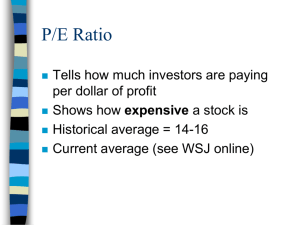

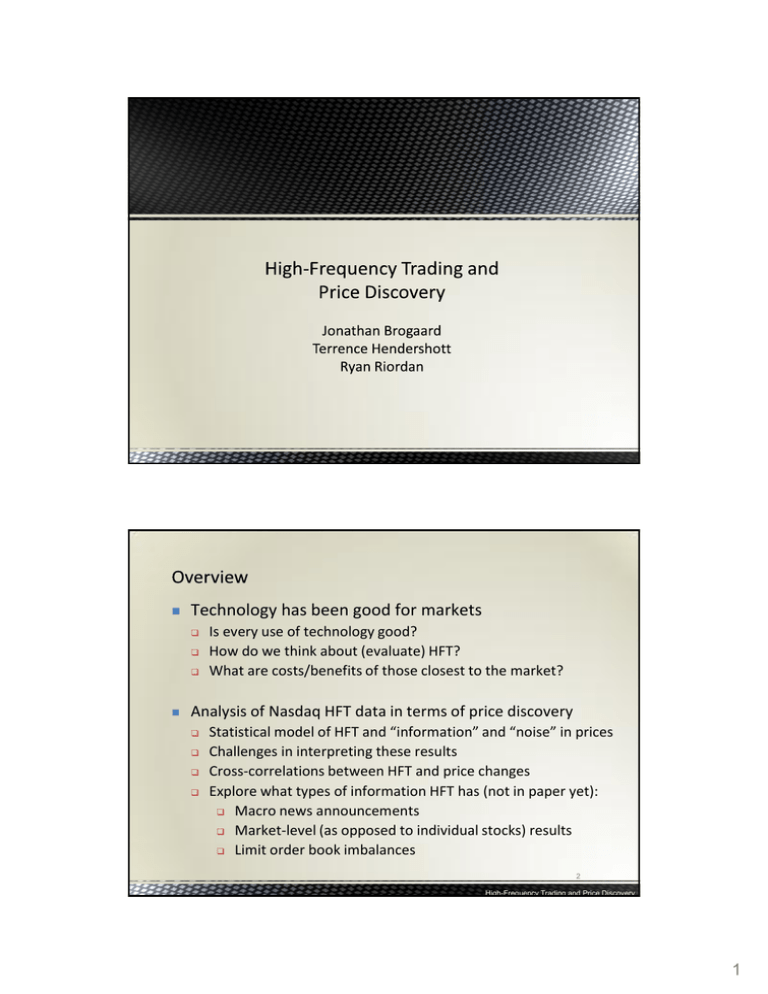

Technology has been good for markets

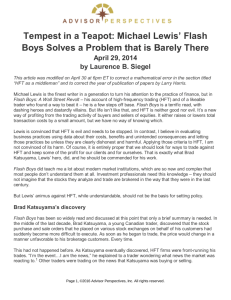

advertisement

Technology has been good for markets Is every use of technology good? How do we think about (evaluate) HFT? What are costs/benefits of those closest to the market? Analysis of Nasdaq HFT data in terms of price discovery Statistical model of HFT and “information” and “noise” in prices Challenges in interpreting these results Cross-correlations between HFT and price changes Explore what types of information HFT has (not in paper yet): Macro news announcements Market-level (as opposed to individual stocks) results Limit order book imbalances 2 High-Frequency Trading and Price Discovery 1 “...rule changes are need to control risks...” “…development have had negative effects…” “HFT firms are accused of flooding markets with orders that are cancelled…, leading to volatility” - Ultra fast trading needs curbs – global regulators - July 7, 2011 - London - - “...the stock market is more prone than ever to large intraday moves with little or no fundamental catalyst.” “locusts … feeding off the equity market.” It's hard to imagine a better illustration (of social uselessness) than high-frequency trading. The stock market is supposed to allocate capital to its most productive uses, for example by helping companies with good ideas raise money. But it's hard to see how traders who place their orders one-thirtieth of a second faster than anyone else do anything to improve that social function. Paul Krugman August 2, 2009 - New York Times - - “High-frequency traders generated about $21 billion in profits last year.” “...use rapid-fire computers to essentially force slower investors to give up profits, then disappear before anyone knows what happened. ” 3 HFT is always AT – but AT is not always HFT Typical properties of HFT: High-speed trading Sophisticated computer programs Use of co-location services and data feeds Short time frames for establishing and liquidating positions, high trading volume and intensity (SEC, 34-61358, Concept Release on Equity Market Structure) HFT is a mixture of the use of technology and trading strategies (do they differ?) What is new is direct access, increased electronic information sources, and more computing 4 High-Frequency Trading and Price Discovery 2 • Make money at the bid-ask spread and liquidity rebates Passive Market Making Arbitrage • Cross asset and cross market arbitrage • Statistical arbitrage Directional • News Trading • Liquidity Detection (order anticipation) • Momentum trading and ignition Strategies • Latency Arbitrage • Flash orders • Structural Anything new here? – Short-lived strategies with tight risk management – Based on public information, technology, and sophisticated tools Is the focus the technology, strategies, or interaction? 5 High-Frequency Trading and Price Discovery Explicitly model observed prices each minute as efficient price (martingale) and noise (pricing error) Observed price is martingale (efficient price) plus noise: pi,t =mi,t + si,t mi,t = mi,t-1 + wi,t. Trading makes cov(s,w) <> 0 Standard market microstructure approach: Innovations in martingale are related to innovations in trading: 𝐴𝑙𝑙 wi,t = 𝜅𝑖𝐴𝑙𝑙 𝐻𝐹𝑇𝑖,𝑡 + 𝜇𝑖,𝑡 Transitory component also relates to trading: 𝐴𝑙𝑙 si,t = 𝜙𝑠𝑖,𝑡−1 + 𝜓𝑖𝐴𝑙𝑙 𝐻𝐹𝑇𝑖,𝑡 + 𝜐𝑖,𝑡 Identification from Cov(m,u)=0 (Hasbrouck (1993) and others) 6 High-Frequency Trading and Price Discovery 3 𝐴𝑙𝑙 wi,t = 𝜅𝑖𝐴𝑙𝑙 𝐻𝐹𝑇𝑖,𝑡 + 𝜇𝑖,𝑡 𝐴𝑙𝑙 si,t = 𝜙𝑠𝑖,𝑡−1 + 𝜓𝑖𝐴𝑙𝑙 𝐻𝐹𝑇𝑖,𝑡 + 𝜐𝑖,𝑡 k trading’s (order flow) relation to efficient price + informed about change in efficient price - adversely selected on efficient price y trading’s (order flow) relation to noise + direction of trading correlates with more noise Transitory price impact, risk mgt., manipulation, order anticipation - trading against noise, making prices more efficient Statistical arbitrage via identifying transitory effects Decompose overall HFT order flow into Liquidity Demand and Supply Examine highest volatility days (stability?) 7 High-Frequency Trading and Price Discovery 120 stocks: small, medium, large cap Identifies 26 independent HFT firms Via unique “port” which firms use Does not identify large integrated firms, e.g., Goldman All data is aggregate across all HFT firms Is this a representative sample? If not, WHY NOT? HFT firms worried about regulatory response Data is available via NDA with Nasdaq Nasdaq had 20-40% market share HFT is 42% of volume in large stock, 12% in small stocks Market/limit order volume similar in large, less limit in small 8 High-Frequency Trading and Price Discovery 4 Overall HFT trade to make prices more efficient Results are remain (and are stronger) on high-volatility days Market order trading is responsible for this + correlation with efficient price, - with pricing error/noise Consistent with forecasting both parts of returns Limit order trading coefficients have opposite signs - correlation with efficient price, + with pricing error/noise Efficient price: standard adverse selection of liquidity providers Noise: risk mgt., adverse selection, manipulation, order anticipation? Do these passive trades make money? Yes, earn the spread and liquidity rebates Overall HFT profitability per $ is low: ~$0.03/$10,000 traded 9 High-Frequency Trading and Price Discovery Is HFT being informed good or bad? HFT liquidity demand imposes adverse selection But, also trade against noise in prices It is possible to do one without the other? How important is this information? How long-lived? Would it get into price anyway? HFT liquidity supply looks a lot like market making (good) How could we measure excess intermediation (bad)? Next, cross-correlations for individual stocks and market-wide and macro news announcements 10 High-Frequency Trading and Price Discovery 5 HFT Demand/Supply/Allt - Rtnt, t+10 0.25 0.20 Correlation Coefficients 0.15 0.10 0.05 HFT Demand HFT Supply 0.00 t t+1 t+2 t+3 t+4 t+5 t+6 t+7 t+8 t+9 t+10 HFT All -0.05 -0.10 -0.15 -0.20 Time (in seconds) HFT Demand positively predict stock returns for a few seconds HFT Supply negatively predict stock returns for a few seconds Demand effect dominates overall 11 High-Frequency Trading and Price Discovery 0.20% 600.00 0.15% 400.00 0.10% 200.00 0.05% 0.00 0.00% -200.00 -0.05% -400.00 -0.10% -600.00 -0.15% -800.00 Returns HFT Order Flow ( $10,000) Negative Macro News 800.00 -0.20% -10 -9 -8 -7 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 7 8 9 10 Seconds Around Macro News Announcements HFT Demand HFT Supply HFT All VW Return Aligning return and HFT times is challenge (Nasdaq BBO for subset) HFT Supply is adversely selected; HFT Demand is transmitting info Overall Supply dominates; how to think about this HFT Demand? Regressions show HFT Demand is not associated with noise 12 High-Frequency Trading and Price Discovery 6 0.20% 600.00 0.15% 400.00 0.10% 200.00 0.05% 0.00 0.00% -200.00 -0.05% -400.00 -0.10% -600.00 -0.15% -800.00 Returns HFT Order Flow ($10,000) Positive Macro News 800.00 -0.20% -10 -9 -8 -7 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 7 8 9 10 Seconds Around Macro News Announcements HFT Demand HFT Supply HFT All VW Return Similar to Negative announcements Predominantly HFT is providing liquidity at most stressful time 209 Announcements in: Construction Spending, Consumer Confidence, Existing Home Sales, Factory Orders, ISM Manufacturing, ISM Services, Leading Indicators, Wholesale Inventories 13 High-Frequency Trading and Price Discovery HFTtD, S, and All - VW Rett, t+10 0.50 Correlation Coefficients 0.30 0.10 HFT Demand HFT Supply -0.10 t t+1 t+2 t+3 t+4 t+5 t+6 t+7 t+8 t+9 t+10 HFT All -0.30 -0.50 HFT Demand positively predict market-wide returns for a few seconds HFT Supply negatively predict market-wide returns for a few seconds Supply effect dominates overall (also true in a market-level SSM) Past market returns predict HFT similarly (E-mini predicts HFT Demand) HFT has a longer lasting role in market-wide price discovery 14 High-Frequency Trading and Price Discovery 7 Limit order book imbalance LOBI (Size at offer minus Size at bid) LOBI predicts future returns (-), HFT Demand (-), HFT Supply (+) Not much in the small stocks Panel A: 𝑹𝒆𝒕𝒕+𝟏 𝑳𝑶𝑩𝑰𝒕 (t-stat) Large Medium Small All -0.01 -0.01 0 -0.01 (-16.36) (-4.35) (0.01) (-1.19) 𝑫 Panel B: 𝐇𝐅𝐓𝐭+𝟏 𝑳𝑶𝑩𝑰𝒕 (t-stat) -0.19 -0.21 -0.13 -0.18 (-15.17) (-7.55) (-2.05) (-8.49) 𝑺 Panel C: 𝐇𝐅𝐓𝐭+𝟏 𝑳𝑶𝑩𝑰𝒕 (t-stat) 0.07 0.05 0.06 0.06 (5.90) (1.86) (1.18) (3.33) 𝑨𝒍𝒍 Panel D: 𝐇𝐅𝐓𝐭+𝟏 𝑳𝑶𝑩𝑰𝒕 (t-stat) -0.06 -0.11 -0.03 -0.07 (-12.36) (-11.81) (-0.63) (-4.20) 15 High-Frequency Trading and Price Discovery Other sources of “Public” information in past prices, orders? In other assets (market-wide, announcement results) Large stock leading small stocks HFT Demand predicts returns How to think about short-lived nature of (public) information? Foucault, Hombert, and Rosu (2012) Reducing the transitory part is good Trading on (soon to be) public information is not How do we know what information will get into price without HFT? 16 High-Frequency Trading and Price Discovery 8 Technology has improved markets Algorithms: prices more efficient and markets more liquid HFT is technology applied to certain strategies Make prices more efficient; true on high-volatility days also What are the benefits of getting info into prices in seconds? Does this improve financing and investment decisions? Should traders closest to the market mechanism be informed? Focus attention on HFT liquidity demanding strategies? Are long-term investors losing out (zero sum trading)? If so, will HFT become competitive and offer technology services to long-term investors? Will market structures evolve to support LFT (without HFT)? What is the optimal configuration of intermediation sector? Free entry or regulated monopoly/oligopoly? Specific regulations on liquidity supply and demand? 17 High-Frequency Trading and Price Discovery 9