Pacific Northwest White Wheat Exports During the 1960's (Agricultural Experiment Station

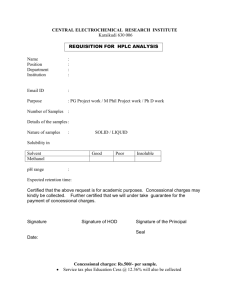

advertisement

I

L,

REPLACEMENT

6S

- -23 14

CAse

Pacific Northwest White Wheat Exports

During the 1960's

(SPECIAL REPORT 314

NOVEMBER 1970

(Agricultural Experiment Station

Oregon, State University

Corvallis

AUTHOR: G. L. Seevers is assistant professor of agricultural economics

at Oregon State University.

PACIFIC NORTHWEST WHITE WHEAT EXPORTS DURING THE 1960's

G. L. Seevers

Export markets provide the principal outlet for white wheat -- the pre

dominant class of wheat produced in the Pacific Northwest. During the 1960's,

over 80 percent of PNW white wheat production entered export markets. The

next decade will present new opportunities and problems to the PNW wheat industry. In view of the heavy dependence on export markets, the major question facing the industry is: What will be the pattern , of exports during the

1970's? This question cannot be answered with any degree of certainty, because it depends on so many contingencies. Actions by the industry itself

to establish and expand markets have in the past, and will in the future,

affect export patterns to a significant extent. Exports also will be influenced by economic policies followed in the United States, as well as

political and economic developments within other exporting and importing

countries.

Our present knowledge does not enable accurate prediction of how the

factors influencing exports will change. The best strategy is to understand

the forces at work, rather than attempt to forecast the future. This report

summarizes PNW export patterns during the past decade, in the belief that a

comprehensive backward glance will be helpful in anticipating the future.

The 1960's began and ended with record stocks of wheat located in major

producing and exporting countries. The resultant depressing effects on

international wheat markets were not present throughout the decade, however.

The Soviet Union became a major net importer in 1963; this development began

to diminish world wheat stocks. Then in 1965-1966 drought reduced food grain

production in broad areas of Asia and hiked wheat shipments, particularly to

India. The world food problem became such a critical concern that the President of the United States called for a comprehensive study by his Science

Advisory Committee. The pessimism about the world food situation soon turned

to guarded optimism in the late 1960's as the benefits of agronomic research

initiated years earlier began to emerge. These benefits appeared dramatically in the form of new rice and wheat varieties that triggered opportunities for greatly improved yields. To a significant extent, these opportunities are being realized in Asia. Along with higher wheat production in most

developed countries -- both exporting countries and importing countries in

Western Europe -- the international wheat markets returned to a position of

excess supply similar to when the decade began.

MARKETS AND MARKET CONCENTRATION

Exports of white wheat from Pacific ports averaged over 100 million

bushels annually during the 1960's. As shown in Figure 1, exports varied

The data for this section, including Figure 1, are given in Table 2.

1 r . --- las.4.-1-i.,..,-„.--

w

4

44444.4.. X 4

• : ' ''. 4.

ler 41

o• ii

, "v.

Am...to.

- .._ -.., - ..p .....1.•

1 • re — -, - , ' - - ;' ,

IiirVile

i ' - 1-

;

'1

tick.4Wet4V44

between 90 million bushels (1961, 1968 crop years) and 120 million bushels

(1960, 1966) during the decade, except for 1967 when they exceeded 143 million bushels. Although smaller quantities were exported in 1968 and 1969

(the year ending July 1, 1970) than the two preceding years, the decline

does not appear to represent a trend. Instead, exports returned to more

normal levels following two unusually favorable years.

India and Japan were the primary markets during the 1960's. Shipments

to India were consistently large, ranging from 33 to 50 million bushels,

until 1968. There were three especially strong years (1965, 1966, 1967)

caused by India's drought-induced poor crops. Shipments to India declined

sharply in 1968 because her own food grain production recovered from the

lean years. Improved wheat varieties, weather, and associated cultural

practices gave rise to above-normal yields in India's wheat-growing Northern region.

Japanese shipments were two-thirds as large as Indian shipments on the

average. In 1963, Japan began importing about 30 million bushels annually.

This continued until 1968, when shipments were interrupted due to a temporary quality problem. The Japanese returned to normal import quantities

in 1969.

One striking feature of PNW export patterns during the 1960's was the

very high geographic concentration of markets. The Japanese and Indian

markets received nearly 62 percent of the total exports. Japan, India,

and four other countries -- Korea, Pakistan, Taiwan, and the Philippines -are called the Big Six countries. These countries accounted for 92 percent

of all PNW exports.

Korean shipments were under 10 million bushels until 1966; they then

increased sharply, reaching 24 million bushels in 1968. Shipments to Pakistan, in contrast, have been erratic, ranging from 3 to 4 million (1965,

1968) to 20 million bushels (1962, 1967, 1969).

One of the most stable markets has been in Taiwan. With the exception

of 1967, when shipments reached 8 million bushels, Taiwan has imported 4 to

6 million bushels annually. Another relatively stable but small market was

in the Philippines, where imports ranged from 2.5 to 4 million bushels during the 1960's.

Overall, the export patterns for white wheat can be characterized as

being highly concentrated in two countries (India and Japan) and encompassing little beyond the Big Six countries. The only major trend during the

1960's was Korea's emergence as a substantial market. A second trend may

have emerged: India, the most important market, diminished her wheat imports from the PNW in 1968 and 1969, but it is too early to determine if

this is a permanent adjustment.

CASH AND CONCESSIONAL SALES

Another way to view PNW exports, in addition to country destinations,

is the financial arrangements under which they occur. There are two broad

categories: cash sales and concessional sales.

Cash sales include all shipments for which the importing country pays

in dollars or other currencies used in international transactions (British

pound or German mark, for example). A concessional sale, in contrast, in

volves some form of assistance on the part of the U.S. government. In practice, this means that the importing country does not pay cash for the shipment at the time of the sale. To combine concessional sales into a single

category is somewhat misleading, because they occur under several programs

that differ markedly in character. These programs are authorized under

U.S. Public Law 480, referred to as "PL 480" or just "480". To illustrate

the variation: shipments for emergency relief, in case of a national disaster in a country such as a flood, are Donations requiring no payments.

But shipments under the CCC (Commodity Credit Corporation) credit program

are paid for in dollars plus interest over a three-year or shorter period.

Such shipments are very similar to cash sales, but are still classified

here as concessional.

Table 1 shows a breakdown of total exports by cash and concessional

sales, and a detailed division of concessional shipments by specific programs, beginning in 1962 when the data were first published. The concessional programs are organized in the table according to increasing concessional aspects and decreasing cash features. For example, the CCC Credit

category is very similar to a cash sale -- perhaps 90 percent cash -- and

is situated adjacent to the cash category. Donations are located farthest

from cash sales because they are totally concessional. Quantitatively,

these two programs were a minor financing method for PNW exports.

Three additional programs are listed between the CCC Credit and Donation extremes in Table 1. The ' Barter category includes shipments which

were exchanged (bartered) for goods and services produced in the recipient

country. These goods and services are then used by U.S. government agencies

in the country, substituting for market purchases which would require dollar

expenditures. Barter shipments are similar to cash sales, except that no

dollars are exchanged. As can be seen in Table 1, Barter shipments became

an important avenue for financing PNW white wheat exports in 1966. Under

the Lon Term Credit (loan) program, countries buy farm commodities and

repay in dollars, or other currencies equivalent to dollars. These loans

normally extend up to 20 years, although in certain circumstances countries

are able to receive 40-year loans. Long-Term Credit offers another significant advantage to the recipient country. The interest paid is less than

for loans in commercial financial markets -- usually 2.5 percent. The final

remaining concessional program is Local Currency sales. Recipient countries

pay for farm commodities in their own currency under this program. Part of

these currencies (15-20 percent) are allocated for expenditure by U.S.

agencies in the country, and the remainder are either loaned or granted to

-0 H

0 0

h.

m

in

40

A

CO

ON 0

ON

ON

CO

In

RS 4..I

1-1 0

C0 1-)

H

...1.

4.)

0

A

At

N.

CO

N.

ON

a

0

1/40

CO

0

0

• -1

01

0

1

st

H

al

ON

E-1

4-)

0

0

0

cn

,-.1

N.

-4'

H

ON

0

H

CO

In

1/40

A

H

N.0

•..7a

co c., In CN1 ON Cc) H

...1-a CVa N.A C") H Cn H

a

a

A

a

1/40 . ..t ...I' ON VI 0 ON

H

H

H

-

ON In %.0

In In .7

H O\ H

A

a

A

0 00 M

NO In N.

•..1"

I

1

0

0

A

.410

H

I

1

0

0

V0

ts•

m

m

c1/41

H

M

0

..-.

N.0

N.

In

CV

N.

N.

4.)

v

0

•••1"

In

a

a

1

CT

CV

Ln

01/4

ON

a

01/4

....3

CO

0

a

In

CO

ND 0

H H

N. H

a

in

0

H

H

N.

ON

VD

ON

a

A

.3- CO

H CV

N.0 o

N. Ul

C*1 0

A

a

-1 CO

H

Cr I

C)

c1/44

ON

.

..../'

I

0

0

.•

CV

0

in

H

w

I

H

I

N.

I

I

I

I

H

0

a

CO

0

H

H

in

I

1

I

1

NO

00

0

a

V00

in

CO

H

I

0

H

H

m

a

•

VI

CV

•

O

..,

1-1

0

1:1-4

H c.)

00

U a)

0 i..,

H p-.1 34

0

CIS

9-4

4-1

U

al

0

4-4

0

C.) C.) .1../

HH

1 '10

GaD C1)

0 $..1

ou

.

cr:

N

O I.+

0. 0

4:1)

Cd 0

C.)

a)

$. 4

N

4.)

C:T■

1

0

4...■ ON

H

•

0 (I)

C../

tx0

O o

O

i

-ci

Ct

1

z

{

tq

L

U

CI)

0

H

N.

ON

I

tn

in

-.7

coa

l0

in

In

0

m

1/43

u1

0

In

ON

0. in H

on

.

m

o.

r--.

00

In

r-..

....t

O

N.

....i.

ON

cc)

ON

cc1/4

..

In.

In

.0

0

0

0

a

H

N.

...T

N.

H

N

%.0

...0

CV

H

H

. ..1'

in

1..)

C.) . e-1

U -0

$.1

„9,

..0

en

N. In

CV Crl

a

a

ce,

C-0

1-1 ON

LOH

0 ••

•r1

U)

U)

c

a)

H

H

c1/41

c1/44

0

U)

0

al

c.)

0

O

C1)

u

1

0. $-+

0 cd

$4 CU

C.) ›N

I

I

I

1

1

I

1

I

I

ON

1

II

In

%.C)

o

in

ill

.1-

CV

,..0

0

0

Lel

rs

i

I

1

H

ON

I

I

1

N

-..t

m

m

.1*

M

csi

h.

ft

CV

(...1

en

-..i.

in

NCI

N.

CO

ON

H

H

H

H

H

H H

H

1/40

Ch

1/40

ON

1/40

1/40

a1/4

1/40

ON

1/40

ON

01

a.

.0

CA

1/4o

r.

1/40

CT

in

CO

00

N

A

YD

NO

cv

-3'

In 0 00 H H NO

.

.

.

01

.

.

In ....7 Ln 0 cc1/4 CO

-.1"

cr.

00

h

,-.1

,--1

ON

0

o

H

0

et

N.

A

Cn

en

1/40

ON

•

in

H

ON

H

a

M

..../'

r,-i

1 -1

,.0

CV N.0

a

Crt

00

ce)

CrI

CNI

00

.

ON

N.

CV

H

0

1J1

0

H

H

in

a

•

N.

1'CO

.

q)

•

CV

CN1

0

00

ON

I■

%C.

•

44"

en

CV

(1)

H

.4.J CO

11/

1..1

0,0

0

1.4

>

.0

0 4.)

CO 0

(..) U

a) 44

Ai o

U

1.1

0

the government in the country, or simply accumulated in U.S. accounts. During the 1960's, over 80 percent of PNW concessional sales have been under

the Local Currency program.

It should be apparent from Table 1 that a substantial proportion of

concessional shipments are not outright gifts, and that the proportion of

the more cash-like sales (CCC Credit, and Barter) has increased since 1962.

This trend will continue in the future because under present legislation

the Local Currency program is scheduled to be replaced after 1971 by LongTerm Credit, a more costly program from the standpoint of recipient countries.

From an economic standpoint, it is more meaningful to view concessional

shipments as a form of price discounting or discrimination, rather than as

charity, which is the view sometimes taken. The programs to the right side

of Table 1 have very large price discounts -- up to 100 percent -- while

programs to the left have small discounts approaching zero. In this context, a significant international wheat market development should be noted.

More and more countries are finding it desirable to adopt some form of concessional (government-sponsored) export programs. This activity is causing the normal cash-concessional distinction to become blurred. Admittedly

it was never crystal clear, because the U.S. has consistently provided

"export payments" to wheat exporters to make U.S. wheat competitive in

world cash markets. But as other countries adopt programs that offer indirect price discounts on cash-like sales, or provide food grains on essentially a gratis basis, the usefulness of viewing concessional shipments as

price-discounted may well increase.

Table 1 shows that concessional sales were about twice as large in

quantity as cash sales. And, what is perhaps more significant, each of the

Big Six countries was either primarily cash or concessional. Japan and the

Philippines (until 1969) imported exclusively on a cash basis; India, Korea,

and Pakistan were almost exclusively concessional. Only the imports of Taiwan could be classified as mixed; even so, only a small fraction of Taiwan's

imports were cash (Table 2).

Japan was a concessional market immediately after World War II, but

shifted to a cash market as her economy improved. It has been expected that

the Japanese model might apply to other PL 480 markets. However, there was

little, if any, trend in this direction during the 1960's. India, Pakistan,

and Korea remained basically concessional markets. Thus, either a continuation of PL 480 programs or the locating of new cash markets would appear to

be of critical importance to the maintenance of significant PNW wheat exports. And even if PL 480 programs continue operating pretty much as they

have been, there are serious questions as to whether these traditional concessional markets collectively will continue to import the quantities they

did during the 1960's.

...-1

CC

1.1

Q

H

oo

04

00

CD

C4

rA

ko

r,

Ch

Ch

00

00 ..--.

ul •..7

v0 CD

a •

CO ../

CA C4

%.4.

Cs ......

c0 .3..T N.

el o•-•.

ol VI

04 rA

Ul ..

41 00

r, N.

40 04

.4 VD

Cs 01

AT 0.

CA C')

•

.

CD . ..7

...1

.....•

a •

%al

.

•

....,

r4 .--.

C4 r,

el vo

. a

Ch 01

r4 C')

9-1 ,...,

0^ .--.

CA P,

..4 01

.7 .--.

el ...T

oh r...

.-4 /"..

FA CO

oh N.

.7 C4

0 ..4

Ch oh

CM CM

a •

r4 •-•'

a •

'-

.4 Ch

a •

CD 04

r-I •-••

CD

CA

OD

a

VD

VD

0

.

CM

00

V0

.

V0

CD

v0

r4

r-^I

.

c)

cv

r-I

rA

U)

C)

$.1 •.4

co

W

.0 4.1

1.1 0

C) O

0

C)

•

cC

C.)

a)

C)

Cm

0

.

ch

uh

.1

CO

.

..01

c) uh

N. cm

CO

•

^ rA

cv N.

....•

CNI

/1

,r ,./.

oh ,♦

NI •

• 0.1

c) 00

,...1 N..."

11

.4 r-

eV .4

CO •

a N.

cv r...

'-

./...

CD 04

Cm CD

r-I

•

•• ON

uh tn

N../

0.1

v) cv

Ch C0

00 •

' ,-I

vo 00

..-,

••••■

0% C)

CD 01

0 •

•• 00

.7 Cl

.4 ,...•

.0....

u1 N.

CD Cm

CO •

. T.

CV til

sno,

/N.

v0 ....7

uh vo

Crl •

" CO

.4 vo

,4

.

00

C)

CO

`..."

a.

0

4,4

0

0

IC

vD

•.4

C'

al

H

CD

v0

C'

0

• -1

c.

4.1

0

1.4

0

0

U)

4.1

14

0

.

-4

.

Ir1

\40

0/

C4 ,-.

00 0

C4 14

' 01

-7 N

.

CA ....

01 VD

c) ul

w•

-4' VD

......

CA Ch

CA CD

•

40

- -4'

In el

.....

...N.

VD -4'

VD .7

C4

•

‘,., 03

ce$ el

0. ...1

C4 0

r, $4

. co

-4' N

.....

.....

CA CA

CM 0

CA •

. N.

N. ,--1

'

.4 ......

Qs 0

CD 1+

.

(1)

NO N

.4-,

00 ..--,

-...? 0

4D 141

try

r4

Ul

.

1!

U/

rt

-4"

Lal

141

. W

NO N

'

0

a)

0

4A

00

,..0

-

PN

r4

a)

4.3

•14

4.1

...0

01

I

10

0-1

C)

.0

fn

0

0.

•-4

,...1

-.-4

CO

No

•--4

NO

(-.4

,...4

vD

.

00

.

crt ...-■

NO C)

.0O

...--1

c.,1 .....

en ..

M 0

.7 O

.*--I

c-.4 ..."

1-4 ......

N. C,

Cm CD

^ .--1

(...3 ',a.'

CO ..

MO

00O

..-1

(NI ..../

s..1' .......

h0

M 0

•• r4

ca) .....•

00

N e•-■

.70

M O

.4 ....,

N"

0 .....,

0.4 C)

n .../

„C

P.4

-

r-I

..-..

NI Lin

01 es.

CD •

•• CV

a-4

0.

CD

ev

••

en el

‘...•

t0

ICL

0 •

• .) a)

C4

CD

a

0

CU V)

(1)

$4 .0

el

O

1

14

O a.

a) 0

•0

0

CD

C)

...

4-4

CO

(1)

$4

o

I

0

0

4.!

(1)

..-I

1

Pv

0

CN1

0

a

00

ON

a-I

0

a

c''1

.4

4)

-4

0

a

v.:)

-4IN

N.

a

CA

,--4

CYN e•-.

CO 0

-0' $4

. 0

C. N

`no'

M ..

00 0

ON 44

a 0)

ON N

.-I •••••

N. .......

.-I CN

•--1 .-I

a •

N-

s....,

tr■ .....

.--1 0

00 14

w

ON N

.....•

N ..

00 0

0 $4

no 0)

•.? N

..../

el ./...

.-4 0

01 14

. tu

00 N

1-4 .....

s.0 .--

r's 0

CT114 1W

.1` N

.....•

-4' /•-..

N 0

I", $4

n a)

NN

'

.-..

Cr• ..4'

00 00

h •

SS C)

1 -4

0

r-4 ‘...,

1-1 .0 •.

01 0

r-4 14

In a)

el N

4-4 .....

••••••

0 0

N.

..0 ..

o.4

It 4)

CO N

,.4 .....,

el

ON

N. .......

CO 0

CT $.1

a 411

ch N

„• 4 .....

N. 0

1,1

- CD

...7

N

(.4 .....,

........

in C.

C•1 00

C. •

a .0

r1 en

.•...

CO ..

•••7 0

Olad

43)

..1a.4

o N

‘.../

0.1 ..•-•.

....? 0

In 14

a a)

0N

csi ../

NO

oo

O..

irl

In

co

^

ch

0

r4

•

ri

4 -al

co

4-$ CU

$4 1.4

O 0)

oh

-4

•.0

.

-4'

X IN

4)

-7

.

■7

ca)

N

ch

a-4

r♦

C.1

ca

4-4

U)

...,

03

(1)

4)

CM

rA

co

O a)

O C.)

-ri

co •A

M M

O .-4

0

0

CL

0:3

1-1

CO

.../'

.../'

C.!

01

A

oh

00

ft

co

Ch CD

.4 CD

-4"

CNC

$4

0

Gr4

•-4

a) 0

cu

CD

Pv

0

14

4.1

0. 0

.--I

CN1

CO .....

.

0

N. rA

1-1 ••••

1•4 ••••■

•• 0

.7 r4

M•/

ce)

N. e....

Cm 0

•• 0

VD "A

NI `•••

in

IN- /.....

00 CD

.4

•0' IN

N.

N.• •••••

•.• 0

CD CD

.. 0

03 CD

C•I ""'''

CD rA

C.' %"'

Ch rA

C4 %"*.

N. ...4

es 0

vh

00

C9 CD

v.O

0

H

M

" ''''

N- C)

to .,....

EN •••••

an 0

CO rA

" ''''

O CO

e--1

CD

oh

C0

.♦

CO

n

01

q)

C4

0

C) 0

0 L.)

.

VD

04

O

44

W0

•

0

9-1

0

•0

.-I

N

-4'

c)a

NO

.4

CO

CO

c4

.

-4

oh

trI ..

CO 0

oh 44

a a)

0 N

.4' •••••

h /1

el 0

N. )4

a tl)

CO B,

Cn

ON ..--.

In 0

N. 14

. at

NN

en •••

NO .0-..

Col 0

CO 11

.w

u1o

.7 • l

0 .-..

NO 0

efl $4

o a,

VI

IA ...-,

0 0

43 14

a)

CO N

..." •••••

cNi ,-..,

el 0

In 14

. ca

e. ,5

NI

N. ...-.

Lel 0

cr, 14

•• 0)

Ch N

NI ".../

0)

w

N

C

›,

0

0

$4

C.)

0

4)

05

v-4

.-4

•0

ON

1-4

CV

'.0

C.

1 -1

01

V)

CA

s-I

.7

NO

CA

r -1

tr)

NO

ON

rI

'0

4)

OS

1-4

N.

43

01

..-1

CO

C.

01

%.0

V:$

I-1

r

01

NO

0

U")

.

.4

in

...1

.

01

en

-.1'

CA

cn

*

fl)

H

0

H

.1-1

U)

R1 CU

U

14

W

cv

v)

.ON (0

4

CO 1--1

00

14 0

00

>0

.4 0 '

8

CHANGING CONSUMPTION PATTERNS AND WHITE WHEAT

It has been argued at times that importing countries are experiencing

changing consumption patterns that will adversely affect their imports of

white wheat. The reasoning goes as follows: as consumers receive higher

incomes, they increase their expenditures on more expensive foods and stabilize, or even decrease, their demand for some types of food. This shift

toward more expensive foods is easily verified in the consumption patterns

of most countries; when incomes rise, consumers buy more fruits, vegetables, and meats, and less food grains, for example. Applied to wheat,

it is reasoned that the demand for bread products will increase and consumers will decrease their consumption of some products made from white

wheat, particularly noodles. If this pattern does emerge as incomes rise,

the implications for white wheat exports are great. There is at present

limited quantitative evidence on which to support or reject this idea.

Based on the data of the 1960's, no trend emerged that would support

the idea that bread wheats are displacing white wheats. Exports of white

wheat to Japan and Taiwan, two countries where economic development has

progressed to the point that this pattern could be manifested, have not

diminished. Japanese imports of white wheat for food were as strong in

the late 1960's as in the early years of the decade, although Australia

had gained some of the market. Taiwan had substantially larger PNW white

wheat imports in the second half of the decade than in the first half. Per

haps the most significant country in this regard is India. And until the

last two years, the composition of Indian imports was largely determined

by availabilities of the various classes of wheat in the U.S. But in 1968,

when India imported less and could be a more discriminating buyer, 45 percent of Indian imports from the U.S. were white (or soft red winter) in

contrast to the hard wheats. The non-bread wheats constituted a larger

proportion of Indian imports than any other years except 1960 and 1967.

However, significant quantities of soft red winter wheat were shipped in

the late 1960's. Whether India will shift toward bread wheats and, at

the same time, diminish her total wheat imports, is still an open and

important question. A detailed study of India's needs and distribution

patterns in the face of growing population and increased food grain production is necessary to adequately assess India's future demands of soft

wheat relative to bread wheat.

Summary

Several points emerge from export patterns during the 1960's. (1)

Very few countries were major PNW white wheat importers. The Big Six

(India, Japan, Pakistan, Korea, Taiwan, and the Philippines) accounted

for over 90 percent of PNW exports. This concentrated pattern means that

developments in only a few countries can significantly alter PNW exports.

If imports to one of the two key countries -- India and Japan -- diminish

as they did in 1968 to India because of much larger domestic food grain

production, and to Japan because of the peculiar quality problem for that

year, PNW exports will suffer accordingly. This concentration of markets

in a few Asian countries raises the question of market outlets in other

areas of the world. Food grain production in Asia as a whole is increasing

dramatically, while food production in Latin America and Africa is progressing very slowly. (2) Concessional shipments under PL 480 accounted for

two-thirds of PNW exports during the 1960's. The future of these shipments

is in doubt on two counts. First, the so-called green revolution has been

most dramatic in India and her dependence on imports has diminished, at

least in the short run. Second, PL 480 legislation in the U.S. is shifting

toward harder terms (smaller price discounts) and more stringent Congressional budget limitations. (3) There is a possibility, although not a certainty, that importing countries will gradually shift toward importing more

bread wheats and less white wheat.