Society, Volumes 1 and 2, October 1989 193 194 Assistance totheTourist Industry, A. Sandrey, S. Scanlan, June 1988. 195 Milk Purchasing: a consumer survey in Auckland and Christchurch, R.L. Sheppard, July 1988. 196 Employment and Unemployment in Rural Southland, J. R Fairweather, November 1988. DISCUSSION PAPERS 116 Government Livestock Industry Policies: Price Stabilisation and Support, G. Griffith, S. Martin, April 1988 117 The NZ Sheepmeat Industry and the Role of the NZ Meat Producer's Board, A. Zwart, S. Martin, March 1988 118 Desirable Attributes of Computerised Financial Systems for Property Managers, P. Nuthall, P. Oliver, April 1988 126 Marketing Boards and Anti-Trust Policy, E. McCann, R. G. Lattimore, 1990. 119 Papers Presented at the Twelfth Annual Conference of the NZ Branch of the Australian Agricultural Economics Society, Volumes 1 and 2, April 1988 127 Marketing of Agricultural and Horticultural Products selected examples, K. B. Nicholson, 1990 120 Challenges In Computer Systems for Farmers, P. Nuthall, June 1988 128 121 Papers Presented at the Thirteenth Annual Conference of the N.Z. Branch of the Australian Agricultural Economics Society, Volumes 1 and 2, November 1988 A Review of the Deregulation of the NZ Town Milk Industry, R. G. Moffitt, R. L. Sheppard, November 1988. Methven and Mt. Somers: Report on Socio-Economic History and Current Social Structure. H. R. Campbell, J. R. Fairweather, 1991 122 123 Do our Experts Hold the Key to Improved Farm Management? P. L. Nuthall, May 1989 129 Proceedings of the Rural Economy and Society Section of the Sociological Association of Aotearoa (NZ), April 1991 130 Evolutionary Bargaining Games J. K. D. Wright, May 1991 AC!dition,al copies of Research Reports. apart. from complimentary copies, are available at $20.00 each. Dlsc'-!sslon. Papers are usually $15.0.0 but .coples of COr/ference Proceedings (which are usually published as DIscussIOn Papers) are $20.00. DIscussIon Papers No.119 and 121 are $20.00 per volume and Discussion Paper No. 109 is $29.70.