The implications of the federal income tax associated with the... agriculture

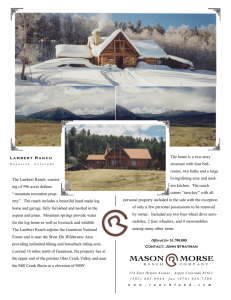

advertisement