Recursive and direct multi-step forecasting: the best of both worlds

advertisement

ISSN 1440-771X

Department of Econometrics and Business Statistics

http://www.buseco.monash.edu.au/depts/ebs/pubs/wpapers/

Recursive and direct multi-step

forecasting: the best of both

worlds

Souhaib Ben Taieb and Rob J Hyndman

September 2012

Working Paper 19/12

Recursive and direct multi-step

forecasting: the best of both worlds

Souhaib Ben Taieb

Machine Learning Group, Department of Computer Science,

Université Libre de Bruxelles,

Brussels, Belgium.

Email: Souhaib.Ben.Taieb@ulb.ac.be

Rob J Hyndman

Department of Econometrics and Business Statistics,

Monash University,

Clayton VIC 3800,

Australia.

Email: Rob.Hyndman@monash.edu

2 September 2012

JEL classification: J11, C53, C14, C32

Recursive and direct multi-step

forecasting: the best of both worlds

Abstract

We propose a new forecasting strategy, called rectify, that seeks to combine the best properties of

both the recursive and direct forecasting strategies. The rationale behind the rectify strategy is

to begin with biased recursive forecasts and adjust them so they are unbiased and have smaller

error. We use linear and nonlinear simulated time series to investigate the performance of the

rectify strategy and compare the results with those from the recursive and the direct strategies.

We also carry out some experiments using real world time series from the M3 and the NN5

forecasting competitions. We find that the rectify strategy is always better than, or at least has

comparable performance to, the best of the recursive and the direct strategies. This finding

makes the rectify strategy very attractive as it avoids making a choice between the recursive and

the direct strategies which can be a difficult task in real-world applications.

Keywords: Multi-step forecasting; forecasting strategies; recursive forecasting; direct forecasting; linear time series; nonlinear time series; M3 competition; NN5 competition.

2

Recursive and direct multi-step forecasting: the best of both worlds

1

Introduction

Traditionally, multi-step forecasting has been handled recursively, where a single time series

model is estimated and each forecast is computed using previous forecasts. More recently, direct

calculation of multi-step forecasting has been proposed, where a separate time series model for

each forecasting horizon is estimated, and forecasts are computed only on the observed data.

Choosing between these different strategies involves a trade-off between bias and estimation

variance. Recursive forecasting is biased when the underlying model is nonlinear, but direct

forecasting has higher variance because it uses fewer observations when estimating the model,

especially for longer forecast horizons.

The literature on this topic often involves comparing the recursive and direct strategies, and

discussing the conditions under which one or other is better. For example, Ing (2003) shows that

in the linear case, the recursive MSE is greater than the direct MSE. Chevillon (2007) concludes

that the direct strategy is most beneficial when the model is misspecified.

In this paper, we take a different approach and propose a new forecasting strategy that seeks to

combine the best properties of both the recursive and direct strategies. The rationale behind the

rectify strategy is to begin with biased recursive forecasts and adjust them so they are unbiased

and have smaller error.

In the next section, we present both the recursive and the direct strategy together with a

decomposition of their corresponding mean squared error. Section 3 presents the rectify

strategy using the same terminology as for the recursive and the direct strategies to allow

theoretical comparisons. Section 4 gives some details about the set-up of our experiments.

Section 5 investigates the performance of the different strategies using linear and nonlinear

simulated time series. Section 6 shows the performance of the different strategies with time

series from two forecasting competitions, namely the M3 and the NN5 competition. Finally, we

conclude our work in Section 7.

2

Forecasting strategies

Given a univariate time series {y1 , . . . , yT } comprising T observations, we want to forecast the

next H values of the time series.

Ben Taieb & Hyndman: 2 September 2012

3

Recursive and direct multi-step forecasting: the best of both worlds

We will assume the data come from a possibly nonlinear autoregressive process of the form

yt = f (xt−1 ) + εt with xt = [yt , . . . , yt−d+1 ]0 ,

where {εt } is a stochastic iid error process with mean zero, variance σ 2 , E[εt3 ] = 0 (for simplicity)

and κ = E(ε4 ) > 0. The process is specified by a function f , embedding dimension d, and an

error term εt .

In this article, we assume the goal of forecasting is to estimate the conditional mean µt+h|t =

E(yt+h | xt ), and we will evaluate different forecasting strategies by how well they approximate

µt+h|t .

When h = 1, we have the simple expression µt+1|t = f (xt ). If f is linear, we can also write down

some relatively simple expressions (Fan & Yao 2003, p.118):

(h−1) (x ), . . . , f (h−d) (x )]0 ),

t

t

f ([f

µt+h|t =

x 0 w ,

t h

if h > 0;

(1)

if 1 − d ≤ h ≤ 0.

where wh has jth element equal to 1 if j = 1 − h and equal to 0 otherwise. Thus, when f is linear,

the conditional mean forecasts can be computed recursively. More generally, for nonlinear f

and h > 1, the calculation of µt+h|t has no simple form.

Each forecasting strategy involves estimating one or more models which are not necessarily

of the same form as f and may not have the same embedding dimension as f . For one-step

forecasts, the model will be denoted by yt = m(xt−1 ; θ) + et where xt = [yt , . . . , yt−p+1 ]0 . That is we

estimate (or assume) the form of m, the parameters θ and the dimension p from a set of training

data. If m is of the same form as f (up to some estimable parameters), we write m f . Ideally,

we would like p = d, m f and the estimates of θ close to the true parameters. But we are

allowing for model mis-specification by not making these assumptions. For multi-step forecasts,

some strategies will use the same model m as for one-step forecasts, while other strategies may

involve additional or alternative models to be estimated.

If we let m̂(h) (xt ) denote the forecasts of a given strategy at horizon h and define m(h) (xt ) =

E[m̂(h) (xt ) | xt ], then the mean squared error (MSE) at horizon h is given by

h

i

MSEh = E (yt+h − m̂(h) (xt ))2

Ben Taieb & Hyndman: 2 September 2012

4

Recursive and direct multi-step forecasting: the best of both worlds

h

i

h

i

= E (yt+h − µt+h|t )2 + (µt+h|t − m(h) (xt ))2 + E (m̂(h) (xt ) − m(h) (xt ))2

{z

} |

|

{z

} |

{z

}

Noise

Bias bh2

(2)

Variance

where all expectations are conditional on xt . The variance term on the right will converge to

zero as the size of the training set increases, and so we will not consider it further.

To simplify the derivation of the remaining terms, we use similar arguments to Atiya et al.

(1999) and consider only h = 2. An analogous approach can be used to derive the MSE for larger

forecast horizons.

Now yt+2 is given by

yt+2 = f (yt+1 , . . . , yt−d+2 ) + εt+2 = f (f (xt ) + εt+1 , . . . , yt−d+2 ) + εt+2 .

Using Taylor series approximations up to second-order terms, we get

yt+2 ≈ f (f (xt ), . . . , yt−d+2 ) + εt+1 fx1 + 21 (εt+1 )2 fx1 x1 + εt+2 ,

where fx1 is the derivative of f with respect to its first argument, fx1 x1 is its second derivative

with respect to its first argument, and so on.

The noise term depends only on the data generating process and is given by

h

i

E (yt+2 − µt+2|t )2

2 1 2

1 2

≈ E f (f (xt ), . . . , yt−d+2 ) + εt+1 fx1 + 2 εt+1 fx1 x1 + εt+2 − f (f (xt ), . . . , yt−d+2 ) − 2 σ fx1 x1

= σ 2 (1 + fx21 ) + 14 (κ − σ 4 )fx21 x1 .

Consequently, the MSE at horizon h = 2 is given by

MSE2 ≈ σ 2 (1 + fx21 ) + 41 (κ − σ 4 )fx21 x1 + (µt+h|t − m(h) (xt ))2

2.1

(3)

The recursive strategy

In the recursive strategy, we estimate the model

yt = m(xt−1 ; θ) + et , where xt = [yt , . . . , yt−p+1 ]0

Ben Taieb & Hyndman: 2 September 2012

(4)

5

Recursive and direct multi-step forecasting: the best of both worlds

and E[et ] = 0. In standard one-step optimization with squared errors, the objective function of

h

i

the recursive strategy is E (yt+1 − m(xt ; θ))2 | xt and the parameters θ are estimated by

θ̂ = argmin

θ∈Θ

X

(yt − m(xt−1 ; θ))2 ,

(5)

t

where Θ denotes the parameter space.

We compute forecasts recursively as in (1):

m̂([m̂(h−1) (xt ), . . . , m̂(h−p) (xt )]0 ),

(h)

m̂ (xt ) =

0

xt wh ,

if h > 0;

if 1 − p ≤ h ≤ 0;

where m̂(x) is a shorthand notation for m(x; θ̂). These forecasts are also sometimes called

“iterated multi-step” (IMS) forecasts (e.g., Chevillon & Hendry 2005, Chevillon 2007, Franses &

Legerstee 2009).

The choice of θ̂ given by (5) minimizes the mean squared error of the one-step forecasts, and

so ensures (see, for example, Hastie et al. 2008, p.18) that m(1) (xt ) = µt+1|t provided m f and

p = d. Thus, the one-step forecasts are unbiased under these conditions. The same unbiasedness

property does not hold for higher forecast horizons except in some special cases.

Again, we will consider only h = 2. The bias of the recursive strategy can be calculated as

b2 = µt+2|t − m(2) (xt ) ≈ f (f (xt ), . . . , yt−d+2 ) + 12 σ 2 fx1 x1 − m(m(xt ), . . . , yt−p+2 )

h

i

≈ f (f (xt ), . . . , yt−d+2 ) − m(m(xt ), . . . , yt−p+2 ) + 21 σ 2 fx1 x1 .

(6)

So even when m f and d = p, the forecasts will be biased unless fx1 x1 = 0. That is, recursive

forecasts are unbiased if and only if f is linear, a linear model m is used, and when the

embedding dimension is correctly determined; in all other situations, recursive forecasts will be

biased for h ≥ 2. In particular, the bias will be large whenever |fx1 x1 | is large; that is when f has

high curvature.

Using expression (3), we see that the recursive strategy has a mean squared error at horizon

h = 2 equal to

MSErecursive

2

h

i

2

≈ σ 2 (1 + fx21 ) + 41 (κ − σ 4 )fx21 x1 + f (f (xt ), . . . , yt−d+2 ) − m(m(xt ), . . . , yt−p+2 ) + 21 σ 2 fx1 x1 .

Ben Taieb & Hyndman: 2 September 2012

6

Recursive and direct multi-step forecasting: the best of both worlds

When m f and d = p, the MSE simplifies to

MSErecursive

≈ σ 2 (1 + fx21 ) + 14 κfx21 x1 .

2

But when the model is misspecified, either in the embedding dimension, or in the functional

form of m, the MSE can be much larger.

A variation on the recursive forecasting strategy is to use a different set of parameters for each

forecasting horizon:

θ̂h = argmin

Xh

i2

yt − m(h) (xt−h ; θ) .

θ∈Θ

t

A further variation selects the parameters to minimize the forecast errors over the first H

forecast horizons:

H Xh

X

i2

θ̂ = argmin

yt − m(h) (xt−h ; θ) .

θ∈Θ

h=1 t

In both of these variants, forecasts are still obtained recursively from the one-step model.

The only difference with standard recursive forecasting is that the parameters are optimized

differently to allow more accurate multi-step forecasts. Examples of machine learning models

using these variations of the recursive strategy are recurrent neural networks (e.g., Williams &

Zipser 1989, Werbos 1990) and local models with the nearest trajectories criterion (McNames

1998).

An advantage of using the recursive strategy is that only one model is required, saving significant

computational time, especially when a large number of time series and forecast horizons are

involved. The strategy also ensures that the fitted model m matches the assumed data generating

process f as closely as possible. On the other hand, the recursive forecasts are not equal to the

conditional mean, even when the model is exactly equivalent to the data generating process.

2.2

The direct strategy

With the direct strategy, different forecasting models are used for each forecast horizon:

yt = mh (yt−h , . . . , yt−h−ph ; θh ) + et,h ,

Ben Taieb & Hyndman: 2 September 2012

(7)

7

Recursive and direct multi-step forecasting: the best of both worlds

where h = 1, . . . , H. For each model, the parameters θh are estimated as follows

θ̂h = argmin

X

θh ∈Θ h

[yt − mh (xt−h ; θh )]2 .

(8)

t

Then forecasts are obtained for each horizon from the corresponding model, m̂(h) (xt ) = mh (xt ; θ̂h ).

This is sometimes also known as “direct multi-step” (DMS) forecasting (e.g., Chevillon & Hendry

2005, Chevillon 2007, Franses & Legerstee 2009).

Because multiple models are used, this approach involves a heavier computational load than

recursive forecasting. Also, we no longer match the model used for forecasting with the assumed

model; the various models are estimated independently and can in practice be quite different

from each other.

Because of the squared errors in (8), m(h) (xt ) = mh (xt ), and the bias of the direct strategy at

horizon h = 2 is given by

b2 = µt+2|t − m(2) (xt ) ≈ f (f (xt ), . . . , yt−d+2 ) + 12 σ 2 fx1 x1 − m2 (yt , . . . , yt−p2 +1 ).

Thus the strategy leads to unbiased forecasts when m2 (yt , . . . , yt−p+1 ) f (f (xt ), . . . , yt−d+2 ) +

1 2

2 σ fx1 x1 .

These conditions will be satisfied whenever m2 is a sufficiently flexible model. Similar

arguments can be used for other forecast horizons.

As for the recursive strategy, we can get the MSE for the direct strategy with

h

i2

2

2

4 2

1

1 2

MSEdirect

≈

σ

(1

+

f

)

+

(κ

−

σ

)f

+

f

(f

(x

),

.

.

.

,

y

)

+

σ

f

−

m

(y

,

.

.

.

,

y

)

.

t

t−d+2

x

x

2

t

t−p

+1

x

x

x

2

4

2

1 1

2

1 1

1

When the strategy is unbiased, the MSE simplifies to

MSEdirect

≈ σ 2 (1 + fx21 ) + 14 (κ − σ 4 )fx21 x1 .

2

Consequently, under ideal conditions when m f and p = d for the recursive strategy, and the

direct strategy is unbiased, we find that the recursive strategy has larger MSE than the direct

strategy:

MSErecursive

− MSEdirect

≈ 14 σ 4 fx21 x1 .

2

2

Ben Taieb & Hyndman: 2 September 2012

8

Recursive and direct multi-step forecasting: the best of both worlds

Ing (2003) shows that even in the linear case (when fx1 x1 = 0), when mh and m are assumed

linear and {yt } is assumed stationary, the recursive MSE is greater than the direct MSE, with the

difference being of order O(T −3/2 ) where T is the length of the time series.

Chevillon & Hendry (2005) provide a useful review of some of the literature comparing recursive

and direct forecasting strategies, and explore in detail the differences between the strategies

for VAR models applied to stationary and difference-stationary time series. They show that

for these models, when f , m and mh are all assumed multivariate linear, and under various

mis-specification conditions, then the recursive MSE is greater than the direct MSE.

In a later paper, Chevillon (2007) provides a further review and unifies some of the results

in the literature. He concludes that the direct strategy is most beneficial when the model is

misspecified (i.e., that m and f are not asymptotically equivalent), in particular when the data

contains misspecified unit roots, neglected residual autocorrelation and omitted location shifts.

Putting aside the computational disadvantage of using the direct strategy, it also has a problem

in generating forecasts from potentially very different models at different forecast horizons.

Because every model is selected independently at each horizon, it is possible for consecutive

forecasts to be based on different conditioning information and different model forms. This can

lead to irregularities in the forecast function. These irregularities are manifest as a contribution

to the forecast variance. The problem is exacerbated when each of the mh models is allowed to

be nonlinear and nonparametrically estimated (Chen et al. 2004).

3

The RECTIFY strategy

In this section we propose a new forecasting strategy that borrows from the strengths of the

recursive and direct strategies. We call this new strategy “RECTIFY” because it begins with

recursive forecasts and adjusts (or rectifies) them so they are unbiased and have smaller MSE.

We begin with a simple linear base model, and produce forecasts from it using the recursive

strategy. These are known to be biased, even when the true data generating process is correctly

specified by the base model. Then we correct these forecasts by modelling the forecast errors

using a direct strategy. The resulting forecasts will be unbiased, provided the models used in

the direct strategy are sufficiently flexible.

The advantage of this two-stage process is that it links all the direct forecast models together with

the same unifying base model, thus reducing the irregularities that can arise with independent

Ben Taieb & Hyndman: 2 September 2012

9

Recursive and direct multi-step forecasting: the best of both worlds

models, and so reducing the forecast variance. Of course, it is still possible for the direct

models to be different from each other, but these differences are likely to be much smaller when

modelling the errors from the recursive strategy than when modelling the time series directly.

We shall denote the simple linear base model by yt = z(xt−1 ; θ) + et , from which recursive

forecasts are calculated. In the second stage, we adjust the forecasts from the base model by

applying direct forecasting models to the errors from the recursive base forecasts; that is, we fit

the models

yt − z(h) (yt−h , . . . , yt−h−p ; θ̂) = rh (yt−h , . . . , yt−h−ph ; γh ) + et,h

(9)

where h = 1, . . . , H.

The parameters for all models are estimated by least squares. Then forecasts are obtained for

each horizon by combining the base model and the rectification models: m̂(h) (xt ) = ẑ(h) (xt )+ r̂h (xt ).

Let m(h) (xt ) = E[m̂(h) (xt ) | xt ]. Then the bias of the rectify strategy at horizon h = 2 is given by

b2 = µt+2|t − m(2) (xt )

h

i

≈ f (f (xt ), . . . , yt−d+2 ) + 12 σ 2 fx1 x1 − z(z(xt ), . . . , yt−p+2 ) + r2 (yt , . . . , yt−p2 +1 )

h

i

= f (f (xt ), . . . , yt−d+2 ) − z(z(xt ), . . . , yt−p+2 ) + 21 σ 2 fx1 x1 − r2 (yt , . . . , yt−p2 +1 ).

Thus the strategy leads to unbiased forecasts when r2 (yt , . . . , yt−p2 +1 ) f (f (xt ), . . . , yt−d+2 ) −

z(z(xt ), . . . , yt−p+2 ) + 12 σ 2 fx1 x1 . In other words, when the rectification models are sufficiently

flexible to estimate the conditional mean of the residuals from the base model.

Bias in the base model is corrected with the rectification model, so the value of the base model

is not in getting low bias but low variance. Consequently a relatively simple parametric base

model works best. In particular, we do not need z f . In our applications, we use a linear

autoregressive model where the order is selected using the AIC. While this model will be biased

for nonlinear time series processes, it will allow most of the signal in f to be modelled, and will

give relatively small variances due to being linear. Another advantage of making the base model

linear is that it provides an estimate of the underlying process in areas where the data is sparse.

The rectification models must be flexible in order to handle the bias produced by the base model.

In our applications we use nearest neighbour estimates (kNN).

Ben Taieb & Hyndman: 2 September 2012

10

Recursive and direct multi-step forecasting: the best of both worlds

We can get the MSE for the rectify strategy with

rectify

MSE2

≈ σ 2 (1 + fx21 ) + 14 (κ − σ 4 )fx21 x1

h

i2

+ [f (f (xt ), . . . , yt−d+2 ) − z(z(xt ), . . . , yt−p+2 ) + 12 σ 2 fx1 x1 ] − r2 (yt , . . . , yt−p2 +1 ) .

When the rectify strategy is unbiased, it has an asymptotic MSE equal to the direct strategy and

less than the recursive strategy:

rectify

MSErecursive

− MSE2

2

= MSErecursive

− MSEdirect

≈ 14 σ 4 fx21 x1 .

2

2

However, this overlooks the variance advantage of the rectify strategy. While the asymptotic

variances of the rectify and direct strategies are both zero (and hence not part of these MSE

results), the rectify strategy should have smaller finite-sample variance due to the unifying

effects of the base model. We will demonstrate this property empirically in the next section.

The rectify strategy proposed here is similar to the method proposed by Judd & Small (2000),

although they do not consider the statistical properties (such as bias and MSE) of the method.

One contribution we are making in this paper is an explanation of why the method of Judd &

Small (2000) works.

4

4.1

Experimental set-up

Regression methods and model selection

Each forecasting strategy requires a different number of regression tasks. In our experiments,

we considered two autoregression methods: a linear model and a kNN algorithm.

The linear models are estimated using conditional least squares with the order p selected using

the AIC.

The kNN model is a nonlinear and nonparametric model where the prediction for a given data

point xq is obtained by averaging the target outputs y[i] of the k nearest neighbors points of

the given point xq (Atkeson et al. 1997). We used a weighted kNN model by taking a weighted

average rather than a simple average. The weights are a function of the Euclidean distance

between the query point and the neighboring point (we used the biweight function of Atkeson

et al. 1997). The key parameter k has to be selected with care as it is controlling the bias/variance

Ben Taieb & Hyndman: 2 September 2012

11

Recursive and direct multi-step forecasting: the best of both worlds

tradeoff. A large k will lead to a smoother fit and therefore a lower variance (at the expense of a

higher bias), and vice versa for a small k.

To select the best value of the parameter k, we adopted a holdout approach in which the first part

(70%) of each time series is used for training and the second part (30%) is used for validation.

More precisely, the first part is used to search for the neighbors and the second part to calculate

a validation error.

4.2

The forecasting strategies

In our experiments, we will compare four forecasting strategies:

• REC: the recursive strategy using the kNN algorithm;

• DIRECT: the direct strategy using the kNN algorithm for each of the H forecast horizons;

• RECTIFY: the rectify strategy;

To show the impact of the base model, we will consider two implementations:

• LINARP-KNN: the linear model as base model and the kNN algorithm for the H rectification models;

• KNN-KNN: the kNN algorithm for both the base model and the rectification models.

5

Simulation experiments

We carry out a Monte Carlo study to investigate the performance of the rectify strategy compared

to the other forecasting strategies from the perspective of bias and variance. We use simulated

data with a controlled noise component to effectively measure bias and variance effects.

5.1

Data generating processes

Two different autoregressive data generating processes are considered in the simulation study.

First we use a linear AR(6) process given by

yt = 1.32yt−1 − 0.52yt−2 − 0.16yt−3 + 0.18yt−4 − 0.26yt−5 + 0.19yt−6 + εt ,

where εt ∼ NID(0, 1). This process exhibits cyclic behaviour and was selected by fitting an AR(6)

model to the famous annual sunspot series. Because it is a linear process, the variance of εt

Ben Taieb & Hyndman: 2 September 2012

12

Recursive and direct multi-step forecasting: the best of both worlds

simply scales the resulting series. Consequently, we set the error variance to one without loss of

generality.

We also consider a nonlinear STAR process given by

h

i−1

yt = 0.3yt−1 + 0.6yt−2 + (0.1 − 0.9yt−1 + 0.8yt−2 ) 1 + e(−10yt−1 ) + εt

where εt ∼ NID(0, σ 2 ). We considered two values for the error variance of the STAR model noise

σ 2 = [0.052 , 0.12 ].

Several other simulation studies used this STAR process for the purposes of model selection,

model evaluation as well as model comparison. See Teräsvirta & Anderson (1992), Tong &

Lim (1980) and Tong (1995) for some examples as well as related theoretical background and

applications.

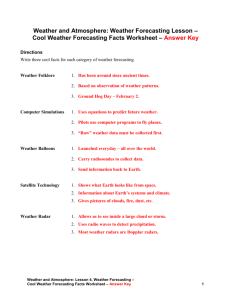

Figure 1 shows samples with T = 200 observations of both DGPs.

5.2

Bias and variance estimation

In expression (2), we have seen the decomposition of the MSE for a given strategy at horizon h.

In this section, we will show how to estimate the different parts of the decomposition, namely

the noise, the squared bias and the variance.

For a given DGP, we generate L independent time series D i = {y1 , . . . , yT } each composed of

T observations using different random seeds for the error term, where i ∈ {1, . . . , L}. These

generated time series represent samples of the DGP.

To measure the bias and variance, we use an independent time series from the same DGP for

testing purposes. We represent this independent testing time series by a set of R input/output

pairs {(xj , yj )}R

j=1 where xj is a sequence of d consecutive observations and the vector yj comprises

the next H consecutive observations.

(h)

If we let m̂D i (xj ) be the forecast of a given strategy for the input xj at horizon h using dataset D i

and yj (h) be the hth element of the vector yj , then the MSE can be calculated as

L R 2

1 XX

(h)

MSEh =

yj (h) − m̂D i (xj )

LR

i=1 j=1

= Noiseh + Bias2h + Varianceh .

Ben Taieb & Hyndman: 2 September 2012

13

Recursive and direct multi-step forecasting: the best of both worlds

0

−10

−5

Values

5

AR(6)

0

50

100

150

200

150

200

150

200

Time

Values

−0.2

0.0

0.2

0.4

STAR(2) − σ = 0.05

0

50

100

Time

0.0

−0.5

Values

0.5

STAR(2) − σ = 0.1

0

50

100

Time

Figure 1

The three components can be estimated as follows

R

2

1 X

Noiseh =

yj (h) − E[yj (h) | xj ]

R

j=1

Bias2h =

R

2

1 X

E[yj (h) | xj ] − m̄(xj )

R

j=1

Varianceh =

L R 2

1 X X (h)

m̂D i (xj ) − m̄(xj )

LR

i=1 j=1

L

where m̄(xj ) =

1 X (h)

m̂D i (xj ) is an estimate of m(h) (xj ).

L

i=1

Ben Taieb & Hyndman: 2 September 2012

14

Recursive and direct multi-step forecasting: the best of both worlds

5.3

Simulation details

The first three hundred simulated values are discarded for each simulated series to stabilize the

time series, as suggested by Law & Kelton (2000).

To show the importance of the size of the time series T for each strategy, we will compare

different sizes, namely T ∈ {50, 100, 200, 400}.

We considered a maximum forecasting horizon H = 10 for the AR(6) DGP and H = 20 for the

STAR(2) DGP.

For the bias and variance estimation, we generate L = 500 sample time series from the DGP.

A large time series is independently generated and R = 2000 input/output pairs are extracted

from it for testing purposes as described in Section 5.2.

For the AR(6) DGP, the conditional mean E[yj (h) | xj ] at input xj and horizons h ∈ {1, . . . , H}

has been calculated analytically. For the STAR(2) DGP, we used simulations to compute

(h)

(h)

1 PS

s=1 ys (xj ) where ys (xj ) is one realization of the future of the input xj . We chose a large

S

value for the parameter S.

The range of values for the parameters p, p1 , . . . , pH (see equations (4), (7) and (9)) required by

all the regression tasks is {2, 3, 4, 5, 6, 7} and the set {2, 3, 4, 5} for the base model of the rectify

strategy. For the STAR(2) DGP, we used the set {2, 3, 4, 5}.

5.4

Results and discussion

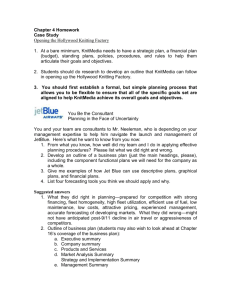

Figure 2 gives for the AR(6) DGP and different values of T , the MSE together with the corresponding squared bias and variance. The same information is given in Figures 3 and 4 for the

STAR(2) DGP with σ = 0.05 and σ = 0.1, respectively.

For both DGPs, we can see in Figures 2, 3 and 4 that the recursive strategy has virtually the same

performance as the direct strategy in the first few horizons while it performs poorly for longer

horizons. For the AR(6) DGP, this is mainly due to the nonlinear model which increases the

forecast variance. For the STAR(2) DGP, both the nonlinear model and the nonlinear time series

make the forecasts of the recursive strategy worse. Indeed, as we have seen in expression (6), if

the time series is nonlinear and fx1 x1 > 0, there is a positive bias. Also, if the model is nonlinear

then an error made at one forecast horizon will be propagated to the subsequent forecast

horizons, thus increasing the bias of the recursive strategy as the horizon increases.

Ben Taieb & Hyndman: 2 September 2012

15

Recursive and direct multi-step forecasting: the best of both worlds

The same figures show also that the direct forecasts converge to the mean forecasts as the size of

the time series T increases, which is not the case for the recursive strategy. This is consistent

with the theoretical analysis of Section 2 where we have seen that the recursive strategy is biased

when the time series is noisy and f has a non-zero second derivative.

Concerning the two implementations of the rectify strategy, we can see that KNN-KNN has

significantly reduced the bias of the recursive strategy for both DGPs. However, this was at a

price of an increase in variance which consequently made the forecasts worse. The increase

in variance is particularly noticeable with small-sample time series and vanishes with large

samples. In consequence, using a nonlinear base model seems not to be a good idea when

implementing the rectify strategy.

If we look at the second implementation of the rectify strategy (LINARP-KNN in blue), we can see

that it performs better compared to KNN-KNN for both DGPs. Instead of using a nonlinear base

model, LINARP-KNN uses a linear AR(p) model which reduces the variance of the final forecasts.

Figure 2 shows that LINARP-KNN has improved the forecasting performance over both the

recursive and the direct strategies. The bias has been reduced over the forecasting horizons

for both strategies. Also, LINARP-KNN has significantly reduced the variance for the recursive

strategy. Compared to the direct strategy, the better performance is particularly noticeable at

shorter horizons and we get similar performance at longer horizons.

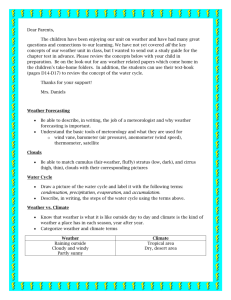

Figures 3 and 4 gives the results for the STAR(2) DGP for two different levels of noise. Comparing

these two figures, we can see that the gain with LINARP-KNN is greater with a higher level of

noise. This can be explained by the fact that the recursive strategy will be more biased and

also because the linear base model performs well in a high noise setting compared to nonlinear

models.

We can also notice in Figure 4 that LINARP-KNN has a smaller MSE compared to other strategies

at shorter horizons and converges to the forecasts of the direct strategy as the horizon increases.

In addition, LINARP-KNN is better with small-sample time series and gets closer to the direct

strategy as T increases.

The different results suggest that we can take advantage of the linear model in areas where the

data is sparse and benefit from the small variance due the linearity.

To illustrate the MSE decomposition for the different strategies, Figure 5 shows for T = 100

and the AR(6) DGP, the noise, the squared bias and the variance stacked in each panel. The

Ben Taieb & Hyndman: 2 September 2012

16

Recursive and direct multi-step forecasting: the best of both worlds

same information is given in Figures 6 and 7 for the STAR(2) DGP with σ = 0.05 and σ = 0.1,

respectively.

Figure 5, 6 and 7 show that the main factors affecting the MSE for all horizons are the noise and

the variance. For both DGPs, we can see that the recursive strategy has both higher bias (in grey)

and higher variance (in yellow) at longer horizons compared to the direct strategy.

For the AR DGP, KNN-KNN has decreased the bias and increased the variance of the recursive

strategy. However, for LINARP-KNN, we can clearly see the decrease in bias as well as in variance.

For the STAR DGP, we can see a higher decrease in terms of both bias and variance for LINARPKNN in Figure 7 compared to Figure 6.

Ben Taieb & Hyndman: 2 September 2012

17

Recursive and direct multi-step forecasting: the best of both worlds

Bias − T = 50

6

8

5

0

2

4

6

8

10

2

6

8

MSE − T = 100

Bias − T = 100

Variance − T = 100

5

4

2

1

0.2

6

8

10

0

0.0

2

4

2

4

6

8

10

2

4

6

8

Horizon

Horizon

MSE − T = 200

Bias − T = 200

Variance − T = 200

6

8

10

5

4

2

1

0

2

4

6

8

10

2

4

6

8

Horizon

Horizon

MSE − T = 400

Bias − T = 400

Variance − T = 400

6

8

10

5

10

4

2

3

Error

0.6

1

0

0.0

2

0.2

4

0.4

6

Error

8

0.8

10

1.0

Horizon

4

10

3

Error

0.6

0.0

2

0.2

4

0.4

6

Error

8

0.8

10

1.0

Horizon

4

10

3

Error

0.6

0.4

6

Error

8

0.8

10

1.0

Horizon

0

2

4

Horizon

0

2

3

Error

2

1

0.2

0.0

10

Horizon

4

Error

0.6

Error

0.4

4

0

2

Error

4

0.8

10

8

6

Error

4

0

2

REC

KNN−KNN

LINARP−KNN

DIRECT

2

Error

Variance − T = 50

1.0

MSE − T = 50

2

Horizon

4

6

Horizon

8

10

2

4

6

8

10

Horizon

Figure 2: AR(6) DGP and T = [50, 100, 200, 400]. MSE with corresponding squared bias and

variance.

Ben Taieb & Hyndman: 2 September 2012

18

Recursive and direct multi-step forecasting: the best of both worlds

15

0.05

0.03

Error

0.02

0.01

5

10

15

20

5

10

15

MSE − T = 100

Bias − T = 100

Variance − T = 100

20

15

20

0.01

0.00

0.000

0.00

10

0.03

0.02

Error

0.004

0.002

0.04

Error

0.06

0.04

0.006

0.05

0.06

Horizon

0.08

Horizon

0.02

5

10

15

20

5

10

15

Horizon

Horizon

MSE − T = 200

Bias − T = 200

Variance − T = 200

20

10

15

0.03

0.02

Error

0.004

20

0.01

5

10

15

20

5

10

15

Horizon

Horizon

MSE − T = 400

Bias − T = 400

Variance − T = 400

20

5

10

15

20

0.03

Error

0.02

0.01

0.00

0.00

0.000

0.02

0.002

0.04

Error

0.06

0.04

0.006

0.05

0.06

Horizon

0.08

5

0.00

0.00

0.000

0.02

0.002

0.04

Error

0.06

0.04

0.006

0.05

0.06

Horizon

0.004

Error

0.00

0.000

20

Horizon

0.08

5

Error

Variance − T = 50

0.04

0.006

10

0.004

0.002

Error

0.06

Error

0.04

0.02

0.00

REC

KNN−KNN

LINARP−KNN

DIRECT

5

Error

0.06

Bias − T = 50

0.08

MSE − T = 50

5

Horizon

10

Horizon

15

20

5

10

15

20

Horizon

Figure 3: STAR(2) DGP, σ = 0.05 and T = [50, 100, 200, 400]. MSE with corresponding squared

bias and variance.

Ben Taieb & Hyndman: 2 September 2012

19

Recursive and direct multi-step forecasting: the best of both worlds

0.08

Bias − T = 50

Variance − T = 50

10

15

20

0.02

0.00

5

10

15

20

5

10

15

Horizon

Horizon

MSE − T = 100

Bias − T = 100

Variance − T = 100

0.08

Horizon

20

10

15

20

0.02

0.00

0.000

0.00

5

10

15

20

5

10

15

Horizon

Horizon

MSE − T = 200

Bias − T = 200

Variance − T = 200

0.08

Horizon

20

10

15

20

0.02

0.00

0.000

0.00

5

10

15

20

5

10

15

Horizon

Horizon

MSE − T = 400

Bias − T = 400

Variance − T = 400

0.08

Horizon

20

10

15

20

0.02

0.00

0.000

0.00

5

0.04

Error

0.010

Error

0.005

0.05

Error

0.10

0.06

0.015

0.15

5

0.04

Error

0.010

Error

0.005

0.05

Error

0.10

0.06

0.015

0.15

5

0.04

Error

0.010

Error

0.005

0.05

Error

0.10

0.06

0.015

0.15

5

0.000

0.00

REC

KNN−KNN

LINARP−KNN

DIRECT

0.04

Error

0.010

Error

0.005

0.05

Error

0.10

0.06

0.015

0.15

MSE − T = 50

5

Horizon

10

Horizon

15

20

5

10

15

20

Horizon

Figure 4: STAR(2) DGP, σ = 0.1 and T = [50, 100, 200, 400]. MSE with corresponding squared bias

and variance.

Ben Taieb & Hyndman: 2 September 2012

20

Recursive and direct multi-step forecasting: the best of both worlds

6

0

2

4

Error

8

10

12

MSE − T = 100 − noise = 1

REC

KNN−KNN

LINARP−KNN

DIRECT

2

4

6

8

10

Horizon

10

8

4

6

8

10

2

4

6

Horizon

T = 100 − DIRECT

8

10

8

10

10

8

6

4

2

0

0

2

4

6

Error

8

10

12

Horizon

T = 100 − LINARP−KNN

12

2

Error

6

Error

0

2

4

6

0

2

4

Error

8

10

12

T = 100 − KNN−KNN

12

T = 100 − REC

2

4

6

8

10

Horizon

2

4

6

Horizon

Figure 5: AR(6) DGP. MSE of the different forecasting strategies (top left). Decomposed MSE in

noise (cyan), squared bias (grey) and variance (yellow).

Ben Taieb & Hyndman: 2 September 2012

21

Recursive and direct multi-step forecasting: the best of both worlds

0.06

0.00

0.02

0.04

Error

0.08

0.10

MSE − T = 100 − noise = 0.05

REC

KNN−KNN

LINARP−KNN

DIRECT

5

10

15

20

Horizon

0.08

10

15

20

5

10

Horizon

T = 100 − DIRECT

15

20

15

20

0.08

0.06

0.04

0.02

0.00

0.00

0.02

0.04

Error

0.06

0.08

0.10

Horizon

T = 100 − LINARP−KNN

0.10

5

Error

0.06

0.00

0.02

0.04

Error

0.06

0.00

0.02

0.04

Error

0.08

0.10

T = 100 − KNN−KNN

0.10

T = 100 − REC

5

10

15

20

Horizon

5

10

Horizon

Figure 6: STAR(2) DGP and σ = 0.05. MSE of the different forecasting strategies (top left). Decomposed MSE in noise (cyan), squared bias (grey) and variance (yellow).

Ben Taieb & Hyndman: 2 September 2012

22

Recursive and direct multi-step forecasting: the best of both worlds

0.00

0.05

Error

0.10

0.15

MSE − T = 100 − noise = 0.1

REC

KNN−KNN

LINARP−KNN

DIRECT

5

10

15

20

Horizon

0.10

Error

0.05

0.00

0.00

0.05

Error

0.10

0.15

T = 100 − KNN−KNN

0.15

T = 100 − REC

10

15

20

5

10

Horizon

T = 100 − DIRECT

15

20

15

20

0.10

Error

0.05

0.00

0.00

0.05

Error

0.10

0.15

Horizon

T = 100 − LINARP−KNN

0.15

5

5

10

15

20

Horizon

5

10

Horizon

Figure 7: STAR(2) DGP and σ = 0.1. MSE of the different forecasting strategies (top left). Decomposed MSE in noise (cyan), squared bias (grey) and variance (yellow).

Ben Taieb & Hyndman: 2 September 2012

23

Recursive and direct multi-step forecasting: the best of both worlds

6

Real data applications

To shed some light on the performance of the rectify strategy with real-world time series, we

carried out some experiments using time series from two forecasting competitions, namely the

M3 and the NN5 competitions.

6.1

Forecasting competition data

The M3 competition dataset consists of 3003 monthly, quarterly, and annual time series. The

competition was organized by the International Journal of Forecasting (Makridakis & Hibon 2000),

and has attracted a lot of attention. The time series of the M3 competition have a variety of

features. Some have a seasonal component, some possess a trend, and some are just fluctuating

around some level.

We have considered all the monthly time series in the M3 data that have more than 110 data

points. The number of time series considered was M = 800 with a range of lengths between

T = 111 and T = 126. For these monthly time series, the competition required forecasts for the

next H = 18 months, using the given historical points. Figure 8 shows four time series from the

set of 800 time series.

The NN5 competition dataset ? comprises M = 111 daily time series each containing T = 735

observations. Each of these time series represents roughly two years of daily cash money

withdrawal amounts at ATM machines at one of several cities in the UK. The competition was

organized in order to compared and evaluate the performance of computational intelligence

methods. For all these time series, the competition required forecasts of the next H = 56 days,

using the given historical points. Figure 9 shows four time series from the NN5 data set.

6.2

Experiment details

The NN5 dataset includes some zero values that indicate no money withdrawal occurred and

missing observations for which no value was recorded. We replaced these two types of gaps

using the method proposed in Wichard (2010): the missing or zero observation yt is replaced by

the median of the set {yt−365 , yt−7 , yt+7 , yt+365 } using only non-zero and non-missing values.

For both competitions, we deseasonalized the time series using the STL (Seasonal-Trend decomposition based on Loess smoothing) (Cleveland et al. 1990). Of course, the seasonality has

been restored after forecasting. For the parameter controlling the loess window for seasonal

Ben Taieb & Hyndman: 2 September 2012

24

5000

3000

Values

7000

Recursive and direct multi-step forecasting: the best of both worlds

1984

1986

1988

1990

1992

6000

2000

0

Values

Month

1982

1984

1986

1988

1990

1988

1990

1988

1990

6000

4000

Values

8000

Month

1982

1984

1986

10000

4000

Values

16000

Month

1982

1984

1986

Month

Figure 8: Four time series from the M3 forecasting competition.

extraction, we used the value s = 50 for the M3 competition and s = periodic for the NN5

competition.

For the M3 competition, the value of each parameters p, p1 , . . . , pH were selected from the set

{2 : 10} for all strategies and from the set {2 : 5} for the base model of the rectify strategy. For the

NN5 competition, we used the set {2 : 14} for all strategies and the set {2 : 7} for the base model

of the rectify strategy.

We considered two forecast accuracy measures. The first was the symmetric mean absolute

percentage error (SMAPE). Let

SMAPEm

h

m

m

2|ŷt+h

− yt+h

|

=

∗ 100

m

m

ŷt + yt

Ben Taieb & Hyndman: 2 September 2012

25

Values

0

10 20 30 40

Recursive and direct multi-step forecasting: the best of both worlds

0

200

400

600

400

600

400

600

400

600

30

0 10

Values

50

Day

0

200

30

0 10

Values

50

Day

0

200

40

20

0

Values

Day

0

200

Day

Figure 9: Four time series from the NN5 forecasting competition.

for the mth time series at horizon h where m ∈ {1, . . . , M} and h ∈ {1, . . . , H}. Then SMAPE is

the average of SMAPEm

h across the M time series. Hyndman & Koehler (2006) discussed some

problems with this measure, but as it was used by Makridakis & Hibon (2000), we use it to

enable comparisons with the M3 competition.

The second accuracy measure was the mean absolute scaled error (MASE) introduced by

Hyndman & Koehler (2006). Let

MASEm

h =

m

m

|ŷt+h

− yt+h

|

P

T

1

m

m

T −s t=s+1 |yt − yt−s |

where s is the seasonal lag. We used s = 7 for the NN5 time series and s = 12 for the M3 time

series. Then MASE is the average of MASEm

h across the M time series.

Ben Taieb & Hyndman: 2 September 2012

26

Recursive and direct multi-step forecasting: the best of both worlds

h = 1−18

MASE

2

0.15

0

0.00

1

0.05

0.10

SMAPE

3

0.20

4

0.25

5

0.30

h = 1−18

REC

L−K

K−K

DIR

L−K

REC

K−K

DIR

Figure 10: Boxplots of the SMAPE (left) and MASE (right) measures averaged over the H = 18

consecutive horizons and obtained across the 800 time series for the different strategies.

6.3

Results and discussion

Figures 10 and 11 present a graphical depiction of the performance of each strategy on both the

M3 and the NN5 Competitions. Each figure has two plots for both SMAPE and MASE measures

and each plot gives notched boxplots ranked according to the median and summarizing the

distribution of the SMAPE/MASE measures averaged over the forecasting horizon H for each

strategy. Outliers were omitted to better facilitate the graphical comparison between the various

forecasting strategies.

For both the M3 and the NN5 competitions, Figures 10 and 11 show that the rectify strategy

is almost always better or at least equivalent to the best of both the recursive and the direct

strategy.

In fact, for the M3 competition, we can see on Figure 10 that the recursive strategy is significantly

better than the direct strategy both in term of SMAPE and MASE measures. We can also see

that the rectify strategy is better or equivalent to the recursive strategy.

For the NN5 competition, the direct strategy performs better than the recursive strategy and as

before, the rectify strategy is better or equivalent to the direct strategy.

Ben Taieb & Hyndman: 2 September 2012

27

Recursive and direct multi-step forecasting: the best of both worlds

h = 1−56

1.0

MASE

0.25

0.10

0.15

0.5

0.20

SMAPE

0.30

1.5

0.35

h = 1−56

DIR

L−K

MEAN REC

K−K

MEAN

L−K

DIR

K−K

REC

Figure 11: Boxplots of the SMAPE (left) and MASE (right) measures averaged over the H = 56

consecutive horizons and obtained across the 111 time series for the different strategies.

This suggests that using the rectify strategy in all situations is a reasonable approach, and avoids

making a choice between the recursive and the direct strategies which can be a difficult task in

real-world applications.

To allow a more detailed comparison between the different strategies, Figures 12–15 present

the same result as in Figures 10 and 11 but at a more disaggregated level. Figures 12 and 13

give the SMAPE/MASE measures for each horizon h while Figures 14 and 15 averaged it over 7

consecutive horizons instead of H = 56 as in Figure 11.

If we compare the performance of the different forecasting strategies in term of lowest median,

upper and lower quartiles of the distribution of errors, the following conclusions can be drawn.

For the M3 forecasting competition, Figure 12 and 13 suggest that direct is the least accurate

strategy consistently over the entire horizon both in term of SMAPE and MASE. This might be

explained by the size of the time series (between 111 and 126) and the large forecasting horizon

H = 18 which can reduce the dataset by 15% for high horizons.

The LINARP-KNN strategy performs particularly well in short horizons and competes closely

with KNN-KNN and REC according to MASE and SMAPE respectively.

For the NN5 forecasting competition, Figures 14 and 15 suggest that the direct strategy provides

better forecasts compared to the recursive strategy, probably because of the greater nonlinearity

present in the NN5 data compared to the M3 data.

Ben Taieb & Hyndman: 2 September 2012

28

Recursive and direct multi-step forecasting: the best of both worlds

K−K

SMAPE

0.00

L−K

L−K

0.30

SMAPE

K−K

DIR

REC

DIR

L−K

SMAPE

0.1

L−K

K−K

DIR

REC

SMAPE

0.3

0.2

SMAPE

0.1

0.0

K−K

DIR

L−K

REC

K−K

K−K

L−K

DIR

h = 18

0.4

h = 17

0.0 0.1 0.2 0.3 0.4

L−K

DIR

0.0

REC

h = 16

REC

K−K

h = 15

0.2

SMAPE

DIR

REC

0.4

0.4

h = 14

0.1

K−K

0.20

0.30

K−K

0.0

L−K

DIR

0.10

SMAPE

L−K

0.3

0.3

0.2

0.1

0.0

REC

K−K

0.00

REC

h = 13

L−K

0.3

DIR

DIR

h = 12

0.00

K−K

K−K

h=9

h = 11

0.30

SMAPE

L−K

0.20

0.30

0.20

0.10

L−K

REC

0.00

REC

0.00

REC

0.20

SMAPE

0.00

DIR

0.00

DIR

K−K

0.20

REC

h=8

0.30

SMAPE

K−K

0.10

K−K

DIR

0.10

L−K

0.20

0.30

0.20

0.10

L−K

REC

0.10

0.20

SMAPE

0.10

DIR

h = 10

SMAPE

L−K

h=6

0.10

REC

0.00

SMAPE

K−K

h=7

REC

SMAPE

K−K

0.00

0.10

SMAPE

0.00

L−K

SMAPE

DIR

h=5

0.20

h=4

REC

0.2

DIR

DIR

0.0 0.1 0.2 0.3 0.4

REC

0.10

0.15

0.10

SMAPE

0.00

0.05

0.10

0.05

L−K

h=3

0.20

h=2

0.00

SMAPE

0.15

h=1

L−K

REC

K−K

DIR

Figure 12: Boxplots of the SMAPE measures for horizon h = 1 to h = 18 obtained across the 800 time

series for the different strategies.

Ben Taieb & Hyndman: 2 September 2012

29

Recursive and direct multi-step forecasting: the best of both worlds

REC

DIR

K−K

1.5

1.0

MASE

0.0

0.0

L−K

0.5

0.8

MASE

h=3

0.4

0.8

0.4

0.0

MASE

h=2

1.2

h=1

L−K

DIR

K−K

L−K

h=5

K−K

REC

DIR

h=6

L−K

REC

K−K

DIR

2.0

MASE

0.0

1.0

2.0

MASE

1.0

0.0

1.0

0.0

MASE

2.0

3.0

h=4

REC

L−K

REC

DIR

L−K

h=8

REC

K−K

DIR

h=9

K−K

DIR

DIR

L−K

REC

DIR

DIR

5

1

0

K−K

L−K

REC

DIR

L−K

h = 14

K−K

REC

DIR

h = 15

2

L−K

DIR

K−K

REC

DIR

DIR

2

0

0

K−K

REC

h = 18

10

MASE

6

2

4

MASE

8

6

4

2

0

L−K

L−K

8

8

10

REC

h = 17

10

h = 16

K−K

6

DIR

4

REC

0

0

K−K

4

MASE

4

2

MASE

6

6

8

0 1 2 3 4 5 6

L−K

MASE

K−K

4

MASE

3

MASE

2

1

0

L−K

REC

h = 12

4

5

4

3

2

0

1

MASE

REC

h = 11

h = 13

MASE

K−K

5

h = 10

K−K

3

1

0

L−K

3

REC

2

L−K

2

MASE

3

0

0

1

2

MASE

2

1

MASE

3

4

4

4

h=7

K−K

L−K

K−K

REC

DIR

K−K

L−K

REC

DIR

Figure 13: Boxplots of the MASE measures for horizon h = 1 to h = 18 obtained across the 800 time

series for the different strategies.

Ben Taieb & Hyndman: 2 September 2012

30

Recursive and direct multi-step forecasting: the best of both worlds

h = 8−14

0.25

SMAPE

0.15

0.15

0.05

0.05

SMAPE

0.25

0.35

0.35

h = 1−7

L−K

DIR

K−K

REC

MEAN

DIR

L−K

K−K

REC

MEAN

K−K

REC

MEAN

REC

K−K

h = 22−28

0.3

SMAPE

0.2

0.3

0.1

0.1

0.2

SMAPE

0.4

0.4

0.5

h = 15−21

MEAN

L−K

DIR

MEAN

K−K

REC

L−K

DIR

h = 36−42

0.2

0.3

SMAPE

0.4

0.3

0.1

0.1

0.2

SMAPE

0.5

0.4

0.6

h = 29−35

REC

MEAN

DIR

L−K

REC

K−K

L−K

K−K

h = 50−56

0.25

SMAPE

0.05

0.1

0.15

0.2

SMAPE

0.3

0.35

0.4

h = 43−49

DIR

L−K

DIR

MEAN

K−K

REC

L−K

MEAN

DIR

Figure 14: Boxplots of the SMAPE measures averaged over 7 consecutive horizons and obtained across

the 111 time series for the different strategies.

Ben Taieb & Hyndman: 2 September 2012

31

Recursive and direct multi-step forecasting: the best of both worlds

h = 8−14

1.0

MASE

0.8

0.5

0.6

0.0

0.0

0.2

0.4

MASE

1.0

1.2

1.5

h = 1−7

L−K

DIR

K−K

REC

MEAN

L−K

DIR

MEAN

REC

REC

K−K

K−K

MEAN

K−K

REC

h = 22−28

0.8

MASE

0.0

0.2

0.5

0.4

0.6

1.5

1.0

MASE

1.0

2.0

1.2

1.4

2.5

h = 15−21

K−K

REC

L−K

MEAN

DIR

K−K

L−K

MEAN

h = 36−42

1.5

MASE

1.0

2.0

1.5

0.0

0.0

0.5

0.5

1.0

MASE

2.5

2.0

3.0

2.5

h = 29−35

DIR

MEAN

DIR

L−K

REC

K−K

L−K

REC

h = 50−56

0.8

MASE

0.0

0.0

0.2

0.4

0.6

1.0

0.5

MASE

1.0

1.2

1.5

h = 43−49

DIR

MEAN

DIR

L−K

REC

K−K

DIR

L−K

MEAN

Figure 15: Boxplots of the MASE measures averaged over 7 consecutive horizons and obtained across

the 111 time series for the different strategies.

Ben Taieb & Hyndman: 2 September 2012

32

Recursive and direct multi-step forecasting: the best of both worlds

7

Conclusion

The recursive strategy can produce biased forecasts and the direct strategy can have high

variance forecasts with short time series or long forecasting horizons. The rectify strategy has

been proposed to take advantage of the strengths of both the recursive and direct strategies.

Using simulations, we have found with nonlinear time series that the rectify strategy reduces

the bias of the recursive strategy as well as the variance if a linear base model is used. A higher

level of noise and a shorter time series make the performance of the rectify strategy even better,

relative to other strategies. With linear time series, we also found that the rectify strategy has

performed particularly well by decreasing both the bias and the variance.

Using real time series, we found that the rectify strategy is always better than, or at least has

comparable performance to, the best of the recursive and the direct strategy. This finding is

interesting as it avoids the difficult task of choosing between the recursive and the direct strategy

and at the same time it shows that the rectify strategy is better or competitive with both the

recursive and the direct strategy.

All these findings make the rectify strategy very attractive for multi-step forecasting tasks.

Ben Taieb & Hyndman: 2 September 2012

33

Recursive and direct multi-step forecasting: the best of both worlds

References

Atiya, A. F., El-shoura, S. M., Shaheen, S. I. & El-sherif, M. S. (1999), ‘A comparison between

neural-network forecasting techniques–case study: river flow forecasting.’, IEEE Transactions

on Neural Networks 10(2), 402–409.

Atkeson, C. G., Moore, A. W. & Schaal, S. (1997), ‘Locally weighted learning’, Artificial Intelligence

Review 11(1-5), 11–73.

Chen, R., Yang, L. & Hafner, C. (2004), ‘Nonparametric multistep-ahead prediction in time

series analysis’, Journal of the Royal Statistical Society, Series B 66(3), 669–686.

Chevillon, G. (2007), ‘Direct multi-step estimation and forecasting’, Journal of Economic Surveys

21(4), 746–785.

Chevillon, G. & Hendry, D. (2005), ‘Non-parametric direct multi-step estimation for forecasting

economic processes’, International Journal of Forecasting 21(2), 201–218.

Cleveland, R. (1990), ‘STL : A seasonal-trend decomposition procedure based on loess’, Journal

of Official . . . .

Fan, J. & Yao, Q. (2003), Nonlinear time series: nonparametric and parametric methods, Springer,

New York.

Franses, P. H. & Legerstee, R. (2009), ‘A unifying view on multi-step forecasting using an

autoregression’, Journal of Economic Surveys 24(3), 389–401.

Hastie, T. J., Tibshirani, R. & Friedman, J. H. (2008), The elements of statistical learning, 2nd edn,

Springer-Verlag, New York.

Ing, C.-K. (2003), ‘Multistep Prediction in Autoregressive Processes’, Econometric Theory

19(02), 254–279.

Judd, K. & Small, M. (2000), ‘Towards long-term prediction’, Physica D 136, 31–44.

Law, A. M. & Kelton, W. D. (2000), Simulation Modelling and Analysis, 3rd edn, McGraw-Hill.

Makridakis, S. G. & Hibon, M. (2000), ‘The M3-Competition: results, conclusions and implications’, International Journal of Forecasting 16(4), 451–476.

Ben Taieb & Hyndman: 2 September 2012

34

Recursive and direct multi-step forecasting: the best of both worlds

McNames, J. (1998), A nearest trajectory strategy for time series prediction, in ‘Proceedings

of the International Workshop on Advanced Black-Box Techniques for Nonlinear Modeling’,

Citeseer, pp. 112–128.

Teräsvirta, T. & Anderson, H. M. (1992), ‘Characterizing nonlinearties in business cycles using

smooth transition autoregressive models’, Journal of Applied Econometrics 7, 119–136.

Tong, H. (1995), ‘A personal overview of non-linear time series analysis from a chaos perspective’,

Scandinavian Journal of Statistics 22, 399–445.

Tong, H. & Lim, K. S. (1980), ‘Threshold autoregression, limit cycles and cyclical data’, Journal

of the Royal Statistical Society, Series B 42(3), 245–292.

Werbos, P. (1990), ‘Backpropagation through time: What it does and how to do it’, Proceedings of

the IEEE 78(10), 1550–1560.

Wichard, J. D. (2010), ‘Forecasting the NN5 time series with hybrid models’, International Journal

of Forecasting .

Williams, R. J. & Zipser, D. (1989), ‘A Learning Algorithm for Continually Running Fully

Recurrent Neural Networks’, Neural computation 1(2), 270–280.

Ben Taieb & Hyndman: 2 September 2012

35