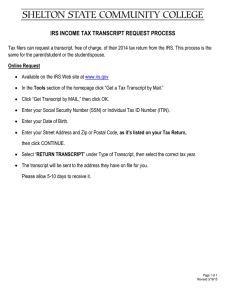

Requesting Your Federal IRS Tax Return Transcript by Mail 2.

advertisement

Requesting Your Federal IRS Tax Return Transcript by Mail 1. Go to www.irs.gov. 2. Choose “Get a Tax Transcript.” 3. You will have the option to request that a transcript be mailed to you. Click on the “Get Transcript by MAIL” button to request a transcript through the mail: 4. 5. 6. 7. 8. 9. First time users must click “Create an Account.” Complete the required name and email fields and click “Send Email Confirmation Code.” Wait to receive your confirmation code via the email address you listed. This may take a few minutes. Once you have your confirmation code, enter the code in the “Enter Confirmation Code” box and click “Verify Email Confirmation Code.” Complete the personal information questions on the next screen then click “Continue” to sign in as a guest for a one-time use of the site. After you click continue, you will be brought to a screen that will present you with questions that must be answered correctly so that irs.gov can validate your identity. Once you answer the questions, hit continue: (NOTE: If you are unable to answer all of the questions correctly, you will be forced to start from the beginning.) If all questions were answered correctly, you will be given the opportunity to select the transcript information. Select the Type of Transcript as “Return Transcript” and select the Tax Year for the correct year for the Return Transcript you are attempting to print. 10. Your request for a transcript will then be accepted, and it will take 5-10 business days for you to receive it in the mail. The Transcript will be sent to the address that the IRS has on file for you. If you have moved, you should follow the IRS’s instructions to update your address which can be found at www.irs.gov in the Help & Resources section under Tax Records. 11. You may also call the IRS’s automated phone transcript service at 1-800-908-9946 to receive a transcript by mail. 12. Paper Request: Complete form 4506T-EZ, “Short Form Request for Individual Tax Return Transcript”, which is available online at https://www.irs.gov/pub/irs-pdf/f4506tez.pdf. Complete lines 1-4, following the instructions on page 2, enter the tax year requested on line 6, and then enter your phone number and sign and date the form. IRS Data Retrieval The easiest way to supply your required tax information is to make a correction to the FAFSA and use the IRS Data Retrieval Tool (if available to you) to transfer the data directly from the IRS into the FAFSA. Transferring the data eliminates the need for you to submit a tax transcript, as long as the data is not changed after transferring it. It may take from 5-10 days for the Student Financial Aid office at Kent State to receive your updated FAFSA.