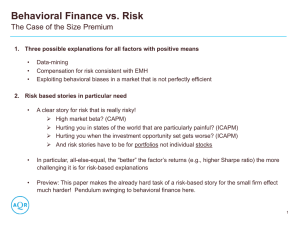

Size Matters, if You Control Your Junk Cliff Asness Andrea Frazzini

advertisement