Credit Reforms in Organized Energy Markets Stakeholder Meeting

advertisement

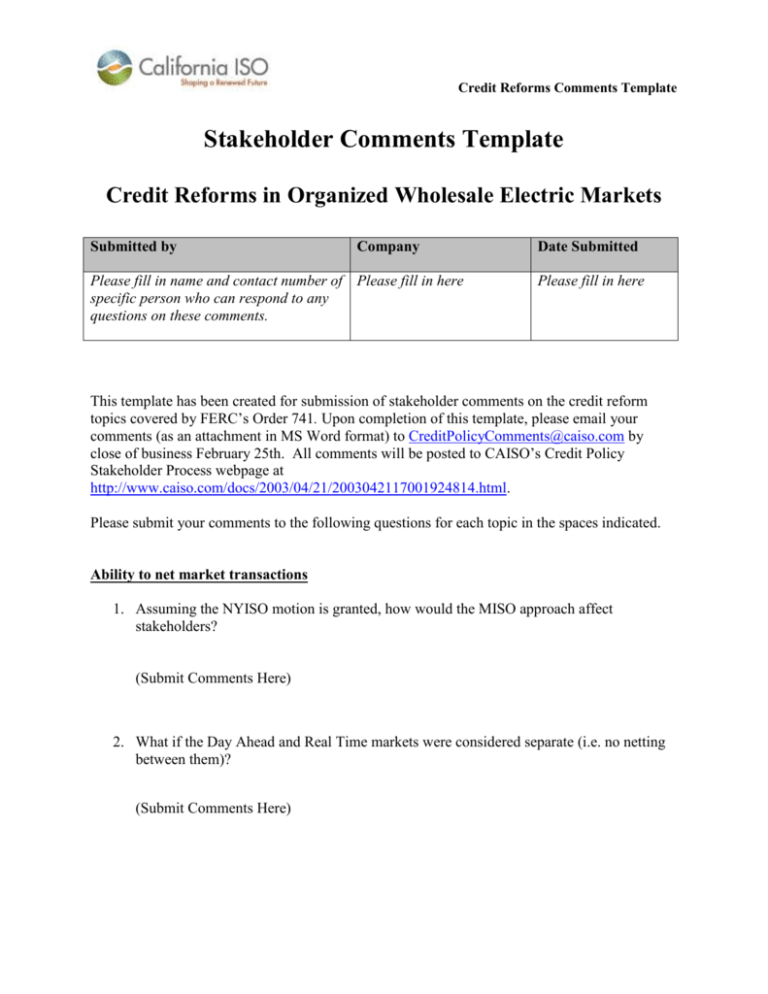

Credit Reforms Comments Template Stakeholder Comments Template Credit Reforms in Organized Wholesale Electric Markets Submitted by Company Please fill in name and contact number of Please fill in here specific person who can respond to any questions on these comments. Date Submitted Please fill in here This template has been created for submission of stakeholder comments on the credit reform topics covered by FERC’s Order 741. Upon completion of this template, please email your comments (as an attachment in MS Word format) to CreditPolicyComments@caiso.com by close of business February 25th. All comments will be posted to CAISO’s Credit Policy Stakeholder Process webpage at http://www.caiso.com/docs/2003/04/21/2003042117001924814.html. Please submit your comments to the following questions for each topic in the spaces indicated. Ability to net market transactions 1. Assuming the NYISO motion is granted, how would the MISO approach affect stakeholders? (Submit Comments Here) 2. What if the Day Ahead and Real Time markets were considered separate (i.e. no netting between them)? (Submit Comments Here) 3. What if the NYISO motion were denied? (Submit Comments Here) 4. Is there interest in pursuing a central counterparty approach, like PJM? (Submit Comments Here) 5. Are there implementation challenges with either approach that would prevent implementation by 10/1/2011? (Submit Comments Here) 6. Are there alternatives to consider? (Submit Comments Here) Shortening the billing and payment cycle 7. What implications are there to the ISO adopting a payment cycle that – Changes the current timeline of the Initial Statement from T+7B to T+3B? – Bases the Initial Settlement Statement on estimated meter data thus resulting in true-ups in the Recalculation Statement T+38B? – Shortens the time in which an invoice payment is due from T+5B to T+2B? (Submit Comments Here) 8. Are there alternative invoicing cycles the ISO can adopt that meets this requirement and minimizes the impact to market participants? (Submit Comments Here) Page 2 9. What constraints exist, if any, for meeting a 10/1/2011 effective date for this directive? (Submit Comments Here) Minimum participation requirements 10. In general, do you believe the minimum standards, as presented, are reasonable and that they address FERC’s concern that under-capitalized market participants or market participants lacking adequate risk management procedures pose a significant risk to the market? (Submit Comments Here) 11. Are there specific criteria in any of the focus areas that the ISO should restate or eliminate altogether? – – – – Effective risk management procedures Effective communications with the ISO (i.e., respond to ISO direction) Adequate capitalization level Customer in good standing with the ISO (Submit Comments Here) 12. Are there additional criteria in any of the focus areas that the ISO should consider? – – – – Effective risk management procedures Effective communications with the ISO (i.e., respond to ISO direction) Adequate capitalization level Customer in good standing with the ISO (Submit Comments Here) Page 3 Material adverse change 13. Are the proposed enhancements to the ISO’s existing material adverse change provisions reasonable? (Submit Comments Here) 14. To address FERC’s desire for the ISOs to use forward-looking indicators as a means to make an unsecured credit limit reduction or a collateral call in advance of an adverse event, what specific forward-looking indicators would you request the ISO consider? (Submit Comments Here) Uniform applicability 15. Are there certain individual entities whose default would not disrupt the market? (Submit Comments Here) 16. Are there certain entity types that should not be subject to the minimum participation requirements? (Submit Comments Here) Page 4