Visualizing the Time Series Behavior of Volatility, Serial Correlation and Investment Horizon

advertisement

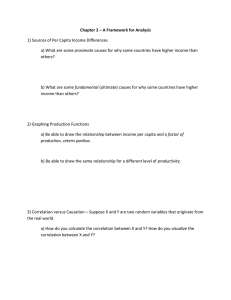

Visualizing the Time Series Behavior of Volatility, Serial Correlation and Investment Horizon Presented by: Ralph Goldsticker, CFA ???? ??, 2014 Summary The standard assumptions we use to model risk don’t hold. • Standard deviations don’t grow with the square root of time. • Cross-asset class correlations are sampling frequency dependent. • Observed volatilities and correlations varied through time. Recommendations: 1. Investors should calculate risk using return periods that are consistent with their investment horizon. Correlations calculated using highfrequency returns can mask underlying relationships. 2. Rather than relying on summary statistics, investors should develop a covariance matrix that represents their future expectations. This requires examining risk and correlation behavior through time. 2 Agenda Using cumulative contribution charts to understand: I. Historical relationships between volatility and holding period II. Historical relationships between correlation and holding period III. Discussion 3 I. Cumulative contribution to volatility charts provide insights into the behavior of volatility over time. 1. 2. 3. 4. 5. 6. 7. Chart of cumulative contribution to volatility Cumulative contribution to volatility versus rolling volatility. Cumulative contribution to volatility versus length of return period Variation of volatility though time depends on length of return period Volatility estimated using daily versus monthly returns Volatility estimated 1-month versus 3- and 12-month returns Volatility estimated 12-month versus 24- and 36-month returns 4 Cumulative contribution to volatility charts provide insights into the behavior of volatility through time. 5 Rolling volatility doesn’t provide the same insights. 6 Cumulative contribution to volatility charts provide shows the effects of serial correlations and changing volatilities. 7 Evolution of volatilities at different sampling horizons show similar but not identical patterns. 8 The volatility of daily returns has been higher than monthly returns since the mid 1990s. 9 Higher volatility of 3- and 12-month returns shows positive serial correlation of monthly returns. 10 Data shows time diversification at multi-year horizons. Pattern was reversed during and after the Tech Bubble. 11 Volatility Summary Volatility varied through time Full period behavior: • Negative serial correlation of daily returns • Positive serial correlation of monthly returns • Negative serial correlation of annual returns But: • Volatility of monthly returns was higher during the 1970s and 1980s. • Positive serial correlation of annual returns during and after the Tech Bubble 12 II. Cumulative contribution to correlation charts provide insights into the behavior of correlations over time. 1. Charting time series contribution to correlation provides insights that are obscured by rolling windows. 2. Stock versus bond correlation increased with the holding period. 3. Correlation between stocks and Treasuries was positive until the Tech Bubble, and negative since. 4. Correlation between stocks and Treasuries was regime dependent. 13 Cumulative contribution to correlation provides insights unavailable using full period and rolling window correlations. • Cumulative contribution shows when stock versus bond correlation changed from positive to negative. • Cumulative correlation is not sensitive to data points dropping out of the sample (e.g. Oct. 1987) • Slope of cumulative correlation line shows the evolution of correlations through time. Correlation 1972 - 2013 0.10 12/1972 – 9/2000 0.31 10/2000 – 12/2013 -0.37 14 Stock versus Bond correlation increased with holding period. • Investors should use a return period that’s consistent with their investment horizon. • The correlation calculated using 3-year returns was larger than correlations calculated using returns for shorter periods. • Higher degree of correlation shows that there are regimes and cycles that are not captured in short-term returns. 15 Cumulative contribution to correlation allows us to identify turning points. Holding Period for Return Calculation Daily Monthly Quarterly Annual 3-Year Full Period: 1972 - 2013 0.00 0.10 0.07 0.21 0.35 While Positive 0.32 0.31 0.38 0.53 0.62 While Negative -0.34 -0.37 -0.52 -0.65 -0.71 10/21/1997 Sep-00 Mar-98 Apr-99 Apr-02 Date Changed from Positive to Negative • The correlations calculated using annual returns are roughly 1½ times the correlations calculated using monthly returns. • The correlations calculated using 3-year returns are roughly two times as large. 16 Stock versus Bond correlation is regime dependent. Macro Environment Correlation 1970s Changing inflation expectations 1980s Falling interest rates 1990s Capital flows into both stock and bond markets + + + 2000s Responses to bursting of the Tech Stock Bubble and the Financial Crisis 17 Changes in the slope of lines highlights regimes • The steep 3-year line between 1975 and 1981 shows that the environment of highly volatile inflation expectations translated into high stock-bond correlations for longer-term investors. • There wasn’t much variability in correlations between 1972 and 2000 using daily and monthly returns. • The correlations were more negative after the Tech Bubble and Financial Crisis than during the period between. Financial Crisis 18 Correlation Summary 1. 2. Correlation between US stocks versus Treasuries varied through time • Positive through the Tech Stock Bubble • Negative since Correlation between US stocks versus Treasuries increased with holding period. • More positive when positive • More negative when negative 19 Discussion • We use charts of cumulative returns to understand market performance, why shouldn’t we put the same effort into understanding risk? • While the presentation focused on the visualizing asset class risks and correlations, similar cumulative contribution charts could be used to visualize other types of risks such as tracking error and information ratios. 20 21 Appendix: Formula for cumulative contribution to standard deviation Standard Deviation = ∑ Cumulative Contribution to Standard Deviation = ∑ StockReturnt − AvgStkRet numberofperiods − 1 2 Note: All returns are log excess returns. 22 Appendix: Formula used to calculate cumulative contribution to correlation Correlation(Stocks, Bonds) = Covariance(Stocks, Bonds) StdDev Stocks × StdDev(Bonds) Covariance(Stocks, Bonds ) = ∑((StkRett − AvgStkRet) × (BndRett − AvgBndRet)) numberofperiods Cumulative Contribution to Correlation(Stock, Bond) = ∑((StockReturnt − AvgStkRet) × (BondReturnt − AvgBndRet)) numberofperiods × StdDev Stocks × StdDev(Bonds) Note: All returns are log excess returns. 23