The Cross-section of Managerial Ability and Risk Preferences Ralph S.J. Koijen Chicago GSB

advertisement

Motivation Data Model Econometric approach Empirical results

The Cross-section of

Managerial Ability and Risk Preferences

Ralph S.J. Koijen

Chicago GSB

October 2008

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Measuring managerial ability

Mutual fund alphas from a performance regression using style

benchmarks

RitA − rf = αi + βi RtB − rf + εit

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Measuring managerial ability

Mutual fund alphas from a performance regression using style

benchmarks

RitA − rf = αi + βi RtB − rf + εit

Reduced-form approach ignores that fund returns are the outcome of

a portfolio-choice problem

Brennan (1993), Becker et al. (1999), Cuoco and Kaniel (2007), Basak, Pavlova,

and Shapiro (2007), Binsbergen, Brandt, and Koijen (2007), Yuan (2007),

Wermers, Yao, and Zhao (2007)

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Measuring managerial ability

Mutual fund alphas from a performance regression using style

benchmarks

RitA − rf = αi + βi RtB − rf + εit

Reduced-form approach ignores that fund returns are the outcome of

a portfolio-choice problem

Brennan (1993), Becker et al. (1999), Cuoco and Kaniel (2007), Basak, Pavlova,

and Shapiro (2007), Binsbergen, Brandt, and Koijen (2007), Yuan (2007),

Wermers, Yao, and Zhao (2007)

Often leads to dynamic strategies that could induce to

misspecifications

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

New approach: Portfolio choice theory

Consider an active portfolio manager’s problem

Manager dynamically selects portfolio to maximize utility

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

New approach: Portfolio choice theory

Consider an active portfolio manager’s problem

Manager dynamically selects portfolio to maximize utility

Two basic components:

1

Managerial ability (λAi ): shapes the investment opportunity set

2

Risk preferences (γi ): determine which portfolio is selected along

this set

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

New approach: Portfolio choice theory

Consider an active portfolio manager’s problem

Manager dynamically selects portfolio to maximize utility

Two basic components:

1

Managerial ability (λAi ): shapes the investment opportunity set

2

Risk preferences (γi ): determine which portfolio is selected along

this set

Main idea: Use restrictions from structural portfolio management

models to estimate the cross-section of managerial ability and risk

preferences

Analogy: Use household’s Euler condition to estimate preference

parameters

Hansen and Singleton (1983), Vissing-Jorgensen and Attanasio (2003), and

Gomes and Michaelides (2005)

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Main economic questions

Main economic questions:

1

Which economic restrictions follow from portfolio choice theory

2

What can we learn about the dynamics of mutual fund strategies?

3

Does heterogeneity matter?

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Main economic questions

Main economic questions:

1

Which economic restrictions follow from portfolio choice theory

2

What can we learn about the dynamics of mutual fund strategies?

3

Does heterogeneity matter?

Main answers:

1

Economic restrictions can be used to disentangle both attributes

2

Fund alphas reflect both ability and risk preferences

3

Second moments of fund returns contain information about the

manager’s attributes

4

Structural model captures important dynamics of fund strategies

5

Heterogeneity matters: utility costs up to 4% per annum by ignoring

heterogeneity

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Main economic questions

Main economic questions:

1

Which economic restrictions follow from portfolio choice theory

2

What can we learn about the dynamics of mutual fund strategies?

3

Does heterogeneity matter?

Main answers:

1

Economic restrictions can be used to disentangle both attributes

2

Fund alphas reflect both ability and risk preferences

3

Second moments of fund returns contain information about the

manager’s attributes

4

Structural model captures important dynamics of fund strategies

5

Heterogeneity matters: utility costs up to 4% per annum by ignoring

heterogeneity

Main methodological contribution:

Develop econometric framework to enable likelihood-based inference

in continuous-time, dynamic optimization models

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Modeling managerial preferences

Model I: preferences for assets under management

Basak, Pavlova, and Shapiro (2007a, 2007b), Chapman, Evans, and Xu (2007)

Model features managerial incentives:

1

Fund flows that depend on past performance

2

Promotion/demotion risk that depends on past performance

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Modeling managerial preferences

Model I: preferences for assets under management

Basak, Pavlova, and Shapiro (2007a, 2007b), Chapman, Evans, and Xu (2007)

Model features managerial incentives:

1

Fund flows that depend on past performance

2

Promotion/demotion risk that depends on past performance

Model II: preferences for returns relative to the benchmark

Brennan (1993), Becker et al. (1999), Chen and Pennacchi (2007), Binsbergen,

Brandt, and Koijen (2007)

Advantage: Derive cross-equation restriction analytically

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Modeling managerial preferences

Model I: preferences for assets under management

Basak, Pavlova, and Shapiro (2007a, 2007b), Chapman, Evans, and Xu (2007)

Model features managerial incentives:

1

Fund flows that depend on past performance

2

Promotion/demotion risk that depends on past performance

Model II: preferences for returns relative to the benchmark

Brennan (1993), Becker et al. (1999), Chen and Pennacchi (2007), Binsbergen,

Brandt, and Koijen (2007)

Advantage: Derive cross-equation restriction analytically

Unfortunately, cross-equation restriction for fund alphas strongly

rejected

Analogy: CRRA preferences cannot match consumption and asset

pricing data → Requires a generalization of preferences

Hansen and Singleton (1983), Vissing-Jorgensen and Attanasio (2003), and

Gomes and Michaelides (2005)

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Modeling managerial preferences

Model points to a desire for underdiversification: managers

overinvest in the active portfolio

Generalize the manager’s preferences: quest for status as a motive

for underdiversification

The manager has preferences for:

1

Assets under management

2

Fund status: relative position in cross-sectional asset distribution

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Modeling managerial preferences

Model points to a desire for underdiversification: managers

overinvest in the active portfolio

Generalize the manager’s preferences: quest for status as a motive

for underdiversification

The manager has preferences for:

1

Assets under management

2

Fund status: relative position in cross-sectional asset distribution

Different curvature parameters for:

1

Assets under management: controls passive risk taking

2

Fund status: controls active risk taking

Standard models nested

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Conventional approach to measure ability

Mutual fund alphas from a performance regression using style

benchmarks

RitA − rf = αi + βi RtB − rf + εit

14

12

10

8

6

4

2

0

−0.2

−0.1

Ralph S.J. Koijen - Chicago GSB

0

αi

0.1

0.2

Motivation Data Model Econometric approach Empirical results

Conventional approach to measure ability

Mutual fund alphas from a performance regression using style

benchmarks

RitA − rf = αi + βi RtB − rf + εit

14

12

10

8

6

4

2

0

−0.2

−0.1

0

αi

0.1

0.2

Cross-sectional distribution displays heterogeneity and estimation

error

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Economic restrictions and efficiency

The impact of imposing the economic restrictions

40

Performance regressions

Structural model

35

30

25

20

15

10

5

0

−0.2

−0.1

0

αi

0.1

The variance of alphas is three times smaller

Ralph S.J. Koijen - Chicago GSB

0.2

Motivation Data Model Econometric approach Empirical results

Main empirical results

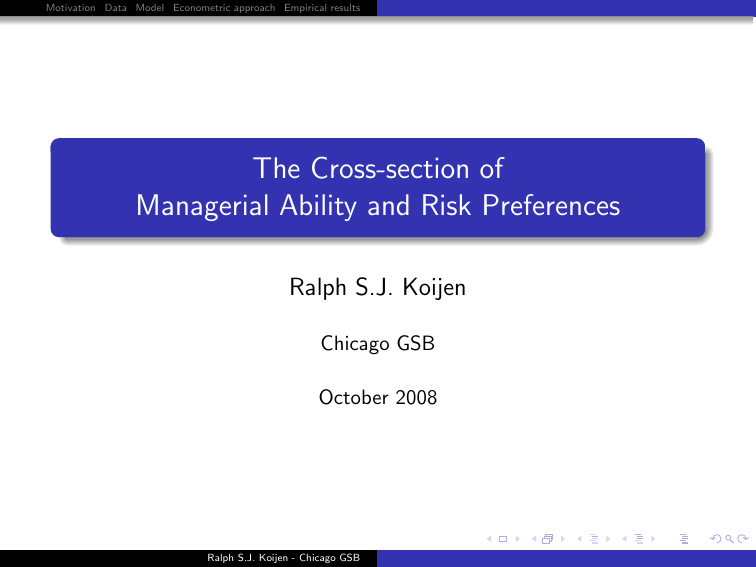

Managerial ability and risk aversion are highly positively correlated

2.5

A

Managerial ability (λ )

2

1.5

1

0.5

0

0

5

10

15

20

25

30

35

40

Coefficient of relative risk aversion (RRA(a0))

Ralph S.J. Koijen - Chicago GSB

45

50

Motivation Data Model Econometric approach Empirical results

Outline

1

Data

2

Financial market and preferences

3

Cross-equation restrictions

4

Status model

5

Novel econometric approach to estimate dynamic models of

delegated portfolio management by maximum likelihood

6

Main empirical results

7

Economic costs of heterogeneity

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Data

Manager-level database based on CRSP data from 1992.1 to

2006.12

Assign each manager-fund combination to one of nine styles

reflecting size and value orientation

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Data

Manager-level database based on CRSP data from 1992.1 to

2006.12

Assign each manager-fund combination to one of nine styles

reflecting size and value orientation

3,694 unique manager-benchmark combinations consisting of 3,163

different managers and 1,932 different funds

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Data

Manager-level database based on CRSP data from 1992.1 to

2006.12

Assign each manager-fund combination to one of nine styles

reflecting size and value orientation

3,694 unique manager-benchmark combinations consisting of 3,163

different managers and 1,932 different funds

Construct returns before fees and expenses

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Data

Manager-level database based on CRSP data from 1992.1 to

2006.12

Assign each manager-fund combination to one of nine styles

reflecting size and value orientation

3,694 unique manager-benchmark combinations consisting of 3,163

different managers and 1,932 different funds

Style composition (R. = Russell)

Mutual fund style

Selected benchmark

Large/blend

Large/value

Large/growth

Mid/blend

Mid/value

Mid/growth

Small/blend

Small/value

Small/growth

Total

S&P 500

R. 1000 Value

R. 1000 Growth

R. Mid-cap

R. Mid-cap Value

R. Mid-cap Growth

R. 2000

R. 2000 Value

R. 2000 Growth

Ralph S.J. Koijen - Chicago GSB

Fraction of

observations (%)

20.1

11.7

11.6

10.2

6.3

13.7

7.8

6.2

12.4

100.0

Number of

observations

714

427

448

383

228

526

291

200

477

3,694

Motivation Data Model Econometric approach Empirical results

Financial market

The manager can trade 3 assets:

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Financial market

The manager can trade 3 assets:

1

Cash account:

Ralph S.J. Koijen - Chicago GSB

dSt0 = St0 rf dt

Motivation Data Model Econometric approach Empirical results

Financial market

The manager can trade 3 assets:

1

2

Cash account:

dSt0 = St0 rf dt

Style benchmark portfolio:

dStB = StB (rf + σB λB ) dt + StB σB dZtB

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Financial market

The manager can trade 3 assets:

1

2

Cash account:

dSt0 = St0 rf dt

Style benchmark portfolio:

dStB = StB (rf + σB λB ) dt + StB σB dZtB

3

Idiosyncratic technology of the manager (Active portfolio):

where λAi

dSitA = SitA (rf + σAi λAi ) dt + SitA σAi dZitA ,

measures managerial ability, with Z B , ZiA t = 0

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Standard model of preferences

Preferences for returns relative to the benchmark:

! 1 − γi

A

R

1

iT

max Et

1 − γi RTB

(xit )t ∈[0,T ]

xit = (xitB , xitA )′ : fractions invested in benchmark and active

portfolio

Optimization subject to the dynamic budget constraint

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Standard model of preferences

Preferences for returns relative to the benchmark:

! 1 − γi

A

R

1

iT

max Et

1 − γi RTB

(xit )t ∈[0,T ]

xit = (xitB , xitA )′ : fractions invested in benchmark and active

portfolio

Optimization subject to the dynamic budget constraint

Optimal strategy:

xi =

1 −1

1

Σi Λ i + 1 −

e1 ,

γi

γi

with Σi = diag(σP , σAi ), Λi = (λP , λAi )′ , and e1 = (1, 0)′

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Implications of the cross-equation restriction

Asset dynamics:

dAit

− rf dt = xitA σAi λAi + xitB σB λB dt + xitB σB dZtB + xitA σAi dZitA

Ait

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Implications of the cross-equation restriction

Asset dynamics:

dAit

− rf dt = xitA σAi λAi + xitB σB λB dt + xitB σB dZtB + xitA σAi dZitA

Ait

Substitute the optimal strategy:

λ2

dAit

λB

γ −1

− rf dt = Ai dt +

+ i

Ait

γi

γσ

γi

|{z}

| i B {z

}

αi

Ralph S.J. Koijen - Chicago GSB

βi

dStB

− rf dt

StB

!

+

λAi

dZitA

γi

|{z}

σ εi

Motivation Data Model Econometric approach Empirical results

Implications of the cross-equation restriction

Substitute the optimal strategy:

λ2

λB

γ −1

dAit

− rf dt = Ai dt +

+ i

Ait

γi

γσ

γi

|{z}

| i B {z

}

αi

dStB

− rf dt

StB

βi

λAi and γi follow from:

βi

=

σ εi

=

Ralph S.J. Koijen - Chicago GSB

λB

γ −1

+ i

γi σ B

γi

λAi /γi

!

+

λAi

dZitA

γi

|{z}

σ εi

Motivation Data Model Econometric approach Empirical results

Implications of the cross-equation restriction

Substitute the optimal strategy:

λ2

λB

γ −1

dAit

− rf dt = Ai dt +

+ i

Ait

γi

γσ

γi

|{z}

| i B {z

}

αi

dStB

− rf dt

StB

βi

λAi and γi follow from:

βi

=

σ εi

=

λB

γ −1

+ i

γi σ B

γi

λAi /γi

The cross-equation restriction on the fund’s alpha, αi :

λB /σB − 1

αi = λ2Ai /γi = σ2εi

βi − 1

Ralph S.J. Koijen - Chicago GSB

!

+

λAi

dZitA

γi

|{z}

σ εi

Motivation Data Model Econometric approach Empirical results

Implications of the cross-equation restriction

Substitute the optimal strategy:

λ2

λB

γ −1

dAit

− rf dt = Ai dt +

+ i

Ait

γi

γσ

γi

|{z}

| i B {z

}

αi

dStB

− rf dt

StB

βi

λAi and γi follow from:

βi

=

σ εi

=

λB

γ −1

+ i

γi σ B

γi

λAi /γi

The cross-equation restriction on the fund’s alpha, αi :

λB /σB − 1

αi = λ2Ai /γi = σ2εi

βi − 1

Main conclusion: Fund alphas

1

2

Reflect ability and risk preferences

Can be estimated from information in second moments

Ralph S.J. Koijen - Chicago GSB

!

+

λAi

dZitA

γi

|{z}

σ εi

Motivation Data Model Econometric approach Empirical results

Empirical results: Preferences for returns rel. to benchmark

Model-implied

S&P 500

Mean

St.dev.

Performance regr.

γi

λAi

αi

βi

σεi

αi

βi

σεi

46.08

108.15

1.36

0.34

6.27%

3.51%

1.10

0.05

4.48%

2.02%

0.82%

2.98%

0.96

0.11

4.10%

1.97%

βi

=

σ εi

=

αi

λB

1

+ 1−

γi σB

γi

λAi /γi

= λ2Ai /γi

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Empirical results: Preferences for returns rel. to benchmark

Model-implied

S&P 500

Mean

St.dev.

Performance regr.

γi

λAi

αi

βi

σεi

αi

βi

σεi

46.08

108.15

1.36

0.34

6.27%

3.51%

1.10

0.05

4.48%

2.02%

0.82%

2.98%

0.96

0.11

4.10%

1.97%

βi

=

σ εi

=

αi

λB

1

+ 1−

γi σB

γi

λAi /γi

= λ2Ai /γi

It requires underdiversification to match the moments of fund

returns

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Managerial preferences: The status model

Quest for status as a motive for underdiversification

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Managerial preferences: The status model

Quest for status as a motive for underdiversification

Motivation status concerns

Hard-wired: Larger funds more visible, higher in ratings, . . .

Evolutionary forces

Strategic interaction among fund managers

Large literature in economics argues that status concerns are

important for financial decision making

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Managerial preferences: The status model

Quest for status as a motive for underdiversification

Motivation status concerns

Hard-wired: Larger funds more visible, higher in ratings, . . .

Evolutionary forces

Strategic interaction among fund managers

Large literature in economics argues that status concerns are

important for financial decision making

Modeling fund status:

Total mass of managers normalized to unity, with measure µ(·)

Status measured by the percentile rank:

A

̺t (a) = µ i it ≤ a ,

Āt

where ĀT is median fund size

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Managerial preferences: The status model

Manager’s objective:

"

#

1− γ

AiT 1i

AiT 1−γ2i

1−γ1i

max E0 η

+ (1 − η ) S (1 − γ2i ) ĀT

̺T

,

1 − γ1i

ĀT

(xit )t ∈[0,T ]

where:

̺T (·): maps relative fund size to fund status

S (·): sign function

′ (·) ≥ 0

Restrictions: η ∈ [0, 1], γ1i > 1, and ̺T

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Managerial preferences: The status model

Manager’s objective:

"

#

1− γ

AiT 1i

AiT 1−γ2i

1−γ1i

max E0 η

+ (1 − η ) S (1 − γ2i ) ĀT

̺T

,

1 − γ1i

ĀT

(xit )t ∈[0,T ]

where:

̺T (·): maps relative fund size to fund status

S (·): sign function

′ (·) ≥ 0

Restrictions: η ∈ [0, 1], γ1i > 1, and ̺T

Comments:

γ2i can be negative

CDF captures the opportunities to improve status

Nests standard model of preferences

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Fund status and risk taking

Coefficient of relative risk aversion

3.5

Coefficient of relative risk aversion

3

2.5

2

1.5

1

0

0.1

0.2

0.3

0.4

0.5

0.6

Rank percentile

0.7

0.8

0.9

1

For most funds, risk aversion and fund size are positively correlated

γ1i controls passive risk taking, γ2i active risk taking

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Estimation strategy

Define rtB+h = log StB+h − log StB and r T = {rh , . . . , rT }

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Estimation strategy

Define rtB+h = log StB+h − log StB and r T = {rh , . . . , rT }

Two-step maximum-likelihood estimation procedure:

1

Estimate ΘB = {λB , σB } using L(r BT ; ΘB )

2

BT , A ; Θ , Θ̂ )

Estimate ΘAi = {λAi , γ1i , γ2i } using L(AT

i0

Ai

B

i |r

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Estimation strategy

Define rtB+h = log StB+h − log StB and r T = {rh , . . . , rT }

Two-step maximum-likelihood estimation procedure:

1

Estimate ΘB = {λB , σB } using L(r BT ; ΘB )

2

BT , A ; Θ , Θ̂ )

Estimate ΘAi = {λAi , γ1i , γ2i } using L(AT

i0

Ai

B

i |r

BT , A ; Θ , Θ̂ )

Main complication: computing L(AT

i0

A

B

i |r

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Estimation strategy

Define rtB+h = log StB+h − log StB and r T = {rh , . . . , rT }

Two-step maximum-likelihood estimation procedure:

1

Estimate ΘB = {λB , σB } using L(r BT ; ΘB )

2

BT , A ; Θ , Θ̂ )

Estimate ΘAi = {λAi , γ1i , γ2i } using L(AT

i0

Ai

B

i |r

BT , A ; Θ , Θ̂ )

Main complication: computing L(AT

i0

A

B

i |r

Density of At +h given At unknown:

dAt = At r + xt⋆ (At )′ ΣΛ dt + At xt⋆ (At )′ ΣdZt

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Using the martingale approach in estimation

I develop a new approach based on martingale techniques of Cox

Huang (1989)

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Using the martingale approach in estimation

I develop a new approach based on martingale techniques of Cox

Huang (1989)

Main steps of the martingale method:

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Using the martingale approach in estimation

I develop a new approach based on martingale techniques of Cox

Huang (1989)

Main steps of the martingale method:

1

⋆ ) that solves:

Choose optimal year-end asset level (AT

max E0 [u (AT )]

AT ≥0

s.t.

⋆ = (u ′ )

Solution: AT

−1

( ξ ϕT )

Ralph S.J. Koijen - Chicago GSB

E0 [ ϕT AT ] ≤ A0

Motivation Data Model Econometric approach Empirical results

Using the martingale approach in estimation

I develop a new approach based on martingale techniques of Cox

Huang (1989)

Main steps of the martingale method:

1

⋆ ) that solves:

Choose optimal year-end asset level (AT

max E0 [u (AT )]

AT ≥0

s.t.

⋆ = (u ′ )

Solution: AT

2

−1

E0 [ ϕT AT ] ≤ A0

( ξ ϕT )

By no-arbitrage, time-t assets under management (At⋆ ):

−1

ϕ

At⋆ = Et u ′

( ξ ϕ T ) T = f ( ϕ t ),

ϕt

with f (·) invertible under mild conditions

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Using the martingale approach in estimation

I develop a new approach based on martingale techniques of Cox

Huang (1989)

Main steps of the martingale method:

1

⋆ ) that solves:

Choose optimal year-end asset level (AT

max E0 [u (AT )]

AT ≥0

s.t.

⋆ = (u ′ )

Solution: AT

2

−1

E0 [ ϕT AT ] ≤ A0

( ξ ϕT )

By no-arbitrage, time-t assets under management (At⋆ ):

−1

ϕ

At⋆ = Et u ′

( ξ ϕ T ) T = f ( ϕ t ),

ϕt

with f (·) invertible under mild conditions

Key insight: transition density ( ϕt ) known exactly

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Novel econometric approach using martingale techniques

Estimation procedure:

1

Map assets under management (AT ) to the state-price density (ϕT )

2

Change-of-variables (Jacobian) formula for random variables

ℓ At |

rtB , ϕt −h ; ΘA , ΘB

= ℓ ϕt |

rtB ,

ϕt −h ; Θ A , Θ B

∂A⋆ −1 t

+ log ∂ϕt

Exact likelihood up to one expectation computed using Gaussian

quadrature

If u (·) is locally convex, apply concavification techniques

Carpenter (2000), Cuoco and Kaniel (2007), Basak, Pavlova, and

Shapiro (2007)

Enables likelihood-based estimation of a large class of dynamic

models

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Summary statistics ability and risk aversion

Summary statistics across all styles

Mean

St.dev.

Coeff. of variation

γ1

4.05

2.41

0.60

γ2

9.50

24.57

2.59

RRA

5.16

7.69

1.49

λA

0.28

0.38

1.36

If anything, dispersion in risk aversion higher than in ability

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Reduced-form α estimates are very noisy

Compare implied estimates from structural model to reduced-form

performance regression:

Reduced-form

β̂i

σ̂Reduced-form

ε,i

α̂Reduced-form

i

Structural

= −.00 + 1.00 β̂i

=

=

−.00 + 1.04σ̂Structural

ε,i

−.00 + 0.99α̂Structural

i

+ ui , R 2 = 97.67%

(2)

2

(3)

+ ui , R = 98.69%

+ ui , R = 35.11%

To match the unconditional moments: intercept equals zero and

slope equals one

Low R-squared in (3) reflects estimation error in reduced-form α

estimates

Variance in fund alphas three times smaller

Ralph S.J. Koijen - Chicago GSB

(1)

2

Motivation Data Model Econometric approach Empirical results

Model specification test

Specification test:

H0 : Performance regression with the same distributional

assumptions

!

dStB

dAit

− rf dt = αi dt + βi

− rf dt + σ εi dZtA

Ait

StB

H1 : Status model

Likelihood ratio test for (non-)nested models to test hypotheses

Vuong (1989)

Perform test at manager’s level; reject if rejection rate exceeds 5%

Rejection rate: 10.3%

Status model captures important dynamics of fund strategies

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Forecasting ability

Cross-sectional stability (rank correlation):

Risk aversion: 65.0%

Ability: 32.9%

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Forecasting ability

Cross-sectional stability (rank correlation):

Risk aversion: 65.0%

Ability: 32.9%

Time-series predictability: Two ways to estimate ability over a 3-year

period

1

Appraisal ratio using a performance regression

2

Structural estimation using the status model

Estimate appraisal ratio over the consecutive year (works against the

structural model)

s A 2

Compute the RMSE: E λA

−

λ̂

it

i ,t +1

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Forecasting ability

Cross-sectional stability (rank correlation):

Risk aversion: 65.0%

Ability: 32.9%

Time-series predictability: Two ways to estimate ability over a 3-year

period

1

Appraisal ratio using a performance regression

2

Structural estimation using the status model

Estimate appraisal ratio over the consecutive year (works against the

structural model)

s A 2

Compute the RMSE: E λA

−

λ̂

it

i ,t +1

Using performance regression: RMSE = 0.6628

Using status model: RMSE = 0.3881

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Are managers really skilled?

Fraction of alphas that recovers their expense ratio:

Reduced-form approach: 46%

Structural: 31%

Fraction of alphas that significantly exceed their expense ratio:

Reduced-form approach: 9%

Structural: 13%

Structural approach leads to a more positive view on managerial

talent

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Why are ability and risk aversion positively correlated?

Managerial ability and risk aversion are highly positively correlated

2.5

A

Managerial ability (λ )

2

1.5

1

0.5

0

0

5

10

15

20

25

30

35

40

Coefficient of relative risk aversion (RRA(a0))

45

50

This is consistent with selection effects or reflects career concerns

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Why are ability and risk aversion positively correlated?

Choose between mutual fund industry and savings bank

The bank provides a known and constant income OT at t = T

Value function mutual fund industry

1

1−γ 2

MF

2

J

=

exp (1 − γ)r +

λA + λB

1−γ

2γ

Value function bank

J OO =

1

1− γ

O

1−γ T

The indifference locus reads

q

λ̄A (γ) = (log OT − r )2γ − λ2B

Fund managers will opt into the industry only if λA ≥ λ̄A (γ)

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Heterogeneity in ability and risk aversion

Dependent variable

Log(TNA)

Tenure

Turnover

Log(Expenses)

Stock holdings

Loads

12B-1 fees

Log(Family TNA)

Fund age

R-squared

Ability (log(λA ))

Risk aversion (log(RRA))

Estimate

T-statistic

Estimate

T-statistic

-8.87%

7.27%

6.36%

5.04%

-6.37%

-3.41%

0.04%

0.10%

3.53%

-2.55

2.19

2.01

1.16

-2.17

-1.00

0.01

0.03

1.10

-9.99%

4.10%

0.11%

-9.07%

-6.47%

1.17%

4.38%

3.30%

2.48%

-2.93

1.26

0.04

-2.13

-2.24

0.35

1.07

1.00

0.79

13.0%

6.6%

Managers of large funds tend to be less skilled, but more aggressive

Skilled managers are more experienced and have higher turnover

Aggressive managers charge higher expense ratios and hold less cash

Substantial unobserved heterogeneity

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Differences across investment styles

Risk aversion

Ability

0.4

0.35

2.5

Large/value manager

Small/growth manager

Large/value manager

Small/growth manager

2

0.3

1.5

Density

Density

0.25

0.2

1

0.15

0.1

0.5

0.05

0

0

5

10

15

Coefficient of relative risk aversion

20

0

0

0.5

1

Ability (λA)

Large/value managers are on average more conservative than

small/growth managers

Larger fraction of small/growth managers is skilled

Ralph S.J. Koijen - Chicago GSB

1.5

Motivation Data Model Econometric approach Empirical results

Does heterogeneity matter?

Investor allocates capital to cash, benchmark, and actively-managed

funds

Three ways to account for heterogeneity:

1

Use performance regressions to estimate cross-sectional distribution

2

Ignore heterogeneity: use average values

3

Use status model to estimate cross-sectional distribution

0

−50

Utility costs (bp)

−100

−150

−200

−250

−300

−350

−400

1

Ignoring heterogeneity

Using performance regressions

2

3

4

5

6

7

8

9

Coefficient of relative risk aversion of the individual investor

Ralph S.J. Koijen - Chicago GSB

10

Motivation Data Model Econometric approach Empirical results

Variation in risk aversion and expected returns

The status model endogenously generates time variation in risk

aversion

Time series of expected returns from Binsbergen and Koijen (2007)

0.2

6

Average coefficient of relative risk aversion

5.75

Expected return

5.5

0.1

5.25

5

0.05

4.75

0

1992

1994

1996

The correlation is 62%

Ralph S.J. Koijen - Chicago GSB

1998

2000

2002

2004

4.5

2006

Average coefficient of relative risk aversion

0.15

Motivation Data Model Econometric approach Empirical results

Conclusions

Restrictions implied by theory disentangle managerial ability and

preferences

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Conclusions

Restrictions implied by theory disentangle managerial ability and

preferences

Ability and risk preferences estimated using information in second

moments

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Conclusions

Restrictions implied by theory disentangle managerial ability and

preferences

Ability and risk preferences estimated using information in second

moments

Standard models lead to implausible estimates of ability or risk

preferences

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Conclusions

Restrictions implied by theory disentangle managerial ability and

preferences

Ability and risk preferences estimated using information in second

moments

Standard models lead to implausible estimates of ability or risk

preferences

Imputing status concerns in the manager’s preferences

Delivers plausible estimates of ability and risk aversion

Formally favored over other models and reduced-form performance

regressions

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Conclusions

Restrictions implied by theory disentangle managerial ability and

preferences

Ability and risk preferences estimated using information in second

moments

Standard models lead to implausible estimates of ability or risk

preferences

Imputing status concerns in the manager’s preferences

Delivers plausible estimates of ability and risk aversion

Formally favored over other models and reduced-form performance

regressions

New framework to estimate continuous-time, dynamic optimization

models

Ralph S.J. Koijen - Chicago GSB

Motivation Data Model Econometric approach Empirical results

Conclusions

Restrictions implied by theory disentangle managerial ability and

preferences

Ability and risk preferences estimated using information in second

moments

Standard models lead to implausible estimates of ability or risk

preferences

Imputing status concerns in the manager’s preferences

Delivers plausible estimates of ability and risk aversion

Formally favored over other models and reduced-form performance

regressions

New framework to estimate continuous-time, dynamic optimization

models

Ignoring heterogeneity: large welfare losses for individual investors

Ralph S.J. Koijen - Chicago GSB