Document 13578512

advertisement

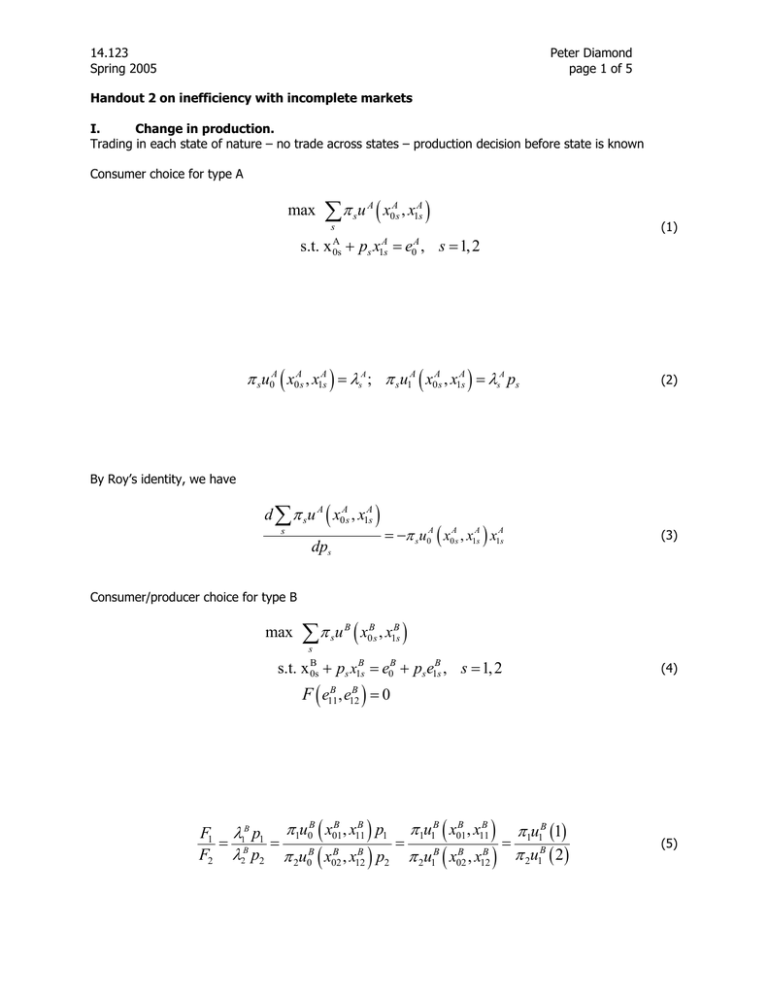

14.123 Spring 2005 Peter Diamond page 1 of 5 Handout 2 on inefficiency with incomplete markets I. Change in production. Trading in each state of nature – no trade across states – production decision before state is known Consumer choice for type A max ∑s π su A ( x0As , x1As ) (1) s.t. x + p x = e , s = 1, 2 A 0s A s 1s A 0 π su0A ( x0As , x1As ) = λsA ; π s u1A ( x0As , x1As ) = λsA ps (2) By Roy’s identity, we have d ∑ π s u A ( x0As , x1As ) s dps = −π s u0A ( x0As , x1As ) x1As (3) Consumer/producer choice for type B max ∑s π su B ( x0Bs , x1Bs ) B + ps x1Bs = e0B + ps e1Bs , s = 1, 2 s.t. x 0s (4) F ( e11B , e12B ) = 0 B B B B B B B F1 λ1B p1 π1u0 ( x01 , x11 ) p1 π 1u1 ( x01 , x11 ) π1u1 (1) = = = = B B B F2 λ2B p2 π 2u0B ( x02 , x12B ) p2 π 2u1B ( x02 , x12B ) π 2u1 ( 2 ) (5) 14.123 Spring 2005 Peter Diamond page 2 of 5 Market clearance x1A ( ps , e0A ) + x1B ( ps , e0B + ps e1Bs ) = e1Bs (6) ps = p ( e1Bs ) (7) de12 F =− 1 de11 F2 (8) x1As = − ( x1Bs − e1Bs ) (9) implying: Impact of deviation from production decision de12 d A A A A A ′ B ′ B B ∑ π s u ( s ) = −π 1u0 (1) x11 p ( e11 ) − π 2u0 ( 2 ) x12 p ( e12 ) de11 s de11 ⎡ π u A ( 2) A de12 ⎤ = −π u (1) ⎢ x11A p′ e11B + 2 0A x12 p′ e12B ⎥ π1u0 (1) de11 ⎥⎦ ⎢⎣ ( ) A 1 0 ( ) ⎡ B ⎤ π 2u0B ( 2 ) B B d B B B B B de12 ′ ′ π π = − − + − u s u 1 x e p e x e p e ( ) ( ) ⎢ ⎥ ( ) ( ) ( ) ( ) s 1 0 11 11 11 12 π1u0B (1) 12 12 de11 ⎦⎥ de11B ∑ s ⎣⎢ ⎡ A ⎤ π 2u0B ( 2 ) A B B B de12 ′ ′ = π 1u0 (1) ⎢ x11 p e11 + x p e ⎥ 12 12 π 1u0B (1) de11 ⎥⎦ ⎣⎢ ( ) ( ) (10) (11) 14.123 Spring 2005 Peter Diamond page 3 of 5 II. Change in production with redistribution We now add redistribution in numeraire good, at the same level in both states of nature. This changes market clearance to: implying: x1A ( ps , e0A − T ) + x1B ( ps , e0B + T ) = e1Bs (12) ps = p ( e1Bs , T ) (13) ∂x1A ∂x1B − ∂ps ∂I ∂I = A A B ∂x ∂x ∂x B ∂T ∂x1 − T1 1 + 1 + ( e1Bs + T1 ) 1 ∂p ∂I ∂p ∂I (14) ⎧ ∂x1A ∂x1B ⎫ ps ⎨ − ⎬ ∂I ∂I ⎭ ∂ps ⎩ = ∂x A ∂x B ∂x B ∂T1 ∂x1A − T1 1 + 1 + ( e1Bs + T1 ) 1 ∂p ∂I ∂p ∂I (15) Note that As long as the income derivatives of A and B are different, these are nonzero. Also the demand derivatives are evaluated at different prices and incomes in the different states. 14.123 Spring 2005 Peter Diamond page 4 of 5 Starting with zero transfers, consider a derivative change in the two transfers, satisfying (for some constant k). dT1 = kdT0 (16) This implies that ⎧ ∂x1A ∂x1B ⎫ (1 + kps ) ⎨ − ⎬ ∂I ⎭ ∂ps dps ∂ps ⎩ ∂I ≡ +k = A A B ∂x ∂x ∂x B dT0 ∂T0 ∂T1 ∂x1 − T1 1 + 1 + ( e1Bs + T1 ) 1 ∂p ∂I ∂p ∂I (17) ≡ (1 + kps ) α s We want to evaluate the impact of a redistribution on expected utilities in equilibrium. d π s u A ( s ) = −∑ π s ( u0A ( s ) + ku1A ( s ) ) ∑ dT0 s s −π 1u0A (1) x11A dp1 dp − π 2u0A ( 2 ) x12A 2 dT0 dT0 (18) ⎡ ⎤ π 2u0A ( 2 ) A A + kp = −π u (1) ⎢(1 + kp1 ) (1 + x11α1 ) + + 1 1 α x ( ) ⎥ ( ) 12 2 2 π 1u0A (1) ⎣⎢ ⎦⎥ A 1 0 Similarly, using the same substitutions as in (11), ⎡ ⎤ π 2u0B ( 2 ) d A B B π π + = + 1 x α + u s u 1 1 kp 1 + kp2 ) (1 + x12Aα 2 )⎥ ( ) ( ∑ 11 1 ) s 1 0 ( ) ⎢( 1)( B π1u0 (1) dT0 s ⎢⎣ ⎥⎦ (19) 14.123 Spring 2005 Peter Diamond page 5 of 5 Generically we have different prices and demands in the two states and different marginal rates of substitution for the two agents. The aim is to find a constant, k, so that the changes in transfers leave both of them better off or both worse off (in which case we reverse the direction of transfers). This may be possible – this model does not fit the Inefficiency Theorem. Contrasting (18) and (19) to (10) and (11), we have an extra degree of freedom in seeking a Pareto gain. For a Pareto gain, we need to find a value of k such that (18) and (19) are both positive or both negative (calling for a reversal of the direction of redistribution). This requires (1 + kp2 ) (1 + x12Aα 2 ) π 2u0B ( 2 ) π 2u0A ( 2 ) <− < π 1u0A (1) (1 + kp1 ) (1 + x11Aα1 ) π1u0B (1) (20) (1 + kp2 ) (1 + x12Aα 2 ) π 2u0B ( 2 ) π 2u0A ( 2 ) >− > π 1u0A (1) (1 + kp1 ) (1 + x11Aα1 ) π 1u0B (1) (21) or