NBER WORKING PAPER SERIES INVESTOR SENTIMENT AND THE CROSS-SECTION OF STOCK RETURNS

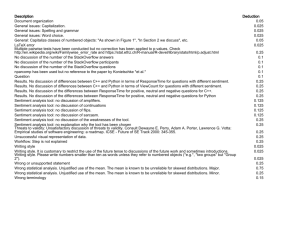

advertisement