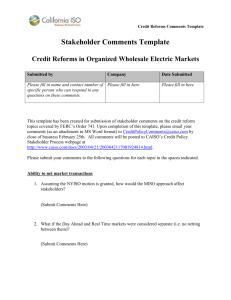

Loop Flow Mystery The Lake Erie

advertisement

The Lake Erie Loop Flow Mystery The circuitous scheduling of electricity by a few New York wholesale market participants has imposed significant costs on municipal utility customers—and underscores the need for reform of the ISO/RTO markets By Alice Clamp F or years, electricity flow around Lake Erie has been split, with much of and chaos” imposed on day-ahead and real-time markets by such cirthe power going in a counterclockwise direction. But sometime in 2007— cuitous scheduling. In May of that year, said Mullane, the ISO’s residual no one is sure exactly when—that began to change. More electricity started adjustment charge represented 70 percent of its services charge. flowing in a clockwise direction. Also in August 2008, APPA told FERC that New York utilities were exClockwise flow of electricity around Lake Erie caused congestion on the periencing “high, unexplained” uplift charges levied on them by the NYISO lines of the New York Independent System Operator (NYISO), the state’s since the beginning of the year. Scheduling practices by certain market pargrid operator. Because electricity flows along the path of least resistance, it ticipants, said APPA, were needlessly increasing costs to other market doesn’t always go where it has been scheduled. Although several NYISO participants. market participants had scheduled power along transmission line paths “Something is clearly wrong here,” said APPA. “This commission, if it is running clockwise around the lake, about to ensure that consumers only pay just and 80 percent of that power actually flowed direasonable rates, as the Federal Power Act rerectly from New York to the PJM quires, must get to the bottom of it.” In a perverse way, the loop flow Interconnection, which operates a transIn addition to the impact on New York utilmission system covering parts of 13 states ities, APPA told FERC, public power utilities problem might be a “silver lining in from Illinois to New Jersey. This unschedoutside the NYISO’s footprint that rely on the disguise,” said Bolbrock. “It caused uled flow of electricity led to higher “uplift” grid operator to transmit hydro power from costs—the costs incurred to relieve congesthe New York Power Authority to their comthe ISO to do things that make sense, tion within a zone and imposed on all grid munities had reported increasing—but even in the absence of this issue. And customers—and, ultimately, higher electricunexplained—charges associated with the ity prices for consumers. transaction. it got FERC’s attention.” The unnamed NYISO market particiIndeed, several states neighboring New pants that scheduled power along York began to notice, and complain, about clockwise paths apparently did so because rapidly growing congestion charges in early of pricing differences among various regional transmission organizations 2007, according to David Straus, an attorney with Thompson Coburn in (RTOs). It cost less to move electricity from New York through Ontario to Washington, D.C., who represents utilities in seven neighboring states that the Midwest Independent Transmission System Operator (MISO) and then purchase hydro power from NYPA. to PJM than it did to send the power from New York straight to PJM. “We noticed drastic fluctuations in the bills that we received from NYPA By mid-2008, municipal utilities, joint action agencies and the American for hydro allocations in 2007, which included ISO pass-through charges,” Public Power Association complained to the Federal Energy Regulatory said Jim Jablonski, executive director of the Public Power Association of Commission about the Lake Erie loop flow problem. Loop flow is defined New Jersey. “But in the first part of 2008, things started to explode.” as the difference between scheduled and actual flow on a path. A certain amount of scheduling on a circuitous path through Canada Robert Mullane, general manager of the New York Municipal Power and MISO, terminating in PJM, helps the loop flows, said David Patton, exAgency, protested to the NYISO in an August 2008 letter about the “costs ecutive director of Potomac Economics, the NYISO’s independent market 10 Public Power . January-February 2010 . APPAnet.org F or starters, a repurposed NYISO might adopt rules that would unmask the identity of bidders, release spot market bid data “ within 24 hours to publicly reveal strategic bidding tactics, forbid anomalous bidding, and require disclosure of marginal costs,” said Norlander. adviser. “Both we and the NYISO were aware of these scheduling practices before they became large enough to be problematic,” he said. Asked when they became problematic, Patton said: May 2008. But in their August 2008 filing, utilities in the seven neighboring states said they had complained about excessive charges more than a year before. “It appears, therefore, that either the NYISO is wrong about when the circuitous scheduling began or that such scheduling practices are merely one cause, not the cause, of the enormous cost increases faced by the neighboring states and other market participants,” Straus noted in a FERC filing. One contributing factor to the increased circuitous scheduling was a change in the NYISO’s policy that resulted in a much lower hourly price of electricity purchased at the New York-Ontario border than at the New YorkPJM border in Pennsylvania, according to Peter Behr, a reporter for E&E Publishing. “Energy traders and utility marketers “detected this arbitrage opportunity at the end of 2007 and began scheduling more trades through the New York-Ontario transmission gateway, locking in the arbitrage profit with simultaneous buy-sell orders,” Behr said in a Sept. 8, 2009, ClimateWire article. “The shift quickly became a flood.” “The circuitous transactions, by capitalizing on the pricing incentives, simply exposed rather than created a market inefficiency,” said Gerald Norlander, executive director of the Public Utility Law Project (PULP), a private nonprofit organization that represents the interests of low-income consumers in utility and energy matters. NYISO’s first steps “In general, you can address any problem like this in two ways: changes in pricing rules or an injunction,” said Potomac Economics’ Patton. “One addresses the incentive and the other precludes it.” After consulting with Potomac Economics, the NYISO took the latter action, filing a request with FERC in July 2008 to preclude the use of circuitous paths around Lake Erie. “The ban on circuitous scheduling helped to bring down the uplift charges,” said Rich Bolbrock, an adviser to the Municipal Electric Utilities Association of New York, the New York Municipal Power Agency and the New York Power Authority, and formerly the executive vice president for power markets at the Long Island Power Authority. Although the ISO did act to address the problem, he said, “it took too long to find out about the problem and it took too long to do something about it.” Here’s what the NYISO did. In May 2008, it initiated more timely updates of the day-ahead loop flow assumptions, which reduced uplift costs, said Ken Klapp, the ISO’s senior communications and media relations specialist. After asking FERC in July 2008 “to investigate the behavior of certain market participants that appeared to be exacerbating loop flows around Lake Erie,” said Klapp, the ISO took several other steps. The ISO’s ban on scheduling of circuitous transactions reduced uplift costs and congestion resulting from the high-volume loop flow. In October 2008, the ISO asked FERC to let the ban remain in place until “a better so- lution” was developed and implemented, said Klapp, a request that FERC approved. The significant change in circuitous scheduling around Lake Erie and the resulting impact on loop flows “identified a need for enhanced analysis capability within the ISO’s operations,” said Klapp. So the ISO adopted “rigorous monitoring procedures to provide improved transparency and to better address congestion costs,” he said. This included “a daily review of market outcomes to identify unusual or unexpected market outcomes to identify the root-cause source of certain uplift and other marketplace costs.” The task of daily monitoring fell to a newly created group—the Operations Analysis & Services group—headed by the ISO’s vice president of operations. The group was to coordinate its analysis with the ISO’s independent market monitor and internal market monitoring. Pressure for better oversight of the market came from New York’s municipal utilities. “We had asked the ISO for a monitoring plan,” said Bolbrock. “And in the fall of 2008, the ISO started a daily review process.” In the spring of 2009, the ISO continued to make changes to its operations, said Klapp. Among them: G Implementing improvements to its day-ahead market software to reduce certain uplift costs resulting from local reliability rule commitments G Implementing procedures to invoke the NERC transmission loading relief procedure to reduce Lake Erie loop flows that result in uplift costs. In a perverse way, the loop flow problem might be a “silver lining in disguise,” said Bolbrock. “It caused the ISO to do things that make sense, even in the absence of this issue. And it got FERC’s attention.” While the ISO was changing the way it oversaw the wholesale market, FERC was conducting a non-public investigation of the problem.“It would have been nice to allow the public to participate,” said Thompson Coburn’s Straus. All the ISO’s actions resulted in a “dramatic” drop in uplift costs, said Klapp. Those costs were 87 percent lower in May 2009 than in 2008, 69 percent lower in June 2009 than in June 2008 and 40 percent lower in July 2009 than in July 2008. Paying the price Talk of costs, however, raises the question of how much utilities in New York and other states—and their customers—had to pay for the circuitous scheduling around Lake Erie. Joint action agencies and municipal utilities buying hydro power from NYPA paid over the odds for that electricity. “By paying unnecessary charges, the value of hydro power was diminished,” said Straus. The bills for the Public Power Association of New Jersey average roughly $200,000 a month, which worked out to about 2 cents per kilowatt-hour, said the association’s Jablonski. “But in mid-2008, we had a bill of around $800,000. That meant the cost of the electricity that we were buying had gone to more than 5 cents/kWh. When we took the bill apart, we found that our NYPA hydro payment had not changed. Public Power . January-February 2010 . APPAnet.org 11 Patton estimated that up to $96 million in system-wide uplift costs had been shared among all market participants as a result of circuitous scheduling around Lake Erie. The escalation occurred in the NYISO charges.” The NYISO’s independent market adviser, David Patton, worked with the ISO staff “to develop an estimate of the cost to the markets of the transactions covering the period from Jan. 1, 2008, to July 22, 2008, when the ISO’s ban took effect,” said the ISO’s Klapp. Patton estimated that up to $96 million in systemwide uplift costs had been shared among all market participants as a result of circuitous scheduling around Lake Erie. PULP’s Norlander has cited the costs to some New York municipal utilities. A few examples: $282,000 in March 2008 and $150,000 in May 2008 for Plattsburg; $161,000 in May 2008 for Lake Placid. Andrew McMahon, supervisor of the Massena Electric Department, was quoted in the July 18, 2009 Watertown Daily Times as saying “…it probably cost us about $1 million.” In a June 10, 2008, Webinar, Suez Energy Resources NA, a provider of retail electricity services to industrial and commercial customers, estimated that the circuitous schedules cost the market $25 million in April and $100 million in May. What FERC did A year after it announced that it would conduct a non-public investigation of the loop flow problem, FERC made public the results. In a July 2009 report, the commission said its Office of Enforcement found no market manipulation; rather, traders were “openly responding to price signals…and therefore did not commit market manipulation.” In an accompanying order, FERC directed the NYISO to submit within six months a “longterm, comprehensive solution” to the Lake Erie loop flow issue, which the commission said “gave rise last year to allegations that market manipulation and tariff violations increased market prices in New York.” Based on its staff investigation, FERC said it had determined that “there was no deception or fraudulent concealment and, thus, no market manipulation on the part of any market participants.” “We would have liked the conclusions of 12 FERC’s investigation to be otherwise,” said Thompson, Coburn’s Straus. “In recent years, FERC has been reluctant to find anyone guilty of any malfeasance. One gets a bit skeptical. In this case, FERC thought that the markets did it, rather than people who took advantage of the markets.” Accountability seems to be lacking, he said. “One has to be skeptical about investigations that are done in private.” FERC’s decision gives a green light to traders to engage in the same or similar behavior, said the PULP’s Norlander. “The lesson of the FERC order seems to be that it is okay for sellers to game the market rules if a tactic is not specifically forbidden and is done for the purpose of making money.” Because there was no market manipulation or tariff violations, said FERC, no refunds were called for. “Just because FERC couldn’t find evidence of market manipulation doesn’t mean it didn’t happen,” said Bolbrock, who advises New York’s municipal utilities. “We were looking for restitution.” New Jersey’s Jablonski said: “We understand certain folks who get sophisticated can figure out ways to game the system. We believe they should be held accountable, but because no rules were broken, despite our protests, and since they didn’t violate laws or tariffs, they didn’t have to be named and they got to keep the money.” PULP’s Norlander pointed to the California ISO, which had a tariff rule against anomalous bidding. “That was important in obtaining billions of dollars in refunds after market manipulation in the state, because the Ninth Circuit required FERC to consider refunds under Section 309 of the Federal Power Act.” That section gives FERC authority to order refunds if it finds violations of the filed tariff and imposes no temporal limitations. “As far as I can determine, the NYISO has no similar rule against anomalous bidding that would give rise to claims for refunds under a tariff violation theory,” said Norlander. “If there is one, there should have been refunds under Public Power . January-February 2010 . APPAnet.org FPA Section 309.” The New York Post reported that Sen. Charles Schumer, D-N.Y., was disappointed “that FERC’s ruling confirmed the exploitation of this loophole by greedy energy traders, but did not help New Yorkers who got taken advantage of.” Proposed NYISO solutions NYISO President & CEO Stephen G. Whitley believes the competitive bulk power market is an advantage in addressing loop flows. The physical phenomenon and resultant cost penalty existed prior to market restructuring, he said. In that era costs were “socialized for payment by all consumers,” he said. “The transparency of the wholesale electricity markets allows us to effectively monitor and identify complex transactions,” Whitley said. “Loop flows, for example occur in every power system due to the laws of physics that govern the actual flow of electricity. When loop flows are exacerbated by certain market transactions, however, their impact becomes apparent in the marketplace. Market transparency enables grid operators to effectively identify and address such problems.” In its July 2009 order, FERC instructed the NYISO to work with other regional market operators to address interface pricing and congestion management. “We are developing ways to better coordinate monitoring efforts with neighboring grid operations to enhance regional coordination,” said the ISO’s Klapp.“We’re also evaluating possible tariff provision changes to address inefficient market outcomes.” He said that the ISO is focusing on three potential market solutions to loop flow: G Buy-through of congestion G Congestion management G Interregional transaction coordination. These are market solutions, said Bolbrock. “We hope they will be included in the ISO’s January 2010 report to FERC.” Buy-through of congestion. “If a market participant schedules a transaction and that transaction causes congestion, the participant would have one of two options: pay for the congestion or have the contract cut by the ISO,” In August 2009, the ISO told FERC that its focus on market design as the sole solution to Lake Erie loop flow is too narrow. said Bolbrock. “It’s a simple concept: the entity causing the congestion could pay for the cost or have the transaction curtailed. It seems doable and it makes sense.” The regional market organizations would have to agree on how to do this, he added. “But that shouldn’t be hard.” Congestion management. “If there is congestion in the NYISO, normally it would have to run more expensive generation,” said Bolbrock. “But under this concept, if less expensive generation would solve the congestion problem, PJM would run that, and there would be a compensation mechanism.” Congestion management makes sense for any congestion problem if cheaper generation can be run in another ISO, said Bolbrock. He calls this concept a no-brainer. “But you need cost sharing and an operations protocol to do it.” Interregional coordination. When an interchange is scheduled between ISOs, it is scheduled for one hour, said Bolbrock. “Things happen, generators or transmission lines trip, but that doesn’t change the transactions between ISOs.” The ISOs are looking into a faster interchange schedule, he said, 15 minutes or less. “This would be helpful. The ISOs could respond to situations. And it makes sense—with or without the loop flow issue.” In addition to the market solutions, the NYISO also has proposed a physical solution. In August 2009, the ISO told FERC that its focus on market design as the sole solution to Lake Erie loop flow is too narrow. The optimal solution, said the ISO, will take all available options into account and incorporate a combination of physical and market methods of controlling or mitigating the effect of Lake Erie loop flow. The physical solution is something known as phase angle regulators (PARs). They are electrical devices that can promote the redirection of power from one circuit to another. PARs have the potential to conform actual power flows to scheduled power flows, reducing unscheduled loop flows. The catch is that the PARs are not yet operational. Soon after four units were installed on the Michigan-Ontario grid border earlier in this decade, one PAR failed. Wrangling about control 14 of the units has prevented their activation. Ontario’s Independent Electricity System Operator, the Midwest Independent System Transmission Operator and Michigan-based International Transmission Co. (ITC) are trying to reach agreement on operating protocols for the PARs. ITC owns the PAR facilities on the U.S. side of the Michigan-Ontario interface. ITC has said it expects to spend roughly $33 million to install two PARs that will replace the failed unit. It wants the NYISO to include in its report to FERC a discussion of “how the costs associated with the PARs can effectively be shared by consumers in NYISO’s service area and the service areas of other regional transmission organizations that will benefit from the PARs’ operation.” While the new PARs would increase phase shifting capability and reduce unscheduled loop flows, said ITC, they won’t eliminate them. Bolbrock agreed, noting that the PARs are not adequately sized to always control loop flow. “They are a partial solution, not a total solution.” In early September 2009, NYISO President and CEO Whitley, told representatives of the Municipal Electric Utility Association of New York State about the market and physical solutions that the ISO is proposing to address the loop flow problem. A more vigilant NYISO? The NYISO told FERC in early September 2009 that three generators had abused market power in its wholesale electricity markets. When any of the three generators were required to run for reliability purposes, they submitted bids that significantly exceeded each facility’s marginal operating cost, said the ISO. It asked FERC to approve a cap on the generators’ bids in the future. “The good news is that the ISO saw this and acted on it,” said Bolbrock. “The ISO is much more aware. I think this came out of the new monitoring group.” But, noted PULP’s Norlander, the NYISO did not disclose the amount of overcharges received by the high bidders and it did not disclose how Public Power . January-February 2010 . APPAnet.org long they had been doing it. “When the exercise of market power in the NYISO receives public attention, it results in rule changes going forward and no refunds to customers.” Each episode, he said, “increases the complexity of market rules while providing no real remedy for buyers who suffer from overcharges.” The NYISO “rigorously monitors market behavior to sustain and enhance the competitive marketplace for wholesale electricity,” said the ISO’s Klapp. “We make course corrections to address issues,” said ISO President and CEO Whitley. “While there appears to be no violation of existing standards in the [case of the three generators], we are adjusting controls to address specific conditions observed on the power system.” The challenge of change As the loop flow issue was heating up, APPA was preparing a white paper—Consumers in Peril— that examined the RTO market failures and pointed to the need for fundamental market reform to protect consumers. “We took this white paper to our legislators in Washington, D.C.” said New Jersey’s Jablonski. “We told them that we have a good example of why the markets need to be reformed. We told them about the Lake Erie loop flow problem.” Bolbrock said he would like to think that FERC is “starting to get the message.” One possible indication may be the commission’s acceptance of a complaint filed by private parties in New England about the behavior of the ISO there. “This may be significant.” he said. Following a complaint by Connecticut Attorney General Richard Blumenthal earlier in 2009, FERC has agreed to investigate the market practices of the New England ISO. Blumenthal alleged that several power companies manipulated the market and those firms owed ratepayers more than $50 million. FERC said that while the attorney general had “provided little evidence in support of these allegations” of market manipulation, it would grant an investigative hearing before a commission judge to probe the practices of the generators operating within the ISO as well as the power grid manager itself. Blumenthal said he expected the investigation to deliver “a stunning jolt of transparency and truth to the public about gross manipulation of our power markets.” “Here’s another example of the need for true market reform, which would avoid this kind of manipulation,” said Jablonski. Things have become “horrendously complex,” said Bolbrock, because of different market designs. “The least sophisticated system should be adopted by all the ISOs. That would be a huge improvement,” he noted. “But it won’t happen any time soon.” FERC may possibly be receptive to change, said Jablonski. “When we presented our latest proposal to commission staff, they said the suggestions were worthy of consideration.” The commission must “reinvigorate its purpose—to protect consumers,” said Thompson Coburn’s Straus. “In many situations in recent years, its purpose is to protect the theory of market-driven pricing, rather than consumers who pay those prices. It has been a frustrating decade. Pricing has rewarded old generation and expensive transmission, protection against any failure. It has rewarded these entities for risks they don’t incur.” New Jersey’s Jablonski agreed. “We are not seeing a lot of generation and transmission being built commensurate with the money being taken in.” So what can be done to advance reform of the RTO/ISO markets? PULP’s Norlander suggests that the NYISO “could be better aligned with the public interest if it were reorganized and its board were appointed by the governor and confirmed by the state Senate. “This was done with the California ISO after the manipulation of its markets,” he said. The D.C. Circuit Court of Appeals upheld the reorganization after FERC attempted to undo it and retain the private ISO utility model, he noted. “For starters, a repurposed NYISO might adopt rules that would unmask the identity of bidders, release spot market bid data within 24 hours to publicly reveal strategic bidding tactics, forbid anomalous bidding, and require disclosure of marginal costs,” said Norlander. “A board with a better public mission and balance might protect buyers against manipulation, and begin to seek refunds from market gamers.” At the federal level, it may not be appropriate for Congress to write detailed ISO/RTO rules to address the loop flow issue without first holding hearings to determine if the problem lies with the law or with FERC, said Norlander. “Through substantive legislation or budget bills, Congress might require FERC to hold hearings on the flaws in the RTO/ISO markets and to consider major reforms of the ‘organized’ private utility spot markets, which FERC has refused to do.” Requiring FERC to enforce the public filing and transparency and review provisions of the Federal Power Act might help too, said Norlander, because FERC approves RTO/ISO tariffs that allow lengthy delays in disclosure of bidding data and require sellers’ identities to be masked. Another option, suggested Norlander, is for the U.S. Senate to insist on appointment of any new FERC commissioners. “None of the sitting commissioners is from a restructured state, and all are ‘organized’ spot market enthusiasts.” New Jersey’s Jablonski said he can’t pick up the phone and talk to the president. “But if the Obama administration wants to do something in the area of energy, specifically electricity, it’s market reform.” I Alice Clamp is a writer in Lovettsville, Va., and a frequent contributor to Public Power. SNC-Lavalin: your partner for POWER SNC-Lavalin has the expertise and experience to design and build your thermal power plant and deliver full SCADA, DMS/OMS, EMS, GMS and Wind real-time systems anywhere in the world. Our GENe Software Suite can make your Smart Grid even smarter and more secure. Our Thermal Power Group has designed and built over 90,000 MW in thermal power projects in 200 locations worldwide in the last 20 years alone. Our Energy Control Systems Group has over 45 years of global experience and our systems currently control more than 150,000 MW of power serving over 300 million people on six continents. Ask us what we can accomplish together! www.snclavalin.com/ecs www.snclavalin.com/thermal Public Power . January-February 2010 . APPAnet.org 15