Visualisation Tools for Exploring the Uncertainty-Risk Relationship in

advertisement

CRPIT Volume 106 - User Interfaces 2010

Visualisation Tools for Exploring the Uncertainty-Risk Relationship in

the Decision-Making Process: A Preliminary Empirical Evaluation

Mohammad Daradkeh, Alan McKinnon, and Clare Churcher

PO Box 84 Lincoln University

Lincoln 7647 Canterbury

mohammad.daradkeh@lincolnuni.ac.nz, {mckinnon, churcher}@lincoln.ac.nz

Abstract

Models play an important part in the decision-making

process. However, due to uncertainty in a model’s input

variables, making decisions involves a degree of risk. We

have developed two visualization prototypes for exploring

the influence of uncertainty in the values of the input

variables on the risk associated with the decision-making.

The first prototype is the interactive tornado diagram,

which is considered as an extension to the static tornado

diagram. The second prototype is the Uncertainty

Influence Explorer (UIExplorer). This paper presents and

discusses the results of an experiment conducted to assess

the efficacy of these prototypes and compare their ability

to help people answer meaningful questions related to the

risk associated with decision-making. The results show

that participants using UIExplorer performed better in

terms of accuracy and time taken to complete the

questions. Also, they found it easier to use and had higher

confidence in the decisions being made.

Keywords: Information visualization, Interaction Design,

Decision-making process, Uncertainty, Risk, Sensitivity

analysis.

1

Introduction

All decisions are intended to bring about some future

benefit to someone or something, and involve choices

(e.g. whether to buy a new machine, whether to

implement design A or B, etc.) (Willows & Connell,

2003). Systematic approaches to decision-making usually

involve models which give a quantitative estimate of the

value for the decision-maker to base a decision on

(Clemen & Reilly, 2001). For example, financial

managers use net present value and internal rate of return

for analysing investment alternatives (Dayananda,

Harrison, Herbohn, & Rowland, 2002; Jovanovic, 1999).

In another decision context such as water management,

decision-makers use more complex models to rank

multiple water management options or compare the

frequency and extent of various flooding events (Hyde,

Maier, & Colby, 2005; Xu & Tung, 2008; Xu, Tung, Li,

& Niu, 2009).

Copyright (c) 2010, Australian Computer Society, Inc. This

paper appeared at the 11th Australasian User Interface

Conference (AUIC 2010), Brisbane, Australia, January 2010.

Conferences in Research and Practice in Information

Technology, Vol. 106. P. Calder, C. Lutteroth, Eds.

Reproduction for academic, not-for profit purposes permitted

provided this text is included.

42

There are different kinds of decisions (Harris, 1998);

some decisions such as which company’s shares to buy,

involve making a choice among alternatives while others

such as whether or not to invest in a new business are

more “yes/no” decisions. Whatever the type of decision,

the decision-maker can never be certain of the values of

the variables or parameters used in the model and there

may also be errors or approximations in the model itself

(Jovanovic, 1999). For this reason, descriptions of the

decision-making process include a sensitivity analysis

step once the “best” decision has been identified (Clemen

& Reilly, 2001; Larichev & Moshkovich, 1995; Roy &

Vincke, 1981). This is evident in Figure 1 which shows a

typical decision-making process (Clemen & Reilly, 2001).

Figure 1: A Decision Analysis Process flowchart

(Clemen & Reilly, 2001).

Many researchers have emphasized the role of

sensitivity analysis in decision-making (Clemen & Reilly,

2001; French, 1986; Triantaphyllou, 2000). After

choosing the “best” alternative and following the

completion of the decision analysis, sensitivity analysis

should be carried out to investigate how uncertainty in the

input variables and criteria weights (preferences) affects

the values of decision criteria, as well as the final ranking

Proc. 11th Australasian User Interface Conference (AUIC2010), Brisbane, Australia

of alternatives (Clemen & Reilly, 2001). Several

sensitivity analysis methods have been proposed (Guillen,

Trejos, & Canales, 1998; Hutton & Charles, 1988;

Mareschal, 1988; Ringuest, 1997; Soofi, 1990;

Triantaphyllou & Sanchez, 1997). These methods are

carried out to investigate the relationship between

changes in the criteria weights and the subsequent

alteration that occurs in the ranking of alternatives (Hyde

et al., 2005). Despite this, decision-making processes are

often applied with little consideration given to uncertainty

in the input variables and propagation of such

uncertainties through the decision model (Basson &

Petrie, 2007; Xu & Tung, 2008). We suggest this is

because the way in which the sensitivity analysis step

should be used as part of the overall decision-making is

not at all clear.

We are investigating the use of visualization tools to

enable the consideration of the uncertainty to be an

integral part of making the decision rather than treating it

as an add-on step which does not have a clear role in the

process. To date we have applied these ideas to "yes/no"

decisions. Application to decisions involving multiple

alternatives will be the subject of later work.

We have proposed three visualization tools to allow

the consideration of uncertainty to be better integrated

into the decision-making process for “yes/no” decisions.

The first visualization we investigate is the well known

static tornado diagram (Cooke & Van Noordwijk, 2000;

Koller, 2005, 2007) which is commonly used to explore

sensitivity in financial decision-making. For the second

visualization we have added interactivity to the tornado

diagram. The third visualization is a prototype of our

Uncertainty Influence Explorer (UIExplorer). It has been

developed to explicitly allow the decision-maker to

explore how the risk of making an undesirable decision is

affected by the uncertainty in the input variables as

depicted by the process shown in Figure 2. The decisionmaker specifies the risk criterion to be used (e.g. that the

NPV is less than zero) and also the uncertainty range for

each input parameter.

Risk criterion

Specify

Risk calculator

Input uncertainties

Risk

Model

Decision-maker

Decision

Specify

Figure 2: Uncertainty-Risk relationship in the decisionmaking process.

This paper describes an empirical evaluation and

presents its results. We introduce an experimental design

with two parts: a quantitative part that measures and

compares the performance of participants during the

experiment. Two variables of performance (accuracy of

the answers and time to complete questions) for each

visualization were measured. In the qualitative part, the

participants answered a number of questions regarding

their experience and satisfaction with these visualizations

in the decision-making process.

This paper is structured as follows. Section 2 briefly

describes the visualizations using a widely used financial

model for investment decisions called Net Present Value

(Dayananda et al., 2002; Jovanovic, 1999). Section 3

describes the evaluation. Section 4 presents and discusses

the experiment results. Future work and conclusions are

discussed in Section 5.

2

Description of the Visualization Tools

In this section, we describe the visualizations using a

widely used financial model for investment decisions

called Net Present Value (Dayananda et al., 2002;

Jovanovic, 1999). NPV is a financial model used in

capital budgeting to analyse the profitability of an

investment or project. A positive NPV indicates that the

investment is acceptable. If NPV is negative, the

investment should properly be rejected. However, there

are many estimations and subtle interactions between

variables that have significant effects on the profit

outcomes. A basic version of calculating NPV is given by

equation 1:

(1)

Where

t is the time of the cash flow.

N is the total time of the project.

r is the discount rate (the rate of return that could be

earned on an investment.)

Ct is the net cash flow (inflow minus outflow) at time t.

2.1

Static Tornado Diagram

A tornado diagram is a pictorial representation of the

contribution of each input variable to the output of the

decision making model (Clemen & Reilly, 2001; Cooke &

Van Noordwijk, 2000; Koller, 2005). It consists of

stacked horizontal bars, each one associated with one

input variable. Each horizontal bar represents the range of

the output (NPV) as the corresponding variable is varied

over its specified range while all other variables remain

constant at their nominal values. The length of the bar

indicates the variable's effect on the model output. The

model output has a nominal value which is calculated for

the nominal values of all the input variables and displayed

as a vertical line on the diagram.

A typical diagram is shown in Figure 3. The left and

right bar ends indicate the corresponding upper and lower

bounds of NPV as the related variable is varied within its

specified range while the other variables remain constant

at their nominal values. The example in Figure 3 shows

that, for the given values of the other parameters, the

NPV is mostly influenced by varying the inflow, while the

variation in the outflow has little effect on NPV. One of

the main drawbacks of the tornado diagram is that it

assumes all of the input variables are independent. Thus,

it ignores the influence of the interaction between input

variables that might have a significant effect on the output

(Koller, 2005). In addition, it is a static representation of

43

CRPIT Volume 106 - User Interfaces 2010

the sensitivity and thus it doesn’t allow users to

interactively explore and compare possible outputs under

different scenarios.

Figure 3: The static tornado diagram shows the

sensitivity of NPV to the variation in each input

variable while other variables are held constant

(Source: own Figure).

2.2

Interactive Tornado Diagram

This visualization prototype is an extension of the static

tornado diagram where users can change the nominal

values of the input variables interactively and so explore

the effects of the interaction between input variables on

the model’s output. As shown in Figure 4, this can be

investigated by varying an input variable (with its scroll

bar) and observing how the bars on the diagram for the

other input variables change. For example, if the user

scrolls the inflow scroll bar, he/she will notice that the

length of the rate bar will change. This means that the

uncertainty in the model’s output resulting from the

variation in the rate variable is affected by the inflow

value, as can be seen from Figures 4b and 4c. In this way,

the prototype can help in exploring the influence of the

interaction between input variables on the overall output

uncertainty.

One drawback with the interactive tornado diagram is

due to how the displayed information is calculated. The

calculation used to display the horizontal bars depends on

varying one input variable at a time while keeping the

other inputs at constant values. The problem with this way

of calculation is that, in most cases, the true influence on

the output variable depends not only on the values of the

input variables, but also on the interaction between input

variables over all ranges. Thus, varying one input variable

while keeping the others constant might not, reveal the

true influence of any input variable. This led to the

development of another prototype that rectifies this

drawback.

2.3

Uncertainty Influence Explorer

(UIExplorer)

The aim of this prototype is to visualize the risk due to

uncertainty in the model’s input variables, and its

sensitivity to the variation in these input variables. The

UIExplorer uses colours to convey the risk magnitude (in

44

this case the probability of making a loss). Figure 5 shows

a screenshot of the prototype. Yellow means no risk (i.e.,

probability of making a loss =0) and dark orange

represents the highest risk (i.e. probability of making a

loss =1). The colour of a cell shows the risk associated

with that value of the input variable. It is calculated by

taking every possible value of all the other variables and

calculating what proportion of these combinations will

result in a loss. The user can retrieve the numerical value

of the risk (i.e., the probability of a negative NPV) by

pointing to any of the cells. For example if the inflow is

$30000 (highlighted cell in Figure 5) then if we consider

all other possible combinations of values for the other

variables about 44% will result in a loss (probability

0.44).

By looking at the displayed range of colours that

represent the risk magnitude, the user can quickly and

easily see where the investment is potentially risky or

where it is not. In addition, he/she can readily see the

values of the input variables for which the investment will

likely be profitable (i.e., low risk). For example, in Figure

5, if the inflow varies within the range [$33000, $35000],

the user can have confidence that the NPV will be

positive (i.e., there is no risk of making a loss if the other

variables stay within the given ranges).

Clicking on a cell in the first grid fixes the value of

that input variable. The chosen cell is highlighted, and the

colours in the lower grid change to convey a new range of

risks associated with the values of the other input

variables. For example, the lower grid in Figure 6 shows

the risk associated with the values of inflow, outflow, and

rate based on fixing the Initial Investment at $90000 and

allowing the other input variables to vary within their

ranges. The new range of colours in the lower grid

represents the recalculated risk which is calculated by

fixing the initial investment at $90000 and taking every

possible value of the other variables and calculating what

proportion of these combinations will result in a loss.

This is useful when the user wants to fix a value for a

certain variable and explore the risk range associated with

the other input variables.

The range of input variables can be modified by

changing their minimum and maximum values and as a

result, the range of colours in both grids will change to

convey the new values of risk. For example, Figure 7

shows the effect of changing the range of Inflow, from

($25000, $35000) to ($20000, $30000). It can be seen

from Figure 7 that the colours in the upper grid are darker

which means that the risk is very high for almost all of the

values of the input variables. However, this does not

mean that the risk associated with all possible scenarios is

very high. For example, when the user chooses the value

$30000 from inflow (the highlighted cell), he/she can

notice from the lower grid that there are some

combinations of the other variables which have low or no

risk. This is helpful when the decision maker wants to

assess the risk of choosing different scenarios and allows

him/her to answer many different “what-if” questions.

Proc. 11th Australasian User Interface Conference (AUIC2010), Brisbane, Australia

a

b

c

Figure 4: (a) Screenshot of interactive tornado diagram. (b) The influence of decreasing the Inflow value on the

Rate bar length. (c) The influence of increasing the Inflow value on the Rate bar length.

Figure 5: A screenshot of the UIExplorer showing the ranges of risk.

45

CRPIT Volume 106 - User Interfaces 2010

Figure 6: A new range of colours in the second grid after holding the Init. Investment at $90000.

Figure 7: The influence of changing the Inflow Range on the calculated risk and the colour range.

In this version of UIExpleorer, we display the

information in a uniform grid. The use of a grid layout

facilitates the presentation of uncertainty and the

associated risk in an organised way. In addition, it makes

it easier to see and follow the change in the risk

magnitude across the rows, which in turn facilitates the

discovery of trends and relationships between uncertainty

and risk. In addition, all input variables are bounded by a

known maximum and minimum and, for this case study,

we have made the assumption that all values in between

occur with equal likelihood. Therefore, they can be

mapped onto equal-sized cells. This way, the user can run

through or compare several scenarios with various values

and easily determine the risk associated with each value

or scenario.

In this version of UIExplorer there is a limit to the

number of divisions. We have divided each input variable

into eleven divisions although there is no specific reason

for that number. However, for finer-grained analysis and

representation the user can change the min and max

values. This facilitates more detailed assessment over a

small range, and consequently more precise and effective

decision making. In the future versions we plan to make

the UIExplorer more flexible and amenable to larger

number of variables.

Colour was chosen for the purpose of presenting risk

because it is widely used for risk visualisation and

communication (Bostrom, Anselin, & Farris, 2008). Also

46

it is an important visual attention guide that can highlight

levels of risk (Wolfe & Horowitz, 2004). Several studies

have addressed the influence of colours on risk perception

and decision-making processes (Lipkus & Hollands,

1999; Rogers & Groop, 1981; Soldat & Sinclair, 2001;

Wogalter, Conzola, & Smith-Jackson, 2002). A study by

Wogalter et al. (Wogalter et al., 2002) supports the

following hierarchy of colours to convey risk level:

red/dark orange riskier than yellow, yellow riskier than

green. Scaling based on lightness or brightness may be

helpful in presenting risk information (Bostrom et al.,

2008). Davis and Keller (Davis & Keller, 1997) asserted

that using colour hue and colour value are the “best

candidates” for presenting risk information using static

methods. Brewer (Brewer, 2006) advises use of light-todark colour for low-to high values with a constant hue.

3

Evaluation

We evaluated the visualizations by testing and observing

how people used them in a controlled experiment. The

aim was to determine whether answering questions using

the three visualizations would differ with respect to

accuracy, completion time, ease of use, and confidence in

the decisions that have been made. Specifically, we try to

address the following questions:

1. How easily and quickly can users assess the

magnitude of risk of making a loss associated

with a certain value or a range of values?

Proc. 11th Australasian User Interface Conference (AUIC2010), Brisbane, Australia

2.

How easily and successfully can users answer a

variety of “what-if” questions?

3. Can users successfully use the interactive options

to assist the risk assessment process?

4. How confident are users in the decisions they

make using these tools?

In the following sections, the method of the evaluation

will be explained, and then the results will be discussed.

3.1

Experimental Design

evaluate the visualizations and would have little trouble

understanding the scenario.

Average profile of participants (1:None, 2:Beginner, 3:Intermediate, 4:Advanced)

Risk Assessment

2.3

Decision Making under

uncertainty

2.3

Financial Modeling

(e.g. Net Present Value)

2.6

11:None

2:Beginner

2

33:Intermediate

4:Advanced

4

For this experiment, the Net Present Value (NPV) model

is used. The four input variables are Initial investment,

cash inflow, cash outflow, and discount rate. The output is

the net present value, calculated over a number of years.

We put the participant in the situation of deciding whether

or not to make an investment as follows:

“You are planning to make an investment and you

need to make a decision based on the value of the NPV.

You are uncertain about the exact values of the model’s

input variables so there is a risk involved in your decision.

You need to deal with this uncertainty and assess the risk

of your decision. The risk here means the probability of

making a loss.”

The participants were given a brief introduction to

each visualization and the experimental method and were

then asked to answer a set of questions using each

visualization. During this time they were observed and

their performance was recorded. Upon completion of the

questions, the participants were asked to complete an exit

questionnaire. Participants took part in the experiment

individually with an observer present to record the time

taken to answer the questions.

3.2

3.4

Participants

We recruited 10 participants from the Lincoln University

community. All participants had some understanding of

the use of financial models and information to analyse and

interpret data relating to business activities. Five were

undergraduate students; all of them have enrolled in the

Financial Information for Business Paper (ACCT103).

One MSc student, with research experience in developing

models for financial forecasting using neural networks,

also participated. The other four participants were PhD

students in the Faculty of Commerce studying marketing,

business management, finance, and accounting

respectively. The latter participant was also working as a

part time lecturer in accounting. Of the sample, 6 were

male and 4 were female ranging in age from late teens to

40+. All of them agreed to spend 30 minutes with our

experiment and receive a $20 voucher in compensation.

The motivation behind recruiting students from Faculty of

Commerce is their good knowledge and understanding of

the basic NPV model.

3.3

Procedure

The method used in the experiment was as follows: The

participants filled out an entrance questionnaire to

determine their background experience. It asked the

participants to rate their experience in three areas on a

four-point scale (1-None, 2-Beginner, 3-Intermediate, 4Advanced). Figure 8 shows the average rating of

participants’ familiarity with financial modelling, decision

making under uncertainty and risk assessment.

Participants rated their familiarity with financial

modelling between none and intermediate, but rated their

familiarity with decision making under uncertainty and

risk assessment between beginner and intermediate level.

This suggests that the participants were well placed to

Figure 8: Background of participants.

Test Questions

The task of the participants in the experiment was to

answer questions about the impact of input uncertainty on

the risk associated with making a decision for the given

scenario. The questions addressed tasks common to the

decision making process and required finding facts and

information to answer them correctly. The five questions

below were repeated for each visualization:

Q1. For the displayed ranges, which variable do you

think has the most effect on the risk of making a loss?

(Purpose: to find the most influential variable on risk)

Q2. Approximately, for what range of cash inflow can

you be assured that the NPV will stay > 0 i.e. there is no

risk of making a loss? (Purpose: to find a range of values

associated with a specified risk)

Q3. What do you think the risk of making a loss will

be if the Discount rate becomes 10%? (Purpose: to

determine the risk associated with a specified input value)

Q4. Given that Initial investment is fixed at $90000,

approximately what is the minimum Cash Inflow that will

ensure a positive NPV? i.e. probability of making a loss is

zero. (Purpose: to find a value within a particular

scenario)

Q5. If the Inflow is $30000, what is the range of rate

values that will ensure no risk of making a loss? (Purpose:

to determine a range of values resulting in a specified

outcome).

In addition to the total time to complete questions

using each visualization and the accuracy of answers

overall, we looked at each question individually. Each

participant was asked to rate the ease of use of each

visualization to answer each question on a four-point

scale (1-Very difficult, 2-Difficult, 3-Easy, 4-Very easy).

Participants were also asked to explain why they found a

47

CRPIT Volume 106 - User Interfaces 2010

question easy or difficult to answer. After completing the

questions for each visualization, participants were

required to rate their confidence in the decisions they had

made with these visualizations on a 5 point scale (where 1

meant Not Confident and 5 Highly Confident).

4

Evaluation Results

The results revealed considerable differences between the

visualizations.

4.1

Accuracy

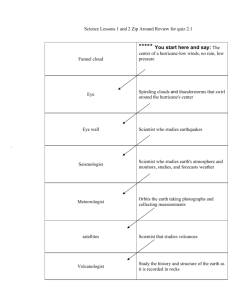

In terms of the accuracy of answers, the results showed

that there is a noticeable difference between the three

visualizations. Figure 9 shows the number of accurate

answers for each question using each visualization. 7 out

of 10 participants answered the question on finding the

most influential variable on risk (Q1) correctly using the

three visualizations. This is because this question doesn’t

need interaction from participants to find the answer. For

the questions on finding a value or range of values (Q2

and Q4), the static tornado diagram failed to give very

accurate answers. This is because these questions could

not be answered without interaction. The number of

correct answers for Q2 and Q4 increased for the

interactive tornado diagram. However, moving the sliders

did not give high accuracy (5 out of 10 were incorrect for

both Q2 and Q4). Using UIExplorer, participants gave

more accurate answers for Q2 and Q4 than using static

tornado or interactive tornado diagram.

For the questions on determining the risk associated

with a certain value (Q3) or the risk associated with a

range of values within a scenario (Q5), the results show

that participants did better using UIExplorer than using

both the static tornado and the interactive tornado. This

suggests that both interactive tornado and UIExplore

helped in finding precise answers to the questions that are

related to finding the risk (Q3 and Q5). On the other

hand, interactive tornado failed to give high accuracy for

the questions that are related to finding the values that

affect the risk (Q2 and Q4), while UIExplore succeed to

give high accuracy for the same questions, as shown in

Figure 9.

Accurate answers

Number of accurate answers

12

10

10

9

9

9

9

8

8

7 7 7

Static

Tornado

6

5

5

4

Interactive

Tornado

4

4

UIExplorer

2

2

1

0

Q1

Q2

Q3

Questions

Q4

Q5

Figure 9: Comparison between the three visualizations

in terms of accuracy.

48

4.2

Time Taken

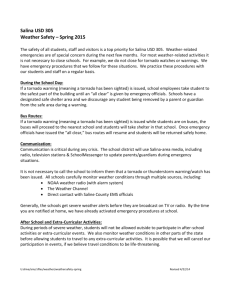

Participants took from 5 to 10 minutes to complete the

five questions using each visualization. Figure 10 shows

that the mean time taken to answer the questions was 7.3

minutes using static tornado, 6.2 minutes using interactive

tornado, and 6 minutes using UIExplorer. The mean time

was shorter for UIExplorer than interactive tornado

perhaps because, as some participants expressed, moving

the sliders in interactive tornado prototype to find the

answer takes longer than observing the colour change in

UIExplorer. Table 1 summarizes the results of the time

taken by the participants to answer the questions using

each visualization.

Time Taken on Average

UIExplorer

6

Interactive tornado

6.2

Static tornado

7.4

0

1

2

3

4

5

6

7

8

9

10

Time in minutes

Figure 10: The average time taken by participants to

complete the questions using each visualization.

visualization

Static tornado

average

sd

min

max

7.4

Interactive tornado

6.2

2.1187

5

10

1.3166

5

UIExplorer

9

6

1.1547

5

8

Table 1: Summary of the time taken Results.

4.3

Ease of Use

Figure 11 shows that there is a clear distinction between

the three visualizations in terms of their ease of use.

While it was difficult to find answers using static tornado,

it becomes easier using interactive tornado and

UIExplorer. For example, using the static tornado

prototype, participants found it difficult to obtain answers

to the questions related to finding the values of the input

variables (Q2 and Q4) and the risk associated with these

values (Q3 and Q5). However, using the interactive

tornado prototype, participants found that the search for

the answers became easier and even much easier when

using UIExplorer.

Using the static tornado prototype, participants found

that the question related to finding the most influential

input variable on the risk (Q1) easier than the other

questions. On the other hand, although the ease of use for

the interactive tornado prototype and UIExplorer was

rated between very easy and difficult, users found

UIExplorer much easier than the interactive tornado. This

was consistent with the feedback from the participants,

who mostly expressed their satisfaction with the use of

UIExplorer.

Proc. 11th Australasian User Interface Conference (AUIC2010), Brisbane, Australia

On average, participants found UIExplorer easier to

use than the static tornado and interactive tornado as

shown in Figure 12. Table 2 summarizes the results of the

participants’ evaluation to the ease of use. It is noted here

that two of the participants who answered Q2 and three

participants who answered Q4 incorrectly assessed

finding the answers as easy. This gives the impression that

the interactive tornado prototype is misleading because

some of the participants have been unable to identify the

correct answers despite what they perceived as a

reasonable ease of use.

associated with each value can be directly seen without

the need for further interpretation. It should be noted that

although some of the participants responded with

incorrect answers, their level of confidence using the

interactive tornado prototype was high. This again

indicates that the interactive tornado prototype leads to

misleading interpretations concerning the risk associated

with the decision making.

Visualization

Static Tornado

Interactive Tornado

UIExplorer

The ease of use rating for each question in each visualization

3.5

3.5

Average

min

1

2

2

max

3

5

5

2.9

3.3

3.1

3.2 3.3

3.3

3.2

3

2.8

2.5

3.5

4.5

2.3

2.1

1.9

2

Static

tornado

1.9

1.5

Interactive

tornado

1

UIExplorer

0.5

0

Q1

Q2

Q3

Q4

Q5

Questions

Figure 11: Comparison between the ease of use for each

question in each visualization.

Easy of Use on average

3.38

UIExplorer

Interactive tornado

3.06

2.22

1

1.5

2

2.5

3

3.5

1: Very diffecult

4

4:Very easy

Figure 12: A comparison between the three

visualizations in terms of ease of use.

Visualization

Static tornado

Interactive tornado

UIExplorer

average

sd

min

max

2.22

3.06

3.38

0.6788

0.5858

0.6023

1

2

2

4

4

4

Table 2: Summary of the ease of use results.

Level of Confidence

Results summarized in Table 3 show that there is a clear

difference in the confidence of the participants for the

decisions that can be made based on the three

visualizations. Participants showed a low level of

confidence in their decisions using the static tornado

prototype (2). This level rose noticeably for the

interactive tornado prototype (3.7) and rose to (4.3) for

UIExplorer. One of the main features of UIExplorer, as

most of the participants expressed, is that the risk

Post-study Questionnaire

Eight of the participants found UIExplorer easier to use,

more intuitive, and quicker to understand and learn. They

understood the representation of risk by colours. On the

other hand, two participants preferred the interactive

tornado diagram because they found that moving the

sliders to reach the required values was intuitive and lead

to more understanding and easier assessment. This is

supported by their correct answers when using the

interactive tornado prototype.

We didn’t notice that participants faced a problem in

distinguishing colours/gradients. Participants were able to

relate between the degree of colour and the degree of risk.

They were also able to understand the relationship

between uncertainty and risk through gradations of

colours. This is consistent with the results of the

experiment which showed that the overall performance of

participants was better using UIExplorer.

5

Static tornado

4.4

sd

0.8165

0.82327

0.94868

Table 3: confidence level results.

4

3

average

2

3.7

4.3

Conclusion and future work

This paper presents the results of an experiment

conducted to compare the ability of three visualization

prototypes to help people explore the influence of

uncertainty in the input variables on the risk associated

with the decision making. The first visualization is a static

tornado diagram. The second visualization is an

interactive tornado diagram, which is a modification of

the static tornado diagram. The third visualization is the

uncertainty influence explorer.

The results show that most of the participants preferred

to use UIExplorer rather than the static or interactive

tornado prototypes. The use of UIExplorer leads to more

correct answers and a shorter time taken to find those

answers. Participants found UIExplorer easier to use and

they had greater confidence in their decisions compared

with the static tornado and interactive tornado prototypes.

This was consistent with the quantitative results.

Participants’ feedback confirmed that further research is

needed to improve the design of the UIExplorer so that

the user can explore the risk associated with the decision

making models at several levels of detail. It is important

for the decision maker to be able to explore the risk

associated with each value of each input variable, the risk

associated with each input variable regardless of the

49

CRPIT Volume 106 - User Interfaces 2010

current value of that variable, and the risk associated with

each scenario.

Although there were only 10 participants in this study

and we did not completely get rid of learning effects and

bias in the results, we believe that the results clearly

indicate that our approach of including the risk of making

an acceptable decision as an integral part of the decisionmaking process has significant merit. However, further

evaluation is needed. More extensive user evaluation

would include more participants and more tasks. In

addition, we intend to develop UIExplorer further and

also explore ways of extending the approach to decisions

where there are a number of alternative options.

Acknowledgements

We would like to thank all participants without whom the

study would not have been possible.

6

References

Basson, L., & Petrie, J. G. (2007). An integrated approach

for the consideration of uncertainty in decision making

supported by Life Cycle Assessment. Environmental

Modelling & Software, 22(2), 167-176.

Bostrom, A., Anselin, L., & Farris, J. (2008). Visualizing

Seismic Risk and Uncertainty. Annals of the New York

Academy of Sciences, 1128(Strategies for Risk

Communication Evolution, Evidence, Experience), 2940. doi:10.1196/annals.1399.005

Brewer, C. A. (2006). Basic Mapping Principles for

Visualizing Cancer Data Using Geographic Information

Systems (GIS). American Journal of Preventive

Medicine,

30(2,

Supplement

1),

S25-S36.

doi:10.1016/j.amepre.2005.09.007

Clemen, R. T., & Reilly, T. (2001). Making Hard

Decisions with DecisionTools (2nd rev. ed.). Pacific

Groce, CA: Duxbury Thomson Learning.

Cooke, R. M., & Van Noordwijk, J. M. (2000).

Generalized Graphical Methods for Uncertainty and

Sensitivity Analysis. Bashkir Ecological Journal,

(Special Issue) 1(8), 54-57

Davis, T. J., & Keller, C. P. (1997). Modelling and

visualizing multiple spatial uncertainties. Comput.

Geosci.,

23(4),

397-408.

doi:260799

http://dx.doi.org/10.1016/S0098-3004(97)00012-5

Dayananda, D., Harrison, S., Herbohn, J., & Rowland, P.

(2002). Capital Budgeting: Financial Appraisal of

Investment Projects. Cambridge: Cambridge University

Press.

French, S. (1986). Decision Theory: An Introduction to

the Mathematics of Rationality. Chichester, U.K: Ellis

Horwood.

Guillen, S. T., Trejos, M. S., & Canales, R. (1998, 8-12

June 1998.). A robustness index of binary preferences.

Paper presented at the XIVth International Conference

on Multiple Criteria Decision Making, Charlottesville,

Virginia.

Harris, R. (1998). Introduction to Decision Making.

(August

15,

2009).

Retrieved

from

http://www.virtualsalt.com/crebook5.htm

50

Hutton, B., & Charles, P. S. (1988). Sensitivity analysis

of additive multiattribute value models. Oper. Res.,

36(1),

122-127.

doi:http://dx.doi.org/10.1287/opre.36.1.122

Hyde, K. M., Maier, H. R., & Colby, C. B. (2005). A

distance-based uncertainty analysis approach to multicriteria decision analysis for water resource decision

making. Journal of Environmental Management, 77(4),

278-290.

Jovanovic, P. (1999). Application of sensitivity analysis

in investment project evaluation under uncertainty and

risk. International Journal of Project Management,

17(4), 217-222. doi:10.1016/s0263-7863(98)00035-0

Koller, G. (2005). Risk Assessment and Decision Making

in Business and Industry: A Practical Guide: CRC

Press.

Koller, G. (2007). Modern Corporate Risk Management:

A Blueprint for Positive Change and Effectiveness: J.

Ross Publishing.

Larichev, O. I., & Moshkovich, H. M. (1995). ZAPROSLM—A method and system for ordering multiattribute

alternatives. European Journal of Operational

Research 82(3)(3), 503-521.

Lipkus, I. M., & Hollands, J. G. (1999). The Visual

Communication of Risk. J Natl Cancer Inst Monogr,

1999(25), 149-163.

Mareschal, B. (1988). Weight stability intervals in

multicriteria decision aid. European Journal of

Operational Research, 33, 54–64.

Ringuest, J. L. (1997). Lp-metric sensitivity analysis for

single and multi-attribute decision analysis. European

Journal of Operational Research, 98, 563–570.

Rogers, J. E., & Groop, R. E. (1981). Regional Portrayal

With Multi-Pattern Color Dot Maps. Cartographica:

The International Journal for Geographic Information

and Geovisualization, 18(4), 51-64.

Roy, B., & Vincke, P. (1981). Multicriteria analysis:

survey and new directions. European Journal of

Operational Research, 8, 207–218.

Soldat, A. S., & Sinclair, R. C. (2001). Colors, smiles,

and frowns: External affective cues can directly affect

responses to persuasive communications in a mood-like

manner without affecting mood. . Social Cognition, 19

469–490.

Soofi, E. S. (1990). Generalized entropy-based weights

for multiattribute value models. Operations Research,

38, 362-363.

Triantaphyllou, E. (2000). Multi-criteria decision making

methods: A comparative study. Boston: Kluwer

Academic Publishers.

Triantaphyllou, E., & Sanchez, A. (1997). A sensitivity

analysis approach for some deterministic multi-criteria

decision-making methods. Decision Sciences, 28, 151–

194.

Willows, R., & Connell, R. (2003). Climate Adaptation:

Risks, Uncertainty and Decision-Making (Technical

Report). Oxford, UK: UKCIP.

Proc. 11th Australasian User Interface Conference (AUIC2010), Brisbane, Australia

Wogalter, M. S., Conzola, V. C., & Smith-Jackson, T. L.

(2002). Research-based guidelines for warning design

and evaluation. Applied Ergonomics, 33(3), 219-230.

doi:10.1016/s0003-6870(02)00009-1

Wolfe, J. M., & Horowitz, T. S. (2004). What attributes

guide the deployment of visual attention and how do

they do it? Nat Rev Neurosci, 5(6), 495-501.

Xu, Y., & Tung, Y. (2008). Decision-making in Water

Management under Uncertainty. Water Resources

Management, 22(5), 535-550.

Xu, Y., Tung, Y., Li, J., & Niu, S. (2009). Alternative risk

measure for decision-making under uncertainty in water

management. Progress in Natural Science, 19(1), 115119.

51