11 February 2014

Practice Group(s):

Energy, Resources

and Infrastructure

New Tax Benefits for Investment Projects in the

Russian Far East

By Sergey J. Milanov and Georgy Daneliya

Companies that carry out qualifying investment projects in the Russian Far East enjoy tax

benefits under a new Federal Law “On the Introduction of Amendments to Parts One and

Two of the Tax Code of the Russian Federation related to the Stimulation of Investment

Projects on the Territory of the Far East Federal District and Certain Other Regions of the

Russian Federation” No. 267-FZ, dated September 30, 2013 that went into force on

January 1, 2014 (the Law).

The Law introduces tax benefits for companies carrying investment projects in the

regions of the Russian Far East and some of the regions of Eastern Siberia. The Law

clearly aims to implement the commitment announced by President Putin to make the

development of the Russian Far East a Russian national priority for the 21st century.

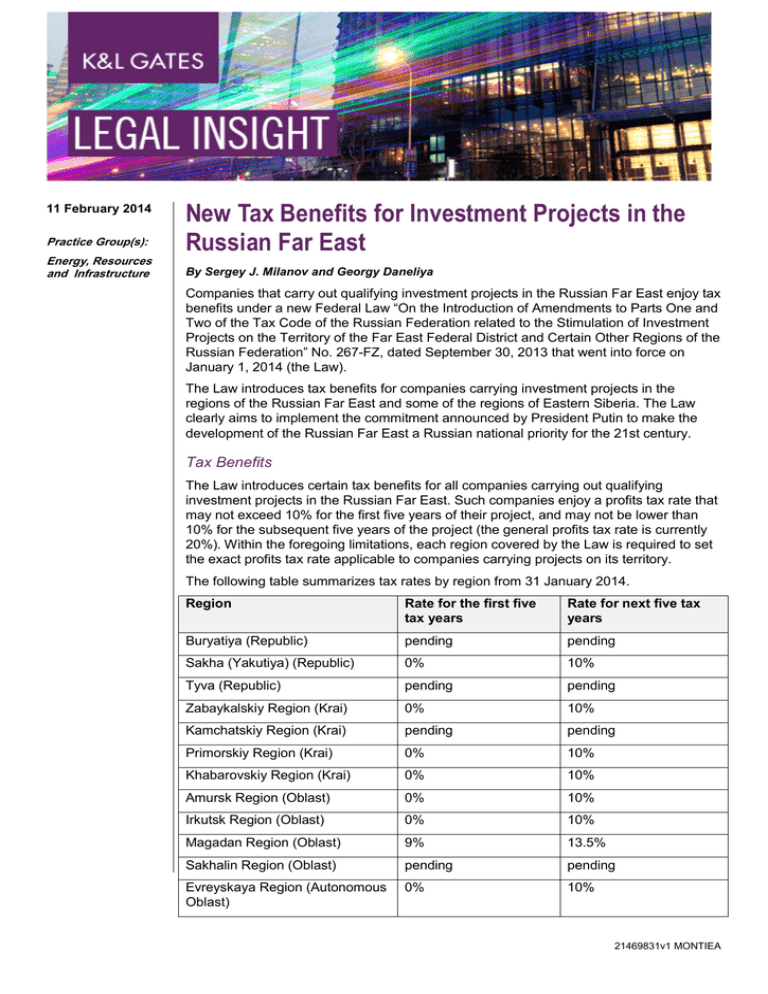

Tax Benefits

The Law introduces certain tax benefits for all companies carrying out qualifying

investment projects in the Russian Far East. Such companies enjoy a profits tax rate that

may not exceed 10% for the first five years of their project, and may not be lower than

10% for the subsequent five years of the project (the general profits tax rate is currently

20%). Within the foregoing limitations, each region covered by the Law is required to set

the exact profits tax rate applicable to companies carrying projects on its territory.

The following table summarizes tax rates by region from 31 January 2014.

Region

Rate for the first five

tax years

Rate for next five tax

years

Buryatiya (Republic)

pending

pending

Sakha (Yakutiya) (Republic)

0%

10%

Tyva (Republic)

pending

pending

Zabaykalskiy Region (Krai)

0%

10%

Kamchatskiy Region (Krai)

pending

pending

Primorskiy Region (Krai)

0%

10%

Khabarovskiy Region (Krai)

0%

10%

Amursk Region (Oblast)

0%

10%

Irkutsk Region (Oblast)

0%

10%

Magadan Region (Oblast)

9%

13.5%

Sakhalin Region (Oblast)

pending

pending

Evreyskaya Region (Autonomous

Oblast)

0%

10%

21469831v1 MONTIEA

New Tax Benefits for Investment Projects in the

Russian Far East

Chukotskiy Region (Autonomous

Okrug)

pending

pending

The Law introduces a certain mechanism allowing a company running an investment

project to carry over the tax benefits granted by the Law, if the project’s income

generation is delayed. However, all the above tax benefits shall cease to apply after

January 1, 2027.

The Law establishes a relatively clear set of criteria pursuant to which a company

implementing an investment project is entitled to the tax benefits above.

The Project Location

Operations of the respective company must take place on the territory of one or several

of the following regions of the Russian Far East or Eastern Siberia:

•

Buryatiya (Republic)

•

Sakha (Yakutiya) (Republic)

•

Tyva (Republic)

•

Zabaykalskiy (Krai)

•

Kamchatskiy (Krai)

•

Primorskiy (Krai)

•

Khabarovskiy (Krai)

•

Amursk Region (Oblast)

•

Irkutsk Region (Oblast)

•

Magadan Region (Oblast)

•

Sakhalin Region (Oblast)

•

Evreyskaya Region (Autonomous Oblast)

•

Chukotskiy Region (Autonomous Okrug).

It is important to clarify that the Constitution of the Russian Federation upholds the

equality of all its regions (constituent sub-divisions) as a fundamental principal of the

Russian federal political system. The differences in their names are a legacy of the

political evolution of the Russian state and do not reflect on their status or scope of

political authority.

Type of Industry

In addition to the project location, the investment project must contemplate the production

of goods.

The total volume of investment within the framework of the project may not be lower than:

2

21469831v1 MONTIEA

New Tax Benefits for Investment Projects in the

Russian Far East

(a) RUB50 million within the period of three years from the date of the entry of the

company running the project into the Register of Participants in Regional Investment

Projects (the Register) (see below for more details),

(b) RUB500 million within five years from the date of the registration with the said

Register.

Finally, the respective investment project must be carried out by only one company (and

one company must run a particular investment project during its lifetime) that must satisfy

all the respective criteria (see below). The implementation of the project must be the

source of at least 90% of the company’s gross income.

However, the project may not engage in any of the following:

•

extraction and/or processing of oil, natural gas and/or gas condensate, transportation

of oil and/or oil products, gas and/or gas condensate

•

production of goods subject to Russian excise tax (such as alcohol products)

•

operations exempt from income tax.

Particulars of the Project Company

In order to receive the tax benefits granted by the Law, a company running an investment

project must satisfy the following requirements:

1. It must be a Russian entity incorporated in the region, where the investment project

will be carried.

2. It may not have branches or offices outside the regions covered by the Law.

3. It may not have opted for any special tax status (such as simplified taxation, taxation

as an agricultural entity, etc.).

4. It may not be part of a group with consolidated Russian tax reporting.

5. It may not be a non-profit organization, bank, insurance company, non-governmental

pension fund, securities company, or a clearing company.

6. It may not have been registered as the company running another investment project.

7. It must own or lease (the lease must expire after January 2024) the land on which the

project will be implemented.

8. It must have obtained a building permit, if such permit is necessary for the

implementation of the project.

9. It may not be a resident of a free (special) economic zone.

Let us emphasise heavily that the Law does not establish any restrictions with respect to

the nationality of the shareholders or stakeholders of the project company. A foreign

parent entity may hold all of the equity of the Russian project company.

Application Procedure

A company running a project becomes eligible for the tax benefits accorded by the Law

from the date of its entry into the Register maintained by the tax authorities of the

respective region. The decision to allow a company to be registered is adopted by the

3

21469831v1 MONTIEA

New Tax Benefits for Investment Projects in the

Russian Far East

administrative body of the respective region designated by the Russian Federal Tax

Service.

For example, in Primorskiy Region (Krai), such authority is the Department of Economy

of the Administration of Primorskiy Krai, in Sakha (Yakutiya) (Republic) it is the Ministry

of Economic and Industrial Policy of the Republic of Sakha (Yakutiya), and in Irkutsk

Region (Oblast) it is the Ministry of Economy of Irkutsk Oblast.

The Law outlines general procedures for such registration, while more detailed

procedural rules will be set forth in regional legislation. Such legislation is still under

development in most of the regions.

The central document that an applicant company has to submit to the designated body of

the respective region is an “investment declaration” of the company. It requires the

company to provide basic business parameters of its contemplated project, including the

number of jobs it is expected to create over the years and a numeric projection of tax

revenue the project is expected to generate.

The competent regional body must decide whether to approve the application or reject it

within 30 calendar days from the date it received it.

Note that the Law also sets forth instances where a registered company may be deprived

of its status and excluded from the Register. The grounds for such sanctions are set forth

in the Law and include a tax audit that reveals non-compliance of the company running

the investment project with the requirements set forth in the Law or in the Tax Code of

the Russian Federation.

A company running an investment project becomes entitled to the low profits tax rates for

the period of 10 years (tax periods), starting from the year when it received its first

income from the investment project.

Regional Criteria

Each of the regions of the Russian Federation covered by the Law is entitled to limit the

types of business operations that will be eligible for the tax benefits under the Law, as

well as increase the above minimal amount of investment with respect to such region.

Some regions have already taken advantage of these powers. For instance, the law of

Primorsky Region “On the Establishment of a Lower Rate of Profits Tax Payable to the

Regional Budget for Certain Categories of Organizations,” No. 330-KZ, dated December

13, 2013 (the Law of Primorsky Region) provides that the minimal volume of investment

in an investment project in Primorsky Region shall be RUB150 million for the first three

years, and RUB500 million for the first five years from the date of entry of the company

running the project into the Register.

Further, the same Law of Primorskiy Region establishes additional criteria for investment

projects in its region, such as:

1. The project must contemplate the creation of highly productive jobs.

2. The project must contemplate production of certain types of goods (in accordance

with the All-Russian Classification of Types of Economic Activity), including products

of agriculture and forestry goods (Section А); fishery and fish-farming goods (Section

B); metal ore and other products of mining works (classes 13 and 14 of Section C);

4

21469831v1 MONTIEA

New Tax Benefits for Investment Projects in the

Russian Far East

certain wood, pulp, cellulose and paper processing goods (sub-classes 15.1-15.8 of

sub-group 15.98.1, 15.98.2 of classes 20, 21, 24-35 of Section D).

3. The project may not be related to the processing of certain raw materials.

Many regions covered by the Law have not yet adopted their respective legislation to

implement the provisions of the Law.

Risk of Recapture

The Law also provides that if the company that runs a particular investment project is

deprived of its status, for instance because the company failed to make the declared

volume of investments or lost its status due to its own action (e.g., pursuant to a decision

to liquidate itself, or because of court-initiated bankruptcy), such company is obliged to

pay back the amounts of the tax benefits it obtained while it remained on the Register.

Authors:

Sergey J. Milanov

sergey.milanov@klgates.com

+81.3.6205.3604

Georgy Daneliya

georgy.daneliya@klgates.com

+81.3.6205.3616

Anchorage Austin Beijing Berlin Boston Brisbane Brussels Charleston Charlotte Chicago Dallas Doha Dubai Fort Worth Frankfurt

Harrisburg Hong Kong Houston London Los Angeles Melbourne Miami Milan Moscow Newark New York Orange County Palo Alto

Paris Perth Pittsburgh Portland Raleigh Research Triangle Park San Diego San Francisco São Paulo Seattle Seoul Shanghai

Singapore Spokane Sydney Taipei Tokyo Warsaw Washington, D.C. Wilmington

K&L Gates practices out of 48 fully integrated offices located in the United States, Asia, Australia, Europe, the Middle East and

South America and represents leading global corporations, growth and middle-market companies, capital markets participants and

entrepreneurs in every major industry group as well as public sector entities, educational institutions, philanthropic organizations

and individuals. For more information about K&L Gates or its locations, practices and registrations, visit www.klgates.com.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon

in regard to any particular facts or circumstances without first consulting a lawyer.

©2014 K&L Gates LLP. All Rights Reserved.

5

21469831v1 MONTIEA