Investment Management

Investment Management

JULY 2003

Advertising Modernization: SEC Approves

Amendments to NASD Rules Governing Member

Communications with the Public

The Securities and Exchange Commission approved amendments (the Amendments) to certain National

Association of Securities Dealers (NASD) advertising rules governing its members (NASD

Members) communications with the public. Most notably, the Amendments create a rule excluding institutional sales material from the pre-use approval and filing requirements relating to sales material. The

Amendments broaden the definition of

communications with the public to include public appearances, institutional sales material, and independently prepared reprints in addition to advertisements, sales literature, and correspondence.

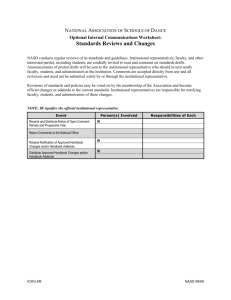

For a comparison of the current NASD advertising rules and the rules as amended, please see the chart below.

PUBLIC APPEARANCES

The Amendments clarify the application of NASD advertising rules to public appearances by NASD

Members by defining public appearance as a type of communication with the public. Public appearances are subject to some, but not all, of the content standards of the NASD advertising rules.

Public appearances include participation in a seminar, forum (including an interactive electronic forum, e.g., Internet chat rooms), radio or television interview, or other public appearance or public speaking activity.

INSTITUTIONAL SALES MATERIALS

The Amendments exclude communications to institutional investors from NASD pre-use approval and filing requirements and from many content standards.

1 Instead, institutional sales material will be subject to review requirements currently applicable to correspondence.

2 However, if the

NASD Member has reason to believe that a communication made to an institutional investor will be forwarded or made available to any person not an institutional investor, such communication will not be treated as institutional sales material. Examples of an institutional investor identified in the

Amendments include: (i) a bank, savings and loan, insurance company, registered investment adviser, persons or entities with assets of at least $50 million, and trust companies organized under state law that come within the NASD definition of bank; (ii) a governmental entity; (iii) an employee benefit plan that has at least 100 participants (but not the participants in the plan); (iv) a qualified plan that has at least 100 participants (but not the participants in the plan); (v) an NASD Member or registered associated person; and (vi) persons acting solely on behalf of any institutional investor.

1 The Amendments specifically indicate which type of communication is subject to each content standard. Content standards that apply only to advertisements or sales literature will not apply to institutional sales material.

2 NASD Members are required to adopt written policies and procedures for the review of correspondence designed to ensure compliance with applicable content standards.

Kirkpatrick & Lockhart

LLP

FORM LETTERS AND GROUP ELECTRONIC MAIL

The Amendments exclude from the NASDs pre-use approval and filing requirements form letters and group e-mails sent to existing retail customers and fewer than 25 prospective retail customers within any

30 calendar-day period as well as electronic communications prepared for delivery to a single retail customer. However, these communications are subject to the NASD approval, review and content standards that apply to correspondence. At a minimum, an NASD Member must adopt written policies and procedures for the review of correspondence in order to ensure compliance with the content standards of the NASD advertising rules.

RANKING GUIDELINES

The Amendments clarify that no advertisement or item of sales literature may present a ranking other than rankings (i) created and published by an independent ranking entity, or (ii) created by an investment company or an affiliate, but based on the performance measurements of a ranking entity. In addition, the Amendments clarify that the ranking guidelines apply only to advertisements and sales literature. Lastly, the Amendments permit the use of investment company family rankings, provided that when a particular investment company is being advertised, the individual rankings for that investment company also must be presented.

INDEPENDENTLY PREPARED REPRINTS

The Amendments exclude independently prepared reprints from NASD filing requirements and many content standards. An independently prepared reprint 3 consists of any article reprint that meets certain standards designed to ensure that it was issued by an independent publisher and was not materially altered by the NASD Member. An NASD

Member may alter an independently prepared reprint in order to comply with regulatory standards or to correct factual errors. Independently prepared reprints are, however, subject to the NASD pre-use approval requirements.

FILING REQUIREMENTS

The Amendments maintain many of the current

NASD filing requirements for advertisements and sales literature and continue to require filing with the

Advertising Regulation Department of NASD of registered investment company sales literature within

10 business days of first use or publication.

CONCLUSION

The NASDs Notice to Members 03-38: Advertising

Modernization: SEC Approves Amendments to

NASD Rules Governing Member Communications with the Public was issued on July 7, 2003 and can be found on NASDs website at www.nasd.com. The effective date of the Amendments is November 3,

2003.

PRESS RELEASES

The Amendments exclude from NASD filing requirements press releases that are made available only to members of the media.

LEGENDS AND FOOTNOTES

The Amendments provide that information may be placed in a legend or footnote only when such placement would not inhibit an investors understanding of the communication. For example, the use of small type in footnotes, or the use of footnotes to balance bold claims, might be deemed not to comply with this content standard.

Michael Caccese is a partner in the Boston office of

Kirkpatrick & Lockhart LLP. He works extensively with investment firms on compliance issues, including all of the

AIMR standards. He was previously the General Counsel to AIMR and was responsible for overseeing the development of the AIMR-PPS, GIPS and other standards governing the investment management profession and investment firms. He can be reached at 617.261.3133 and mcaccese@kl.com. Erica Blake is an associate with K&L in the Boston office and may be reached at 617.261.3244

and eblake@kl.com.

MICHAEL S. CACCESE

617.261.3133

mcaccese@kl.com

ERICA BLAKE

617.261.3244

eblake@kl.com

3 An independently prepared reprint also includes independent reports concerning investment companies that meet certain standards and are already exempt from filing requirements for investment company sales material.

Kirkpatrick & Lockhart

LLP 2

COMPARISON CHART OF CURRENT AND AMENDED NASD ADVERTISING RULES

Public

Appearances

Institutional

Sales Materials

Form Letters and Group

Electronic Mail

Current Rule

Provides that NASD Members who engage in public appearances or speaking activities must follow the content standards of NASD advertising rules.

Does not distinguish between retail and institutional sales material. Defines "sales literature" to include any "form letter" interpreted by the NASD to mean written communications, including e-mail sent to at least two persons. Consequently, any communication sent to two or more institutional investors is deemed "sales literature" and must comply with the pre-use approval, filing requirements and content standards.

Correspondence is defined as any written or electronic communications prepared for delivery to a single retail customer.

Amended Rule

Defines "public appearance" as a type of communication with the public. Such communication is subject to some, but not all, of the content standards of the NASD advertising rules.

Eliminates the pre-use approval and filing requirements applicable to communications that are distributed or made available only to institutional investors. Such communication is subject to supervision and review requirements applicable to correspondence and to some, but not all, of the content standards.

Independently

Prepared

Reprints

Press Releases

Legends and

Footnotes

Ranking

Guidelines

Does not include independently prepared reprint in definition of "communication with the public."

Defines "sales literature" to include press releases concerning an NASD Member's product or service.

Requires NASD Members, in judging whether a communication may be misleading, to consider that material disclosure included in legends or footnotes may not enhance the reader's understanding of the communication.

Prohibits the use of any investment company rankings in advertisements, sales literature, or general promotional material other than those produced by ranking entities.

Amends the definition of correspondence to include form letters and group e-mails sent to existing retail customers and fewer than 25 prospective retail customers within any 30 calendar-day period ("Group

Correspondence"). Excludes from NASD's pre-use approval and filing requirements

Group Correspondence. However, these communications are subject to the NASDs pre-use approval, review and content standards that apply to correspondence. At a minimum, an NASD Member must adopt written policies and procedures for the review of correspondence in order to ensure compliance with the content standards of the

NASD advertising rules.

Defines independently prepared reprint as new type of "communication with the public."

Subject to some, but not all, content standards and pre-use approval requirements.

Excludes from NASD filing requirements press releases that are made available only to members of the media.

Provides that information may be placed in a legend or footnote only when such placement would not inhibit an investor's understanding of the communication.

Filing

Requirements

Requires filing with the Advertising Regulation

Department of NASD within 10 business days of first use or publication for advertisements and sales literature.

Clarifies that no advertisement or sales literature may contain investment company rankings other than rankings (i) created and published by a "ranking entity," 4 or (ii) created by an investment company or an affiliate, but based on the performance measurements of a ranking entity. In addition, clarifies that the ranking guidelines apply only to advertisements and sales literature. Lastly, permits the use of investment company family rankings, provided that when a particular investment company is being advertised, the individual rankings for that investment company also must be presented.

Maintains many of the current NASD filing requirements for advertisements and sales literature and requires filing with the

Advertising Regulation Department of NASD within 10 business days of first use or publication.

4 A ranking entity is defined as an independent entity providing general information about investment companies to the public whose services are not procured by the investment company or its affiliates.

Kirkpatrick & Lockhart

LLP 3

Kirkpatrick & Lockhart LLP maintains one of the leading investment management practices in the United States, with more than 60 lawyers devoting all or a substantial portion of their practice to this area and its related specialties. The American Lawyer Corporate Scorecard, published in April 2003, lists K&L as a primary legal counsel to the investment companies, board members or advisory firms for 15 of the 25 largest mutual fund complexes. No law firm was mentioned more frequently in the Scorecard.

We represent mutual funds, closed-end funds, insurance companies, broker-dealers, investment advisers, retirement plans, banks and trust companies, hedge funds, offshore funds and other financial institutions. We also regularly represent mutual fund distributors, independent directors of investment companies and service providers to the investment management industry. In addition, we frequently serve as outside counsel to industry associations on a variety of projects, including legislative and policy matters.

We work with clients in connection with the full range of investment company industry products and activities, including all types of open-end and closed-end investment companies, funds of hedge funds, variable insurance products, private and offshore investment funds and unit investment trusts. Our practice involves all aspects of the investment company business.

We invite you to contact one of the members of the practice, listed below, for additional assistance. You may also visit our website at www.kl.com for more information, or send general inquiries via email to investmentmangement@kl.com.

BOSTON

Michael S. Caccese

Philip J. Fina

Mark P. Goshko

Thomas Hickey III

Nicholas S. Hodge

LOS ANGELES

William P. Wade

617.261.3133

617.261.3210

mcaccese@kl.com

617.261.3156

pfina@kl.com

617.261.3163

mgoshko@kl.com

617.261.3208

thickey@kl.com

nhodge@kl.com

310.552.5071

wwade@kl.com

NEW YORK

Beth R. Kramer 212.536.4024

bkramer@kl.com

Richard D. Marshall 212.536.3941

rmarshall@kl.com

Robert M. McLaughlin 212.536.3924

rmclaughlin@kl.com

Loren Schechter 212.536.4008

lschechter@kl.com

SAN FRANCISCO

Eilleen M. Clavere

Jonathan D. Joseph

David Mishel

Mark D. Perlow

Richard M. Phillips

415.249.1047

415.249.1010

eclavere@kl.com

415.249.1012

jjoseph@kl.com

415.249.1015

dmishel@kl.com

415.249.1070

mperlow@kl.com

rphillips@kl.com

WASHINGTON

Clifford J. Alexander 202.778.9068 calexander@kl.com

Diane E. Ambler 202.778.9886 dambler@kl.com

Catherine S. Bardsley 202.778.9289 cbardsley@kl.com

Arthur J. Brown

Arthur C. Delibert

202.778.9046 abrown@kl.com

202.778.9042 adelibert@kl.com

Robert C. Hacker 202.778.9016 rhacker@kl.com

Benjamin J. Haskin 202.778.9369 bhaskin@kl.com

Kathy Kresch Ingber 202.778.9015 kingber@kl.com

Rebecca H. Laird 202.778.9038 rlaird@kl.com

Thomas M. Leahey 202.778.9082 tleahey@kl.com

Cary J. Meer

R. Charles Miller

Dean E. Miller

R. Darrell Mounts

202.778.9107 cmeer@kl.com

202.778.9372 cmiller@kl.com

202.778.9371 dmiller@kl.com

202.778.9298 dmounts@kl.com

C. Dirk Peterson

Alan C. Porter

202.778.9324 dpeterson@kl.com

202.778.9186 aporter@kl.com

Theodore L. Press 202.778.9025 tpress@kl.com

Robert H. Rosenblum 202.778.9464 rrosenblum@kl.com

William A. Schmidt 202.778.9373 william.schmidt@kl.com

Lynn A. Schweinfurth 202.778.9876 lschweinfurth@kl.com

Donald W. Smith

Robert A. Wittie

Robert J. Zutz

202.778.9079 dsmith@kl.com

202.778.9066 rwittie@kl.com

202.778.9059 rzutz@kl.com

Kirkpatrick & Lockhart

LLP

Challenge us.

www.kl.com

BOSTON n DALLAS n HARRISBURG n LOS ANGELES n MIAMI n NEWARK n NEW YORK n PITTSBURGH n SAN FRANCISCO n WASHINGTON

............................................................................................................................................................

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer.

© 2003 KIRKPATRICK & LOCKHART

LLP

. ALL RIGHTS RESERVED.