Communications Usage Trend Survey in 2005 Compiled

advertisement

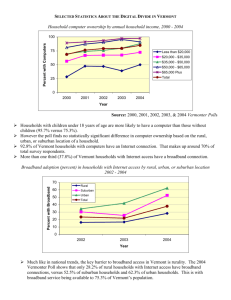

Communications Usage Trend Survey in 2005 Compiled MIC has compiled the "Communications Usage Trend Survey" as of the end of CY2005 in order to grasp the usage trends in telecommunications and broadcasting services within households (households and household members), companies (enterprises) and offices (establishments). [Highlights of the survey results] The number of Internet users via mobile terminals has been increasing further, surpassing those via personal computers (PCs) for the first time. With respect to terminals for accessing the Internet by individual users, the number of Internet users via mobile terminals, including cellular telephones, increased by 10.98 million from the end of the previous year (an increase of 18.8 percentage points over the previous year) to 69.23 million, surpassing those via PCs (66.01 million, an estimated figure) for the first time. This shows a further increase in the number of Internet users via mobile terminals. More than a half of the Internet users (57.0%, or 48.62 million, of the total number [85.29 million], estimated figures) are using both personal computers and mobile terminals. The number of Internet users subscribing to broadband access networks continues to be on the rise. When looking into the ratio of each broadband network, while the ratio of fiber-optic circuits has been increasing, that of digital subscriber lines, or DSL, recoded a decrease for the first time. The number of broadband access network users increased by 4.6 million (an increase of 10.8 percentage points compared to the figure as of the end of previous year) to 47.07 million (an estimated figure), showing a continuous increase in the number of broadband users, or reaching 55.2% to the total number of Internet users. About two-thirds of households have access to the Internet via PCs (65.0%) and 68.1% of corporate Internet users have subscribed to broadband access network services. With regard to types of broadband circuits to which residential users' PCs are connected, while the usage ratio of fiber-optic circuits grew from 6.1% to 14.8%, that of DSLs decreased from for the first time from 39.2% to 34.2%. The same trend was seen in companies and offices. Internet users have been continuously increasing. The number of Internet users who have accessed the Internet in 2005 reached 85.29 million (an estimated figure), increased by 5.81 million (a 7.3 percentage point growth over the previous year). Thanks to the increase, the population coverage ratio of Internet users increased by 4.5 percentage points to 66.8% (an estimated figure). The digital divide between age groups still exists. Differences in the usage rates for age groups, annual income groups, gender groups and sizes of cities were narrowed in comparison with those in the previous year. However, the differences in the usage rates for the age groups of their 60s or older and younger age groups are still remarkable (e.g., a difference of 20 percentage points between their 50s and their early 60s). When comparing the usage rate for cellular telephones with that for PCs, that for cellular telephones is high. The PC usage rates extremely differ by age groups. The cellular telephone usage rate (71.9%) exceeds the PC usage rate (56.7%) by 15 percentage points, as is seen by age groups. In particular, the cellular telephone usage rate for the age group "ages between 6 through 12" overwhelmingly exceeds the PC usage rate by 37 percentage points. The cellular telephone usage rates for their 20s through 40s surpass 90%, even for their late 60s exceeds 50%. On the other hand, the PC usage rates for their 20s through 40s exceed 70%, that for their 50s is 55%, and that for their late 60s is 22.7%. With respect to the digital divide by age groups, since skills and knowledge are needed to operate PCs, the older the age group grew, the lower the PC usage rates decline. Although IP telephony services have been introduced into corporate users, the number of residential IP telephony users has slowed down in the growth rate. The corporate usage rate for IP telephony services has grown by 11.6 percentage points year on year to 39.4%. On the contrary, the residential usage rate for IP telephony services has slightly increased by 2.3 percentage points to 15.0%, showing a stagnant growth rate lower than that of the year before (an increase of 5.4 percentage points). Some measures for protecting personal information have been taken by corporate users on a swift pace. The corporate user rate of information and communications networks who take some measures for protecting personal information have grown by 16.7 percentage points over the previous year to 73.2%, indicating that measures for protecting personal information have been taken by corporate users on a swift pace. Of such measures, "improved training at office" recorded the highest rate of 45.7%, followed by "appointment of a chief information officer (CIO)" (41.4%). [Outlines of the survey] The "Communications Usage Trend Survey," which is composed of the following three sections: "Households/household members," "Companies (enterprises)," and "Offices (establishments)" has been conducted annually since 1990* as a statistical survey authorized by MIC in accordance with the Statistical Report Coordination Law. The survey on "Companies (enterprises)" was conducted in 1993 as the annual survey (except 1994), and "household members" was added in 2001. [Details of the survey method] Households Survey period Survey area Households (including single households) headed by Object samples someone aged 20 or older surveyed as of April 1, 2005 Number of samples Effective replies (Rate) Items surveyed Sampling Method Method of survey 6,400 Companies (Enterprises) As of January 2006 Nationwide Enterprises with more than 100 regular employees, excluding the industries of "Agriculture," "Forestry," "Fisheries" and "Mining" as defined in JSIC. 3,000 Offices (Establishments) Establishments with more than 5 regular employees excluding the industries of "Postal Services" and "Telecommunications" as defined in JSIC. 5,600 3,982 (12,879 persons) 1,406 2,821 (62.2%) (46.9%) (50.4%) Usage trends in information and communications services, rates of ICT equipment possession, etc. Random sampling (Stratified Random sampling Random sampling Two-stage Sampling on (Systematic Sampling on (Systematic Sampling on sizes of cites, towns and regular employee size for regular employee size for villages) each industry) each industry) Mail survey (postal service) Appendix Communications Usage Trend Survey in 2005 Key Survey Results Contents 1 Internet usage ..................................................................................................... 1 (1) Internet penetration (for households and companies)........................................1 (2) Internet users as a proportion of the population (householders)........................1 (3) Internet usage by device (householders)...........................................................2 (4) Demographic breakdown of internet usage (householders) ..............................3 (5) Impact of demographic factors on internet usage (householders) .....................3 (6) Frequency of internet usage (householders) .....................................................5 (7) Purpose of internet usage (householders).........................................................6 (8) Usage of e-commerce (companies)...................................................................7 (9) Corporate websites (companies) .......................................................................7 2. Broadband penetration....................................................................................... 8 (1) Home computer internet access (households)...................................................8 (2) Broadband users (householders).......................................................................8 (3) Corporate internet access (large companies) ....................................................9 (4) Small business internet access (small companies)............................................9 3 Usage of telecommunications devices ........................................................... 10 (1) Cell phone vs. computer usage (householders)...............................................10 (2) Impact of demographic factors on cell phone and computer usage (householders) .......................................................................................................11 (3) Ownership of telecommunications devices (households) ................................12 (4) IP phone penetration (companies/households) ...............................................13 (5) Penetration of ubiquitous technology* (companies).........................................14 (6) Computers-to-employees ratio (companies)....................................................15 (7) Telecommunications equipment ownership (small companies).......................16 4 Network configuration ...................................................................................... 17 (1) Home LANs (households)................................................................................17 (2) Internal networks (companies).........................................................................18 (3) Inter-company networks (companies)..............................................................19 (4) Network installation (companies) .....................................................................20 (5) Types of corporate networks (companies).......................................................21 5 Safety and security ........................................................................................... 22 (1) Internet concerns and annoyances (householders aged 15+) .........................22 (2) Safeguarding privacy (householders) ..............................................................23 (3) Network usage issues (companies) .................................................................24 (4) Safeguarding privacy (companies) ..................................................................25 (5) Role of CIO* (companies)................................................................................26 1 Internet usage (1) Internet penetration (for households and companies) Internet penetration rates have levelled off in recent years, remaining at 87.0% for households and 99.1% for large companies, while the penetration rate for small companies has risen slightly to 85.7%. Internet penetration for households and companies Large companies (over 300 employees) 100 90 80 70 60 50 98.4 (%) 88.6 Small companies (5 – 300 employees) 44.8 40 30 20 10 88.1 97.6 95.8 99.1% (large companies) 98.3 98.2 86.8 87.0% (households) 85.7% (small companies) 81.4 68.0 60.5 82.6 79.1 81.8 Households 31.8 34.0 19.1 0 End 1999 End 2000 End 2001 End 2002 End 2003 End 2004 End 2005 (2) Internet users as a proportion of the population (householders) The number of people who used the internet in the past year was 85.29 million, up 5.81 million (7.3%) since the end of last year. Continuing growth in absolute user numbers was matched by a commensurate increase in the proportion of internet users relative to the total population, which rose 4.5% to 66.8%. Internet users as a proportion of the population (householders) Millions 90 80 70 60 50 40 30 20 10 0 60.6 Internet users 62.3 66.8 54.5 Proportion of population 60 44.0 50 37.1 85.29 million 21.4 9.2 13.4 6,942 4,708 7,730 7,948 40 30 5,593 20 2,706 1,155 70 % 10 1,694 0 End 1997 End 1998 End 1999 End 2000 End 2001 End 2002 End 2003 End 2004 End 2005 Notes 1. Internet user numbers shown here are projections based on the number of survey respondents aged six and over who accessed the internet during the past year, from any device (including computer, cell phone/PHS, PDA and game console) and for any purpose (including private, school-related and work-related). 2. The figure for internet users as a proportion of the population is an estimate calculated by dividing the total population as of October 2005 (127.71 million, the intermediate projection given by the National Institute of Population and Social Security Research in Future Population Projections for Japan) by the projected number of internet users (85.29 million). 3. Figures for 1997 to the end of 2000 are quoted from the Communications White Paper. Figures for 2001 to the end of 2005 are taken from the Communications Usage Trend Survey. 4. The survey sample in 1999 was respondents aged 15 to 69. This was expanded to respondents aged 15 – 79 in 2000, then to all respondents aged six and over from 2001 to reflect increasing internet usage by school-age students. As a result of these demographic changes, it is not always possible to make direct comparisons between survey results from different years. 1 (3) Internet usage by device (householders) The number of personal internet users employing mobile terminals (chiefly cell phones) to access the internet rose by a further 10.98 million (18.8%) to reach 69.23 million, surpassing internet access by computer (66.01 million) for the first time and indicating continued growth in the trend towards mobile internet usage. The majority of internet users (48.62 million or 57.0%) access the internet from both computers and mobile terminals; the number of users who access the internet from a computer only fell by 5.21 million. Internet usage by device (householders) Computer Cell phone/PHS/PDA Computer only 15.85 million (18.6%) 69.23 million (81.2%) 66.01 million (77.4%) Computer and cell phone/PHS/PDA 48.62 million (57.05%) 1.33 million (1.6%) 19.21 million (22.5%) Game console/television 1.63 million (1.9%) Game console/television only 0.01 million (0.0%) 0.07 million (0.1%) Cell phone/PHS/PDA only 0.2 million (0.2%) Note Percentages represent proportion of all internet users aged six and over. Subtotals may differ slightly due to rounding off. Total: 85.29 million For comparison, the results from the Communications Usage Trend Survey in 2004 are shown below. Computer 64.16 million (80.7%) Computer only 21.06 million (26.5%) Cell phone/PHS/PDA 58.25 million (73.3%) 0.14 million (0.2%) Computer/cell phone/PHS/PDA 42.04 million (52.9%) Cell phone/PHS/PDA 15.11 million (19.0%) 0.92 million (1.2%) Game console/television 1.27 million (1.6%) Game console/television only 0.04 million (0.1%) 0.17 million (0.2%) 2 Total: 79.48 million (4) Demographic breakdown of internet usage (householders) Although variation in internet usage rates according to age, gender, city size and household income has decreased since the previous survey, internet usage rates are still much lower among people aged 60 or more — for instance, there is a difference of 20% between the 50 – 59 age group and the 60 – 64 age group. Demographic breakdown of internet usage (householders) (1) By age (%) 100 90.7 93.9 92.3 95.0 90.5 90 80 69.4 70 92.8 90.6 84.8 75.3 65.8 74.9 62.8 65.9 55.2 49.0 60 50 42.0 40 27.3 30 19.3 15.4 20 6.9 7.2 10 0 All people aged 6 and over 13-19 6-12 20-29 30-39 40-49 End 2004 60-64 70-79 55-69 80+ End 2005 (2) By gender (%) 90 80 70 60 50 40 30 20 10 0 50-59 (3) By city size 90 80 70 60 50 40 30 20 10 0 79.8 75.1 70.3 64.0 Males End 2004 (%) 79.3 78.2 73.5 68.4 68.0 56.9 Designated major cities, special economic zones, towns with prefectural offices Females End 2005 Other cities Towns and villages End 2004 End 2005 (4) By household income (%) 90 80 70 60 50 40 30 20 10 0 74.9 68.8 64.0 63.4 72.4 76.7 74.1 78.7 75.6 80.3 85.1 79.3 77.5 81.4 55.8 48.1 Under ¥2 million ¥2 million – less than ¥4 million ¥4 million – less than ¥6 million ¥6 million – less than ¥8 million ¥8 million – less than ¥10 million End 2004 ¥10 million – less than ¥15 million ¥15 million – less than ¥20 million ¥20+ million End 2005 (5) By age and gender (end 2005) (%) 93.9 93.8 100 90 80 70 94.5 95.5 94.0 91.6 93.1 88.0 80.9 79.8 70.3 69.8 65.9 66.0 68.1 60 51.5 50 42.1 33.5 40 30 20 28.1 12.3 10 8.1 6.7 0 All people aged 6 and over 6-12 13-19 20-29 30-39 40-49 Males Females 3 50-59 60-64 65-69 70-79 80+ (5) Impact of demographic factors on internet usage (householders) Among the demographic characteristics considered in the survey, age group had the greatest impact on internet usage followed by household income, while city size and gender were of negligible significance. The “12 and under” and “50 and over” age groups had a negative influence (i.e., respondents in these age groups were less likely to use the internet), with the “60 and over” age group having a particularly strong negative influence. Looking at household income, the “less than ¥6 million” categories had a negative impact, while the “¥6 million and over” categories had a positive impact. Impact of demographic factors on internet usage (householders) -3 -2 -1 13 – 19 0.71 0.71 20 – 29 0.81 0.75 30 - 39 0.73 0.68 0.46 0.63 40 - 49 -0.37 -0.23 50 - 59 60+ Designated major cities, special economic zones, towns with prefectural offices Other cities Towns and villages Under ¥2 million ¥2 million – less than ¥4 million Household income * ¥4 million – less than ¥6 million -1.83 -1.91 0.22 0.09 -0.04 -0.02 -0.32 -0.17 -0.64 -0.54 -0.55 -0.36 -0.01 -0.15 0.06 0.10 ¥6 million – less than ¥8 million ¥8 million – less than ¥10 million 0.21 0.17 ¥10+ million 0.25 0.29 Sample size: 450 respondents broken down by age and gender 3 -0.50 -0.63 6 – 12 City size 2 -0.15 -0.11 Female Age group 1 0.15 0.11 Male Gender - End 2004 End 2005 Range Gender Age City size Household income End 2004 0.30 2.64 0.54 0.88 End 2005 0.22 2.66 0.26 0.84 Note: The impact rating is determined via multivariate analysis using type II quantization*. A positive figure indicates a factor that promotes internet usage, while a negative figure indicates a factor that hinders internet usage. The higher the number, the greater the impact. * Type II quantization is a form of multivariate analysis involving the use of qualitative data for both predictor and nonpredictor variables. Here, the impact in each category (called the category score) is calculated with internet usage as the non-predictor variable and the demographic characteristics as the predictor variables. 4 (6) Frequency of internet usage (householders) Of those householders who access the internet at least once a day, over half (55.3%) do so using a cell phone, while 43.9% use a computer, a difference of 11.4%. Cell phones are preferred over computers across all age groups, particularly in the younger age brackets (13 – 19 and 20 – 29), where the proportion rises to over 60%. The proportion for computers is lowest in the 13 – 19 age bracket at 36.2%, but relatively constant at around 40% from 20 to 59 years of age. Few children aged 6 – 12 use the internet on a daily basis, with the cell phone and computer figures both in the range 14% - 15%. Frequency of internet usage (householders) (1) Using cell phone 0% 20% 40% 60% 55.3 Totals 18.9 At least once a day 15.1 6 – 12 8.4 14.2 15.3 6.2 49.7 50 – 59 8.9 12.2 4.6 7.9 10.4 12.2 11.7 27.8 5.7 11.8 7.5 27.3 29.3 65+ 10.0 20.1 42.9 60 – 64 4.1 10.0 19.6 8.3 5.6 19.8 50.8 40 – 49 5.9 15.5 56.7 30 – 39 No response 16.3 69.0 20 – 29 Less often 7.6 34.9 64.3 13 – 19 9.7 At least once a month At least once a week 19.5 n = 7,498 100% 80% 4.5 13.5 15.5 15.2 (2) Using computer 0% 10% 20% 30% 40% 50% 60% 70% 80% n = 7,619 100% 90% Less often 43.9 Totals 28.5 At least once a day 6 – 12 13 – 19 18.4 49.4 29.0 48.2 50 – 59 10.0 29.4 49.2 37.9 22.7 5 6.4 5.6 6.1 6.5 10.2 15.7 3.9 9.8 11.4 13.5 4.4 8.9 12.4 25.6 4.6 5.6 12.0 25.4 40.2 No response 11.5 26.0 46.3 5.6 13.4 33.3 40 – 49 65+ 34.8 36.2 30 – 39 8.1 At least once a month At least once a week 32.8 14.4 20 – 29 60 – 64 13.9 6.0 9.3 13.5 (7) Purpose of internet usage (householders) When accessed from a cell phone, the internet is overwhelmingly used for contacting and/or sending information to friends and colleagues via email or equivalent (69.5%); the next most common uses are downloading or listening to digital audio content (26.2%) and viewing news and weather forecasts (25.1%). These findings indicate a strong preference for obtaining and exchanging information while in transit. When accessed from a computer, meanwhile, the internet is generally used for obtaining information on products, services, businesses and retailers (55.4%), contacting and/or sending information to work associates and friends (54.4%), and viewing news and weather forecasts (50.2%). Thus, computer-based internet usage is spread among various categories, whereas mobile internet usage tends to be concentrated in one category. Cell phones are used more than computers in two categories only: contacting and/or sending information to friends and colleagues, and accessing digital content. In all other categories, computers are used more than cell phones, particularly for obtaining information on products and services and viewing news and weather forecasts. Purpose of internet usage (householders) 10 0 20 30 40 Contacting and/or sending information to friends and colleagues via email or equivalent 50 60 70 69.5 54.4 Downloading or listening to digital audio content 16.3 26.2 25.1 Viewing news and weather forecasts 50.2 13.3 Obtaining information on products, services, businesses and retailers 55.4 11.2 Downloading or viewing digital images and video content 19.1 8.6 Purchasing or transacting on goods and services 39.7 6.8 Quizzes, competitions and questionnaires 15.1 3.1 Online games (net games) Internet banking Obtaining information on government procedures and services Job searching 10.0 1.9 8.8 1.5 21.7 1.5 Cell phones (n = 7,498) 7.1 e-Learning and correspondence programs 0.2 2.4 Computers (n = 7,619) Submitting government applications and 0.0 2.5 notifications, paying taxes Other No response 1.2 4.0 22.4 10.6 6 80 (%) ] (8) Usage of e-commerce (companies) Some 30.9% of companies use e-commerce in the form of procurement and sales over the internet. Very large companies with 2,000 or more employees are more than twice as likely to use e-commerce as small companies with 100 – 299 employees (60.7% versus 27.0%). Usage of e-commerce (companies) (by number of employees) (%) 70 60 50 40 60.7 30 20 10 30.9 38.5 38.2 40.0 300 – 499 500 – 999 1,000 – 1,999 27.0 0 Overall 100 – 299 2,000+ (9) Corporate websites (companies) The majority of companies (85.6%) have their own websites, which are increasingly used as a means of disseminating information about the company. Almost 100% of very large companies with 2,000 or more employees have a website; the percentage of smaller companies with websites is less, but the figure is steadily rising and closing the gap on larger companies. Corporate websites (companies) 100 90 80 70 60 50 40 30 20 10 0 (%) 90.7 91.9 85.6 79.1 Overall 83.1 84.5 87.7 93.6 92.1 96.6 98.2 97.5 99.1 1,000 – 1,999 2,000+ 74.5 100 – 299 300+ 300 – 499 End 2004 7 500 – 999 End 2005 2 Broadband penetration (1) Home computer internet access (households) Broadband now accounts for two-thirds (65.0%) of all home computer connections, but growth in broadband take-up has slowed to three percentage points over the last year. During the same period, optic fiber connections more than doubled, from 6.1% to 14.8%, while DSL connections fell for the first time, from 39.2% to 34.2%. Home computer internet connections (households) — multiple response 0 10 20 30 40 50 60 (%) 70 62.0 65.0 Broadband total 39.2 DSL 34.2 15.5 16.1 Cable television line 6.1 Optic fiber 3G cell phone 1.2 1.3 Fixed line 1.3 0.5 14.8 End 2004 End 2005 18.4 19.2 ISDN 20.4 Telephone line (dial-up) 16.4 Note 1. Sample is defined as respondents who access the internet from a computer at home. 2. “Broadband total” comprises DSL, cable television/CATV, optic fiber (FTTH), 3G cell phone (when used as to provide the computer’s internet connection) and fixed line services. 3. Narrowband includes the above plus cell phone and PHS lines. (2) Broadband users (householders) The number of broadband users continued to rise, reaching an estimated 47.07 million, an increase of 4.6 million (10.8%) since last year. This represents 55.2% of all internet users, up 1.8% since last year. (million) Broadband and narrowband users (householders) 85.29 million 9,000 77.30 million 8,000 7,000 79.48 million 69.42 million 37.01 million 6,000 5,000 4,000 49.87 million 51.23 million 46.6% 2,000 19.55 million 66.3% 28.2% 26.07 million 42.47 million 53.4% 47.07 million 33.7% 0 End 2002 44.8% 71.8% 3,000 1,000 38.23 million End 2003 End 2004 Broadband users Narrowband users 8 End 2005 55.2% (3) Corporate internet access (large companies) Broadband now accounts for 68.1% of corporate internet connections, indicating a continued rise in the adoption of broadband by industry. Optic fiber connections also rose from 35.4% to 50.2%, while DSL connections fell for the first time, from 33.9% to 29.2%. Corporate internet connections (large companies) — multiple response 10 0 20 30 40 50 60 61.1 Broadband 68.1 35.4 Optic fiber 50.2 33.9 DSL 29.2 3.3 3.7 Cable television Fixed line - 1.1 19.5 16.1 ISDN (permanent connection) 18.0 15.7 Dedicated line 12.1 9.6 Telephone line (dial-up) ISDN (dial-up) End 2004 End 2005 8.9 8.9 3.5 3.1 Other No response (%) 80 70 1.7 1.6 Note: “Broadband” includes optic fiber, DSL, cable television and fixed line connections (4) Small business internet access (small companies) Broadband connections at small companies lifted from 49.6% last year to 55.2%, an increase of 5.6 percentage points. Optic fiber connections increased from 15.8% to 27.0%, while DSL connections fell for the first time, from 29.9% to 24.1%. Small business internet connections (small companies) 10 0 20 30 16.3 15.8 Optic fiber 24.1 (%) 55.2 29.9 End 2003 End 2004 End 2005 5.7 3.4 3.9 Cable television 49.6 60 27.0 20.0 DSL 0.7 0.5 0.2 23.5 21.5 18.7 ISDN (permanent connection) 10.9 10.5 8.9 10.0 8.2 7.2 Dial-up line Dedicated line ISDN (dial-up) 50 42.7 Broadband * Fixed line 40 3.3 8.5 * Sum total of optic fiber, DSL, cable television and fixed line connections 11.4 9 3 Usage of telecommunications devices (1) Cell phone vs. computer usage (householders) Overall, cell phone usage is more than 15% higher than computer usage (71.9% versus 56.7%) in all age groups. The only exception is the 6 – 12 age bracket, where computer usage is approximately 37% higher than cell phone usage. Cell phone usage is over 90% in the 20 – 49 age bracket, and still around 50% in the 65 – 69 age group. Computer usage is over 70% in the 20 – 49 age bracket, falling to 55% among 50 – 59 year olds and 22.7% among 65 – 69 year olds. These results indicate that computers, which are more difficult to master than cell phones, have created a significant digital divide between generations. Viewed by gender, city size and household income, the difference in usage rates was greater for computers than for cell phones. As household income rises, the discrepancy between computer and cell phone usage narrows. Cell phone versus computer usage rates (householders) (1) By age 100 (%) 96.6 90 80 81.6 78.0 71.9 94.2 78.3 90.1 80.9 75.8 71.2 70 69.3 58.5 56.7 60 55.0 48.3 50 36.5 40 30 25.8 22.7 21.1 20 7.9 10 7.7 0 All people aged 6 and over 6 – 12 13 – 19 20 – 29 30 – 39 40 – 49 Cell phone (2) By gender (%) 65 – 69 70 – 79 1.1 80+ Computer 90 80 70 60 50 40 30 20 10 0 76.0 68.1 64.7 70 60 – 64 (3) By city size 90 80 50 – 59 60 49.1 50 40 30 20 10 0 (%) 70.7 67.3 62.5 55.0 48.1 Designated major cities, special economic zones, towns with prefectural offices Female Computer Male Cell phone 75.5 Towns and villages Other cities Cell phone Computer (4) By household income (%) 90 80 70 60 50 40 30 20 10 0 70.8 55.2 53.4 34.4 Under ¥2 million 60.7 63.8 81.6 80.8 78.6 77.4 71.9 64.7 68.5 69.6 67.4 40.3 ¥2 million – less than ¥4 million ¥4 million – less than ¥6 million ¥6 million – less than ¥8 million Cell phone ¥8 million – less than ¥10 million Computer 10 ¥10 million – less than ¥15 million ¥15 million – less than ¥20 million ¥20+ million (2) Impact of demographic factors on cell phone and computer usage (householders) Among the demographic characteristics considered in the survey, age group had the greatest impact on both cell phone and computer usage rates, followed by household income. In general, demographic factors had a greater impact on computers than on cell phones. The “12 and under” and “50 and over” age groups had a negative influence (i.e., respondents in these age groups were less likely to use computers), with the “60 and over” age group having a particularly strong negative influence. Looking at household income, the “less than ¥6 million” categories had a negative impact. These findings are similar to the trends for internet usage. Impact of demographic factors on cell phone and computer usage (householders) -3 -2 -1 - -0.05 -0.21 Female 6 - 12 -1.92 -0.23 0.38 0.64 13 - 19 0.88 0.74 20 - 29 Age 0.76 0.64 30 - 39 0.65 0.41 40 - 49 50 - 59 60 + -0.38 -1.82 0.05 0.12 -0.04 -0.03 Other cities Towns and villages Under \2 million By household income -0.21 0.01 -0.53 -0.85 \2 million - less than \4 million -0.11 -0.63 \4 million - less than \6 million -0.08 \6 million - less than \8 million -0.04 0.00 0.14 0.15 0.21 \8 million - less than \10 million 0.10 0.43 \10+ million * Sample size : 450 respondents broken down by age and gender 0.28 -1.04 Designated major cities, special economic zones, towns with prefectural offices City size 2 0.05 0.21 Male Gender 1 Cell phone Computer Range Cell phones Computers Gender 0.10 0.41 Age 2.80 2.57 City size 0.09 0.33 Household income 0.68 1.28 11 3 (3) Ownership of telecommunications devices (households) Cell phones are owned by 89.6% of households and computers by 80.5%. These strong penetration rates have slowed in recent years. Fax machines have likewise leveled off after achieving penetration of approximately 50% of households. Household ownership of telecommunications devices (%) 100 91.1 90 89.6 Cell phones 93.9 86.1 78.2 80 75.4 77.5 80.5 Computers 75.6 70 71.7 64.2 60 58.0 57.7 52.9 50.8 50 37.7 40 40.4 32.6 30 53.9 50.5 50.4 Fax machines 41.4 Car navigation 33.8 systems 34.2 31.9 30.6 33.5 23.8 20 11.5 16.0 17.5 11.0 11.1 10 Internet-compatible 12.0 9.0 9.3 3.2 0 End 1998 End 1999 End 2000 End 2001 End 2002 3.2 End 2003 4.5 End 2004 11.1 TV games 4.1 Internet-compatible appliances End 2005 Note: The “Internet-compatible TV games” category was added to the survey in 2001, followed by “Internetcompatible appliances” in 2002. 12 (4) IP phone penetration (companies/households) The industry IP phone penetration rate rose 11.6 points since last year to reach 39.4%, or roughly 40% of large companies. IP phone systems are used mainly for calls between different company locations (27.4%), as well as internal calls (25.7%) and external calls (21.9%). The household IP phone penetration rate rose only 2.3 points to 15.0%, a slowdown in growth from last year’s 5.4 points. (1) IP phone penetration in industry 50 (2) Purpose of IP phones (companies) (%) 30 (%) 39.4 40 27.4 25.7 25 21.9 12.1 20 9.9 27.8 30 13.0 15 20 10 11.1 15.8 15.3 10 5 0 8.9 0 End 2003 End 2004 Calls between different company locations End 2005 Company-wide Internal calls Some sections only (3) IP phone penetration in households (%) 16 15.0 14 12.7 12 10 8 7.3 6 4 2 0 End 2003 End 2004 13 End 2005 External calls (5) Penetration of ubiquitous technology* (companies) The highest penetration rate for ubiquitous technology was networked devices such as cameras and sensors (12.9%), followed by non-contact IC cards (10.9%), positioning systems such as GPS and cell phones (4.5%) and RFID tags (2.8%). In each of these areas, at least 10% of companies were planning to introduce the technology in the near future, suggesting a further increase in penetration rates. Company size has a significant effect on penetration rates. Very large companies with 2,000 or more employees have higher usage rates — for example, 34.5% for networked devices and 44.5% for non-contact IC cards, compared to just 10.9% and 7.3% respectively for small companies with 100 – 299 employees. Penetration of ubiquitous technology (companies) (%) 30 25 20 13.5 14.8 15 10 10.5 10.9 12.9 5 0 2.0 (1) Networked cameras and sensors Used throughout the company 7.9 14.7 10.9 3.0 0.5 (2) Non-contact IC cards 4.0 4.5 (3) Positioning systems such as GPS and cell phones Used in some offices/divisions only 0.2 2.6 2.8 (4) RFID tags Planning to use * Here, “ubiquitous technology” is a generic term used to refer to business technology with next-generation communication features, such as RFID tags, non-contact IC cards, networked cameras and sensors, and cell phones and other types of positioning systems. 14 (1) Networked devices such as cameras and sensors (%) 50 40 30 20 10 0 34.5 23.0 18.0 12.9 10.9 Overall 100 – 299 employees 17.6 12.2 300+ employees total 300 – 499 employees 500 – 999 employees 1,000 – 1,999 employees 2,000+ employees total (2) Non-contact IC cards (%) 50 44.5 40 30 20 10 28.2 20.3 10.9 20.1 11.3 7.3 0 Overall 100 – 299 employees 300+ employees total 300 – 499 employees 500 – 999 employees 1,000 – 1,999 employees 2,000+ employees total (3) Positioning systems such as GPS and cell phones (%) 50 40 30 20 10 0 15.3 4.5 Overall 3.4 100 – 299 employees 9.0 7.4 300+ employees total 8.6 3.4 300 – 499 employees 500 – 999 employees 1,000 – 1,999 employees 2,000+ employees total (4) RFID tags (%) 50 40 30 20 10 11.1 2.8 1.8 Overall 100 – 299 employees 5.2 4.2 4.4 6.2 300+ employees total 300 – 499 employees 500 – 999 employees 1,000 – 1,999 employees 0 15 2,000+ employees total (6) Computers-to-employees ratio (companies) 38.1% of companies provide one or more computers per employee for in-house, inter-company and internet access, while a further 22.9% provide one computer per two employees. Thus, over 60% of companies provide at least one computer per two employees. Larger companies (in terms of the number of employees) are more likely to provide at least one computer for every employee. Computers-to-employees ratio (companies) 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2.1 End 2004 36.1 20.5 13.8 4.3 2.4 20.8 1.9 End 2005 38.1 One or more computers per employee 22.9 One computer per two employees One computer per three employees 11.9 One computer per four employees 3.9 1.4 19.9 One computer per five or more employees None No response Computers-to-employees ratio by company size 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2.0 100 – 299 employees 36.7 12.3 22.2 21.2 4.1 1.6 1.8 37.4 300 – 499 employees 14.9 23.6 18.4 3.3 0.7 2.7 41.3 500 – 999 employees 8.0 27.9 4.4 14.9 1,000 – 1,999 employees 47.0 2,000+ employees 23.0 19.1 53.0 One or more computers per employee One computer per two employees One computer per three employees One computer per four employees 10.3 16.5 5.7 3.1 17.9 One computer per five or more employees 0.9 0.3 1.7 None 1.1 0.0 1.3 No response (7) Telecommunications equipment ownership (small companies) Small companies have high ownership rates for cell phones (70.4%), computers (93.5%) and fax machines (95.6%), although ownership of radio pagers has almost halved since last year, falling 3.9% to just 4.5%. Telecommunications equipment ownership (small companies) 100 93.2 93.5 (%) 80 67.0 97.8 95.6 70.4 60 40 20 11.4 9.7 4.0 3.7 8.4 4.5 0 Cell phones PHS PDAs Radio pagers End 2005 End 2004 16 Computers Fax machines 4 Network configuration (1) Home LANs (households) 57.0% of households with two or more computers employ a home LAN. This figure is up 5.0% from last year, although growth in LAN usage has dropped to less than half the previous increase of 11.4%. Roughly half the home LANs are configured using cable only, although growth in cable LANs has clearly levelled off (0.7% this year, 1.0% last year). Growth in fully wireless LANs has plummeted from 5.6% last year to just 0.8% this year, while LANs configured using a combination of cable and wireless components have increased by a relatively solid 3.5%. Home LANs (households) 10 0 20 30 40 50 60 (%) 35.5 End 2002 End 2003 End 2004 27.4 3.3 8.1 Both cable and wireless End 2005 11.6 9.9 28.4 40.6 15.5 52.0 Cable only Fully wireless 29.1 16.3 * The distinction between cable and wireless configurations was introduced to the survey in 2003. 17 57.0 (2) Internal networks (companies) The proportion of companies with internal networks has remained relatively constant in recent years, and this year was no different at 89.6%. Larger companies are more likely to have internal networks deployed throughout the company (96.0% of companies with 2,000 or more employees versus 65.3% of companies with 100 – 299 employees). Smaller companies are more likely to have internal networks that reach only certain part of the company, which accounts for the lack of company-wide networks. Internal networks (companies) (%) 100 90 80 70 60 50 40 30 20 10 0 77.9 86.4 85.5 29.4 28.1 57.0 57.4 End 2000 End 2001 90.6 91.6 89.5 89.6 23.0 24.7 22.2 19.0 67.6 66.9 67.3 70.6 End 2002 End 2003 End 2004 End 2005 34.4 43.5 End 1999 Company-wide Certain offices/divisions only Internal networks (companies) — by company size (%) 100 90 80 70 60 50 40 30 20 10 0 89.5 89.6 95.3 86.6 19.0 22.2 25.4 70.6 67.3 61.2 87.6 98.0 96.8 90.4 21.2 13.2 74.1 77.2 11.3 10.7 86.7 86.1 99.0 97.3 8.5 8.4 90.5 88.9 99.1 97.1 4.1 1.1 95.0 96.0 22.3 65.3 End 2004 End 2005 End 2004 End 2005 End 2004 End 2005 End 2004 End 2005 End 2004 End 2005 End 2004 End 2005 Total 100 – 299 employees Company-wide 300 – 499 employees 500 – 999 employees 1,000 – 1,999 employees Certain offices/divisions only 18 2,000+ employees (3) Inter-company networks (companies) As with internal networks, the proportion of companies with inter-company networks has levelled off, reaching 60.2% in the latest survey. Once again, larger companies are more likely to maintain inter-company networks — 75.9% of companies with 2,000 or more employees compared to 57.0% of companies with 100 – 299 employees (a difference of 18.9 percentage points). Inter-company networks (companies) (%) 70 60 50 40 30 20 10 0 59.3 59.0 End 2003 End 2004 54.4 60.2 40.4 End 2000 End 2002 End 2005 Inter-company networks (companies) — by company size (%) 100 90 80 70 60 50 40 30 20 10 0 85.6 77.5 73.6 73.9 75.9 65.5 59.0 60.2 53.2 Total 80.3 57.0 100 – 299 employees 58.9 300 – 499 employees End 2004 19 500 – 999 1,000 – 1,999 2,000+ employees employees employees End 2005 (4) Network installation (companies) Two-thirds of companies (65.2%) chose to outsource part or all of the work involved in construction and installation of their corporate networks. Looking at the effect of company size on outsourcing, 63% of companies with 100 – 299 employees used outsourcing. This figure increase to 74.2% for companies with 300 – 499 employees but declines thereafter, reaching a low of 64.2% for very large companies with 2,000 or more employees. Larger companies are also more likely to perform the entire installation process in-house (i.e., with no outsourcing). Network installation (companies) 0% 10% 20% 30% 40% 50% 34.8 End 2005 70% 80% 42.3 32.8 End 2004 60% 100% 24.9 39.2 All work performed in-house 90% 26.0 Some work outsourced All work outsourced Network installation (companies) — by company size 0% 100 – 299 employees 300 – 499 employees 500 – 999 employees 1,000 – 1,999 employees 2,000+ employees 20% 40% 60% 37.4 37.0 25.8 44.1 80% 100% 25.7 30.1 31.4 43.3 25.3 31.4 44.3 24.3 35.8 41.4 All work performed in-house Some work outsourced Note: Figures rounded off; totals may not add to 100% 20 22.9 All work outsourced (5) Types of corporate networks (companies) The most common backbone networks are Ethernet WAN and IP-VPN (both 20.4%), while IP-VPN is the most common branch network (14.0%). Ethernet WAN is the most common choice for both backbone and branch networks, while IP-VPN is declining in popularity. Types of corporate networks (companies) — backbone networks 0% 20% 40% 60% 80% 100% 0.5 1.8 End 2004 13.8 24.7 15.1 4.1 3.2 18.3 2.1 16.4 0.21.6 End 2005 20.4 20.4 Ethernet WAN IP-VPN Dedicated line 15.0 14.8 Dial-up Internet VPN Frame relay 6.1 Cell relay 2.8 Other 13.1 5.5 Don’t know No response Types of corporate networks (companies) — branch networks 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0.1 1.1 End 2004 9.9 15.1 7.4 15.7 4.8 1.9 2.7 41.2 1.3 0.11.8 End 2005 13.4 Ethernet WAN 14.0 IP-VPN 8.0 Dedicated line 13.6 Internet VPN 7.0 Dial-up Frame relay Notes 1. Backbone network: network linking major nodes and computer centers 2. Branch network: network used to connect to minor nodes 21 34.5 6.3 Cell relay Other Don’t know No response 5 Safety and security (1) Internet concerns and annoyances (householders aged 15+) The most common concern with the internet was privacy of personal information (56.9%), followed by computer viruses (46.9%) and reliability/security of electronic payment systems (34.6%). Only 11.6% of respondents had no concerns or annoyances, indicating that the majority of users experience some degree of unease when using the internet. Internet concerns and annoyances (householders aged 15+) — multiple response 10 0 Privacy of personal information Computer viruses Reliability/security of electronic payment systems Too much illegal/harmful information/content Internet charges too expensive Computers and other devices too expensive Computers and other devices hard to understand Connection speeds too slow Reliability/security of authentication technology Lack of protection of intellectual property rights Too hard to find information No need for it Don't trust e-mails to arrive properly No information of interest to me on the internet Other No concerns or annoyances No response 20 30 40 50 (%) 60 56.9 46.9 34.6 26.5 21.2 19.2 14.8 13.6 13.5 10.5 8.8 4.7 3.9 2.3 1.4 11.6 9.9 22 (2) Safeguarding privacy (householders) Half of all internet users (49.4%) employ some form of strategy to safeguard the privacy of person information. This figure is almost identical to that from last year’s survey. The most common privacy strategy is to avoid giving out personal details on the internet (31.9%), followed by thinking twice before downloading (24.2%). Types of privacy safeguards (householders) — multiple response 10 0 20 30 40 51.5 49.4 Total (all types) 33.9 31.9 (Don't give out personal details on the internet) 25.1 24.2 (Think twice before downloading) 23.7 21.8 (Don't give out credit card details on the internet) 17.6 18.1 (Avoid sites that offer prizes and incentives) 5.3 (Installed anti-spyware software) (Other) 50 End 2004 End 2005 9.6 2.4 2.5 27.6 None No response 16.7 23 20.9 33.9 (%) 60 (3) Network usage issues (companies) The most common network issue for companies was difficulty implementing security measures (68.2%), followed by virus threats (61.3%). These findings are similar to last year’s survey, when security issues were most commonly nominated. Personnel issues also featured strongly, particularly security awareness among employees and lack of suitably trained personnel. Network usage issues (companies) — multiple response 0 10 20 Difficult to restore operations after a failure Hard to quantify the benefits High access charges Limited benefit to our company Slow connection speeds 40 50 60 70 66.8 68.2 Difficult and/or complex security measures Virus threats Insufficient awareness of security among employees Shortage of suitably trained operation/administration personnel Operation/administration costs 30 61.3 61.3 44.0 47.4 39.4 29.7 36.3 29.8 27.4 23.3 18.0 17.9 16.8 End 2004 14.5 10.8 End 2005 11.5 11.4 10.7 4.7 5.4 5.0 5.1 6.2 Authentication technology not reliable 4.8 Other 1.4 1.5 2.2 No issues of concern 3.7 0.9 No response 2.3 Electronic payment systems not reliable Insufficient protection of copyright and intellectual property 24 80 (%) (4) Safeguarding privacy (companies) Following the enactment of the Privacy Act on April 1, 2005, the proportion of companies using networks (both internal and external, including the internet) that have taken steps to safeguard the privacy of personal details rose to 73.2%, an increase of 16.7% since last year. Meanwhile, the proportion of companies with no privacy safeguards fell from 34.5% to 18.0%, indicating a growing awareness of the importance of personal information security. Larger companies are more likely to have privacy safeguards in place (around 90% of companies with 500 or more employees compared to around 70% of companies with 100 – 299 employees). The most common privacy safeguards are internal training programs (45.7%). The next three most common responses all increased significantly from last year: appointing Privacy Officers (41.4%), formulating privacy policies (29.7%) and reducing the amount of personal information collected (27.8%). Use of privacy safeguards (companies) — by company size (%) 100 80 60 89.6 88.8 84.3 76.0 73.2 68.7 89.2 92.5 79.9 68.6 67.9 60.2 56.5 51.7 40 20 0 Overall 100 – 299 employees 300+ employees total 300 – 499 employees 1,000 – 1,999 2,000+ employees employees total 500 – 999 employees End 2005 End 2004 Types of privacy safeguards (companies) — multiple response 0 10 20 30 40 50 56.5 Total (all types) 30.9 Internal training programs 45.7 23.4 Appointed a Privacy Officer Formulated a privacy policy Reduced the amount of personal information collected Reconfigured systems and/or procedures Tighter selection criteria for subcontractors (such as Privacy Logo) Use the Privacy Logo Other 41.4 13.6 No response 29.7 20.0 19.2 20.0 27.8 4.5 7.0 5.0 5.8 6.8 8.7 End 2004 End 2005 34.5 None Don't know 60 18.0 4.9 4.2 4.1 4.6 25 70 80 (%) 73.2 (5) Role of CIO* (companies) Only 2.0% of companies have a full-time CIO, and only 16.0% have a part-time CIO. Most companies (72.4%) have no plans to establish a CIO position. Role of the CIO (companies) 0% End 2003 1.9 2.0 10% 20% 12.1 9.3 12.1 8.7 30% 40% 50% 60% 70% 68.9 80% 90% 100% 5.8 1.4 End 2004 2.5 13.1 62.2 1.5 End 2005 2.0 12.5 6.0 72.4 5.6 Full-time Part-time — his/her duties are mostly ICT/IT related Part time — his/her duties are mostly elsewhere No CIO, but we plan to appoint one No CIO, and no plans to appoint one No response * CIO = Chief Information Officer, the person responsible for coordination and supervision of management strategies and information/communication strategies. 26