Document 13613771

advertisement

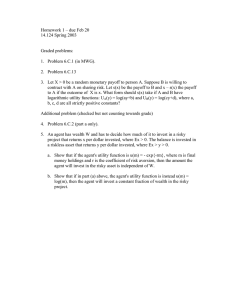

15.401 Recitation 5: Options Learning Objectives R i off Concepts Review C t o Payoff profile o Put‐call parityy o Valuation of options o Binomial tree Examples o Payoff replication o Arboreal Corporation 2010 / Yichuan Liu 2 Review: elements of a call/put option Type: o Call: holder has the right but not the obligation to buy o Put: holder has the right but not the obligation to sell Q Quantity tit off the th underlying d l i asset: t o Usually one share of stock with current price S Strike/exercise price (K) Expiration date (T) Style: o European: can only be exercised at T o American: can be exercised at any time between 0 and T. 2010 / Yichuan Liu 3 Review: payoff profile Call Put Payoff Long Payoff 45° Asset Price K 45° Asset Price Asset Price K 45° K Asset Price Short K 45° Payoff 2010 / Yichuan Liu Payoff 4 Review: payoff profile The payoff of a portfolio of options is the sum of payoffs of the individual components: 1 put Straddle 1 call + = K1 K1 1 call @ K1 ‐2 call @ K1 + K1 2010 / Yichuan Liu K1 + K2 Butterfly spread 1 call @ K3 = K3 K1 K2 K3 5 Review: put‐call parity Two portfolios with identical payoffs Portfolio 1 1 call @ K Bond w/ FV=K + = K K K Portfo olio 2 1 put @ K + K 2010 / Yichuan Liu 1 stock = K 6 Review: put‐call parity No arbitrage implies that the two portfolios must have the same cost: C C PV K P S K P S C T 1 r This is the put‐call parity. Note: the call and put must have the same exercise exercise price (K). 2010 / Yichuan Liu 7 Pricce of options Review: value of an option Price of underlying asset 2010 / Yichuan Liu Value of call Value of put price ((K)) Strike p Decrease Increase Price of underlying asset (S) Increase Decrease Volatility of the underlying asset (σ) Increase Increase Maturity (T) Increase Increase Interest rate (r) Increase Decrease 8 Review: binomial tree Idea: if there are only two states of the world next period, we can price options given the underlying asset and a risk‐free asset (“bond”) by replication: Underlying Asset p Su S S Call B Sd Cu C B/(1+r) 1‐p 2010 / Yichuan Liu Bond B Cd 9 Review: binomial tree Replication: A shares of underlying asset Bond (FV=B) Total Replication CF at t = 0 CF at t=1 (“up” state) CF at t=1 (“down” state) ‐A x S A x Su A x Sd ‐ B/(1+r) B B ‐A A x S ‐ B/(1+r) A x Su + B A x Sd + B = ‐C = Cu = Cd o A = ( C u – C d ) / ( Su – Sd ) o B = C u – A x Su o C = A x S + B/(1+r) 2010 / Yichuan Liu 10 Review: binomial tree Equivalently, we can solve for the risk risk‐neutral neutral probability, q: Then, qSu 1 q S d q S S 1r qCu 1 q Cd C 1 r Note: q is not related to the state probability p. In fact,, p is not used in the pricing g of C. 2010 / Yichuan Liu 11 Example 1: payoff replication How would you replicate the following payoff profile using only call and put options? a) 10 15 25 30 b) 8 8 2010 / Yichuan Liu 12 16 20 12 Example 1: payoff replication Answer: a) Long 1 call (K=10) Short 1 call (K=15) Sh t 1 callll (K Short (K=25) ) Long 1 call (K=30) b) Long 1 put (K=8) Short 1 call (K=8) Long 2 calls (K=12) Short 1 call (K=20) (K 20) 2010 / Yichuan Liu 13 Example 2: Arboreal Corporation Arboreal Corporations stock price is currently $102. At the end of 3 months it will be either $120 or $90. The 3‐month spot rate is 2%. What is the value of a 3‐month European call option with a strike price of $110? Call Stock $120 $102 C $90 2010 / Yichuan Liu $10 $0 14 Example 2: Arboreal Corporation The call can be replicated with: o Long 1/3 stock: costs $34 o Short bond with FV=30: costs ‐$30/(1+2%) = ‐$29.41 Th price The i off th the callll mustt b be C 34 29.41 $4.59 Alternatively, we can solve for the risk Alternatively risk‐neutral neutral probability: 120q 901 q 1 2% 102 q 0.468 The price of the call is then 2010 / Yichuan Liu 100.468 01 0.468 $4.59 C $4 59 1 2% 15 MIT OpenCourseWare http://ocw.mit.edu 15.401 Finance Theory I Fall 2008 For information about citing these materials or our Terms of Use, visit: http://ocw.mit.edu/terms.